Belgium Tax Exemption If the earned income that is taxable in Belgium amounts to at least 75 of the total earned income both the Belgian and foreign earned income a non resident is entitled to a tax free allowance This means that a portion of your taxable income is not taxed The tax free allowance is EUR 9 270 for 2022 income 2023 income EUR 10 160

In some cases Belgian income is exempt from tax in Belgium This means that even if you submit a tax return that mentions income you do not need to pay tax After having filed your tax return you will receive a tax assessment notice Belgian residents are taxed on their worldwide income but their foreign source income is exempted with progression in Belgium if it is taxable taxed or effectively taxed depending on the wording of the DTT in another country according to the applicable DTT

Belgium Tax Exemption

Belgium Tax Exemption

https://www.thebulletin.be/sites/default/files/20130808_tax.jpg

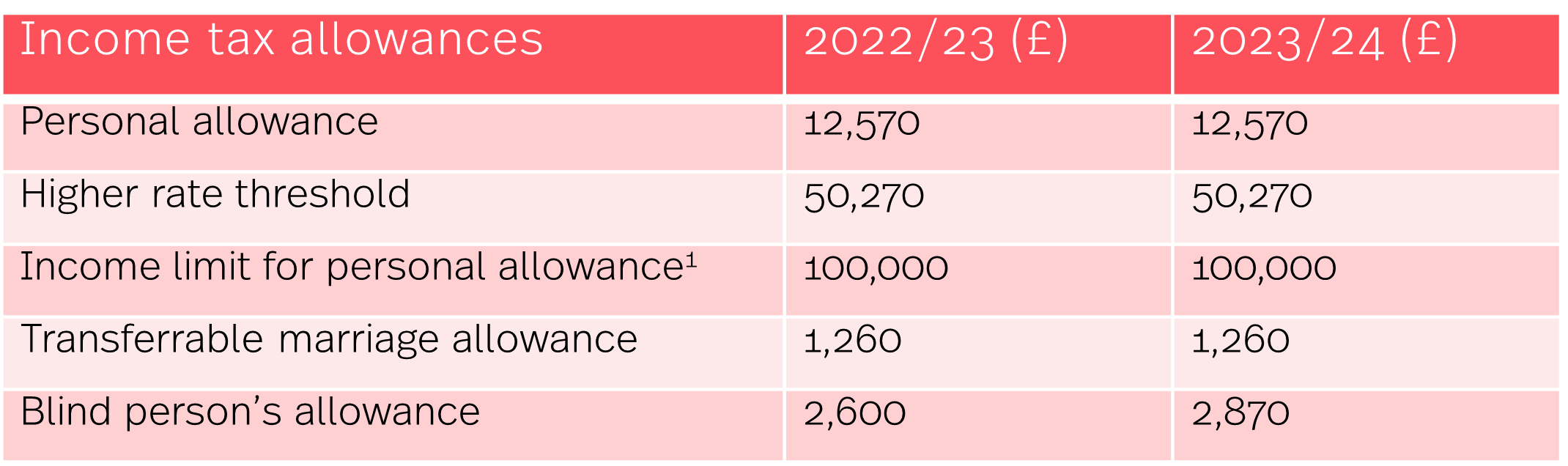

Autumn Statement 2022 HMRC Tax Rates And Allowances For 2023 24

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt8743826b67930bd8/63767939ac59ed1089b31054/table_1.png

