Welcome to Our blog, an area where inquisitiveness meets info, and where daily topics become appealing conversations. Whether you're seeking understandings on way of life, technology, or a little every little thing in between, you have actually landed in the best place. Join us on this exploration as we dive into the realms of the common and phenomenal, understanding the world one article at once. Your trip right into the remarkable and diverse landscape of our Arizona Form 309 Credit For Taxes Paid To Another State Or Country begins right here. Explore the exciting material that awaits in our Arizona Form 309 Credit For Taxes Paid To Another State Or Country, where we unwind the ins and outs of numerous topics.

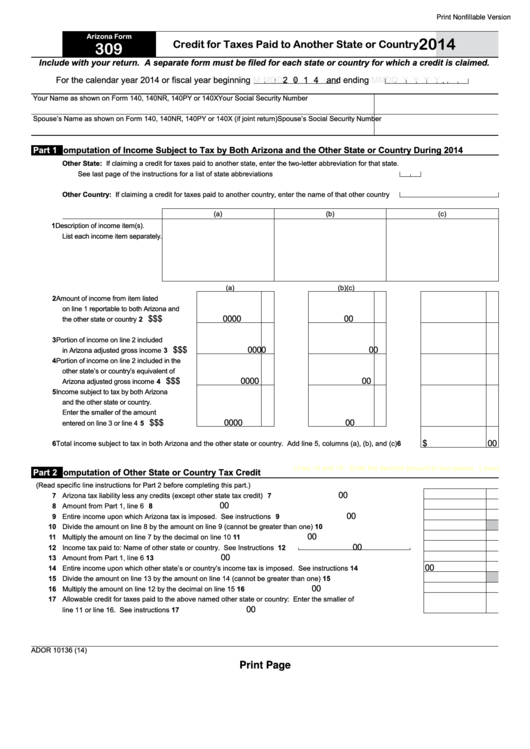

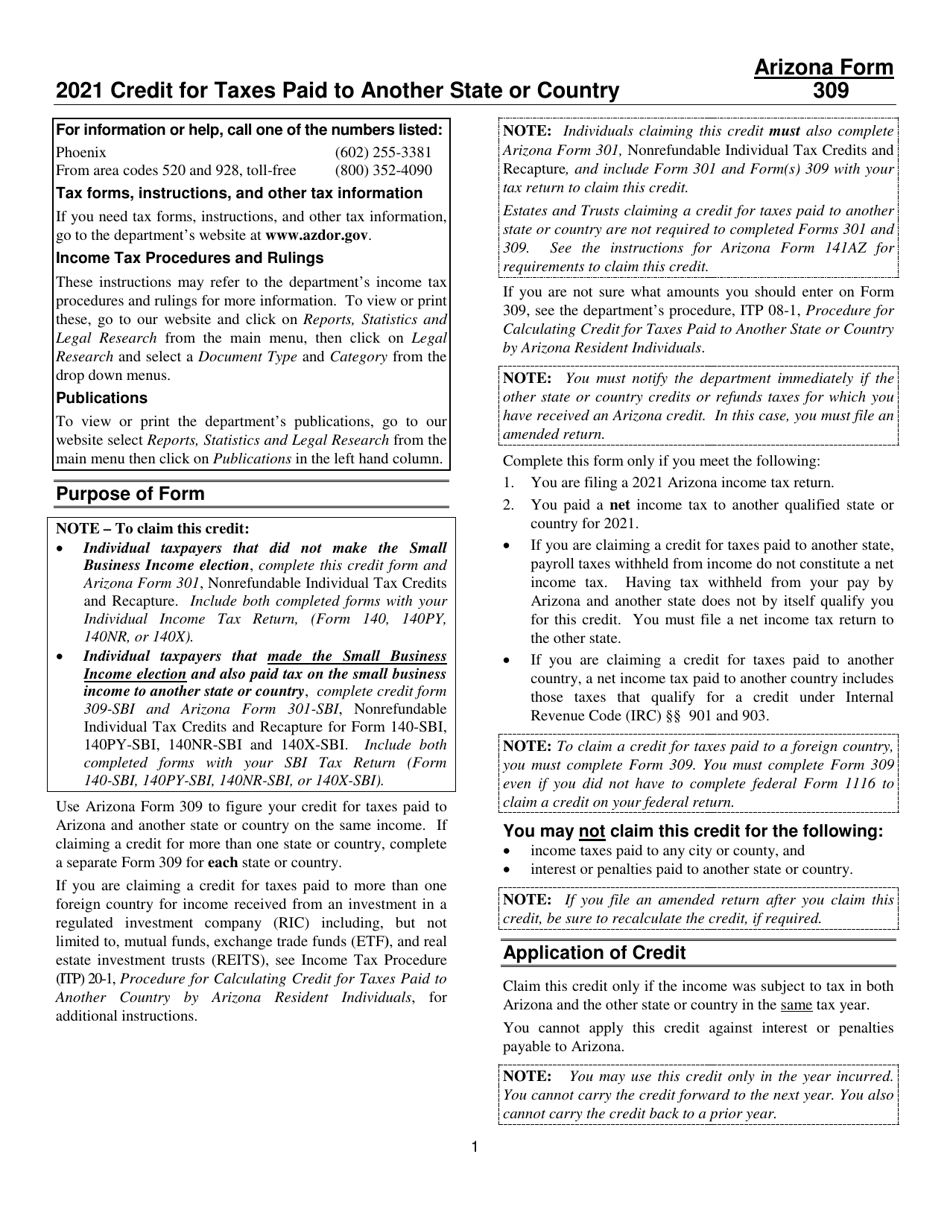

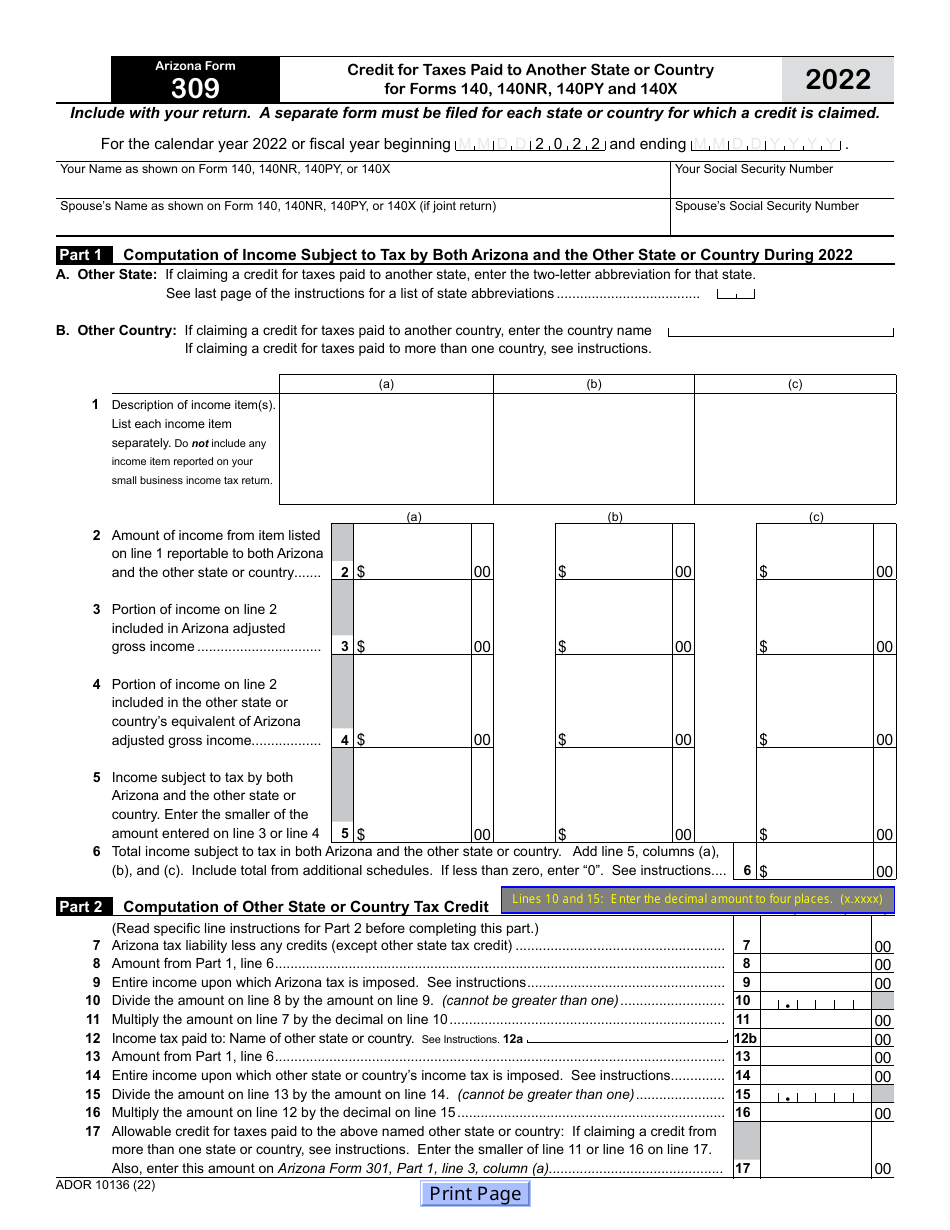

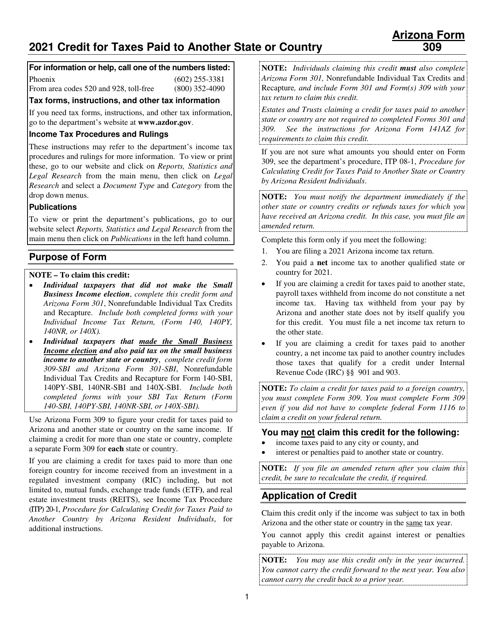

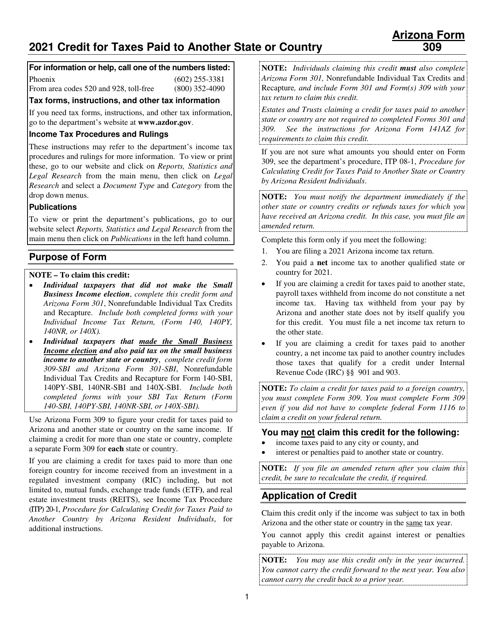

Arizona Form 309 Credit For Taxes Paid To Another State Or Country

Arizona Form 309 Credit For Taxes Paid To Another State Or Country

Which States Pay The Most Federal Taxes MoneyRates

Which States Pay The Most Federal Taxes MoneyRates

How To Pay Lyon County Kansas Real Estate Taxes Tourisme83

How To Pay Lyon County Kansas Real Estate Taxes Tourisme83

Gallery Image for Arizona Form 309 Credit For Taxes Paid To Another State Or Country

