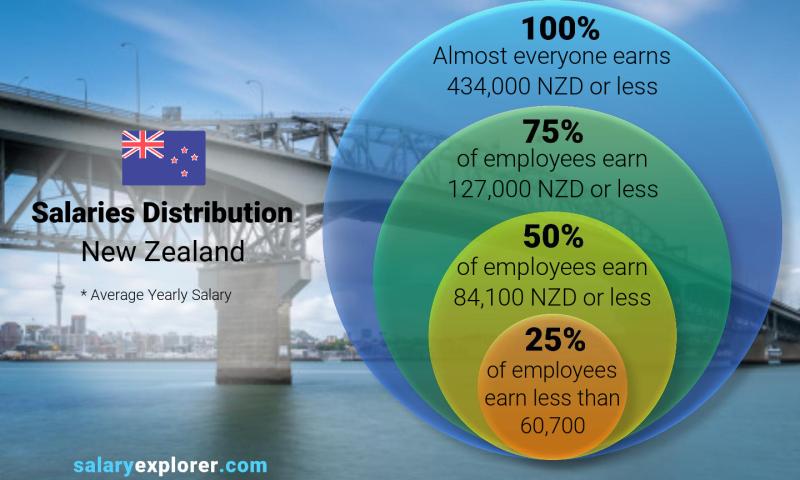

Average Tax Rate Calculator Nz New Zealand s Best PAYE Calculator Calculate your take home pay from hourly wage or salary KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE

If you make 50 000 a year living in New Zealand you will be taxed 8 715 That means that your net pay will be 41 285 per year or 3 440 per month Your average tax rate is Calculate your after tax earnings in seconds with our trusted tool Updated 8 January 2024 Important the calculator below uses the 2023 24 rates which is what you need to

Average Tax Rate Calculator Nz

Average Tax Rate Calculator Nz

https://media.cheggcdn.com/media/241/241ac8b7-dddf-40b9-af25-e49baebc3738/phpwVkA0w

Free Calculator How Much Tax Do You Pay On Rental Income

https://resources.wiseadvice.co.nz/hubfs/Rental Income Tax Calculator.png#keepProtocol

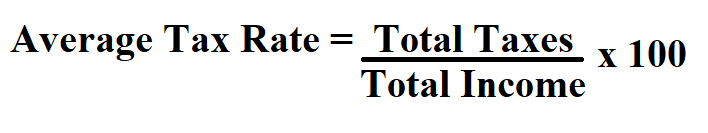

How To Calculate Average Tax Rate

https://www.learntocalculate.com/wp-content/uploads/2020/06/Average-Tax-Rate.png

Tax rates for individuals Main and secondary income tax rates tailored and schedular tax rates and a calculator to work out your tax Topics Tax rates for businesses Situations 1 154 70 per week Giving an effective tax rate of 22 87 21 34 1 53 ACC Average Wage These rates are valid for income earned from 2023 04 01 Calculations

Income Tax Calculator This income tax calculator will allow you to quickly and easily see your tax or government deductions based on your salary To use this income tax Earning 350 000 salary per year before tax in New Zealand your net take home pay will be 231 247 42 per year This is equivalent to 19 270 62 per month or 4 447 07 per

