Hmrc Uniform Tax Rebate P87 Web 5 sept 2023 nbsp 0183 32 find detailed information on how tax relief claims for job expenses can be submitted to HMRC get confirmation that the HMRC version of the P87 form must be

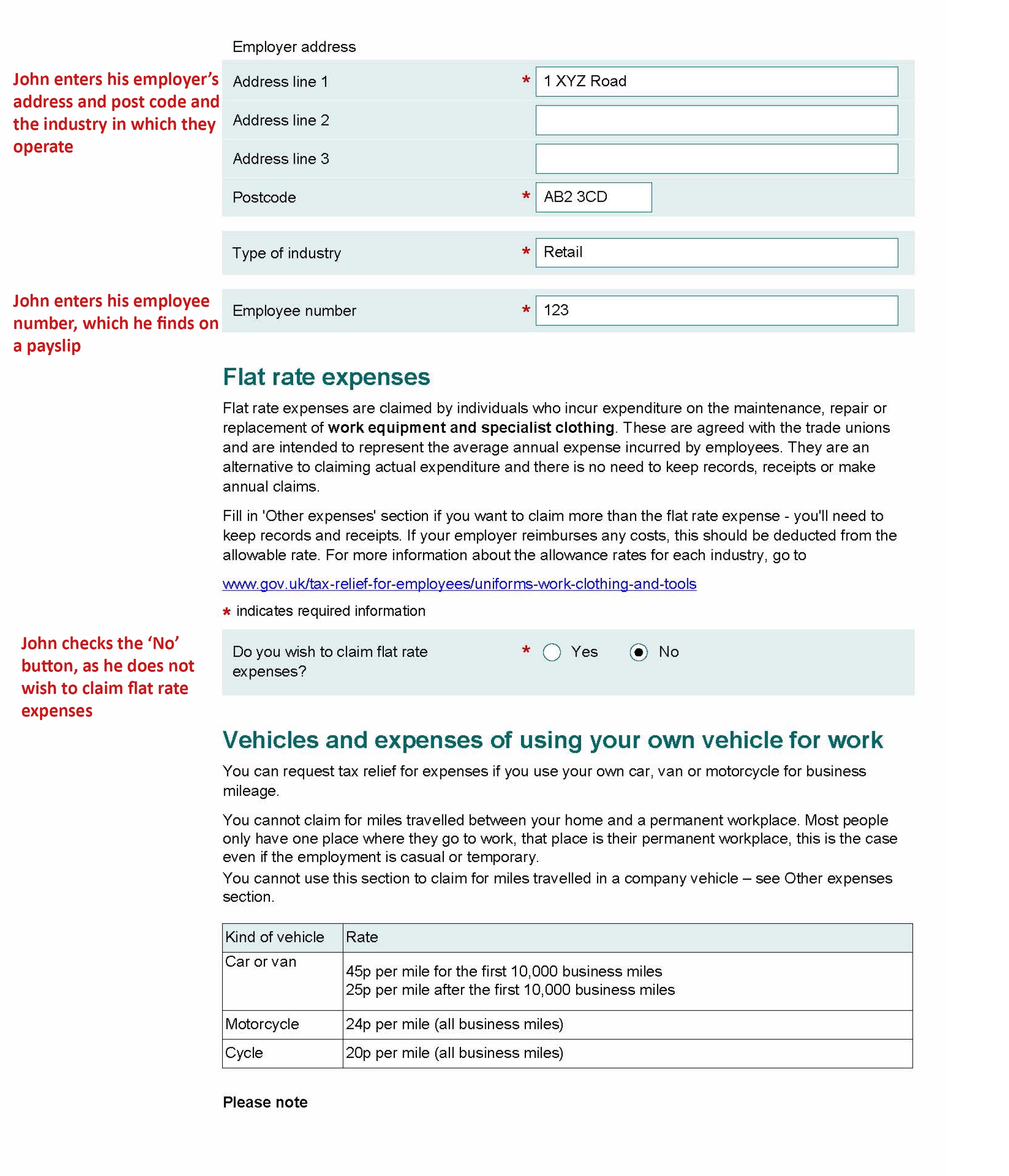

Web 21 mars 2022 nbsp 0183 32 From 7 May HMRC is mandating the use of the standard P87 form for claiming income tax relief on employment expenses on gov uk and will reject Web 84 lignes nbsp 0183 32 1 janv 2015 nbsp 0183 32 Flat rate expenses sometimes known as a flat rate

