Ato Tax Deduction Travel Expenses To claim a deduction for a work related expense you must have spent the money yourself and weren t reimbursed it must be directly related to earning your

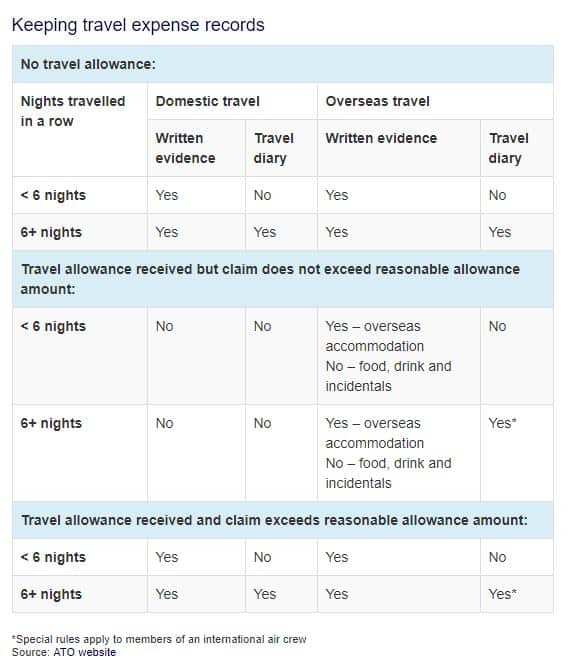

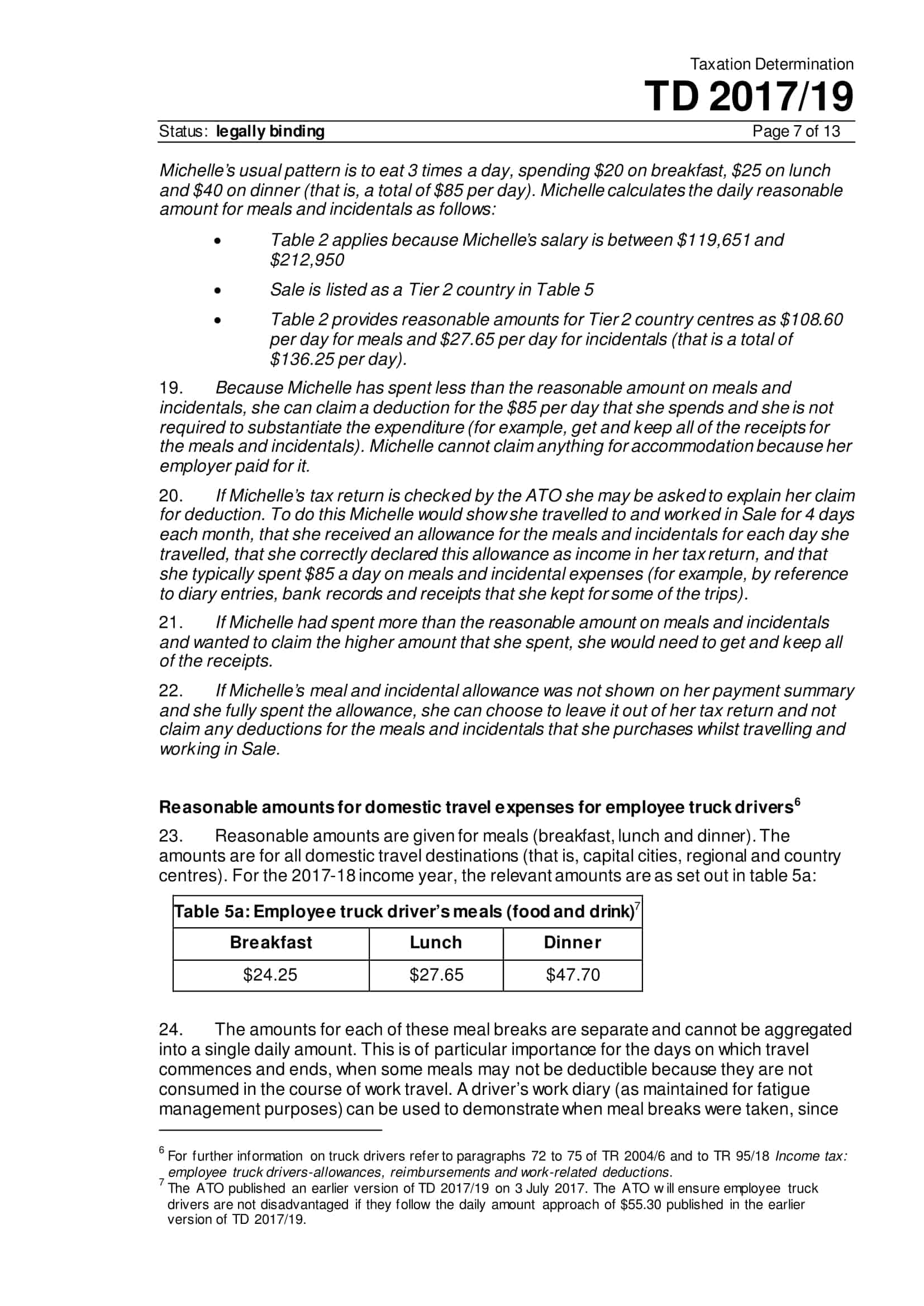

Deductible travel allowance expenses Receiving a travel allowance from your employer does not automatically entitle you to claim a deduction for travel expenses A travel Where an employer provides an allowance or pays or reimburses an employee for travel expenses including accommodation food and drink and incidentals

Ato Tax Deduction Travel Expenses

![]()

Ato Tax Deduction Travel Expenses

https://db-excel.com/wp-content/uploads/2019/01/free-real-estate-agent-expense-tracking-spreadsheet-within-realtor-expense-tracking-spreadsheet-fresh-tax-deduction-cheat-sheet-768x994.png

Rental Property Tax Deductions Property Tax Deduction

https://www.houselogic.com/wp-content/uploads/2016/08/tax-deductions-rental-home-standard_1f79136f45639b6e63f8a93b18c9fdcc.jpg

Guide To Travel Related Work Expenses AFS Associates

https://www.afsbendigo.com.au/wp-content/uploads/2020/06/Travel-expense-records.jpg

In order to claim travel expenses as a tax deduction you need to ensure that the correct substantiation is maintained The type and length of the business work related travel Work related travel expenses can boost your tax refund The following travel related expenses are tax deductible if you are eligible to claim them check eligibility rules further down this page Accommodation

TR 2021 D1 sets out the Commissioner s preliminary view on the deductibility and FBT treatment of accommodation and food and drink expenses including the criteria for This video explains when you can claim travel expenses in your business For more information visit https ato gov au TaxBasicsVideos