Download Average Tax Rate Calculator Nz

More picture related to Average Tax Rate Calculator Nz

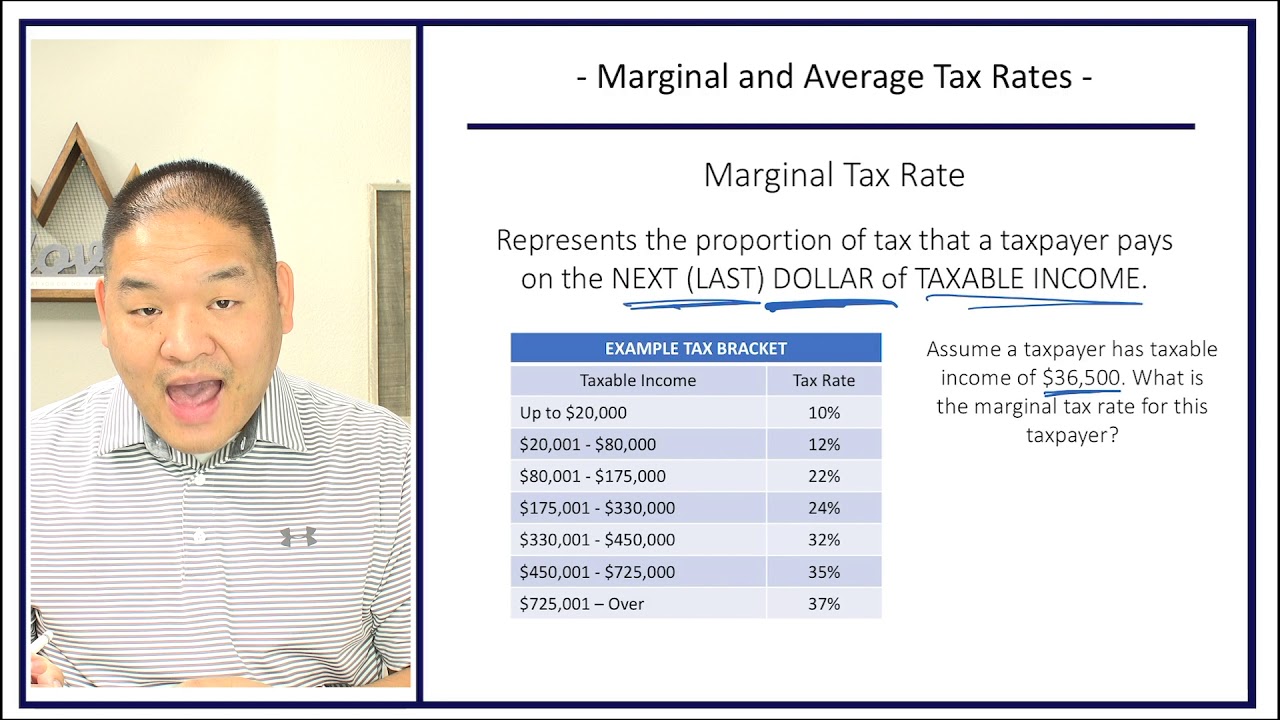

How To Calculate Average Tax Rate On Taxable Income

https://i.ytimg.com/vi/roGdEOT9TWI/maxresdefault.jpg

Average Tax Rate Calculator StuartKendall

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150323/Effective-Tax-Rate-Formula.jpg

Average Income Tax Rate For A Two earner Married Couple With Two

https://figure.nz/chart/JuJ61POrBwtF98lK-lb3PHrao81NHCyUj/download

The tool allows you to modify the tax brackets the tax rates and the indirect and company tax offset and outputs an estimated change in revenue along with plots of the The New Zealand Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in New Zealand This includes

This NZ salary calculator accounts for all three Income Tax Pay in New Zealand is taxed at a progressive rate starting at 10 5 for incomes under 14 000 and capping at 39 Earning 300 000 salary per year before tax in New Zealand your net take home pay will be 200 747 42 per year This is equivalent to 16 728 95 per month or 3 860 53 per

