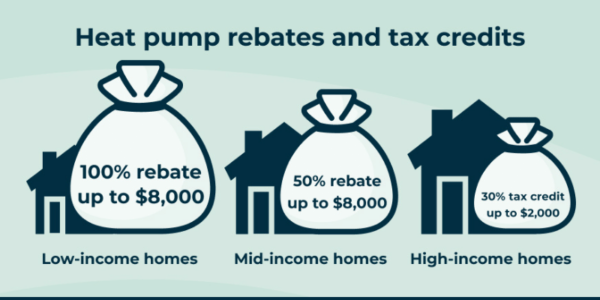

Hvac Heat Pump Rebates Through the High Efficiency Electric Home Rebate Act HEEHRA some homeowners may receive rebates of 100 or 50 off heat pump installation up to 8 000 if they qualify based on their income What is the 2023 federal tax credit for heat pumps

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit When it comes to paying for your heat pump there are two ways the Inflation Reduction Act can help tax credits and rebates Tax credits for heat pumps If you install an efficient heat pump between now and 2032 you are eligible for a federal tax credit that will cover 30 up to 2 000 of the heat pump cost and installation This tax credit

Hvac Heat Pump Rebates

Hvac Heat Pump Rebates

https://imgv2-1-f.scribdassets.com/img/document/171174767/original/4119d86a2d/1586408976?v=1

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-118.png

Heat Pump Rebates From Utility Providers Minneapolis St Paul HVAC

https://www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-rebates-from-utility-providers-minneapolis-st-paul-hvac-2.jpg

Beyond the tax incentive you also could be eligible for up to 1 750 for a heat pump water heater and 8 000 for a heat pump for space heating and cooling Both incentives would be in the form Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Taxpayers have claimed more than 6 billion in credits for residential clean energy investments which include solar electricity generation solar water heating and battery storage and more than 2 billion for energy efficient home improvements which include heat pumps efficient air conditioners insulation windows and doors on

Download Hvac Heat Pump Rebates

More picture related to Hvac Heat Pump Rebates

Eversource Mini Split Rebates PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/residential-hvac-rebates.jpg?fit=927%2C1200&ssl=1

HVAC Solutions Simplified HVAC Solutions

https://www.hvac.com/wp-content/uploads/2022/09/heat-pump-rebates-2023-600x300-c-default.png

Clark PUD Rebates Ductless Heat Pump Hvac Installation Heat Pump

https://i.pinimg.com/originals/2b/14/3b/2b143b778cb04873df0b3f797cd19ae8.png

The Home Energy Rebates will provide Americans with deep discounts on household upgrade purchases that can lower monthly utility bills Depending on where you live you can use the rebates to get discounts on ENERGY STAR Includes a 14 000 cap per household with a 8 000 cap for heat pump costs 1 750 for a heat pump water heater and 4 000 for panel service upgrade Other eligible rebates include electric stoves and clothes dryers

Heat pump federal tax credit 2024 Starting in 2023 continuing this year and through the end of 2032 all homeowners will be eligible for a 30 federal tax credit on the total cost of buying and installing their new heat pump with a maximum credit of 2 000 In theory you could combine the 8 000 heat pump rebate and a 2 000 tax credit to get 10 000 off a heat pump that is as long as the heat pump meets the stricter CEE efficiency guidelines and your tax liability is at least 2 000 for the year

