Montana Property Tax Rebate Deadline 2024 The Montana Property Tax Rebate is available for eligible homeowners in 2024 offering up to 675 in relief for property taxes paid on a principal residence The department has approved over 180 000 claims totaling 120 million which is about 80 of estimated potential claims

The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022 However taxpayers can also have their rebate mailed to them by check The department will process claims as they are received and distribute rebates by December 31 2023 Montana homeowners will be eligible for a second property tax rebate up to 675 in 2024 for property taxes paid on a principal residence for 2023 Last November the

Montana Property Tax Rebate Deadline 2024

Montana Property Tax Rebate Deadline 2024

https://townsquare.media/site/1107/files/2023/08/attachment-Tax-Rebate.jpg?w=980&q=75

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Montana-Tax-Rebate-2023-768x684.png

Unlocking Your 2022 Montana Tax Rebate A Step by Step Guide To Finding Your Property Geocode

https://dogiakos.com/wp-content/uploads/2023/08/Montana-Property-Tax-Rebate.png

The rebate application requires the home s physical address geocode the amount of property taxes paid in 2022 and the names and Social Security numbers of the owner any spouse and dependents The state s website has tools to find this information This spring the governor also delivered Montanans 120 million in permanent long term property tax relief and secured up to 1 350 in property tax rebates for Montana homeowners over the next two years Eligible Montana homeowners may now claim their first rebate up to 675 at getmyrebate mt gov The deadline for claims is October 1 2023

Selected applicants can get a rebate of up to 675 on their primary residence in 2023 and 2024 The revenue department will start accepting 2024 claims Tax Year 2023 on Aug 15 2024 The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online Claiming a property tax rebate online should take

Download Montana Property Tax Rebate Deadline 2024

More picture related to Montana Property Tax Rebate Deadline 2024

Montana Property Tax Rebate Deadline Extended To Oct 2

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA15HEs8.img?w=1000&h=500&m=4&q=75

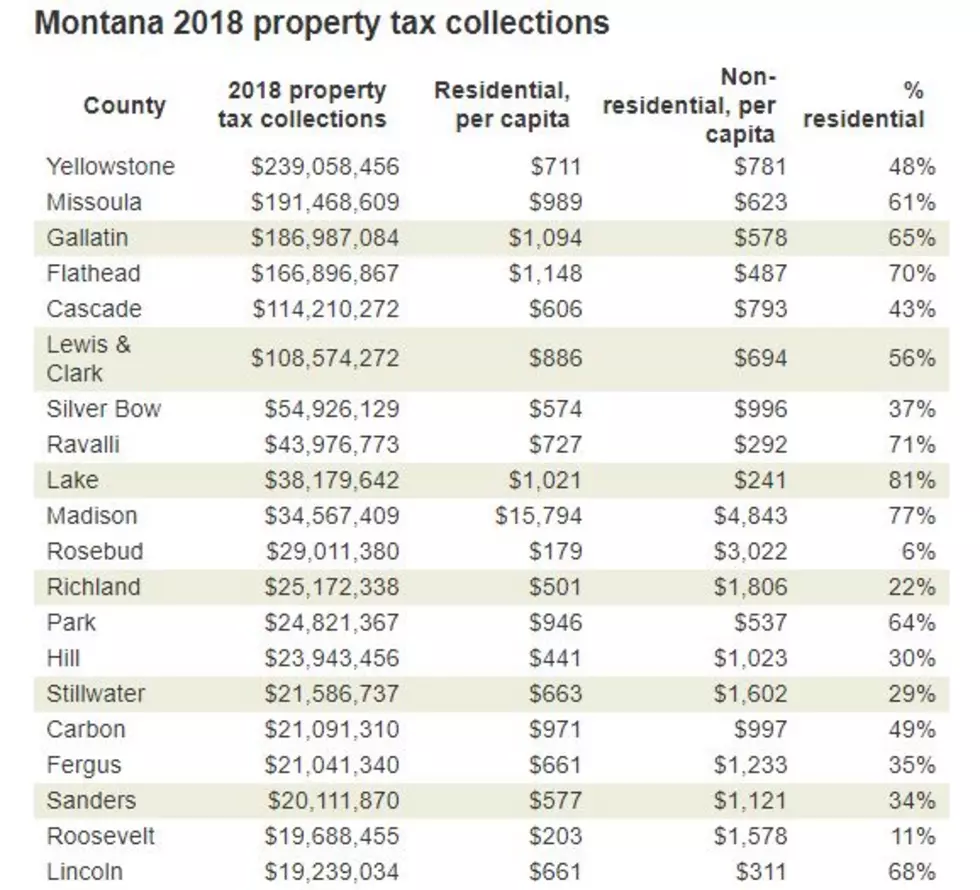

Montana Property Taxes Keep Rising But Missoula Isn t At The Top

https://townsquare.media/site/1098/files/2020/02/Taxes-4.jpg?w=980&q=75

Income And Property Tax Relief Montana s 675 Rebate For 2023 Explained

https://ridgecrestpact.org/wp-content/uploads/2023/08/Income-and-Property-Tax-Relief-Montanas-675-Rebate-for-2023-Explained.jpg

