Ato Fuel Rebate Form Web 1 juil 2017 nbsp 0183 32 Liquid fuels for example diesel or petrol Unit cents per litre 20 5 47 7 Blended fuels B5 B20 E10 Unit cents per litre 20 5 47 7 Blended fuel E85 Unit

Web NAT 15634 07 2021 How to work out your fuel tax credits Step 1 Work out the eligible quantity Work out how much fuel liquid or gaseous you acquired for each business Web 7 mars 2023 nbsp 0183 32 Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for

Ato Fuel Rebate Form

Ato Fuel Rebate Form

https://www.pdffiller.com/preview/250/319/250319623/large.png

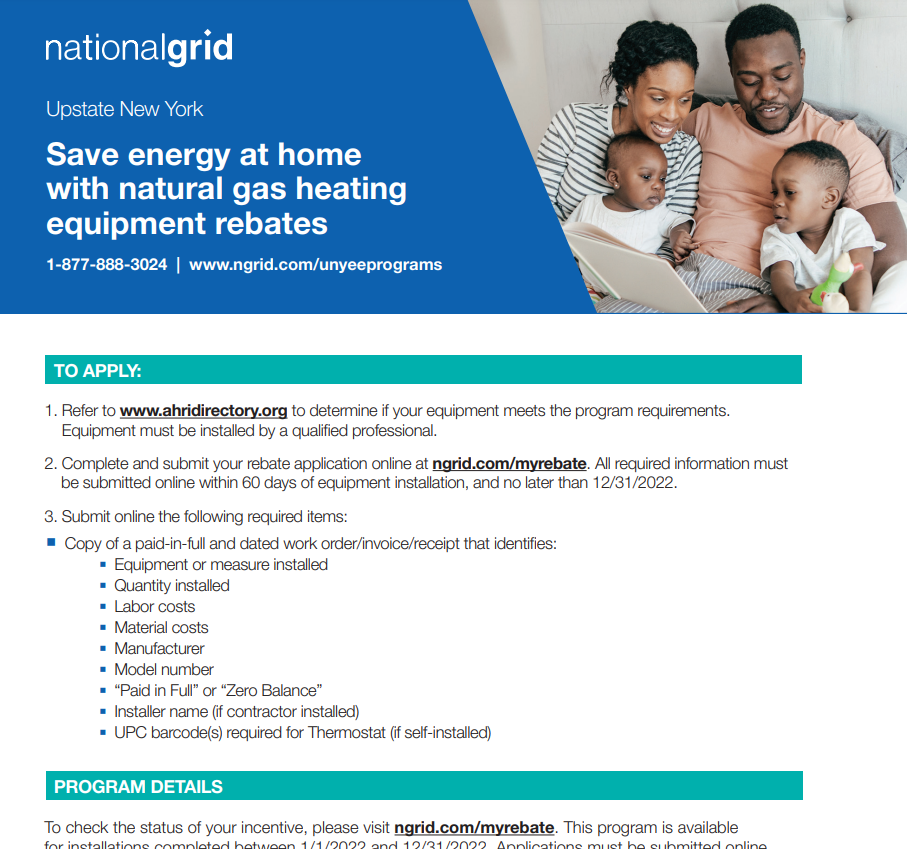

National Fuel Printable Rebate Form Gas Rebates

https://i0.wp.com/www.gasrebates.net/wp-content/uploads/2023/03/national-fuel-printable-rebate-form.png?fit=768%2C553&ssl=1

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell

https://www.howellcountynews.com/sites/default/files/field/image/afront-gas rebate.jpg

Web The following tools will help you check if you re eligible for fuel tax credits and work out the amount of fuel tax credits you can claim Eligibility tool check if you can claim fuel tax Web 22 nov 2022 nbsp 0183 32 You can claim fuel tax credits for fuel you purchase manufacture or import for business use Work out if you are eligible for fuel tax credits with the ATO s Fuel tax

Web When to use this form Use this form if you are not registered for GST and are an individual who wants to claim fuel tax credits for fuel used to generate domestic electricity for your Web You can claim fuel tax credits for any taxable fuel you acquired manufactured or imported to use in your business Fuel is generally considered taxable fuel if an excise or excise

