Bc Sales Tax Credit 2023 The BC sales tax credit is a refundable credit that helps low income individuals and families in British Columbia offset the provincial sales tax The maximum credit is 75 for individuals and 150 for couples The credit amount changes based on income and a formula calculates the claim amount

The BC sales tax credit is a tax benefit designed to help low income individuals and families offset the provincial sales tax they pay on eligible goods and services You can claim the BC sales tax credit if you were a BC resident on December 31 of the tax year and met any of these requirements 2 Authorization is given for the remission of a penalty under section 203 1 of the Act imposed on a collector who has not levied tax on the portion of the purchase price of ready mixed concrete that is a specified delivery charge if the sale occurred on or after April 1 2013 and on or before October 14 2022 Provisions relevant to the

Bc Sales Tax Credit 2023

Bc Sales Tax Credit 2023

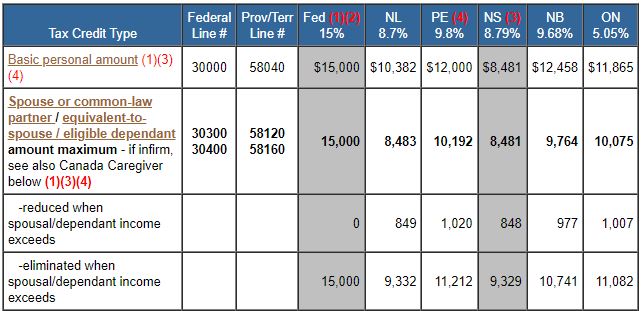

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

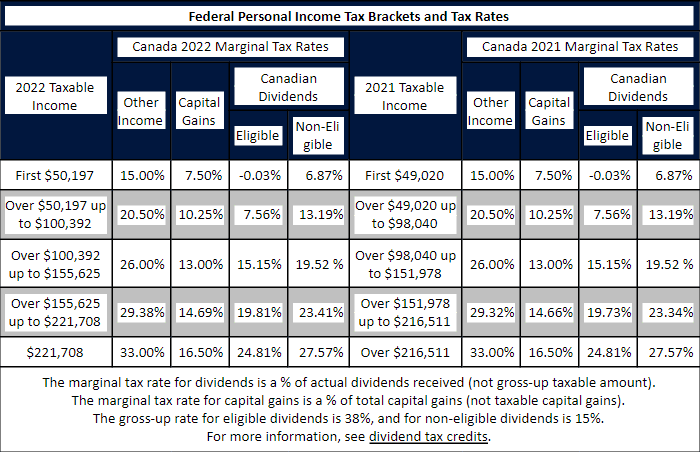

2023 Federal Tax Rates Cra Printable Forms Free Online

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

A Comprehensive Guide To BC Sales Tax Credit Eligibility

https://www.gatewaytax.ca/wp-content/uploads/2023/03/A-Comprehensive-Guide-to-BC-Sales-Tax-Credit-Eligibility-2048x1152.png