Download Ato Tax Deduction Travel Expenses

More picture related to Ato Tax Deduction Travel Expenses

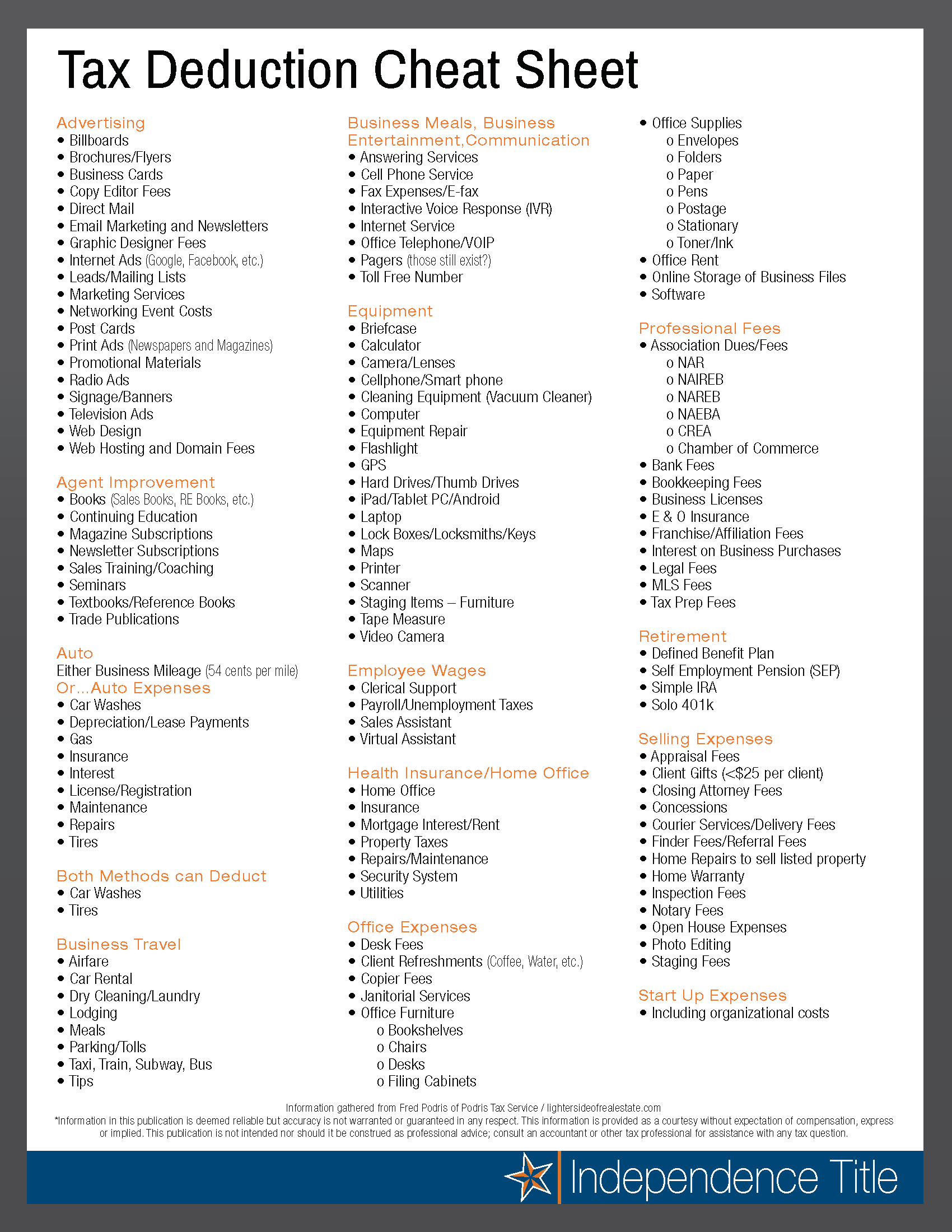

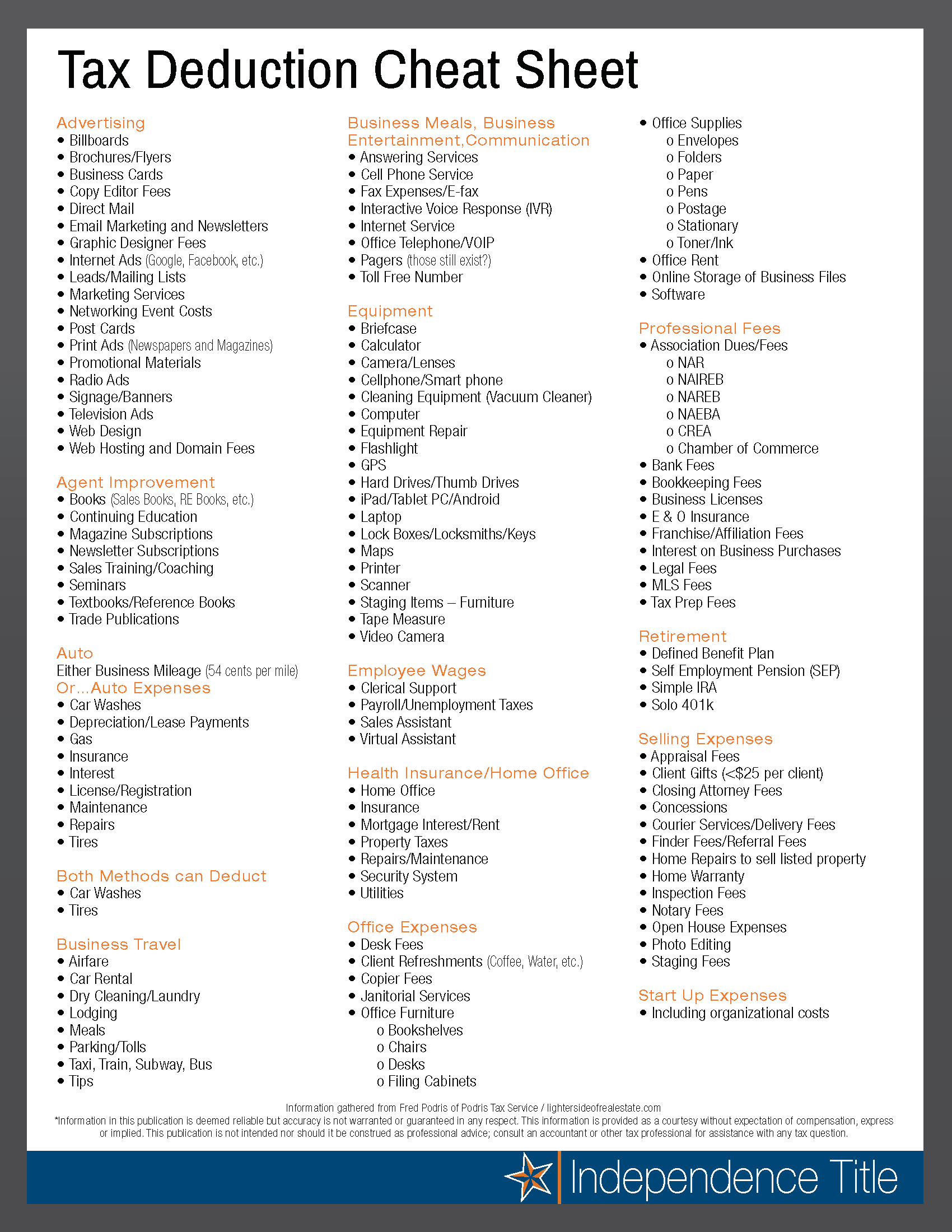

Printable Tax Deduction Worksheet Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-cheat-sheet-for-real-estate-agents-728x942.png

How To Complete Your Tax Return As A Sole Trader A Step By Step Guide

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/6273a38491505ed34870ec3d_xetQv6k7a8OsVfMe7dGDkxF-6xB_t0UtLd-aDCPkpt5_JQdc0bvR9hrmTEAufe3rv_Zw9tYEprFSlQiDk4dhP4yQ5ow8QHiYGtd4FtKy5tHHYc-h2MuqdczqOOHWzQ_E-5H3Kp4_lEL8gpxcqw.png

Realtor Tax Deductions Worksheet

https://db-excel.com/wp-content/uploads/2018/11/business-itemized-deductions-worksheet-beautiful-business-itemized-for-business-expense-deductions-spreadsheet-750x970.jpg

To be claimable as a tax deduction and to be excluded from the expense substantiation requirements travel and overtime meal allowances must be for work related purposes and be supported by Deductibility of travel costs mainly airfares are dependent on the purpose of the travel The current view of the ATO is that if the travel was predominantly for work related purposes then the airfares are claimable

We pre fill your tax return with work related travel expense information you uploaded from myDeductions Check them and add any work related travel expenses Some expenses the Australian Taxation Office ATO allows as travel tax deductions include accommodation meals and transportation For accommodation

