Average Annual Total Return Vs Cumulative Return The average annual return AAR is a percentage that represents a mutual fund s historical average return usually stated over three five and 10 years Before making a mutual fund

The cumulative return is the total change in the investment price over a set time an aggregate return not an annualized one Reinvesting the dividends or capital gains of an investment impacts What the annualized return is why it comes in handy and how to calculate it What is a cumulative return and how do you calculate it As the name suggests the cumulative

Average Annual Total Return Vs Cumulative Return

Average Annual Total Return Vs Cumulative Return

https://m.foolcdn.com/media/dubs/images/original_imageshttpsg.foolcdn.comeditorialimag.width-880_HYgZHZz.png

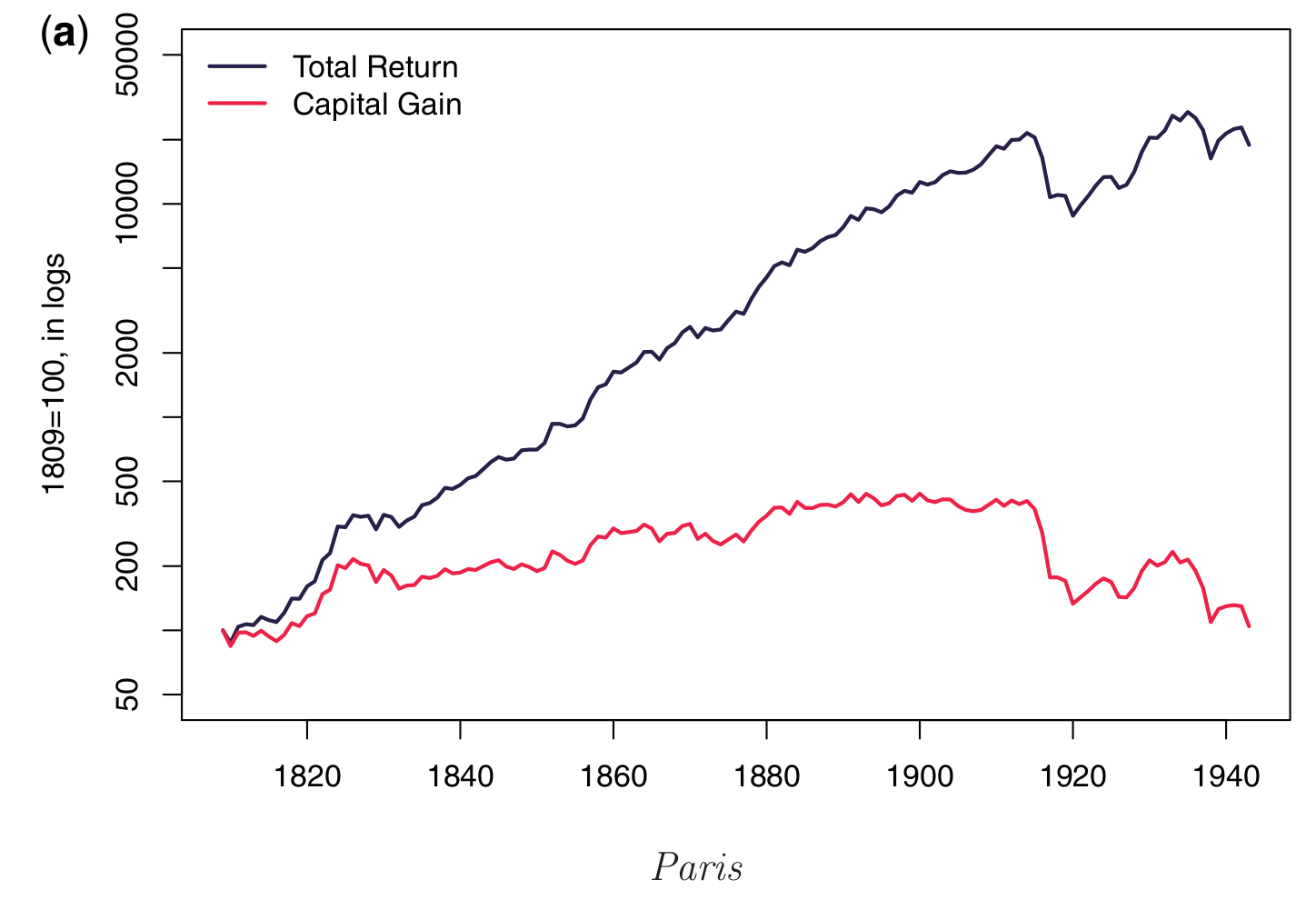

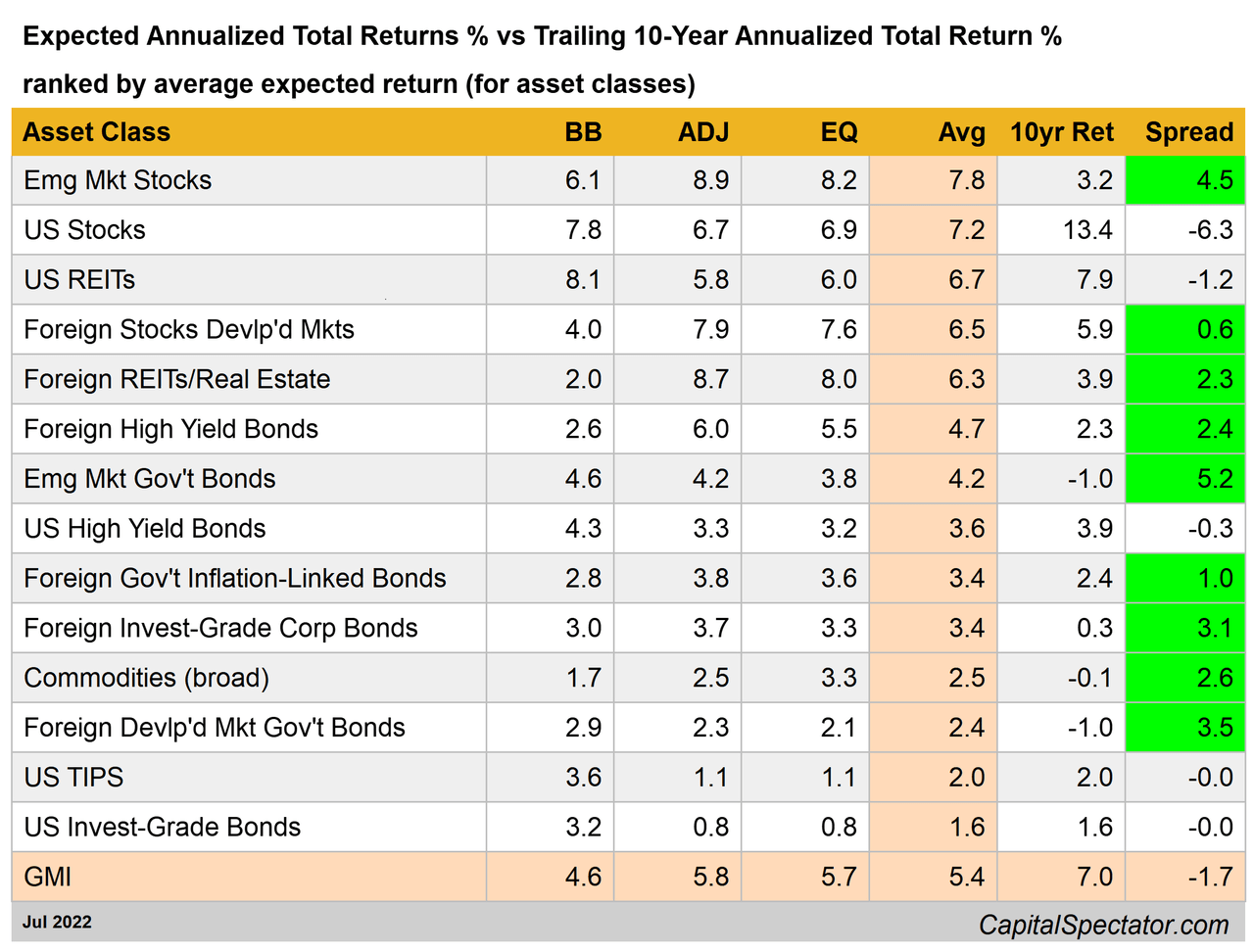

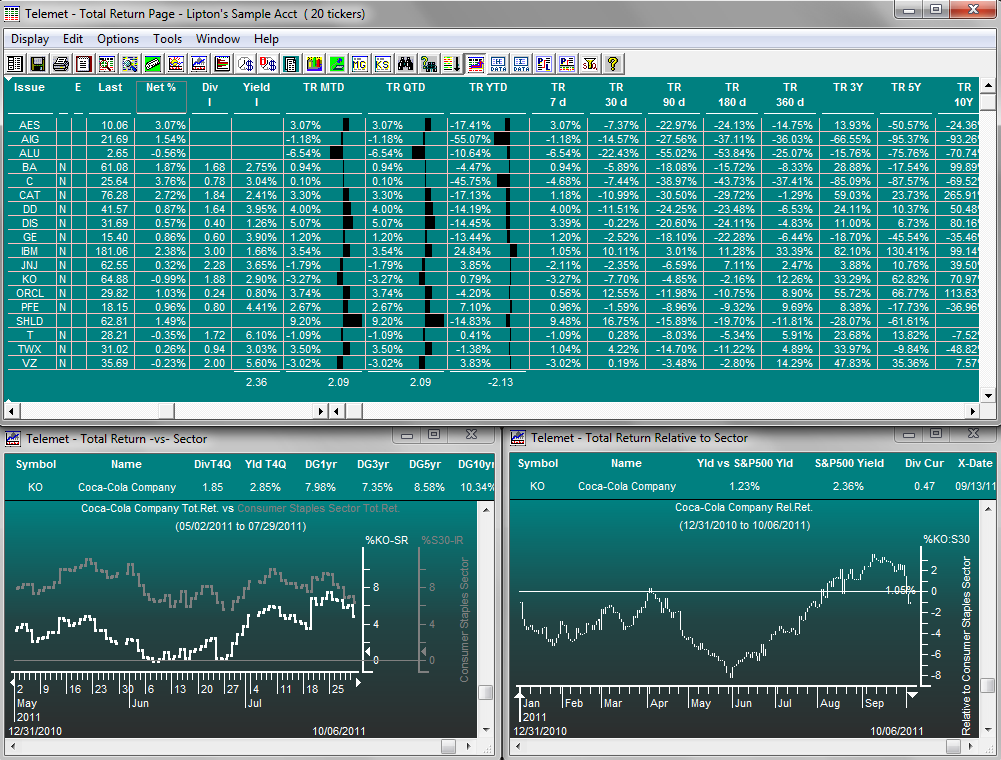

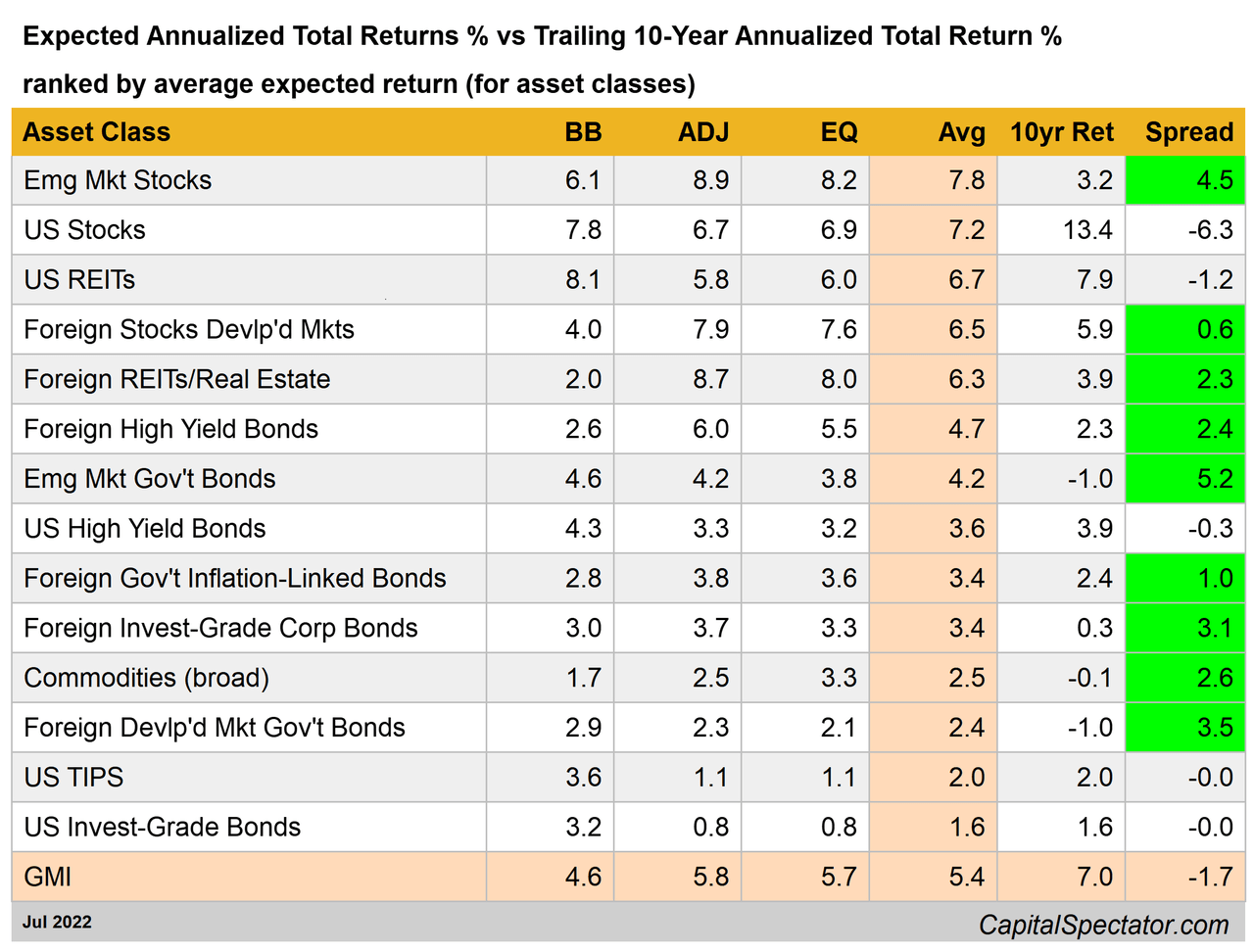

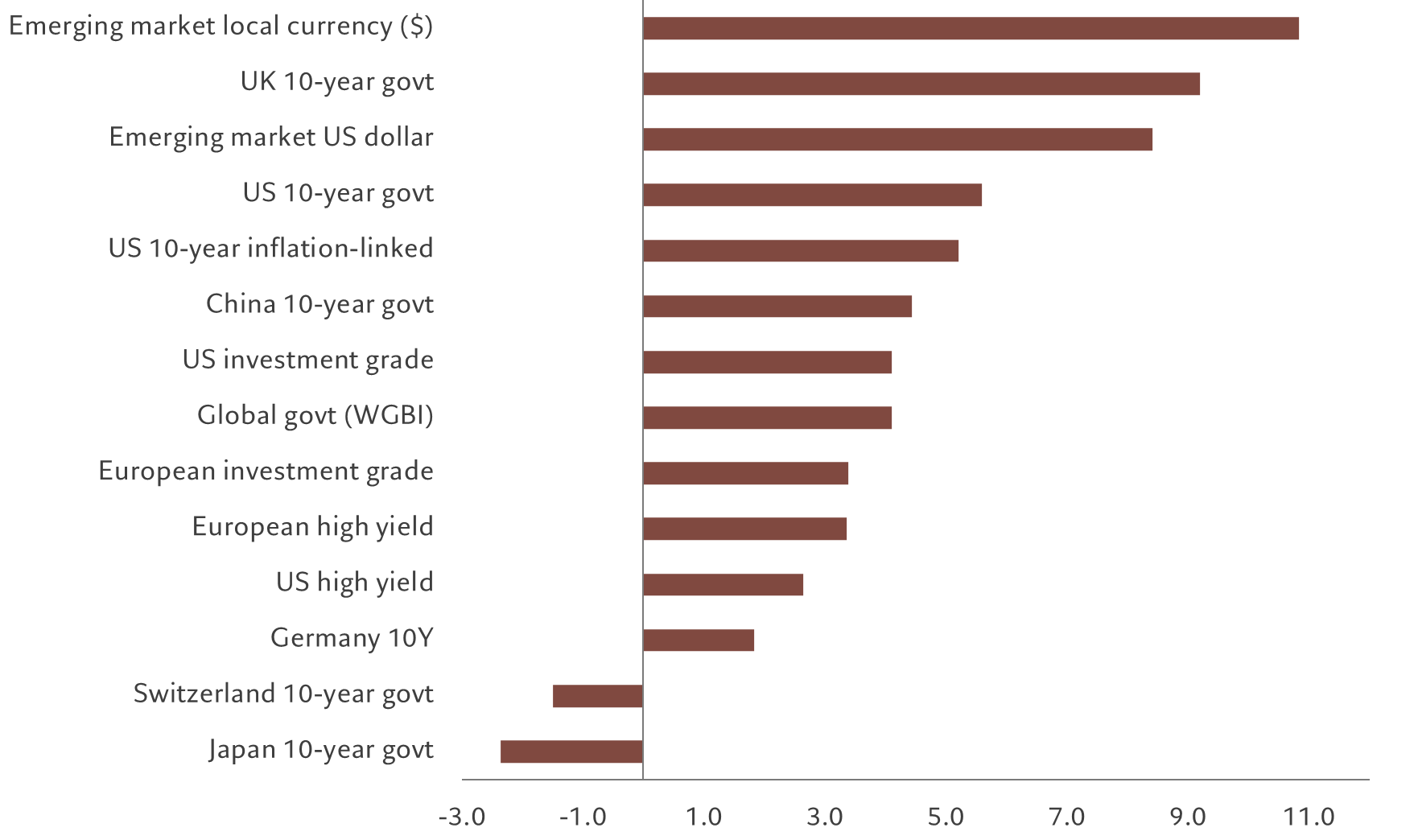

Total Return Forecasts Major Asset Classes 4 January 2023 The

https://www.capitalspectator.com/wp-content/uploads/2023/01/exp.ret_.all_.tab1_.png

Portfolio Cumulative Return With SP 500 Return Download Scientific

https://www.researchgate.net/publication/269223386/figure/fig3/AS:614013851410461@1523403718527/Portfolio-Cumulative-Return-with-SP-500-Return.png

Cumulative return is the method to use if you are making projections based on an intent to sell an investment at a specific point while average annual return is the method Understanding the differences between annualized vs cumulative rate of return is essential in making informed investment decisions By considering the context of their investment goals investors can choose the

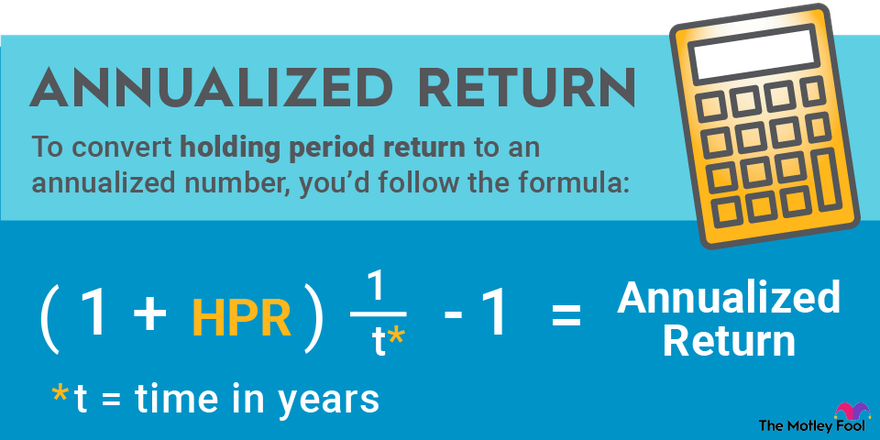

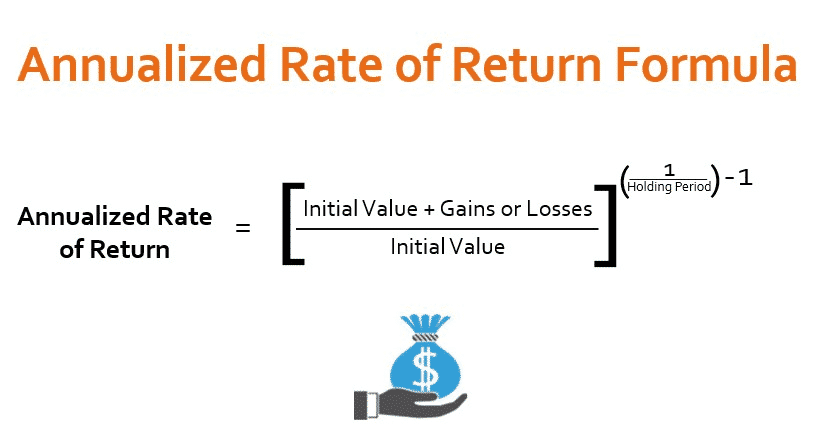

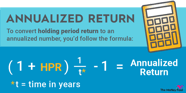

An investment can be held for a given number of days and in that case the annualized total return can be calculated using the formula Where R is the cumulative return For example assume an investor held an investment for Annual vs Cumulative THE CUMULATIVE GAIN was 21 in the first example given in the previous section The annualized gain however was 10 This is known as a geometric average It s the amount you would have to earn each

Download Average Annual Total Return Vs Cumulative Return

More picture related to Average Annual Total Return Vs Cumulative Return

New Publication The Total Return To Real Estate

https://www.lindenthal.eu/assets/images/teaser/total_returns_teaser.png

Annualized Return Formula JodyZachari

https://etfhead.com/wp-content/uploads/2021/09/Average-Annualized-Return-Formula-4.png

High Level Rules 202 Calculate Total Return From Annual Returns

https://1.bp.blogspot.com/-gfpnunUxHrw/W3_GR2tHOMI/AAAAAAAABuE/XaGpP8Oh8YAtPN2BPfSVTQuCzszOhjGBwCLcBGAs/s1600/Total%2BReturns%2Bfrom%2BAnnual%2BReturns.jpg

Yes annualized return is the same as compound annual growth rate CAGR Both measure the average annual return earned on an investment over a given period and both take into account the effects of compounding Compound Annual Growth Rate CAGR vs annualized return what s the difference While many investors count on compounding to help them achieve financial independence many confuse CAGR for annualized average

There are a few key differences between annualized returns and cumulative returns Annualized return is calculated by taking the average return over a specified period typically one year On Cumulative performance measures an investment s total return over a specific period accounting for all gains and losses It provides a comprehensive view of an

Total Return Forecasts Major Asset Classes August 2 2022 Seeking

https://static.seekingalpha.com/uploads/2022/8/2/saupload_erp.02aug2022_thumb1.png

Cumulative Total Return What Is It Formula Calculate Example FAQ

https://www.poems.com.sg/wp-content/uploads/2023/03/Cumulative-total-return-1024x536.png

https://www.investopedia.com/terms/a/…

The average annual return AAR is a percentage that represents a mutual fund s historical average return usually stated over three five and 10 years Before making a mutual fund

https://www.investopedia.com/.../cum…

The cumulative return is the total change in the investment price over a set time an aggregate return not an annualized one Reinvesting the dividends or capital gains of an investment impacts