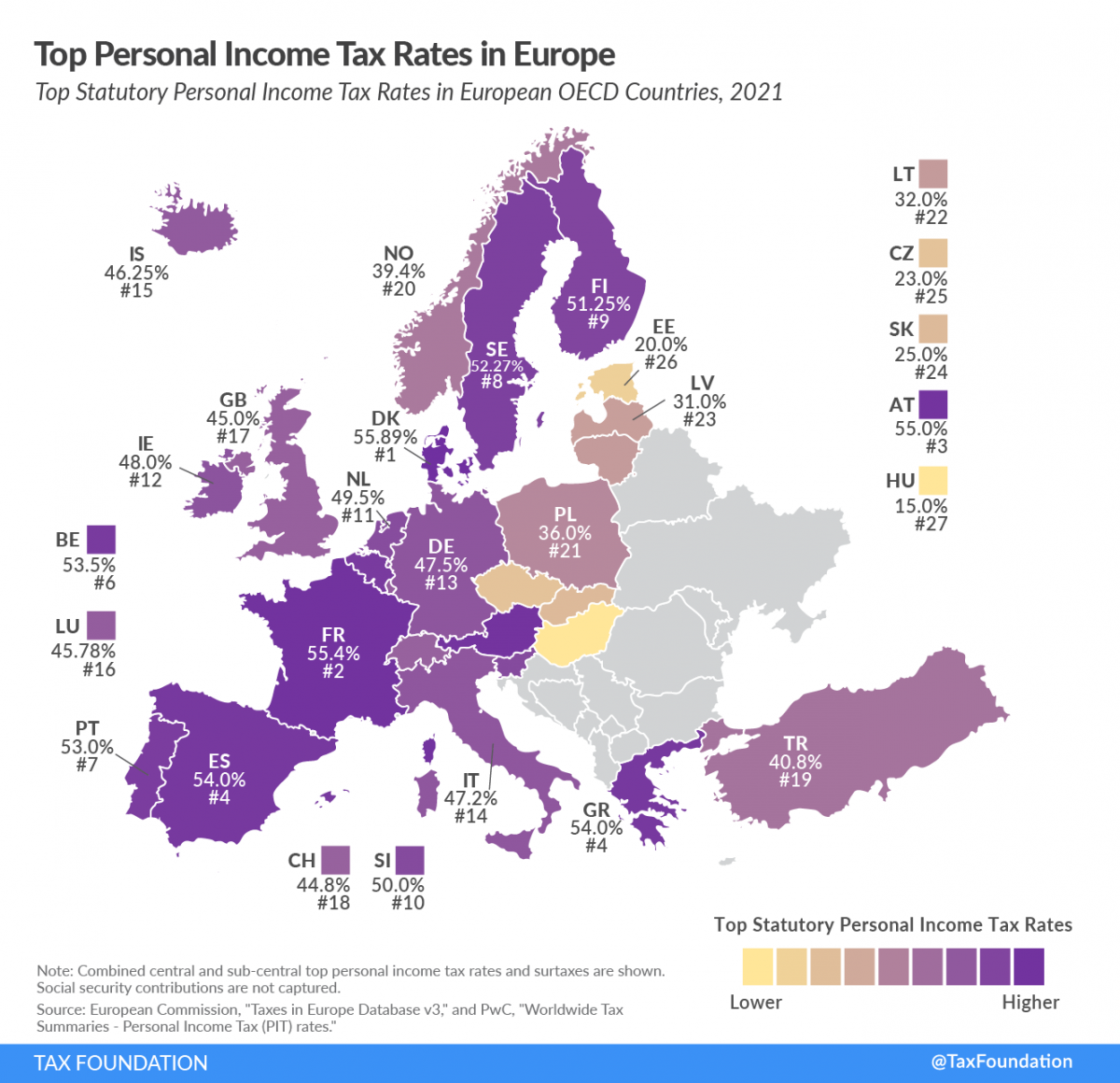

Finally an Agreement Reached On The Reformation Of Belgian Corporate

https://de-langhe.be/wp-content/uploads/2017/07/Vennootschapsbelasting.jpg

For residents of Belgium communal taxes are levied at rates varying from 0 to 9 of the income tax due For non residents a flat surcharge of 7 is due In some cases communal taxes may also be levied on exempted foreign source income 11 February 2022 The Belgian government has limited tax benefits for expats Businesses and employees must adjust to new rules from 1 January 2022 The change is due to the increasing number of expats who benefit from the favourable tax regulations in Belgium The Ecovis experts in Belgium explain what is changing

The personal basic exemption amounts to EUR 10 160 For dependent children For any other dependent person an amount of EUR 1 850 is deductible It must be stressed that the exemption takes place on the lowest part of income at the lowest marginal tax rates Exemptions of an economic character fiscal measures to encourage investment and or employment losses Social contributions Your salary is taxable on the gross sum minus personal social security contributions You may therefore deduct the compulsory contributions which are paid to your mutual society

Download Belgium Tax Exemption

More picture related to Belgium Tax Exemption

Belgian Tax Authorities Hunting Down Cryptocurrency Speculators

http://bitcoinist.com/wp-content/uploads/2018/03/ss-belgium-taxes.jpg

Dividend Tax In Belgium

https://www.lawyersbelgium.com/uploads/default/files/dividend_tax_in_belgium.jpg

Tighter Ground Rules For Withholding Tax Exemption Brussels

http://static1.squarespace.com/static/5e5d727b3ab03d2892a1eac0/5e82546872aa99214c7090c6/64a985ac0e23a5275ea49954/1688831976461/Accountant+Brussels+Belgium+Fidelium+11790.JPG?format=1500w

The Belgian tax rules allow expats under certain conditions who have been under the old regime for less than five years at 1 January 2022 to Opt in to the new regime within an 8 year total time limitation Belgian tax law does not provide for any general regime of exemption As mentioned above SMEs companies can benefit from a reduced tax rate of 20 on the first bracket of EUR 100 000 profit provided that certain conditions are met