Hmrc Uniform Tax Rebate P87

Hmrc Uniform Tax Rebate P87

https://www.litrg.org.uk/sites/default/files/files/P87 2018 page2_0.jpg

2014 2023 Form UK HMRC P87Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/100/433/100433977/large.png

P87 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Uniform-Tax-Rebate-Form-P87-768x731.png

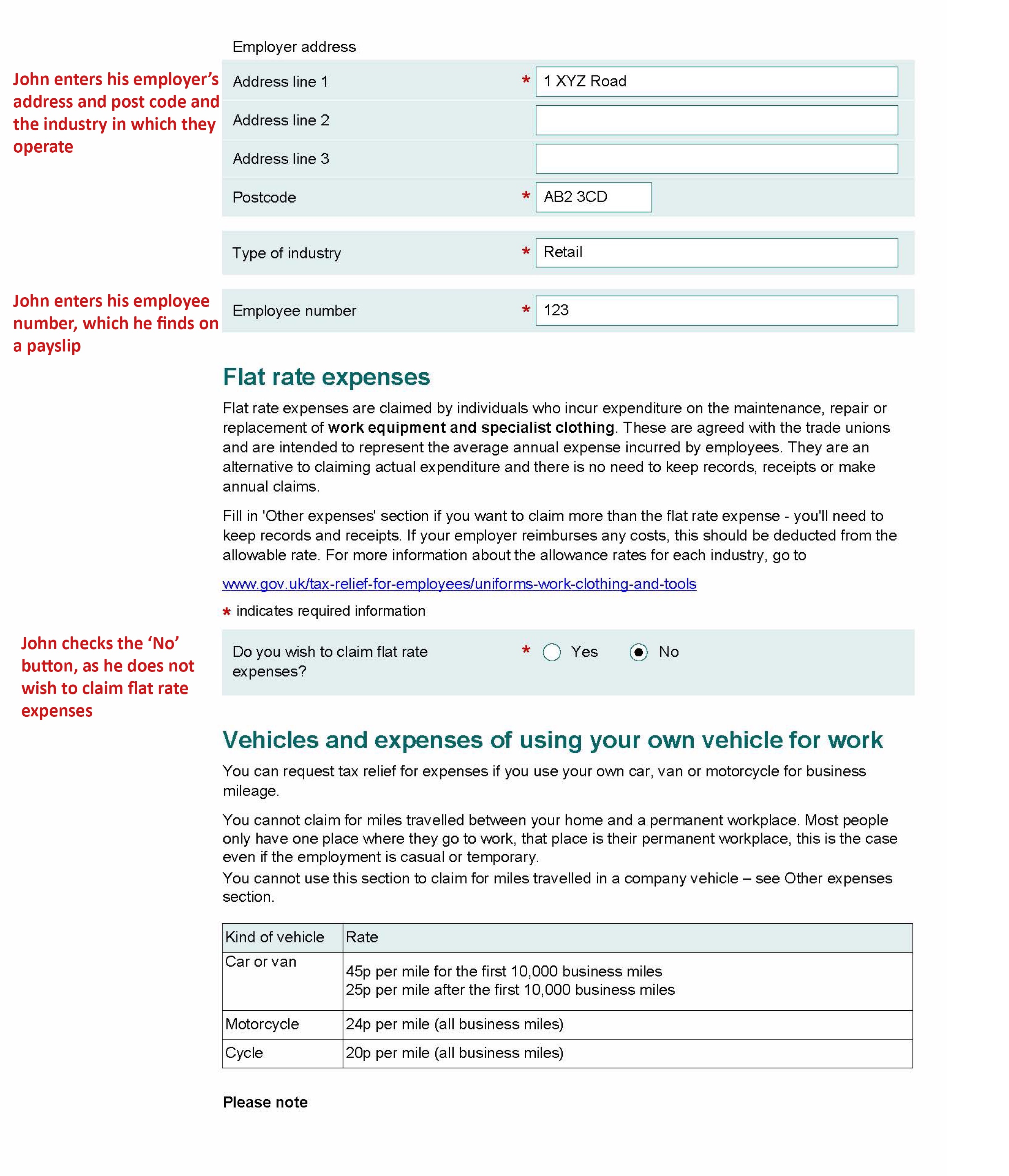

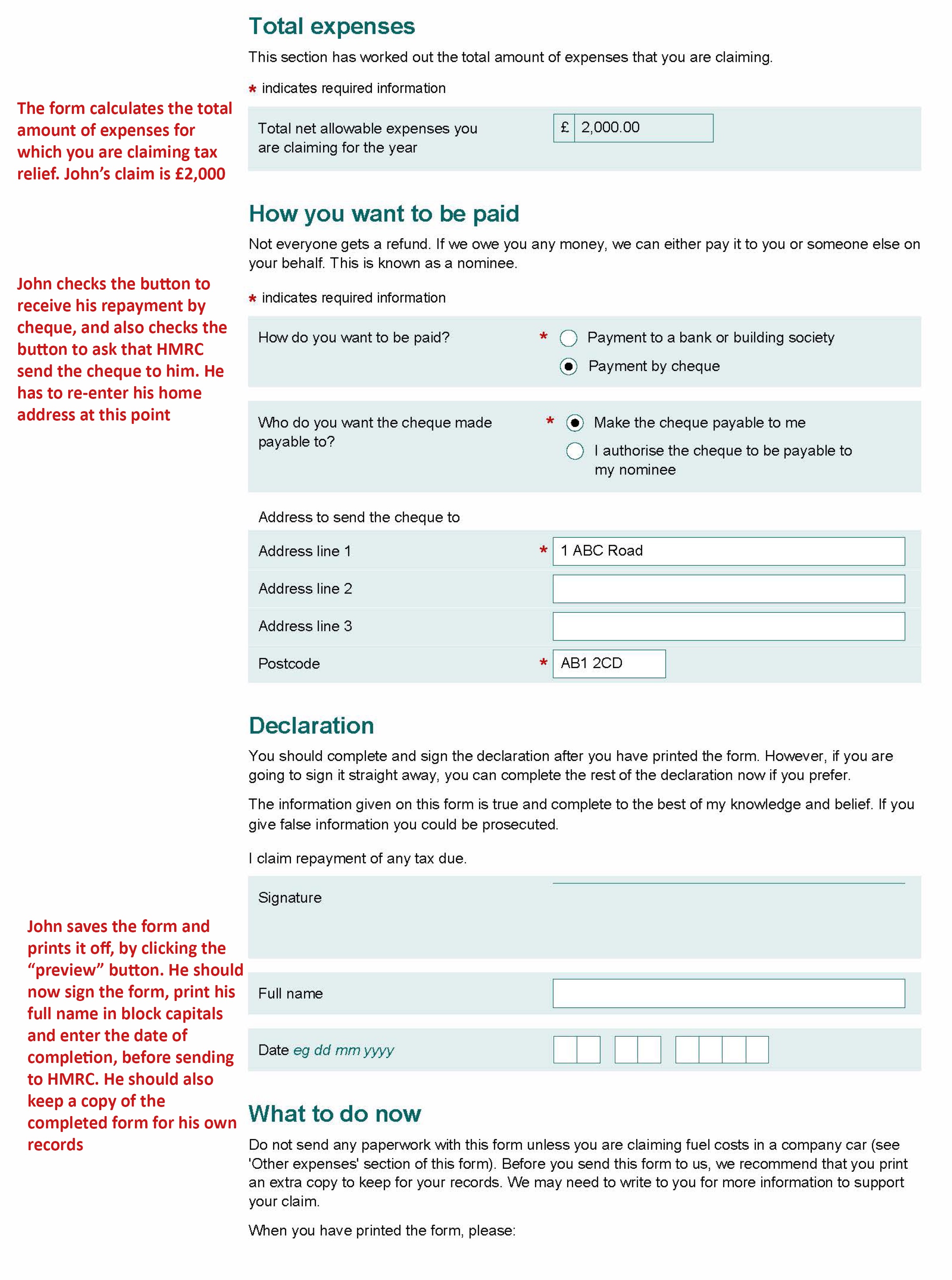

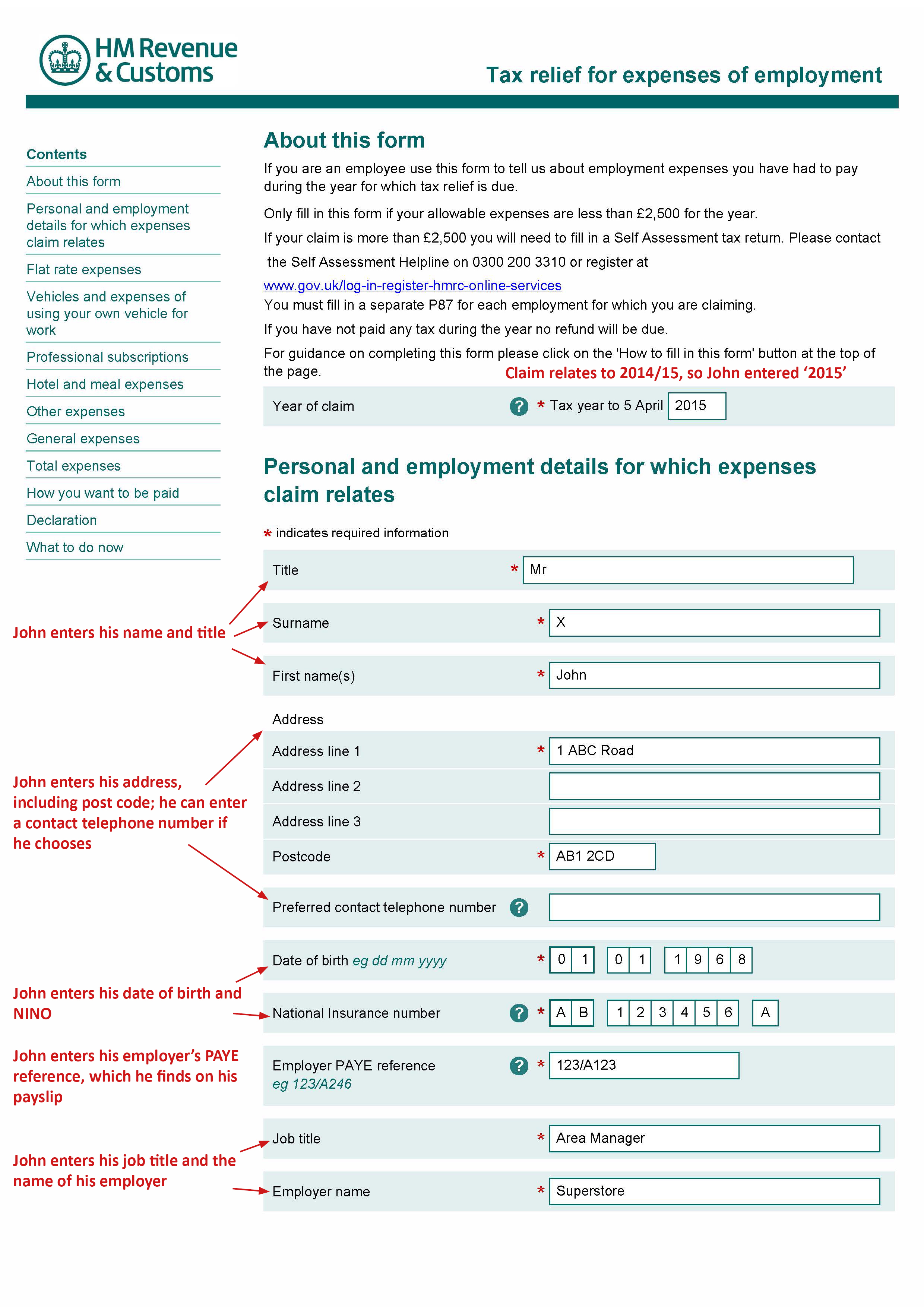

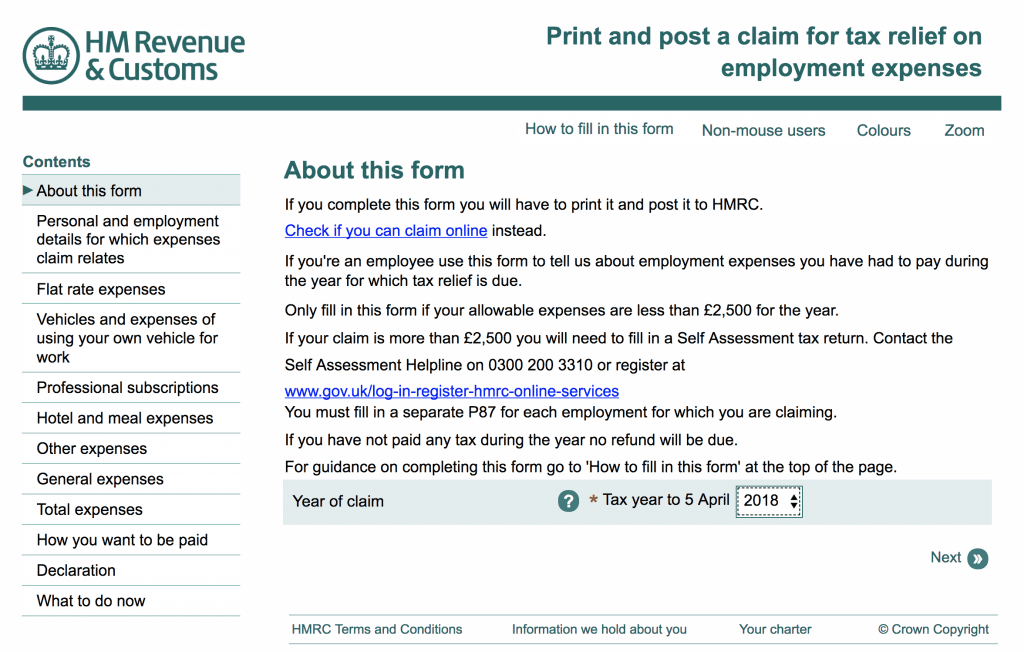

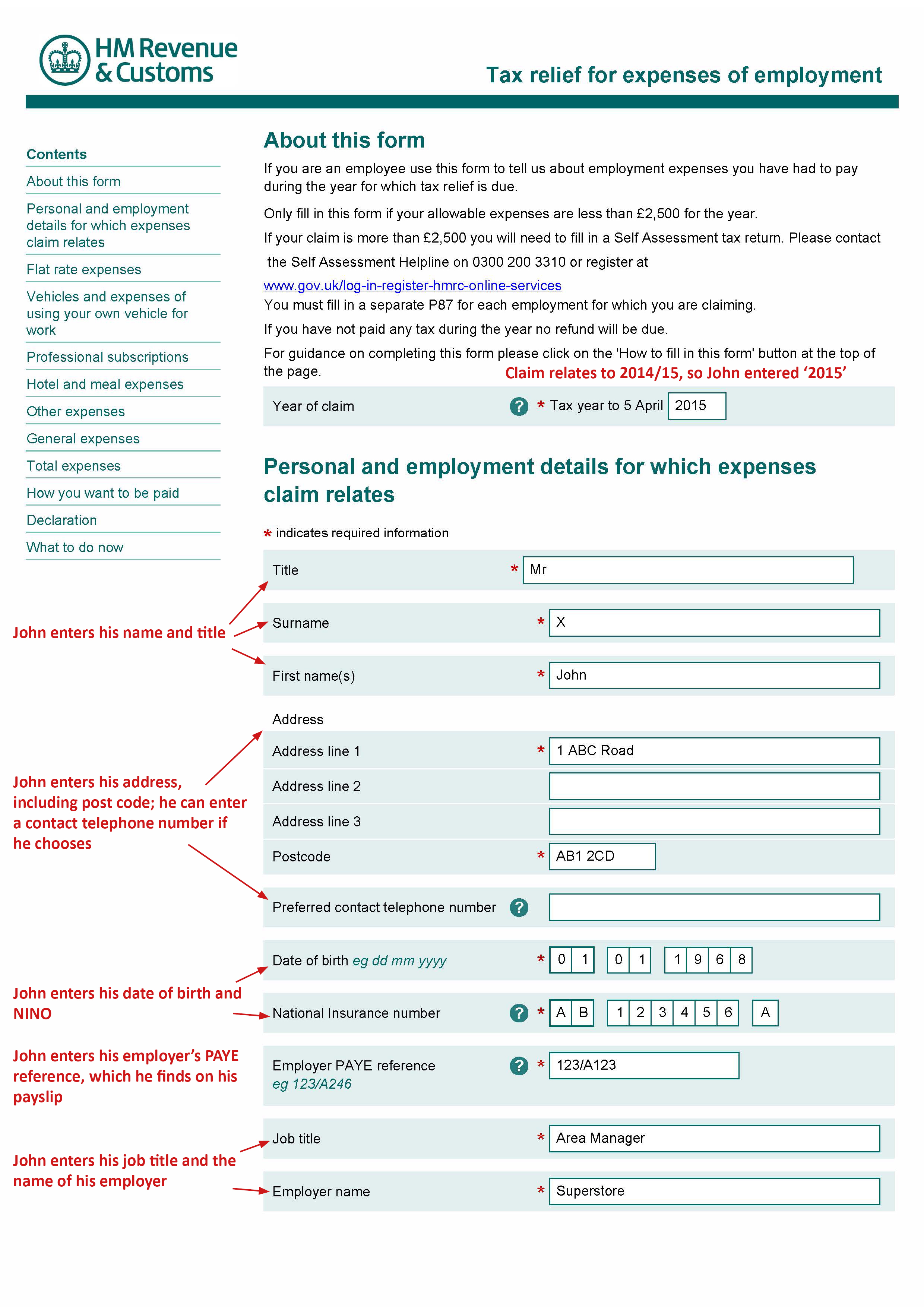

Web 29 nov 2022 nbsp 0183 32 Since May 2022 the format of claims for tax relief on employment expenses has been mandated HMRC s version of the P87 form must be used for claims made by Web 3 avr 2023 nbsp 0183 32 There is a HMRC guidance document to accompany the P87 form which you can access on GOV UK Note that since 21 December 2022 claims for tax relief made on P87 forms must include the following

Web 14 d 233 c 2022 nbsp 0183 32 Individuals in paid employment needing to claim tax relief on job expenses by post are required to use the P87 form However from 21 December 2022 the new Tax relief for expenses of employment P87 Web 24 mai 2022 nbsp 0183 32 Project objectives The P87 expenses claim form will become a prescribed form in May 2022 Regulations were laid 7 March 2022 to enable HMRC to prescribe the