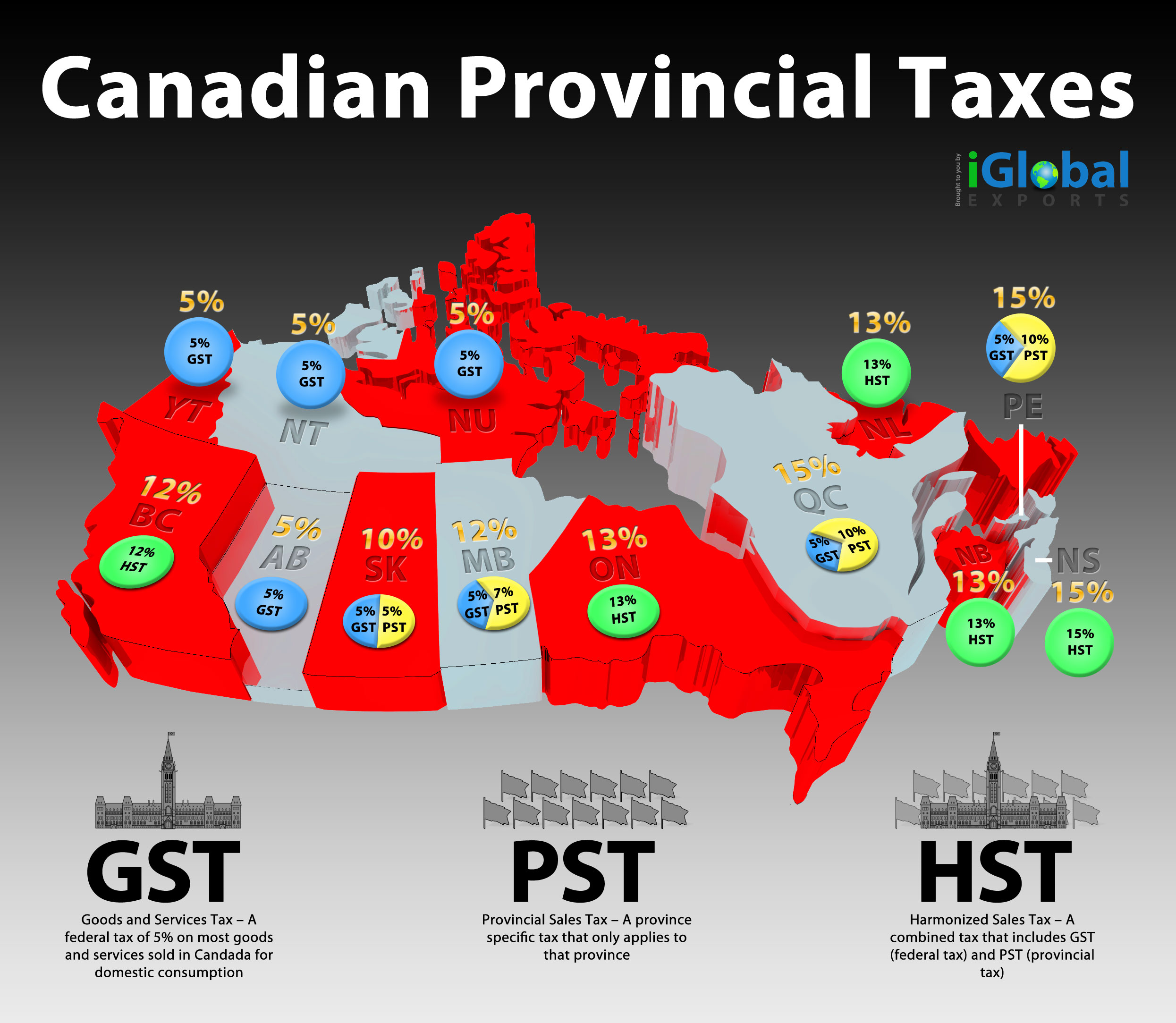

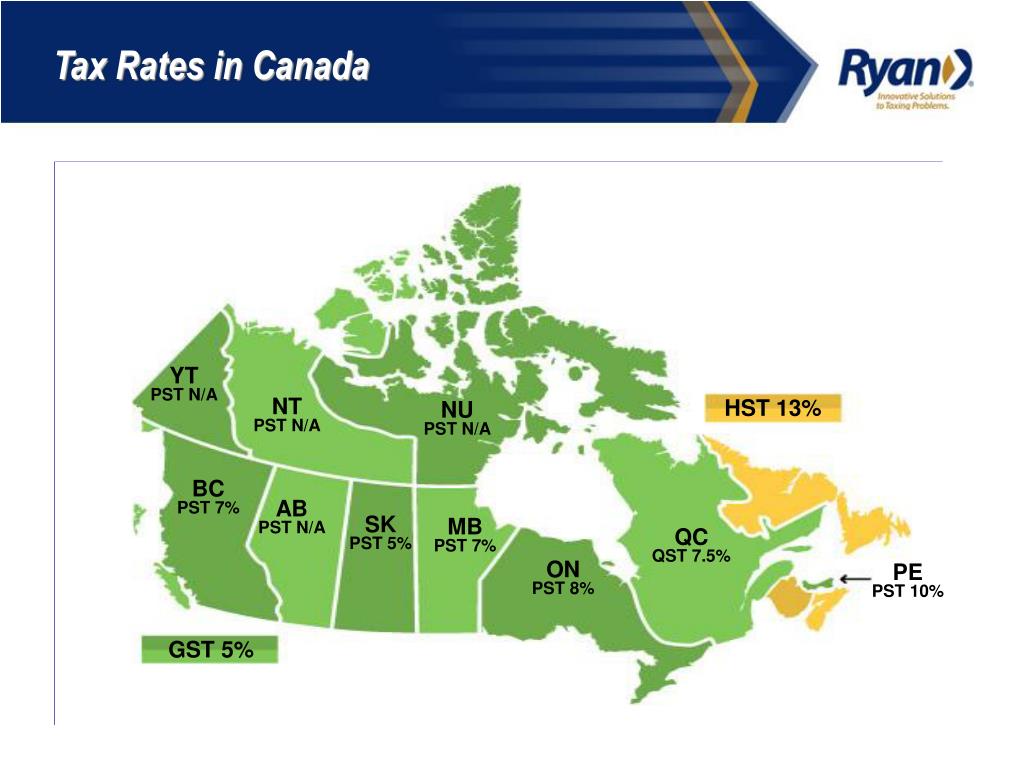

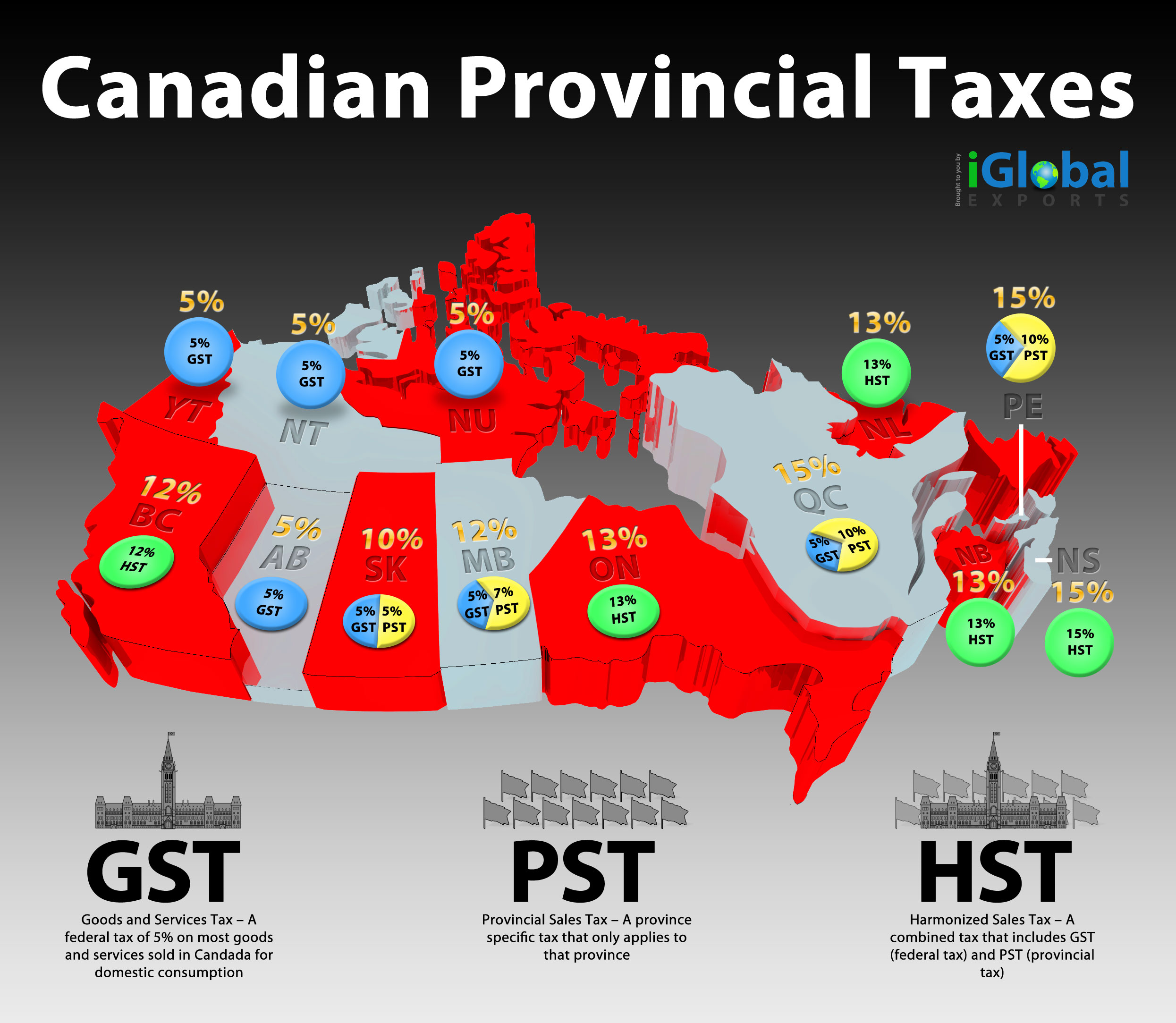

Calculate the GST 5 PST 7 amounts in BC by putting either the after tax or before tax amount Find out about the rates rebates in BC The BC sales tax credit is a refundable tax credit available to eligible British Columbia residents It is designed to provide financial relief to low and moderate income individuals and families to offset the cost of provincial sales tax PST paid on their purchases

