Auto Donation Tax Deduction Rules Learn how to claim a tax deduction for donating your car to charity including the documentation valuation and documentation requirements Find out how to vet charities avoid scams and get the

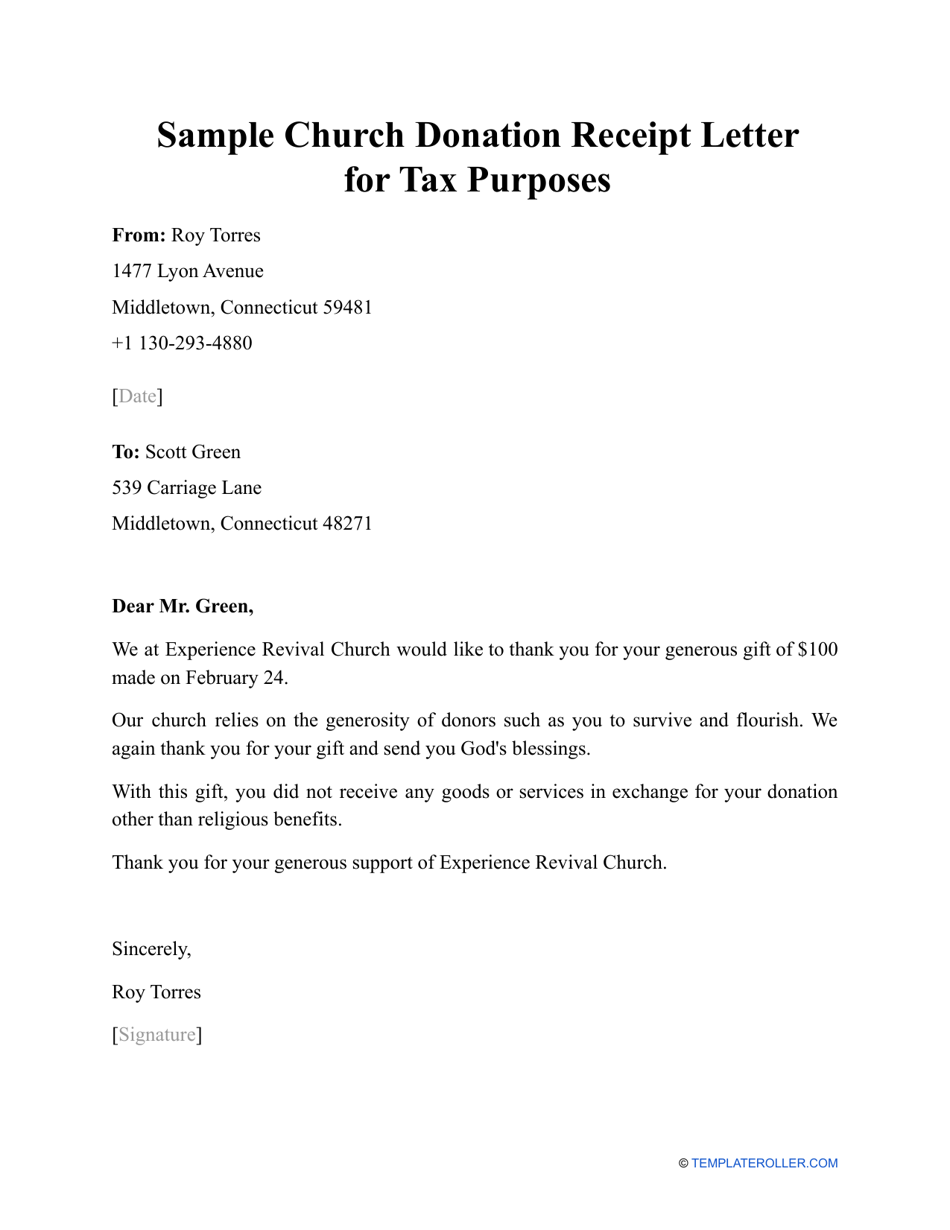

Requires donors to get a timely acknowledgment from the charity to claim the deduction Donors may claim a deduction of the vehicle s fair market value under the As with all things taxable charitable auto donations are somewhat complicated You ll need to be sure that you can in fact deduct your donation from

Auto Donation Tax Deduction Rules

Auto Donation Tax Deduction Rules

https://www.goodwillcardonation.org/wp-content/uploads/2020/07/Tax-Documents-1024x683.jpg