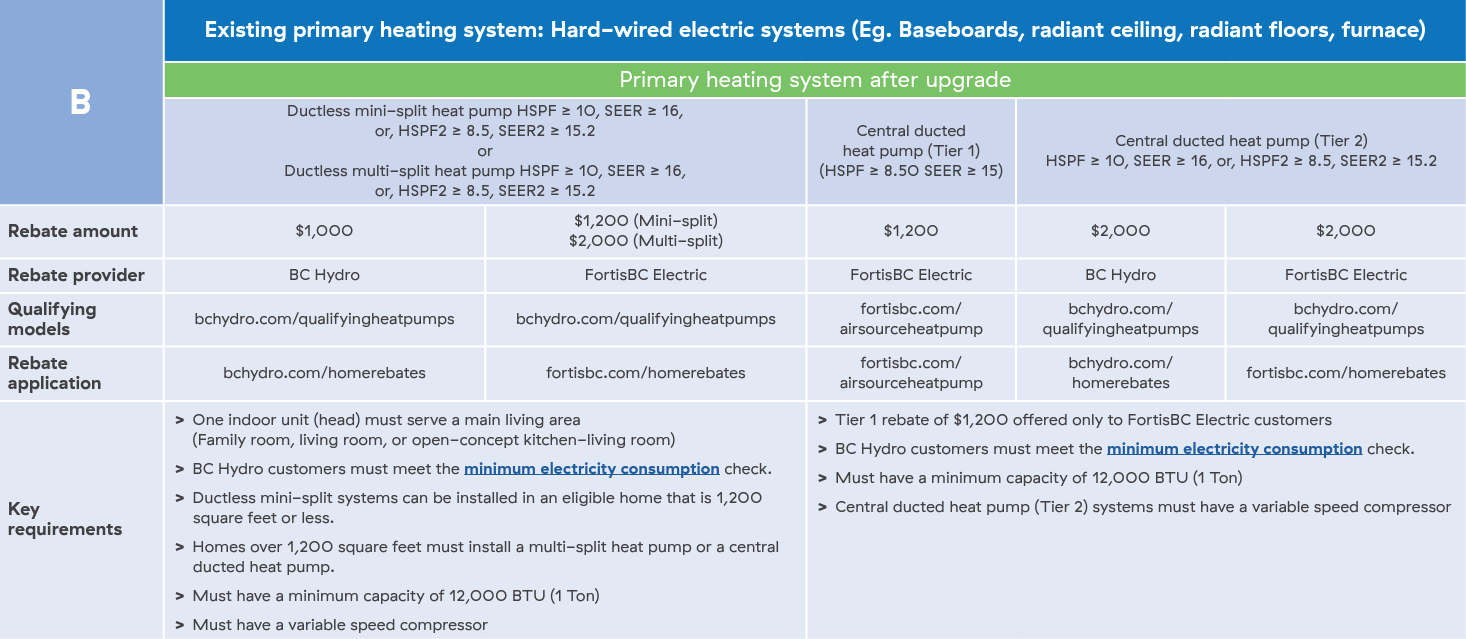

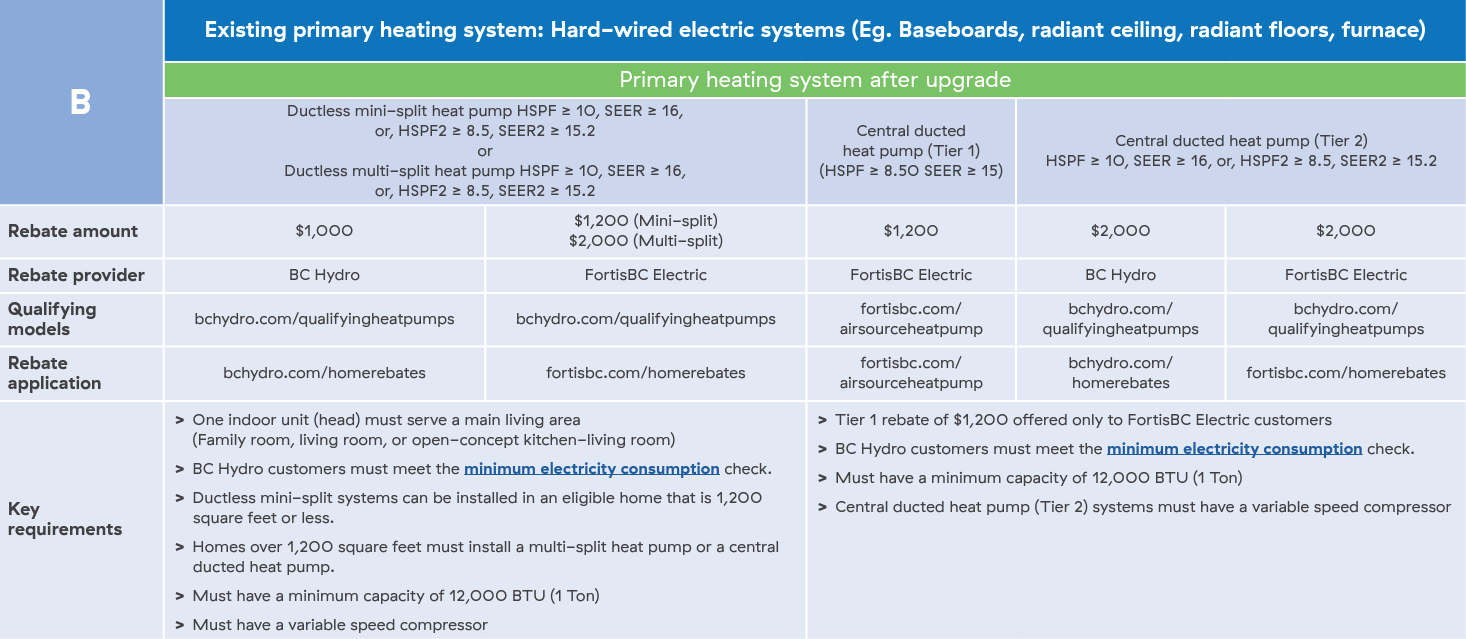

BC Heat Pump Rebates Home Heating Rebates Lockhart Industries

https://lockhart.ca/wp-content/uploads/2023/06/home-heating-rebate-bc.png

750 Rebate For Heat Pump With Efficiency Advantage Heating And Cooling

https://www.advantagehcp.com/wp-content/uploads/2019/09/750-rebate-for-heat-pump-with-efficiency-90-HSPF14-SEER-or-higher-when-converting-from-an-electric-furnace-Additional-250-rebate-for-variable-speed.png

https://www.hvac.com/expert-advice/inflation...

Through the High Efficiency Electric Home Rebate Act HEEHRA some homeowners may receive rebates of 100 or 50 off heat pump installation up to 8 000 if they qualify based on their income What is the 2023 federal tax credit for heat pumps

https://www.irs.gov/credits-deductions/energy...

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

2023 Heat Pump Rebates 24 7 Furnace AC Tankless Attic Insulation

BC Heat Pump Rebates Home Heating Rebates Lockhart Industries

7100 Rebate On Heat Pumps Don t Miss Out On A Free Heat Pump 24 7

Heat Pump Hot Water System How It Works Why Use One Rebates

The Inflation Reduction Act Pumps Up Heat Pumps HVAC Solutions

How To Take Advantage Of New Federal Heat Pump Rebates ProSkill

How To Take Advantage Of New Federal Heat Pump Rebates ProSkill

Heat Pump Rebates In Ontario Maximize Your Savings With Constant Home

Heat Pump Rebates Atmosphere Climate Control Specialists

Heat Pump Rebates Maine PumpRebate

Hvac Heat Pump Rebates - Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings