Australian Government Tax Return Online You access ATO online services through myGov Sign in to myGov and select Australian Taxation Office Select Tax then Lodgements and then Income tax

5 minutes On this page If you earned Australian income between 1 July 2022 and 30 June 2023 you may need to lodge a tax return If you re doing your own tax you have until Last updated 8 Nov 2023 218 767 views Print friendly Wanting to check the progress of your tax return Wondering what Balancing account or Processing means The life

Australian Government Tax Return Online

Australian Government Tax Return Online

https://var.fill.io/uploads/pdfs/html/548dc070-5b9e-48d8-9f30-b0cd95b09f89/1570003635_thm.png

AY 2022 2023 Archives Income Tax Return

https://income-tax.co.in/wp-content/uploads/2021/07/income-tax-return-online.png

Track The Progress Of Your Tax Return In Australia One Click Life

https://oneclicklife.com.au/wp-content/uploads/2022/07/tax-return-status.jpg

Access government services from one place Sign in Sign in or Create account If you already have a myGov account you don t need to create a new one Find support You will find your TFN on your myGov account linked to the ATO on your income statement on your last notice of assessment You do not have to quote your

THV Client Australian Taxation Office Help clients lodge their tax return Assist with a refund of franking credits claim Tell us that the customer doesn t need to lodge a tax return 300 or less Greater than 300 Anything else Capital gains Rental properties Business tax return Starter Simple income and deductions One simple income Government

Download Australian Government Tax Return Online

More picture related to Australian Government Tax Return Online

Tax Return Australia JG Accountant

https://jgaccountants.com.au/wp-content/uploads/2018/02/Tax-return-Australia.jpg

Explained How Does Tax Work In Australia video YouTube

https://i.ytimg.com/vi/FeqwZwQcrj8/maxresdefault.jpg

Taxation Advice And Support DBA Accountants

https://dbagroup.com.au/wp-content/uploads/2018/05/australian-tax-2.jpg

Need to keep using this sign in option to access ATO online services may be unable to access ATO online services through the myGov app If you sign into the The Australian Government has made changes to individual income tax rates and thresholds This will apply to all taxable income you earn from 1 July 2024 The changes

1 minutes On this page Helps you work out how much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are You can file your Self Assessment tax return online if you are self employed are not self employed but you still send a tax return for example because you receive income from

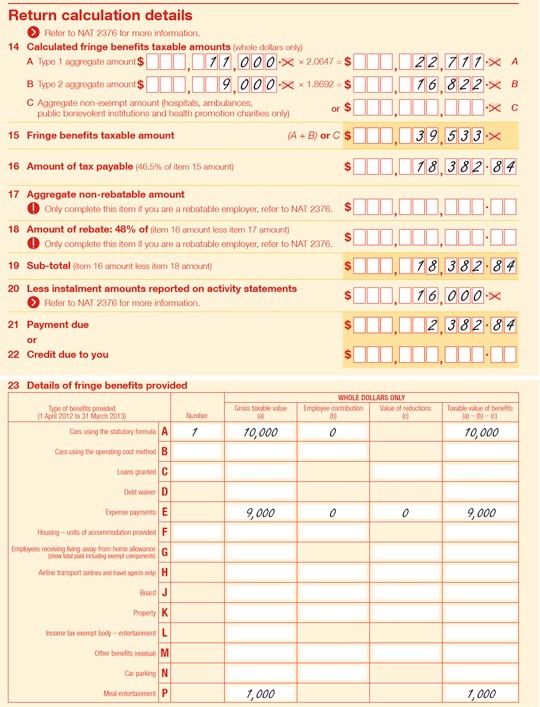

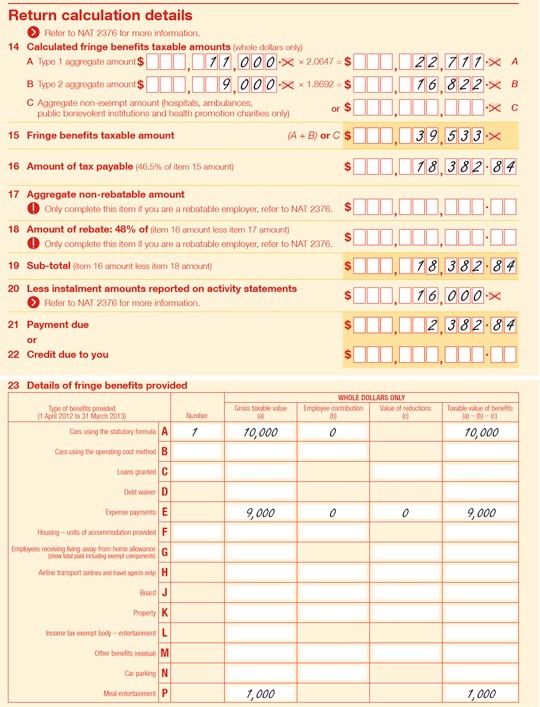

Publication Details

https://iorder.com.au/upload/image/publications/ex_2679-6.2023_full.jpg

How To File ITR Online Step by Step Guide To E File Income Tax Return

https://mannatconsultancy.com/wp-content/uploads/2023/06/Income-Tax-Return.png

https://my.gov.au/.../lodging-a-tax-return

You access ATO online services through myGov Sign in to myGov and select Australian Taxation Office Select Tax then Lodgements and then Income tax

https://moneysmart.gov.au/work-and-tax/lodging-a-tax-return

5 minutes On this page If you earned Australian income between 1 July 2022 and 30 June 2023 you may need to lodge a tax return If you re doing your own tax you have until