Download Ato Fuel Rebate Form

More picture related to Ato Fuel Rebate Form

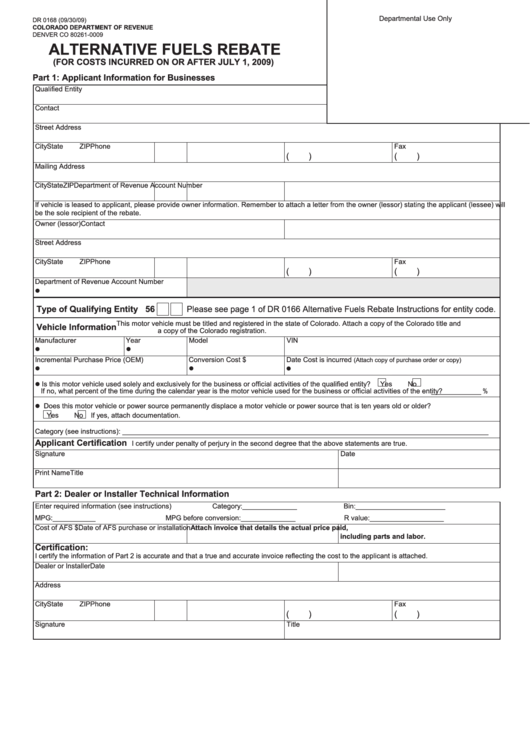

Form Dr 0168 Alternative Fuels Rebate 2009 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/172/1728/172849/page_1_thumb_big.png

Ho50 Form Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/22/555/22555714/large.png

National Fuel Rebate Form 2022 Government Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/National-Fuel-Rebate-Form-2022.png

Web 12 oct 2022 nbsp 0183 32 What are Fuel Tax Credits Fuel tax credits provide your business with a credit for the fuel tax excise included in the fuel price The excise is paid at the pump and subject to certain conditions refunded by Web 28 juil 2023 nbsp 0183 32 How To Register Heavy Vehicles Farmers in Disaster Areas Rate of Credit Missed Claims Eligibility Flow Chart Further info amp references The fuel tax credit is a

Web The total fuel purchased for the BAS period is 500 000 L The vehicle logbooks show 15 245 L were used in passenger vehicles travelling on public roads which is ineligible for fuel Web Fuel Tax Credits are claimed on your Business Activity Statement and you may make a claim within four years of purchasing the fuel The amount of credit changes every six

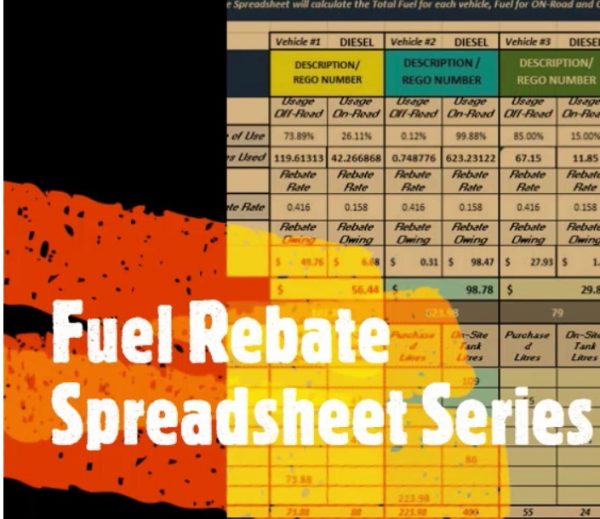

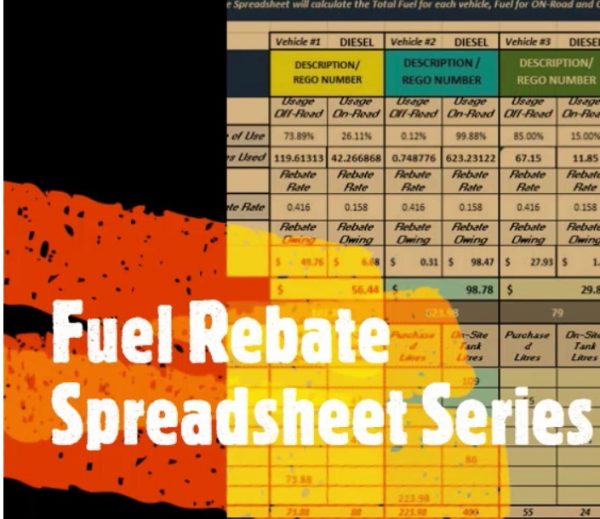

Fuel Rebate Spreadsheet Series Chews Learning Space

https://chewslearningspace.com/wp-content/uploads/2020/05/Fuel-Rebate-Series-Spreadsheet-600x519.jpg

National Fuel Rebate Form 2023 Printable Forms Free Online

https://www.temperatureexperts.com/wp-content/uploads/2022/01/2022-National-Fuel-Rebate.png

https://www.ato.gov.au/Business/Fuel-schemes/Fuel-tax-credits---non...