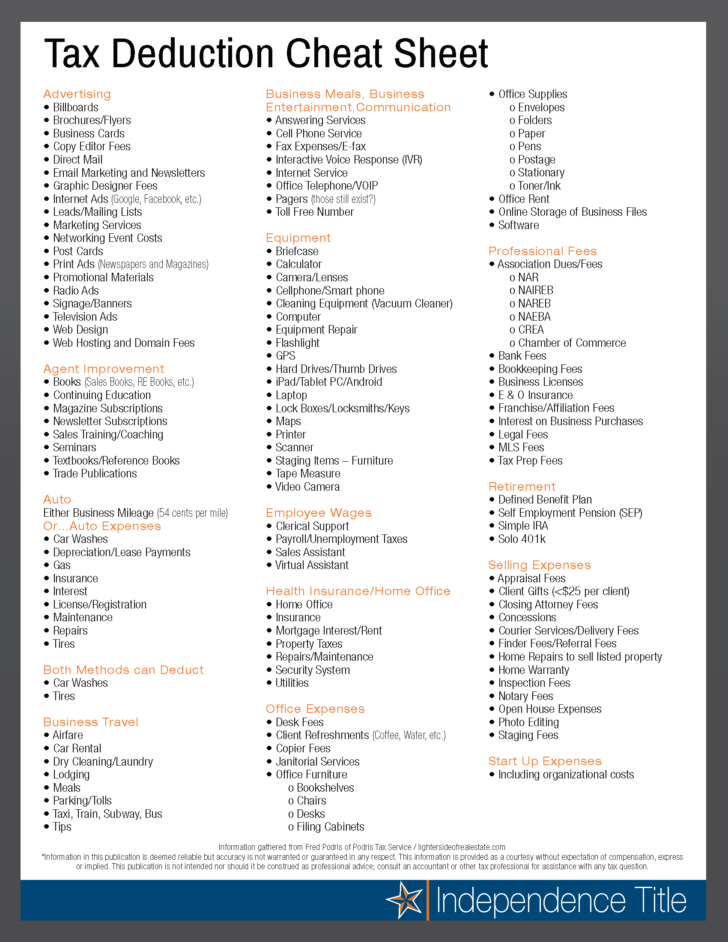

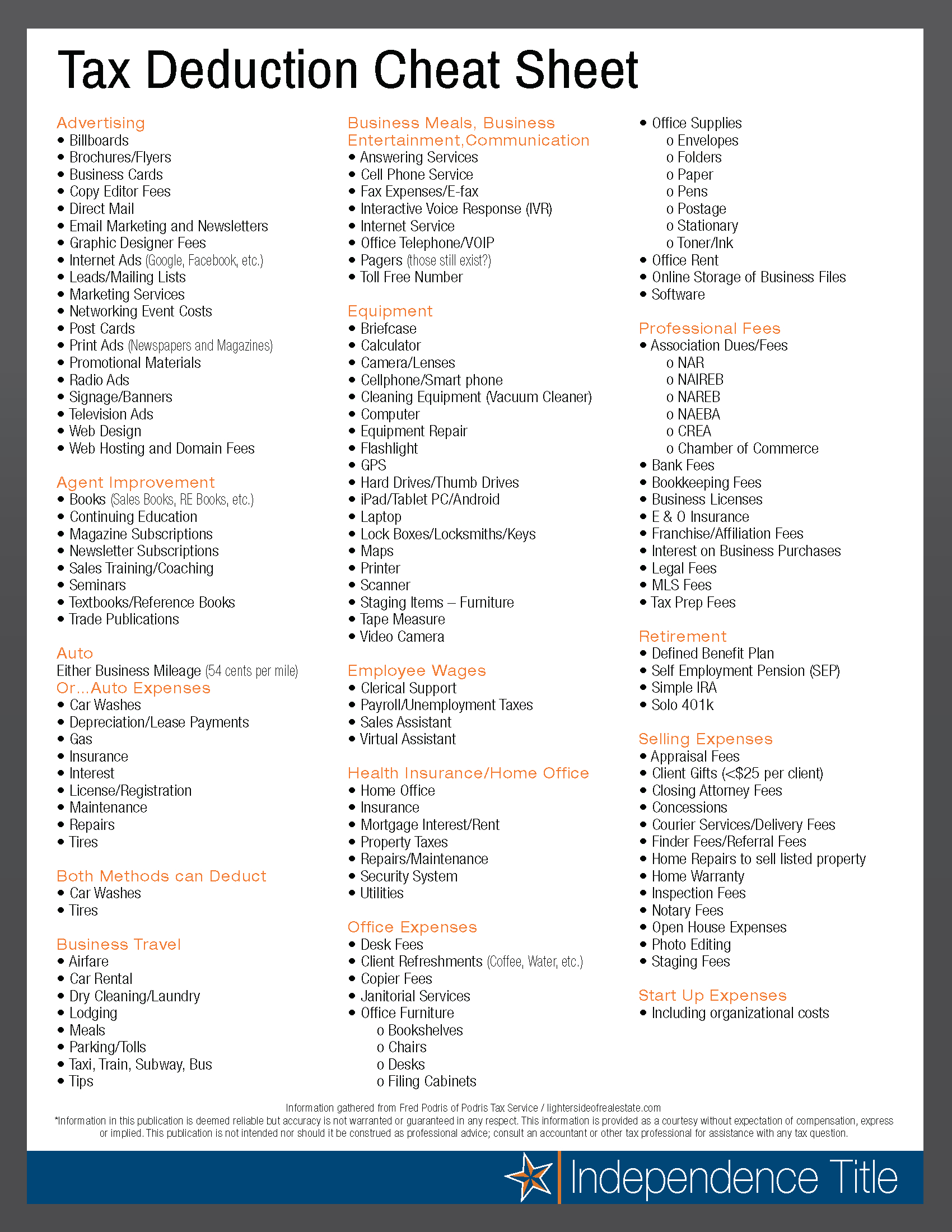

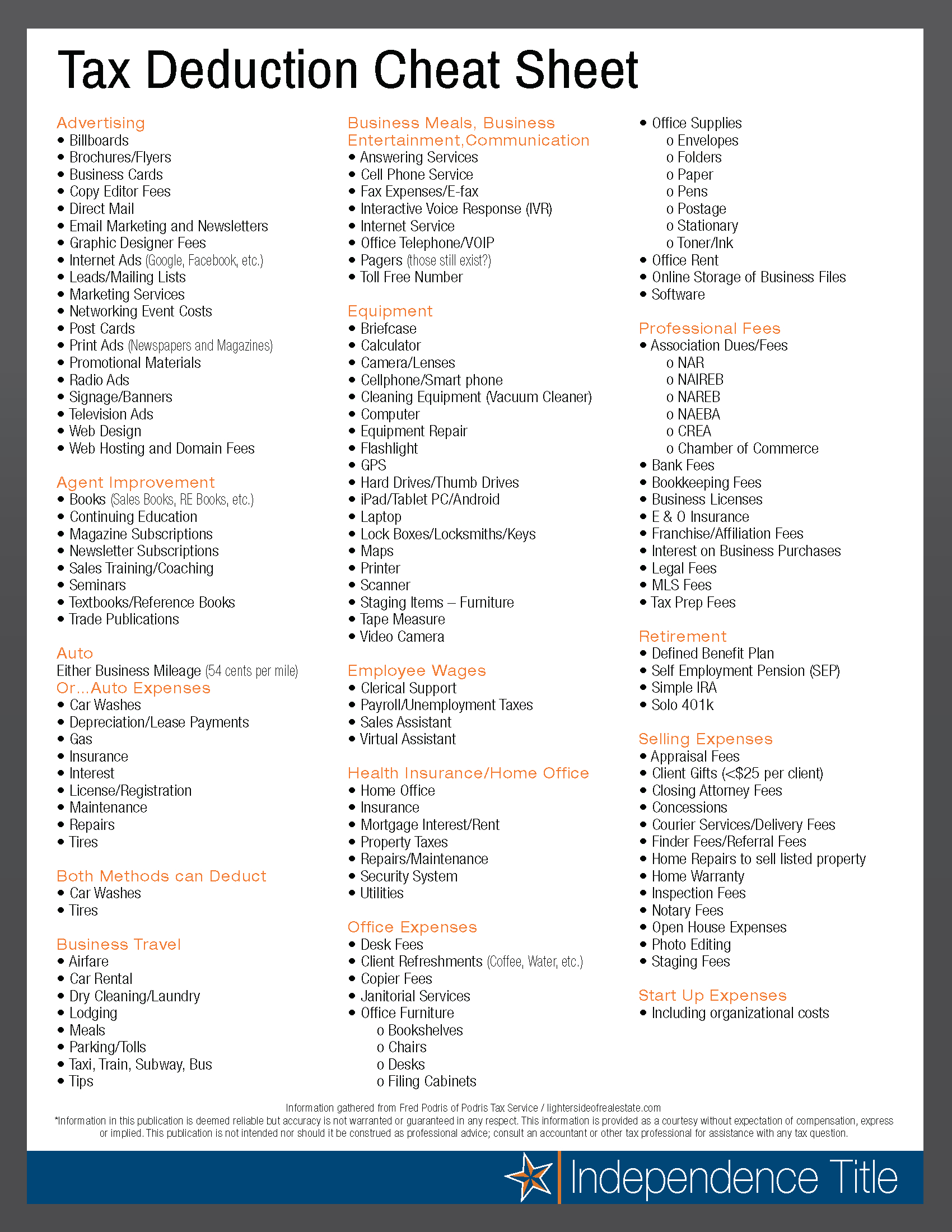

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-cheat-sheet-for-real-estate-agents-1.png

Real Estate Agent Tax Deductions Worksheet 2021

https://i.pinimg.com/originals/16/16/86/161686673757e7aaf5dba85fa41be0ed.jpg

https://www.ato.gov.au/individuals-and-families/...

To claim a deduction for a work related expense you must have spent the money yourself and weren t reimbursed it must be directly related to earning your

https://www.ato.gov.au/individuals-and-families...

Deductible travel allowance expenses Receiving a travel allowance from your employer does not automatically entitle you to claim a deduction for travel expenses A travel

ATO Work Expenses Letter Sent To 300 000 Australians

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

What Will My Tax Deduction Savings Look Like The Motley Fool

Income Tax Worksheet Pdf

List Of Itemized Deductions Checklist Fill Out Sign Online DocHub

Tax Deduction Spreadsheet Throughout Tax Deduction Cheat Sheet For Real

Tax Deduction Spreadsheet Throughout Tax Deduction Cheat Sheet For Real

ATO Reasonable Travel Allowances AtoTaxRates info

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense

Can I Claim Wedding Expenses On My Taxes Wedding Poin

Ato Tax Deduction Travel Expenses - A travel expense is any cost related to that travel be it an expense for the actual transport by plane train car bus or other vehicle or accommodation meals