Wallonia Road tax amounts Some vehicles are exempt from road tax including Electric and hybrids Those driven by people with certain disabilities Occasional transport conditions apply Those exported to the In order to apply for the tax exemption scheme you have to enter an amending declaration of a VAT identification form 604B via MyMinfin There are two possible dates on which the scheme comes into effect 1 July you must apply before 1 June 1 January you must apply before 15 December New business

Revocation Of Federal Tax Exemption Grant Management Nonprofit Fund

https://mygrantmanagement.com/wp-content/uploads/2019/07/tax_exemption_1563850735.png

MALAYSIA Extension Of Group Relief For Service Tax BDO

https://www.bdo.global/getmedia/69e10cf3-595c-48fe-822f-a2d61cfbdfce/Malaysia-KL.jpg.aspx?width=1800&height=611&ext=.jpg

https://finance.belgium.be/.../tax-rates

If the earned income that is taxable in Belgium amounts to at least 75 of the total earned income both the Belgian and foreign earned income a non resident is entitled to a tax free allowance This means that a portion of your taxable income is not taxed The tax free allowance is EUR 9 270 for 2022 income 2023 income EUR 10 160

https://finance.belgium.be/.../tax-return

In some cases Belgian income is exempt from tax in Belgium This means that even if you submit a tax return that mentions income you do not need to pay tax After having filed your tax return you will receive a tax assessment notice

Declaring Your UK Income In Your Belgian Tax Return BritCham Blog

Revocation Of Federal Tax Exemption Grant Management Nonprofit Fund

Singapore Tax Exemption Scheme AssemblyWorks

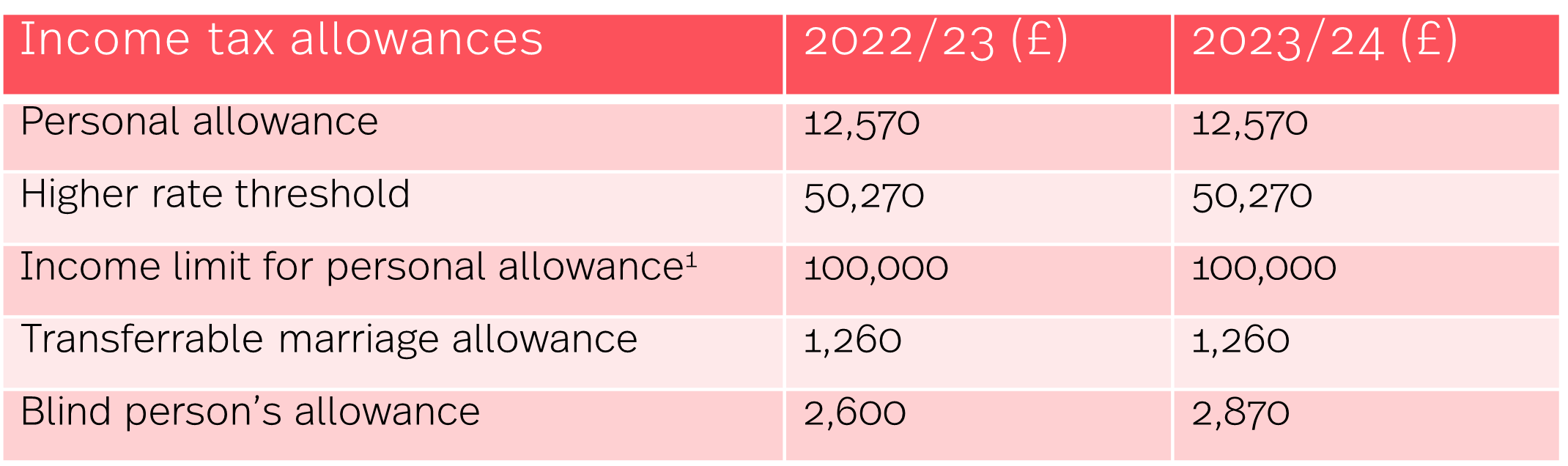

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

The Belgian Tax Reform Brussels Express

Taxation Exemption Documents For Customers To Complete And Return

Taxation Exemption Documents For Customers To Complete And Return

BELGIUM REVENUE STAMPS RARE R Belgian Tax Fiscal Stempelmarke Fiscaux

Belgium Tax And Financial Measures Associated With COVID 19

Countries That Pay The Highest Taxes WorldAtlas

Belgium Tax Exemption - As a result the salaries paid by European institutions are exempt from national income tax Officials of European institutions who are domiciled for tax purposes in Belgium must complete the tax return but are required to tick special boxes 1062 05 1020 47 exempting them from taxes on their salary