States That Tax Social Security Benefits Tax Foundation

Download Instructions For Arizona Form 309 ADOR10136 Credit For Taxes

Arizona Form 309 ADOR10136 Download Fillable PDF Or Fill Online

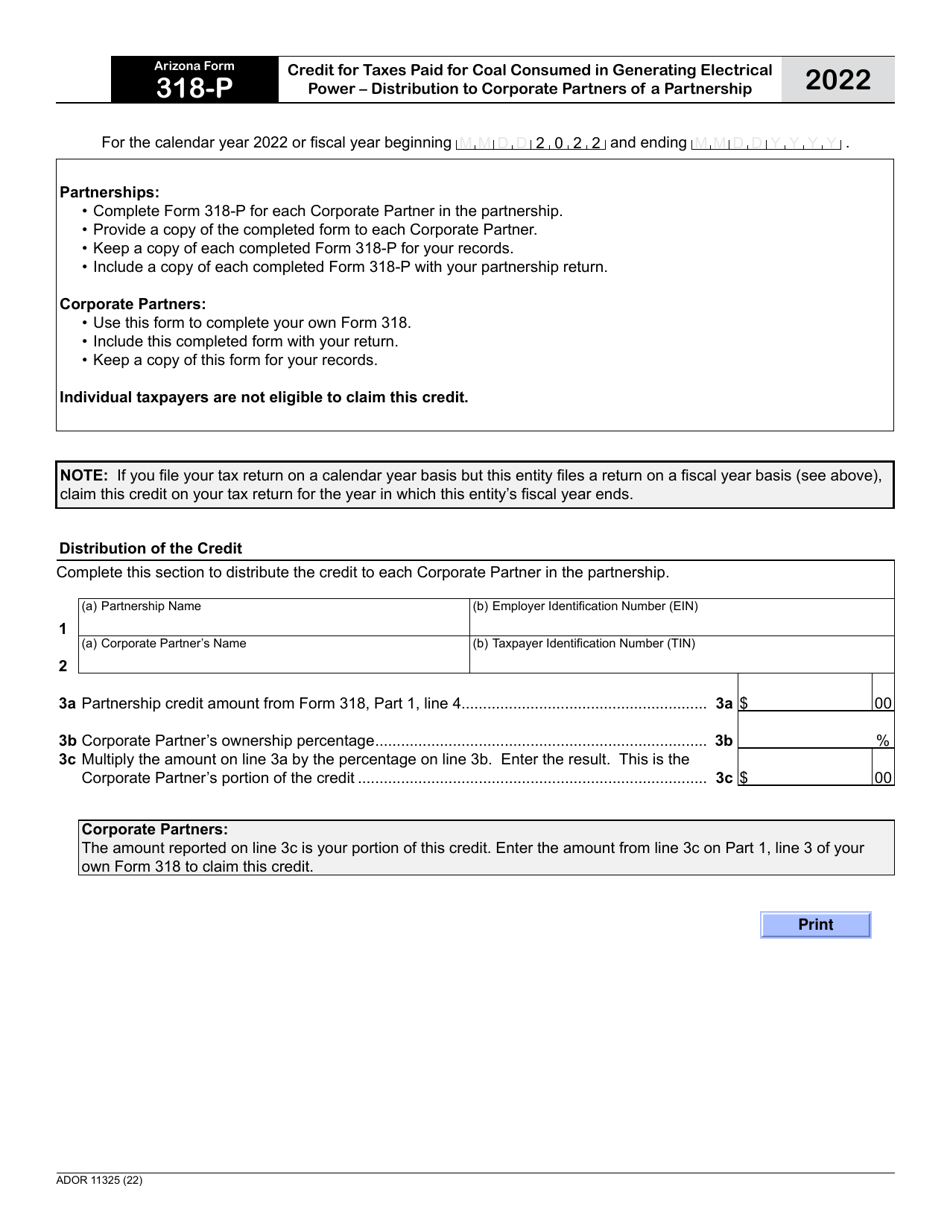

Arizona Form 318 P ADOR11325 Download Fillable PDF Or Fill Online

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Download Instructions For Arizona Form 309 ADOR10136 Credit For Taxes

Download Instructions For Arizona Form 309 ADOR10136 Credit For Taxes

How Much Does A State Get From The Centre For Every 100 Paid In

Thanks for selecting to discover our internet site. We genuinely wish your experience exceeds your assumptions, and that you find all the details and resources about Arizona Form 309 Credit For Taxes Paid To Another State Or Country that you are seeking. Our dedication is to offer an easy to use and interesting system, so feel free to browse through our web pages effortlessly.