Web 1 juil 2017 nbsp 0183 32 Liquid fuels for example diesel or petrol Unit cents per litre 20 5 47 7 Blended fuels B5 B20 E10 Unit cents per litre 20 5 47 7 Blended fuel E85 Unit

https://www.ato.gov.au/uploadedFiles/Content/ITX/download…

Web NAT 15634 07 2021 How to work out your fuel tax credits Step 1 Work out the eligible quantity Work out how much fuel liquid or gaseous you acquired for each business

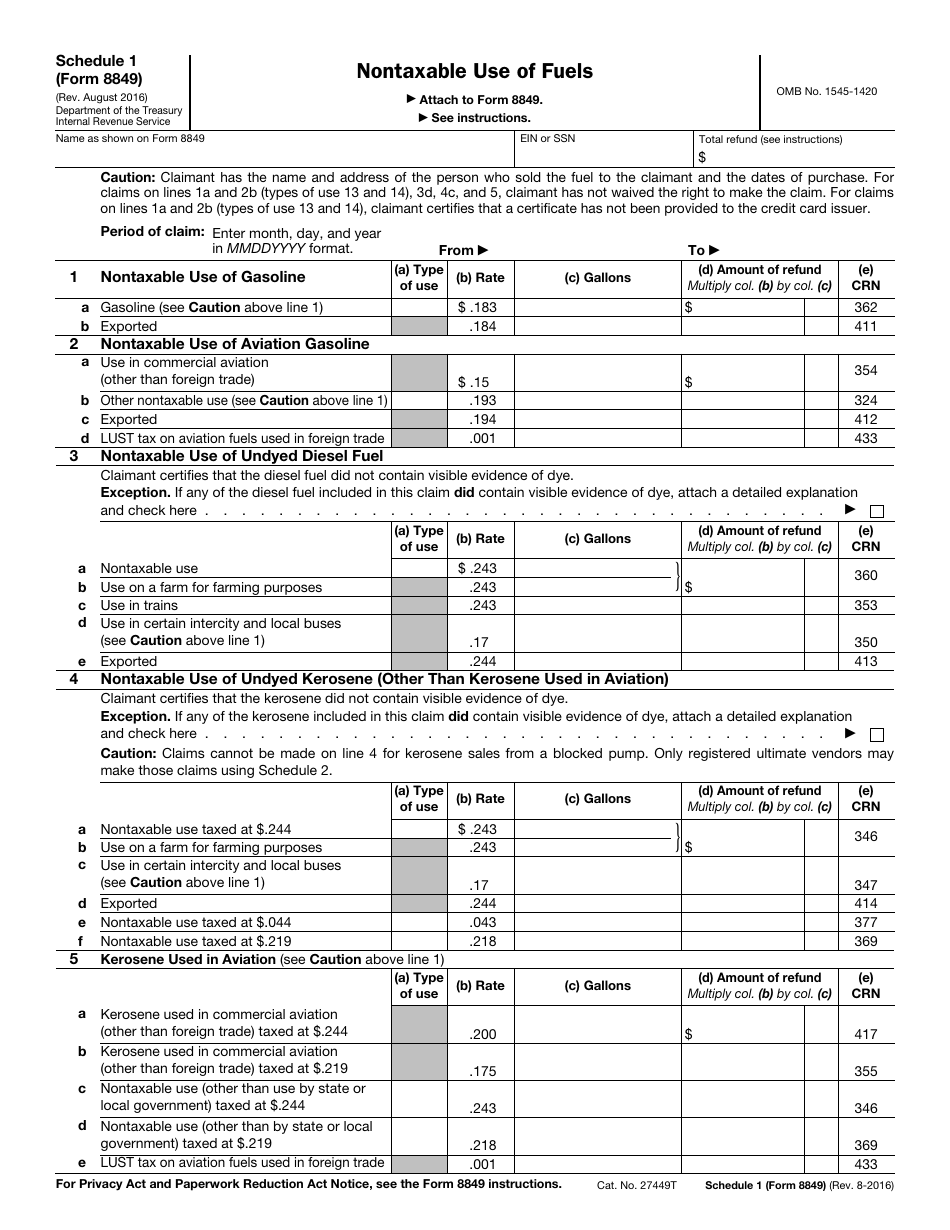

IRS Form 8849 Schedule 1 Download Fillable PDF Or Fill Online

Fuel Rebate Spreadsheet Series Chews Learning Space

Mass Save 2022 Rebates Forms Mass Save Rebate