Download Hmrc Uniform Tax Rebate P87

More picture related to Hmrc Uniform Tax Rebate P87

Form P87 Claim For Tax Relief For Expenses Of Employment Low

https://www.litrg.org.uk/sites/default/files/files/P87 2018 page3.jpg

Hmrc P87 Printable Form Printable Forms Free Online

https://www.litrg.org.uk/sites/default/files/files/P87 2016 page5.jpg

Hmrc P87 Printable Form Printable Forms Free Online

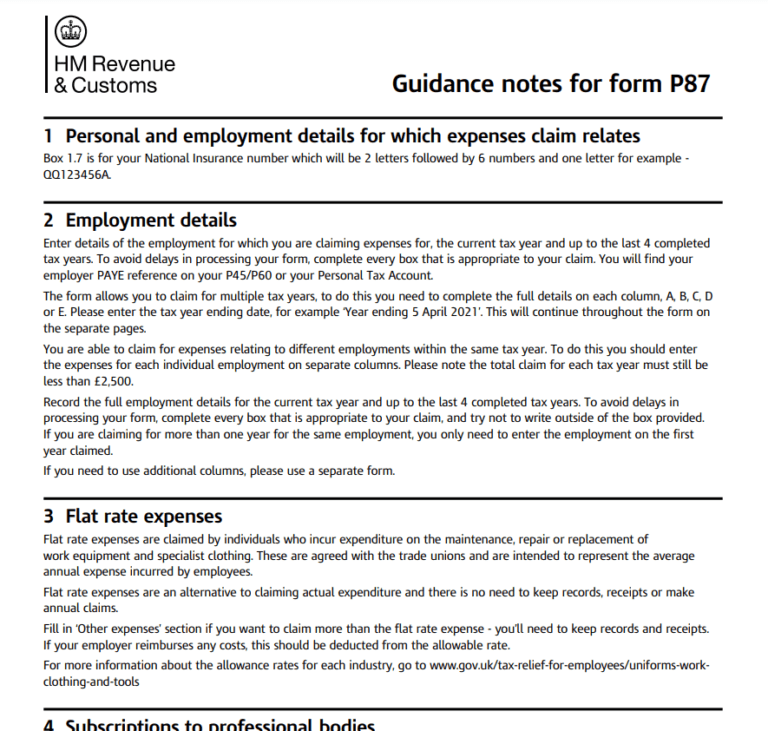

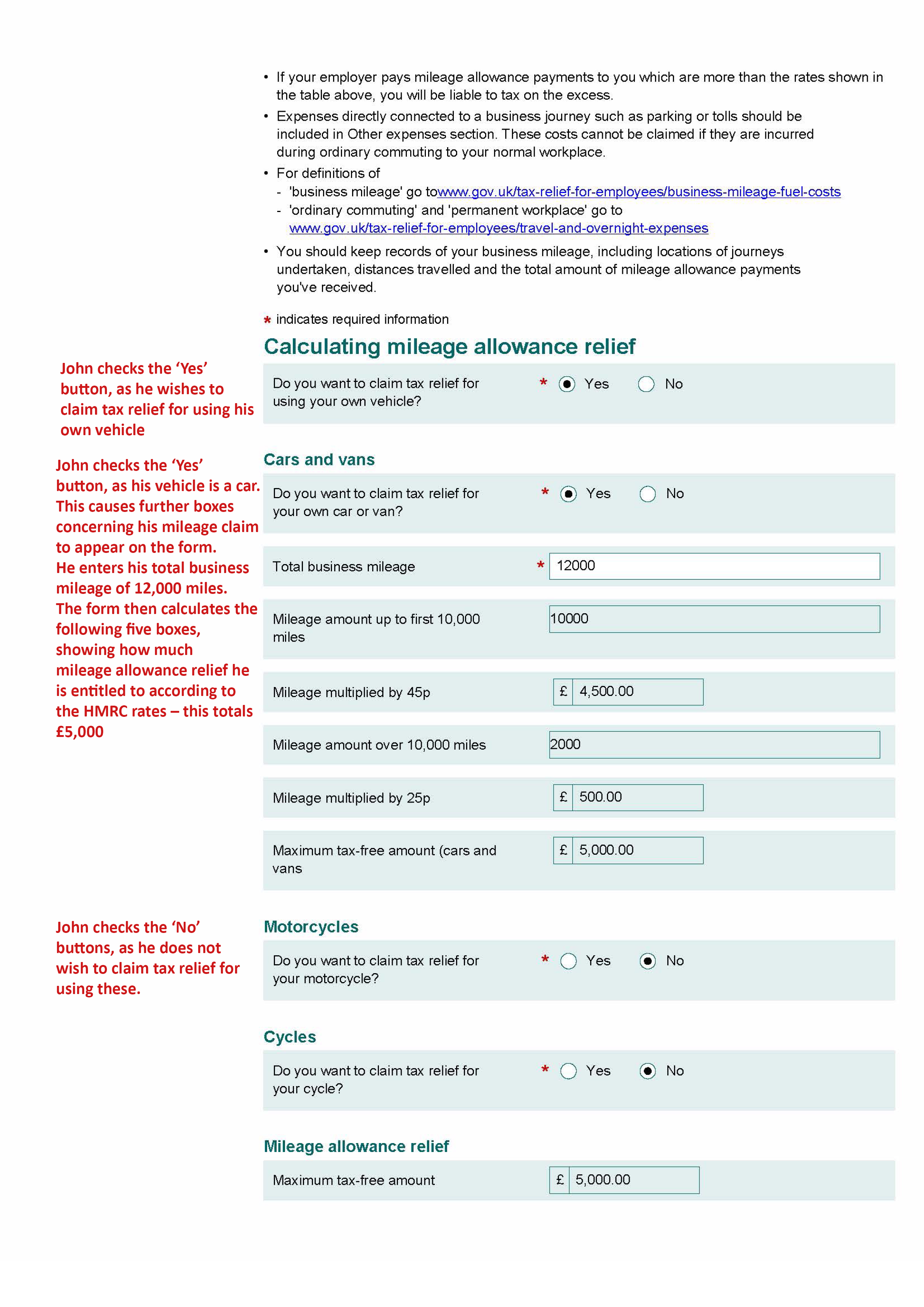

https://www.litrg.org.uk/sites/default/files/files/R40_annotated_form_Page_4.jpg

Web If you pay the 20 basic rate of tax and claim tax relief on 163 6 a week you would get 163 1 20 per week in tax relief 20 of 163 6 You ll usually get tax relief through a change to your Web If you re a basic rate taxpayer who wore a uniform in each of the five tax years your rebate will be worth 163 60 You ll have until 5 April 2024 to claim the relief for 2019 20 after that you ll lose the ability to backdate for that

Web A P87 form is an HMRC form that you need to use to claim income tax relief on certain employment expenses These expenses are the ones that you are required to pay for yourself for work purposes but your employer Web 5 oct 2022 nbsp 0183 32 Basic rate taxpayers get 20 of their industry s qualified deductions as a rebate while higher rate taxpayers get 40 For example if the uniform allowance is