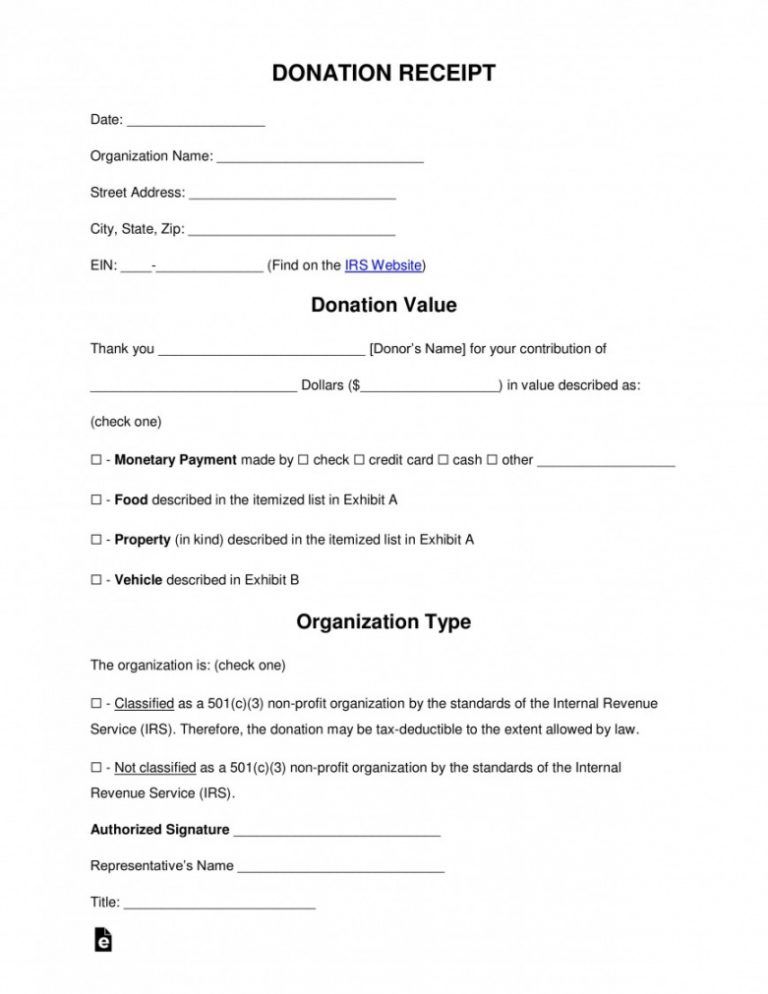

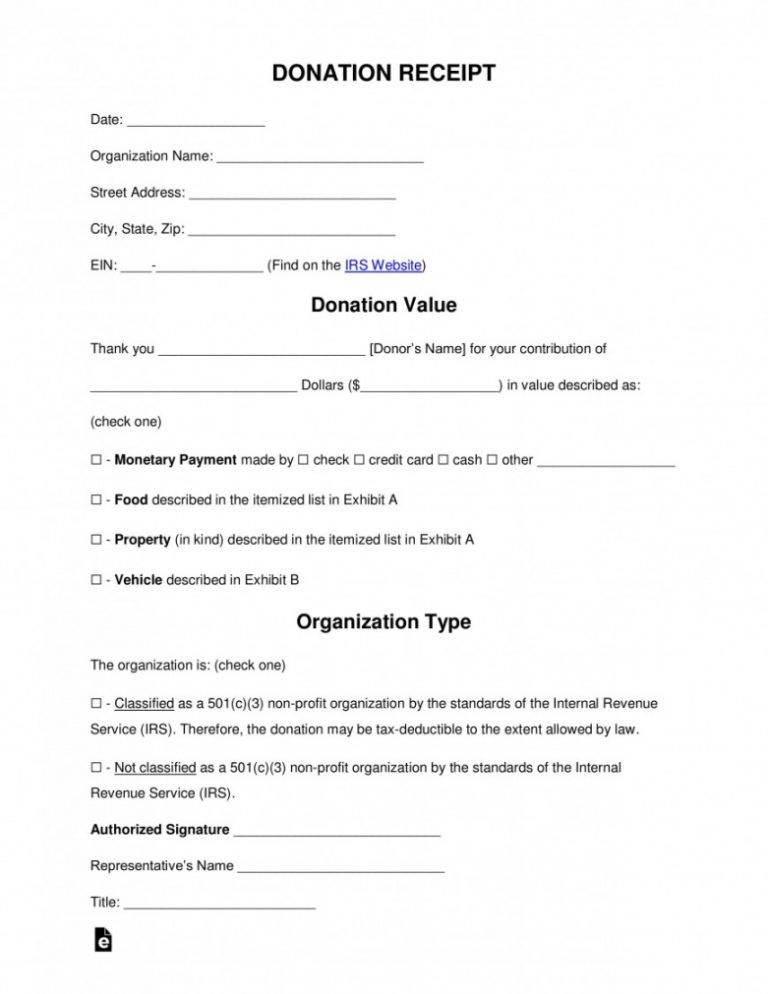

Free Tax Donation Form Template Addictionary Tax Deductible Donation

http://www.emetonlineblog.com/wp-content/uploads/2020/06/free-tax-donation-form-template-addictionary-tax-deductible-donation-receipt-template-sample-768x994.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Your deduction for charitable contributions generally can t be more than 60 of your AGI but in some cases 20 30 or 50 limits may apply Table 1 gives examples of Qualifying for a Tax Deduction You can deduct contributions to charity only if you itemize deductions on your Schedule A of Form 1040 You must take into account certain

Yes Habitat for Humanity is a 501 c 3 nonprofit organization Contributions including vehicle donations may be claimed as deductions on your federal tax return if you itemize How much can I deduct Once If the donated vehicle is sold for less than 500 you can claim the fair market value of your vehicle up to 500 or the amount it is sold for if less than fair market value If the donated vehicle sells for more than 500

Download Auto Donation Tax Deduction Rules

More picture related to Auto Donation Tax Deduction Rules

Tax Deduction Rules For Self employed Person Ungrounded Thinking

https://ungroundedthinking.com/wp-content/uploads/2021/06/13-1024x683.jpg

10 Clothing Donation Tax Deduction Worksheet

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-in-clothing-donation-tax-deduction-worksheet-2018-goodwill-sample.jpg

Donate Auto U S A Sacramento Auto Donation Tax Deduction

https://1.bp.blogspot.com/-vuquEckHtFg/VEbI9pw5nwI/AAAAAAAAAI0/3tSK3jwyUEo/s1600/donatetocharity33.jpg

If you donate a car worth 3 000 your possible itemized deductions are 4 000 since the standard deduction is more it still makes more sense to claim the If your car sold for less than 500 To receive an IRS deduction for a donated vehicle you must itemize your deductions including any charitable contributions on Section A of Form 1040 from