Vehicle Fuel Log Template In 2021 Vehicle Maintenance Log

2021 chart prequalified rebates Fueling Tomorrow Today

Form 4923 H Fill Out And Sign Printable PDF Template SignNow

Form 4923 H Fill Out And Sign Printable PDF Template SignNow

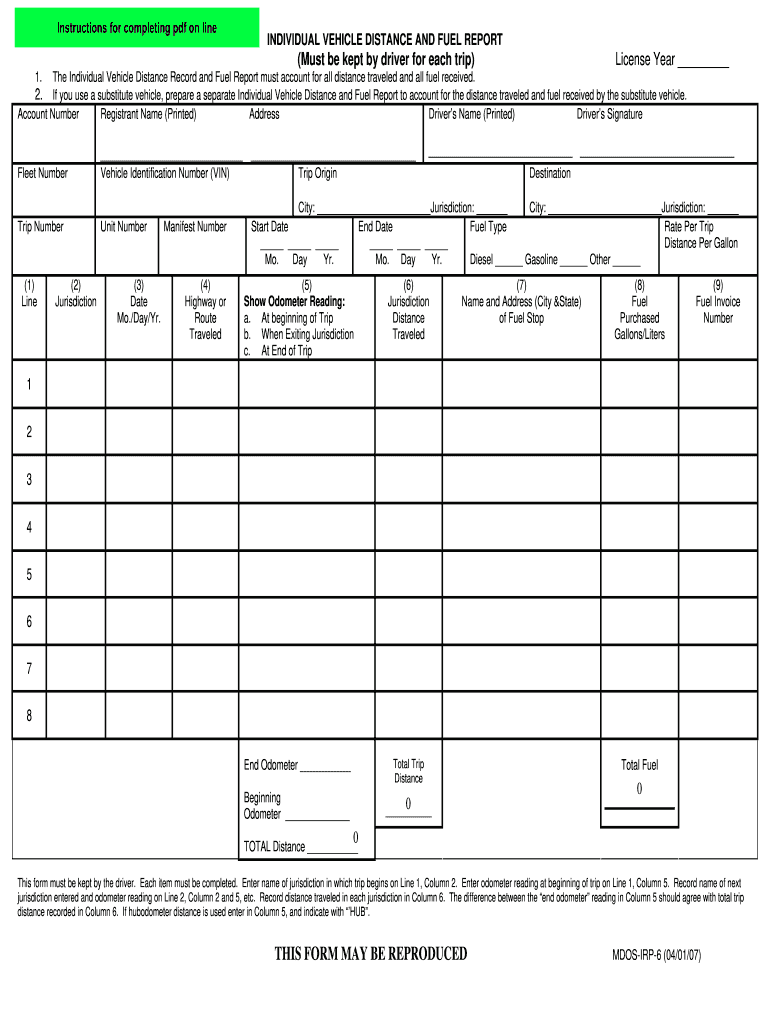

Fuel Report Template Fill Out And Sign Printable PDF Template SignNow

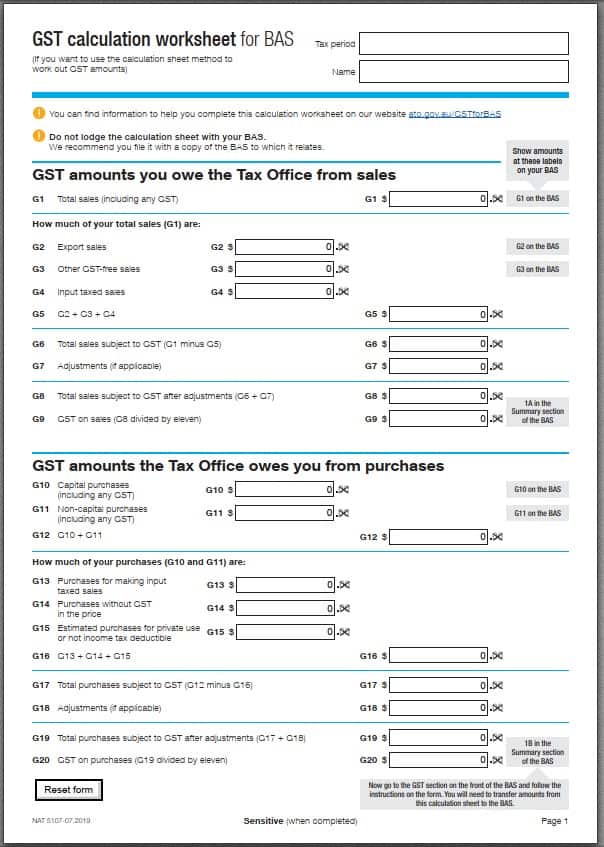

Kalamita Hovor Hlasno Zamestnanci Gst Calculation Sheet Odovzda Hlbok

Gas 1274 A Form Fill Out Sign Online DocHub

Ato Fuel Rebate Form - Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can