P87 Claim Form Printable Printable Forms Free Online

https://www.litrg.org.uk/sites/default/files/files/P87 2016 page1.jpg

P87 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/57/100057253/large.png

https://www.gov.uk/guidance/send-an-income-tax-relief-claim-for-job...

Web 5 sept 2023 nbsp 0183 32 find detailed information on how tax relief claims for job expenses can be submitted to HMRC get confirmation that the HMRC version of the P87 form must be

https://www.icaew.com/insights/tax-news/2022/Mar-2022/HMRC-to-mand…

Web 21 mars 2022 nbsp 0183 32 From 7 May HMRC is mandating the use of the standard P87 form for claiming income tax relief on employment expenses on gov uk and will reject

P87 Form Claiming Tax Relief On Employment Expenses

P87 Claim Form Printable Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes

Hmrc P87 Printable Form Printable Forms Free Online

How To Claim The Work Mileage Tax Rebate Goselfemployed co

How To Claim The Work Mileage Tax Rebate Goselfemployed co

How To Fill Out Your P87 Tax Form FLiP

How To Fill Out Your P87 Tax Form FLiP

Tax Relief Working From Home Due To Coronavirus This Form Could Help

Hmrc Uniform Tax Rebate P87 - Web P87 Notes Page 1 HMRC 03 22 Guidance notes for form P87 1 Personal and employment details for which expenses claim relates Box 1 7 is for your National Insurance number