In this comprehensive guide we will delve into the intricacies of car donations for tax deductions providing you with valuable insights to make informed decisions Claiming a Deduction for Your Car Donation To claim a tax deduction the organization you re donating to must be a qualified organization according to the IRS which means it

10 2014 Itemized Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/12/tax-deduction-worksheet_449398.png

Maximize Your Impact The Ultimate Guide To Car Donation And Tax

https://www.u-pull-it.com/wp-content/uploads/2023/07/BEST-CHARITIES-FOR-CAR-DONATION-TAX-DEDUCTION.jpg

https://www.forbes.com/advisor/taxes/donat…

Learn how to claim a tax deduction for donating your car to charity including the documentation valuation and documentation requirements Find out how to vet charities avoid scams and get the

https://www.irs.gov/.../irs-guidance-explains-rules-for-vehicle-donations

Requires donors to get a timely acknowledgment from the charity to claim the deduction Donors may claim a deduction of the vehicle s fair market value under the

Sample Church Donation Receipt Letter For Tax Purposes Fill Out Sign

10 2014 Itemized Deductions Worksheet Worksheeto

Inspiring Tax Receipt For Donation Template

Fillable Online Charitable Donation Tax Deduction Rules Apply On Giving

Tax Deduction Rules For 529 Plans What Families Need To Know College

How To Maximize Your Charity Tax Deductible Donation WealthFit

How To Maximize Your Charity Tax Deductible Donation WealthFit

Car Donation Car Donation Tax Deduction Calculator

Donation Tax Deduction Malaysia Phillip Weiss

Printable Itemized Deductions Worksheet

Auto Donation Tax Deduction Rules - To claim a tax deductible donation you must itemize on your taxes The amount of charitable donations you can deduct may range from 20 to 60 of your AGI