Telemet Orion Tips And News Workspaces Total Return

Total Return Forecasts Major Asset Classes August 2 2022 Seeking

Performance Evaluation Average Return Vs Cumulative Return

009 Average Rate Of Return VS Actual Rate Of Return Producers Wealth

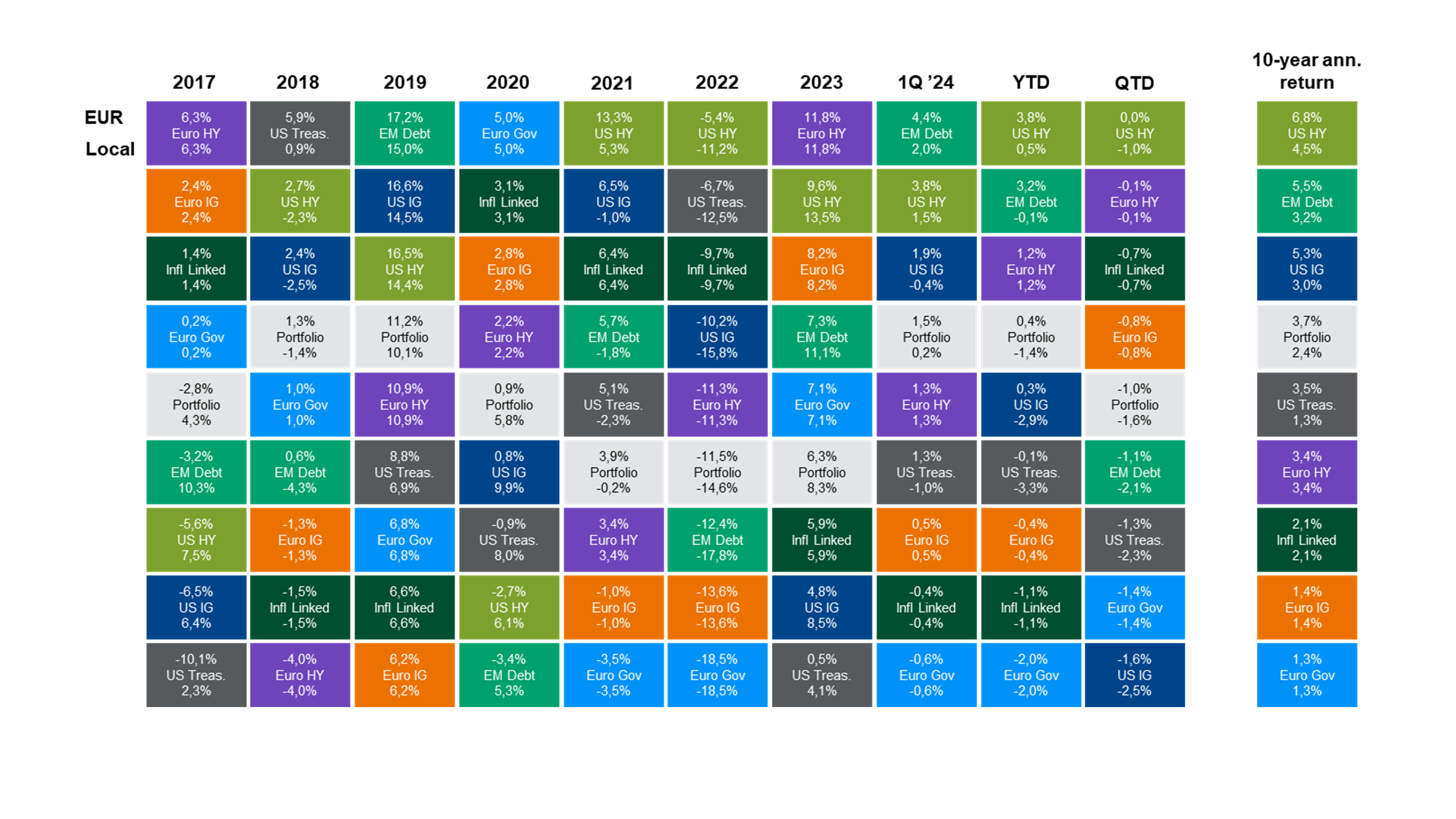

Global Fixed Income Returns

The Myth Of Volatility Drag Part 1 CFA Institute Enterprising Investor

The Myth Of Volatility Drag Part 1 CFA Institute Enterprising Investor

Accounting average Rate Of Return FundsNet

Bonds Outlook For 2024 Pictet Asset Management

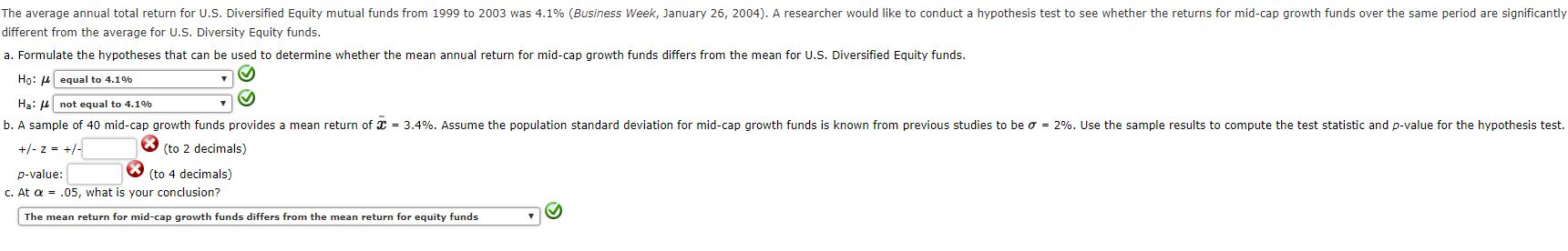

Solved The Average Annual Total Return For U S Diversified Chegg

Average Annual Total Return Vs Cumulative Return - Cumulative return is the method to use if you are making projections based on an intent to sell an investment at a specific point while average annual return is the method