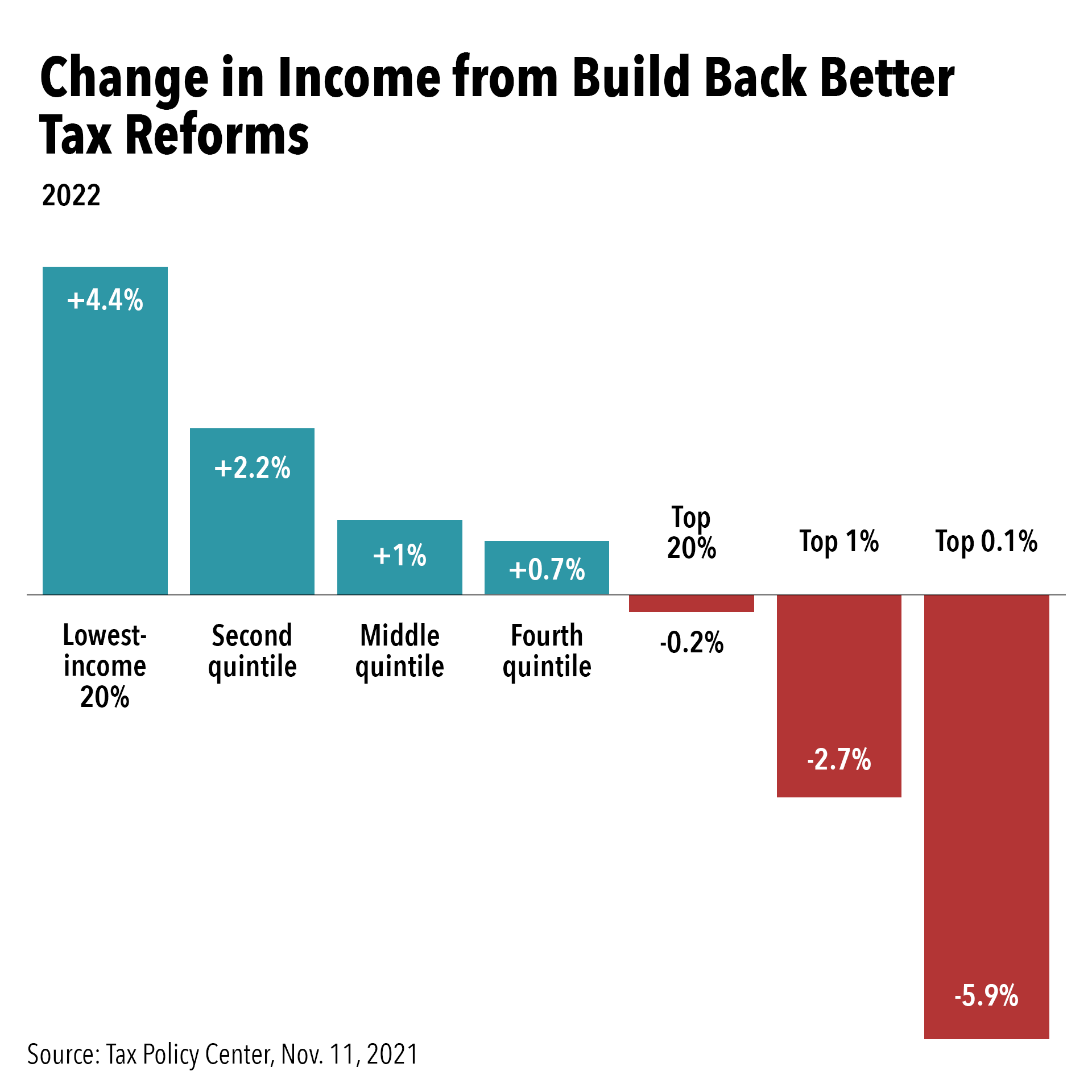

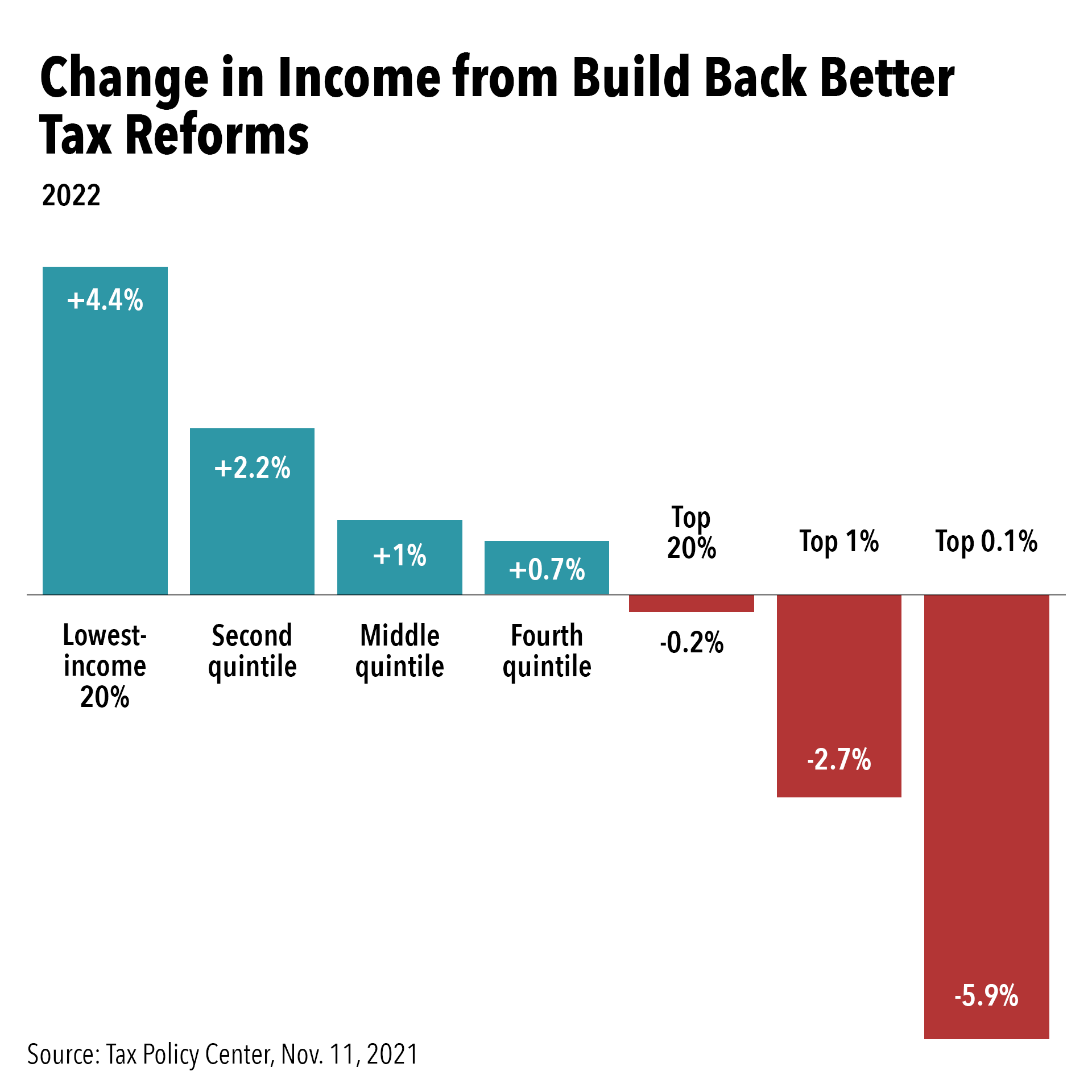

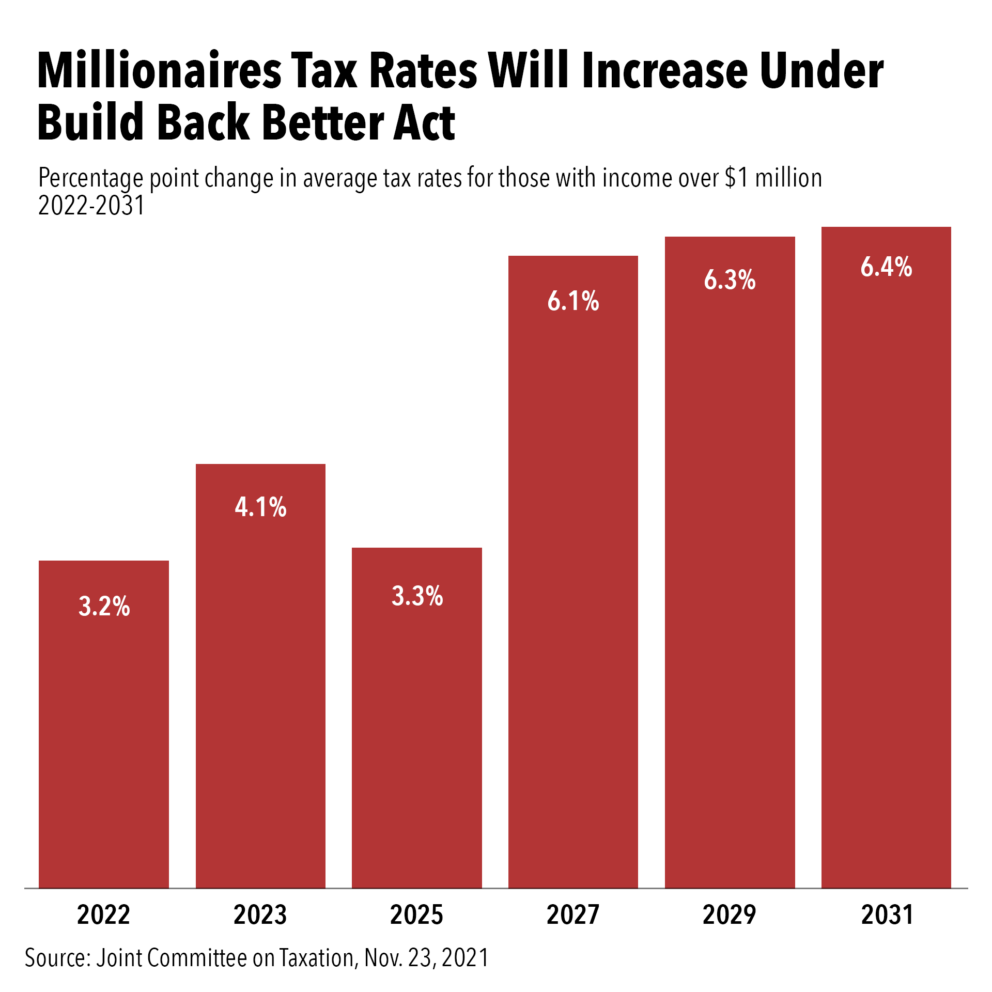

BUILD BACK BETTER ACT WILL RAISE TAX RATES ON MILLIONAIRES Americans

https://americansfortaxfairness.org/wp-content/uploads/Chart-1-1.png

Share Your Anecdotal Evidence That Trump Is Going To Win NeoGAF

https://files.taxfoundation.org/20170804133536/Average-Effective-Tax-Rate-on-the-Top-1-Percent-of-U.S.-Households.png

https://www.paye.net.nz/calculator

New Zealand s Best PAYE Calculator Calculate your take home pay from hourly wage or salary KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE

https://nz.talent.com/tax-calculator

If you make 50 000 a year living in New Zealand you will be taxed 8 715 That means that your net pay will be 41 285 per year or 3 440 per month Your average tax rate is

Effective Tax Rate Calculator ArfanRaithin

BUILD BACK BETTER ACT WILL RAISE TAX RATES ON MILLIONAIRES Americans

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Chapter 1 Introduction To Taxation ACCT 1125 Study Guide Atlanta

Hourly Wage Calculator Nz Imor Salary

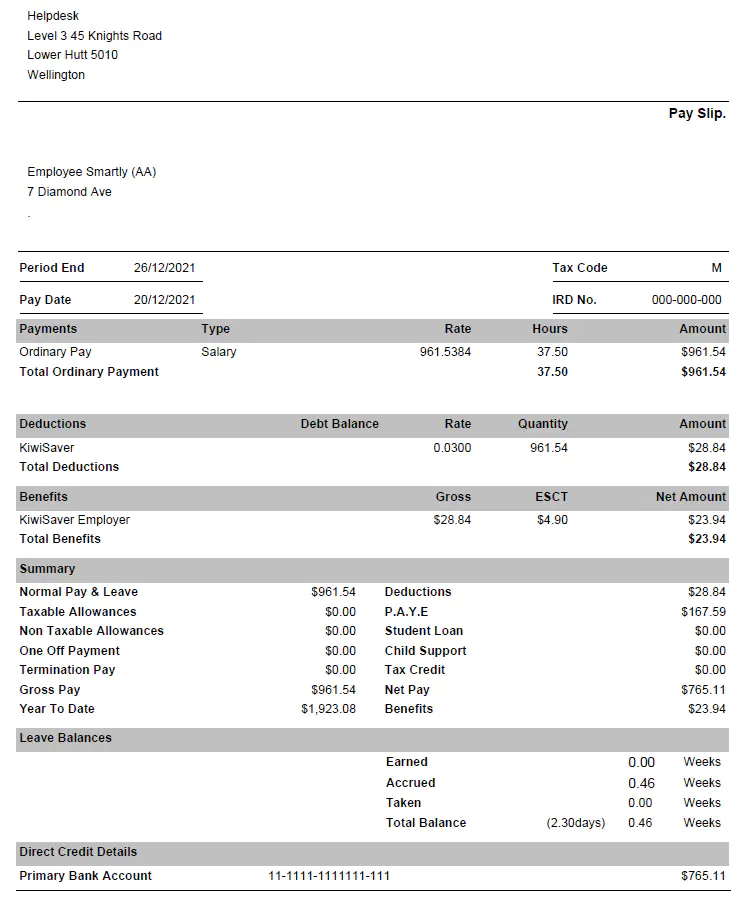

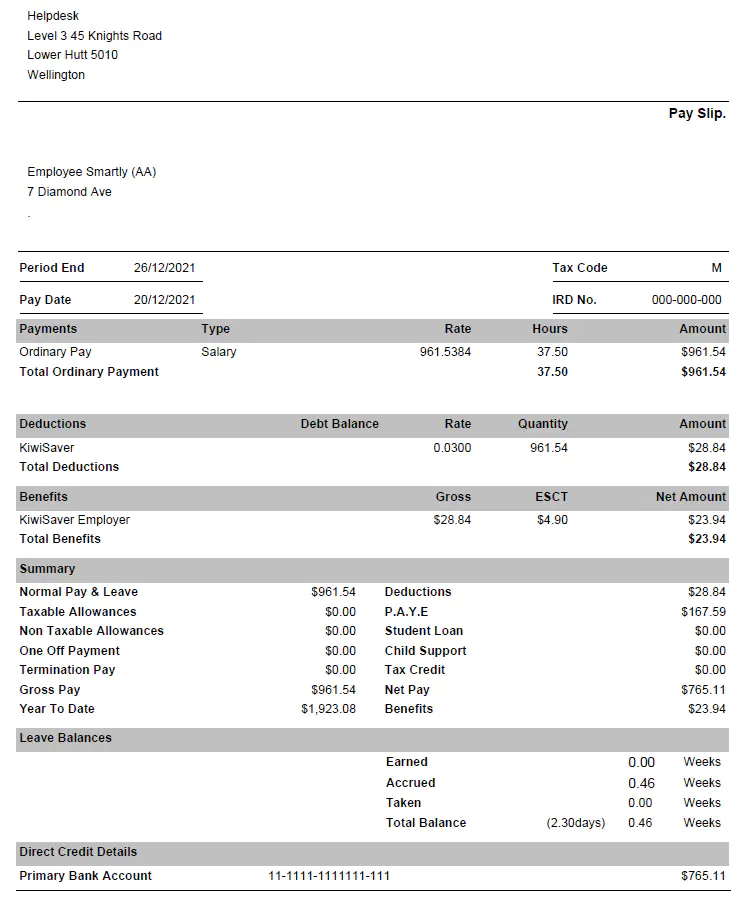

Smartly Payslip Template Example For NZ Employees

Smartly Payslip Template Example For NZ Employees

How To Find Average Income Tax Rate Parks Anderem66

BUILD BACK BETTER ACT WILL RAISE TAX RATES ON MILLIONAIRES Americans

Average Tax Rate Calculator StuartKendall

Average Tax Rate Calculator Nz - 1 154 70 per week Giving an effective tax rate of 22 87 21 34 1 53 ACC Average Wage These rates are valid for income earned from 2023 04 01 Calculations