Arizona Military Family Relief Tax Credit Verkko 1 tammik 2022 nbsp 0183 32 Credit for Donations to Military Family Relief Fund A nonrefundable individual tax credit for cash donations made to the Military Family Relief fund which is administered by the Arizona Department of Veterans Services

Verkko State Zip Email Phone Tax Credit Option Consult your tax preparer or accountant for guidance on eligibility or applicability of tax credits Single Tax Credit MFRF Post 9 11 200 yr Joint Tax Credit MFRF Post 9 11 400 yr Single Tax Credit MFRF Pre 9 11 200 yr Verkko The Arizona Military Family Relief Fund MFRF was created to provide financial assistance to active duty service members Veterans and their families for unforeseen financial hardships caused by the service member s military service MFRF is open to both pre 9 11 and post 9 11 service members

Arizona Military Family Relief Tax Credit

Arizona Military Family Relief Tax Credit

https://www.wfyi.org/files/wfyi/articles/original/military-family-relief-fund.jpeg

9 Ways The Arizona Military Family Relief Fund Helps Low Income Relief

https://lowincomerelief.com/wp-content/uploads/2022/01/pexels-photo-1582492-720x405.jpeg

Arizona Tax Credits 2022 Price Kong

https://www.pricekong.com/wp-content/uploads/2020/08/Donations.jpg

Verkko NOTICE The 2023 Arizona MFRF Tax Credit fund is CLOSED to ONLINE donations Get an AZ Tax Credit for Military Family Relief Fund MFRF Post 9 11 200 Single filer MFRF Post 9 11 400 Joint filer MFRF Pre 9 11 200 Single filer MFRF Pre 9 11 400 Joint filer Donate to a charitable fund Military Family Relief Fund no tax credit Verkko Here s what you need to know about claiming an Arizona tax credit for a donation to the Arizona Military Family Relief Fund MFRF which offers financial help to active duty service