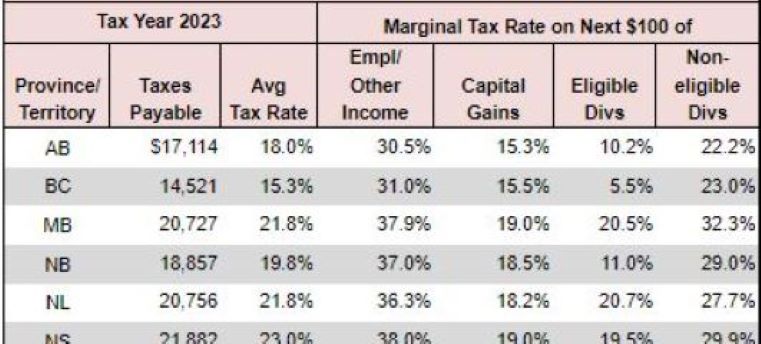

Last update 2024 01 23 Previous year versions are also available Date modified 2024 01 23 Use this form to calculate your British Columbia credits B C basic tax credits are calculated by multiplying the base amount by the lowest tax rate in effect for the year For current income tax brackets and rates see our tax rates page 2024 and 2023 B C basic tax credits Find 2024 and 2023 B C basic tax credits below For previous years see our archived basic tax credits page

Download Bc Sales Tax Credit 2023

More picture related to Bc Sales Tax Credit 2023

TaxTips ca 2023 Earlier Basic Tax Calculator Compare 2 Scenarios

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

BC Sales Tax Credit Eligibility Criteria More Gateway Surrey

https://www.gatewaytax.ca/wp-content/uploads/2022/01/BC-Sales-Tax-Credit-Featured-Image-2048x1152.png

Charging Customers PST In British Columbia

https://mdaccounting.ca/wp-content/uploads/sites/8/bc-sales-tax-responsibilities.jpg

The B C climate action tax credit is a quarterly payment that helps offset the impact of the carbon taxes paid by individuals and families Budget 2024 increased the B C climate action tax credit amounts and thresholds effective July 1 2024 The BC sales tax credit is a dollar for dollar income tax reduction for Canadians in British Columbia You may claim up to 75 for yourself and 75 for your spouse or common law partner If you are single the credit decreases by 2 of your net income over 15 000 up to 18 750

The BC tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1 028 2 8 increase The Federal tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1 027 2 7 increase Government will introduce a new tax on income from the sale of residential real estate in British Columbia The proposed new tax applies to income realized from the sale of properties in British Columbia that have been owned for less than 2 years

Provincial Taxation In The Ur III State Cuneiform Monographs

https://i.visual.ly/images/canadian-provincial-taxes_502914bc01c88.jpg

Your Personal Guide To The Homebuyer Tax Credit 2023 SavingAdvice

https://www.savingadvice.com/wp-content/uploads/2023/01/pexels-rodnae-productions-8293700-scaled.jpg

https://turbotax.intuit.ca/tips/claiming-the...

The BC sales tax credit is a refundable credit that helps low income individuals and families in British Columbia offset the provincial sales tax The maximum credit is 75 for individuals and 150 for couples The credit amount changes based on income and a formula calculates the claim amount

https://turbotax.intuit.ca/tips/12-bc-tax-credits...

The BC sales tax credit is a tax benefit designed to help low income individuals and families offset the provincial sales tax they pay on eligible goods and services You can claim the BC sales tax credit if you were a BC resident on December 31 of the tax year and met any of these requirements

Canadian Tax Rates Www vrogue co

Provincial Taxation In The Ur III State Cuneiform Monographs

BC Sales Tax Credit Eligibility Criteria More Gateway Surrey

Free Arkansas Motor Vehicle Bill Of Sale Form PDF Word Free

BC Sales Tax Credit Eligibility Criteria More Gateway Surrey

What Is BC Property Transfer Tax Everything You Need To Know

What Is BC Property Transfer Tax Everything You Need To Know

BC Sales Tax Credit Eligibility Criteria More Gateway Surrey

What s New For 2023 Tax Year Get New Year 2023 Update

Tax Credit 2023 The Tax Credit Discussion Thread Page 16 Tesla

Bc Sales Tax Credit 2023 - Last update 2023 12 22 Date modified 2023 12 22 As an employee you complete this form if you have a new employer or payer and will receive salary wages or any other remuneration or if you wish to increase the amount of tax deducted at source