These you have to apply for The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 to Oct 1 2023 A second application period for 2023 rebates will be open across the same dates in 2024 You can also call the department at 406 444 6900 Rebates on 2022 and 2023 property taxes Homeowners are eligible for up to 675 a year for their 2022 and 2023 property taxes on their principal residence defined as the place where you ve lived for at least seven months of the year If you paid less than 675 in property taxes in either year

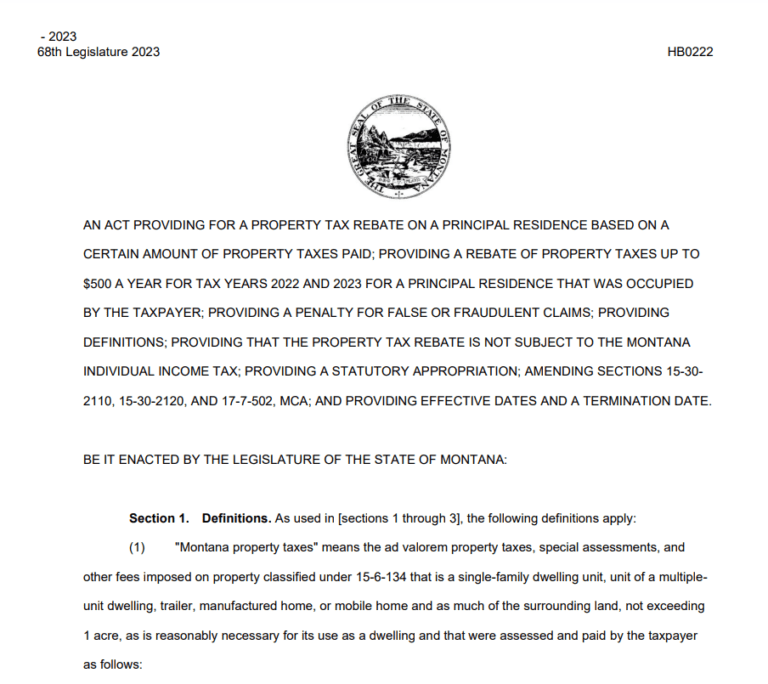

Original post below Montana homeowners have one week left to claim a rebate of up to 675 on their property taxes The window to claim a state property tax rebate opened on Aug 15 and to HELENA Mont Montana homeowners can file their claim for this year s property tax rebate starting in August The rebates are available after Governor Greg Gianforte signed House Bill 222 which provides a property tax rebate of up to 675 in both 2023 and 2024 for Montana homeowners at their primary residence

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Beaver County

https://s3.amazonaws.com/static.beavercountyradio.com/wp-content/uploads/2021/01/25060432/unnamed-7-1536x1024.jpg

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

https://tnnmc.org/montana-property-tax-rebate-2024-claiming-procedure-eligibility-deadline/

The Montana Property Tax Rebate is available for eligible homeowners in 2024 offering up to 675 in relief for property taxes paid on a principal residence The department has approved over 180 000 claims totaling 120 million which is about 80 of estimated potential claims

https://leg.mt.gov/content/Committees/Interim/2023-2024/Revenue/Meetings/July-2023/property-relief-flyer.pdf

The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

PA Property Tax Rebate What To Know Credit Karma

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Beaver County

Montana To Send All Property Tax Rebates By Paper Check KECI

This US States Property Tax Rebate For Residents How To Qualify

Montana Personal Property Tax PROPERTY BSI

675 Property Tax Rebate From Montana Deadline To Claim Is Oct 1 24 7 Wall St

675 Property Tax Rebate From Montana Deadline To Claim Is Oct 1 24 7 Wall St

75 Montgomery Property Tax Rebate Deadline Apply By Dec 31

Montana Property Tax Calculator SmartAsset Tax Rate Property Tax Income Tax Home

Unraveling The Montana Tax Rebate 2023 Your Comprehensive Guide USRebate

Montana Property Tax Rebate Deadline 2024 - The rebate application requires the home s physical address geocode the amount of property taxes paid in 2022 and the names and Social Security numbers of the owner any spouse and dependents The state s website has tools to find this information