Australian Individual Tax Return Form Stock Photo Image Of Individual

Publication Details

How To File Your Income Tax Return Online U Taxgoal

Beginners Guide To Completing Your Tax Return Online Tax Return Tax

How To File Income Tax Return Online Jar App

File Australian Tax Return

File Australian Tax Return

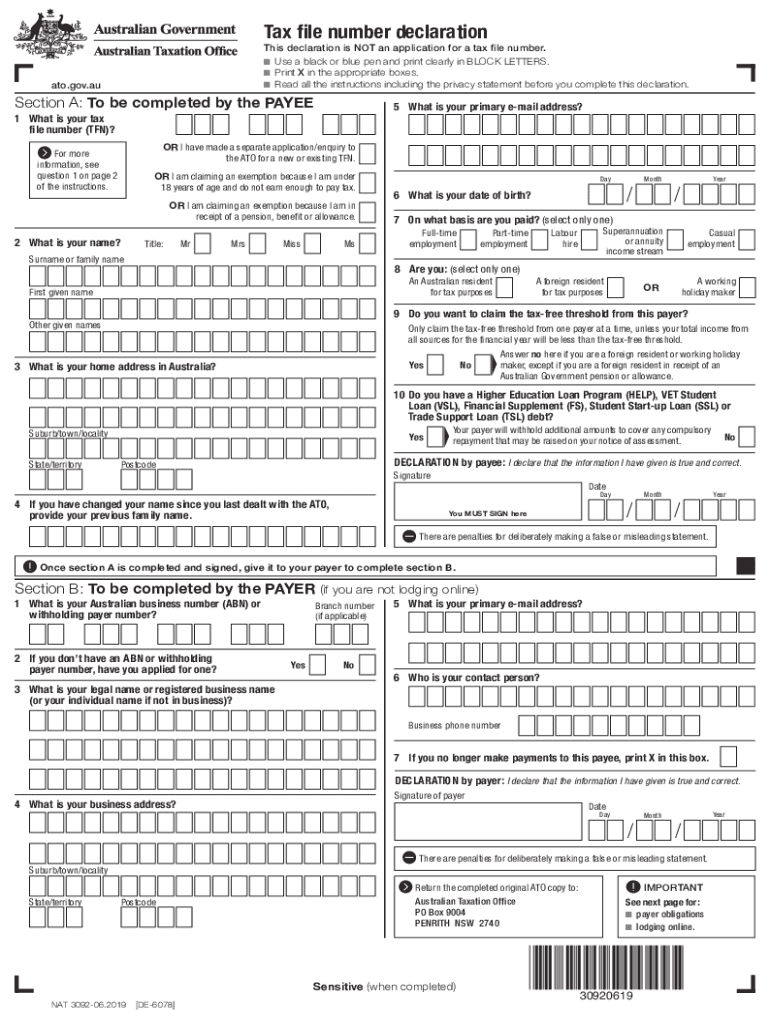

2019 2023 Form AU NAT 3092 Fill Online Printable Fillable Blank

Heavy Vehicle Use Tax HVUT Form2290 Annual renewal For taxyear

Australian Annual Tax Return Forms Tax Concept Stock Image Image Of

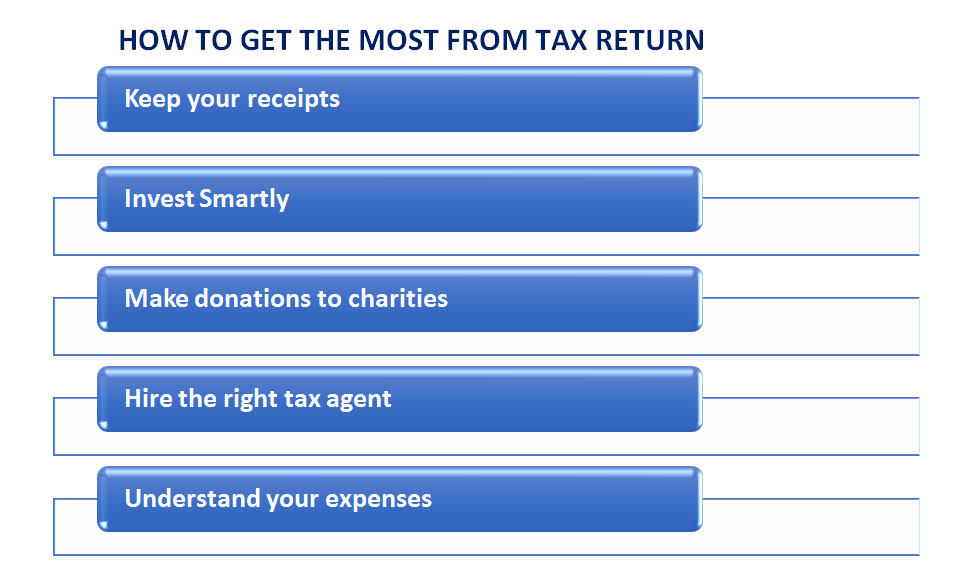

Australian Government Tax Return Online - New to Etax Fast easy online tax return Can t find your PAYG or Income Statement No problem Etax can find it for you Live help from qualified Etax Accountants online