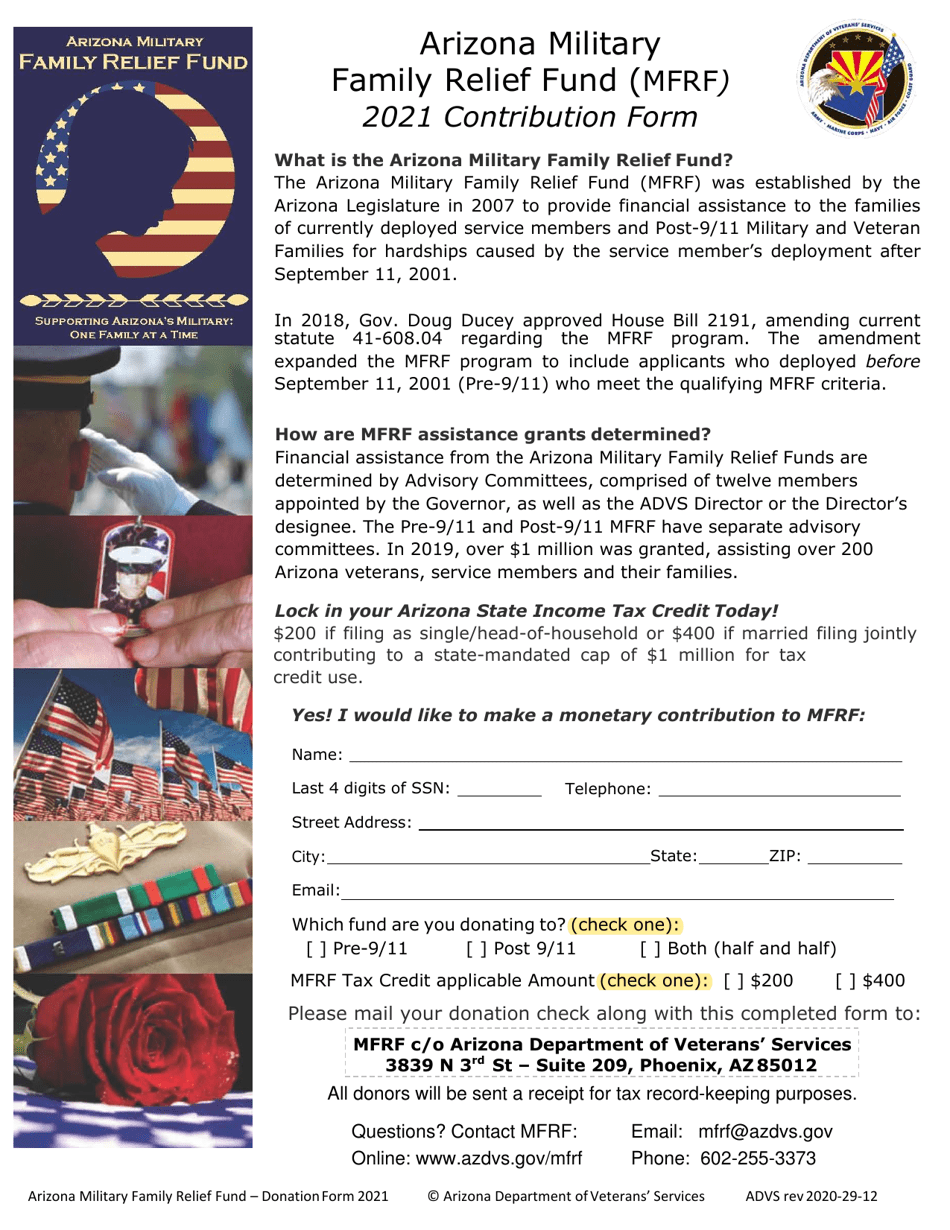

Verkko MFRF Tax Credit applicable Amount check one 200 400 Please mail your donation check along with this completed form to MFRF c o Arizona Department of Veterans Services 3839 N 3rd St Suite 209 Phoenix AZ 85012 Arizona Military Family Relief Fund Donation Form 2022 Arizona Department of Veterans Services Verkko 19 toukok 2022 nbsp 0183 32 Military Family Relief Fund Native American Settlement Fund Veterans Donation Fund AZ State Grants Solicitation Gold Star Medal State Veteran Homes ASVH Flagstaff ASVH Phoenix ASVH Tucson ASVH Yuma Women Veterans Veteran Tool Kit Resources Arizona Benefits Guide BeConnectedAZ Request Form

Download Arizona Military Family Relief Tax Credit

More picture related to Arizona Military Family Relief Tax Credit

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax

https://wtop.com/wp-content/uploads/2022/08/shutterstock_1425899771-scaled-e1661301925948.jpg

Application Process Opens For Student Loan Debt Relief Tax Credit

https://kubrick.htvapps.com/htv-prod-media.s3.amazonaws.com/images/student-loan-1562083488.jpg?crop=1.00xw:1.00xh;0,0&resize=1200:*

Military Family Relief Fund Committee Documents Department Of

https://dvs.az.gov/sites/default/files/2022-05/amfrm_0.png

Verkko More about the Arizona Form 340 Corporate Income Tax Tax Credit TY 2022 We last updated the Credit for Donations to Military Family Relief Fund in February 2023 so this is the latest version of Form 340 fully updated for tax year 2022 You can download or print current or past year PDFs of Form 340 directly from TaxFormFinder Verkko 28 marrask 2022 nbsp 0183 32 Military Family Relief Fund MFRF 2022 ONLINE CAP HAS BEEN REACHED ON THE MILITARY FAMILY RELIEF FUND CREDIT We are always available to answer any Arizona tax credit questions or any other tax questions you may have Please contact our office at 520 886 3181 Posts You Might Also Like

Verkko If Arizona tax was withheld from your active duty military pay you must file an Arizona income tax return to claim any refund you may be due from that withholding You must also file an Arizona income tax return if you have any other income besides compensation received for active duty military pay and you meet the filing requirements Verkko Single taxpayers may contribute up to 200 and married taxpayers filing jointly may contribute up to 400 to the Military Family Relief Fund administered by the Arizona Department of Veteran s Services Unused amounts may not be used in a future year

Military Family Relief Fund Department Of Veterans Services

https://dvs.az.gov/sites/default/files/2022-05/ADVS-MFRF-artwork-2021-09.jpg

Arizona Tax Credits Landmark

https://www.landmarkcpas.com/wp-content/uploads/2020/04/Qualified-Leave-Wages-Image-RS.jpg

https://azdor.gov/.../credit-donations-military-family-relief-fund

Verkko 1 tammik 2022 nbsp 0183 32 Credit for Donations to Military Family Relief Fund A nonrefundable individual tax credit for cash donations made to the Military Family Relief fund which is administered by the Arizona Department of Veterans Services

https://dvspay.az.gov/content/mfrf-tax-credit

Verkko State Zip Email Phone Tax Credit Option Consult your tax preparer or accountant for guidance on eligibility or applicability of tax credits Single Tax Credit MFRF Post 9 11 200 yr Joint Tax Credit MFRF Post 9 11 400 yr Single Tax Credit MFRF Pre 9 11 200 yr

9 Ways The Arizona Military Family Relief Fund Helps Low Income Relief

Military Family Relief Fund Department Of Veterans Services

Plan Early To Help Military Families Giving Tucson

2021 Arizona Arizona Military Family Relief Fund Mfrf Contribution

Inflation Relief Checks Summary News 17 October AS USA

Illinois National Guard Commander Inducted Into Illinois State

Illinois National Guard Commander Inducted Into Illinois State

DVIDS Images Arizona National Guard Soldiers Deploy Image 2 Of 3

Military Family Tax Relief Act Ideal Tax

How And Where To Stretch Your Tax Dollars With Arizona Tax Credits

Arizona Military Family Relief Tax Credit - Verkko MFRF Tax Credit applicable Amount check one 200 400 Please mail your donation check along with this completed form to MFRF c o Arizona Department of Veterans Services 3839 N 3rd St Suite 209 Phoenix AZ 85012 Arizona Military Family Relief Fund Donation Form 2022 Arizona Department of Veterans Services