Irs Tax Rebate December 2024 The maximum credit for the 2023 tax year is 7 430 up from 6 935 the prior year But Social Security beneficiaries may get hit with higher taxes Jaeger warned That s because the threshold

Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP Bonus Depreciation 100 bonus depreciation is extended through 2025 allowing businesses to fully expense qualified property Increased Section 179 Deduction The act raises the deduction limit for qualifying property providing businesses with greater flexibility in deducting investment costs

Irs Tax Rebate December 2024

Irs Tax Rebate December 2024

https://phantom-marca.unidadeditorial.es/fa8dca0f613b5b2703e6297386515270/resize/1320/f/jpg/assets/multimedia/imagenes/2022/09/17/16634245499228.jpg

IRS Tax Updates For 2023

https://cdn.leadpilot.io/6041397b0161a700085abb54/IRS Tax Updates.png

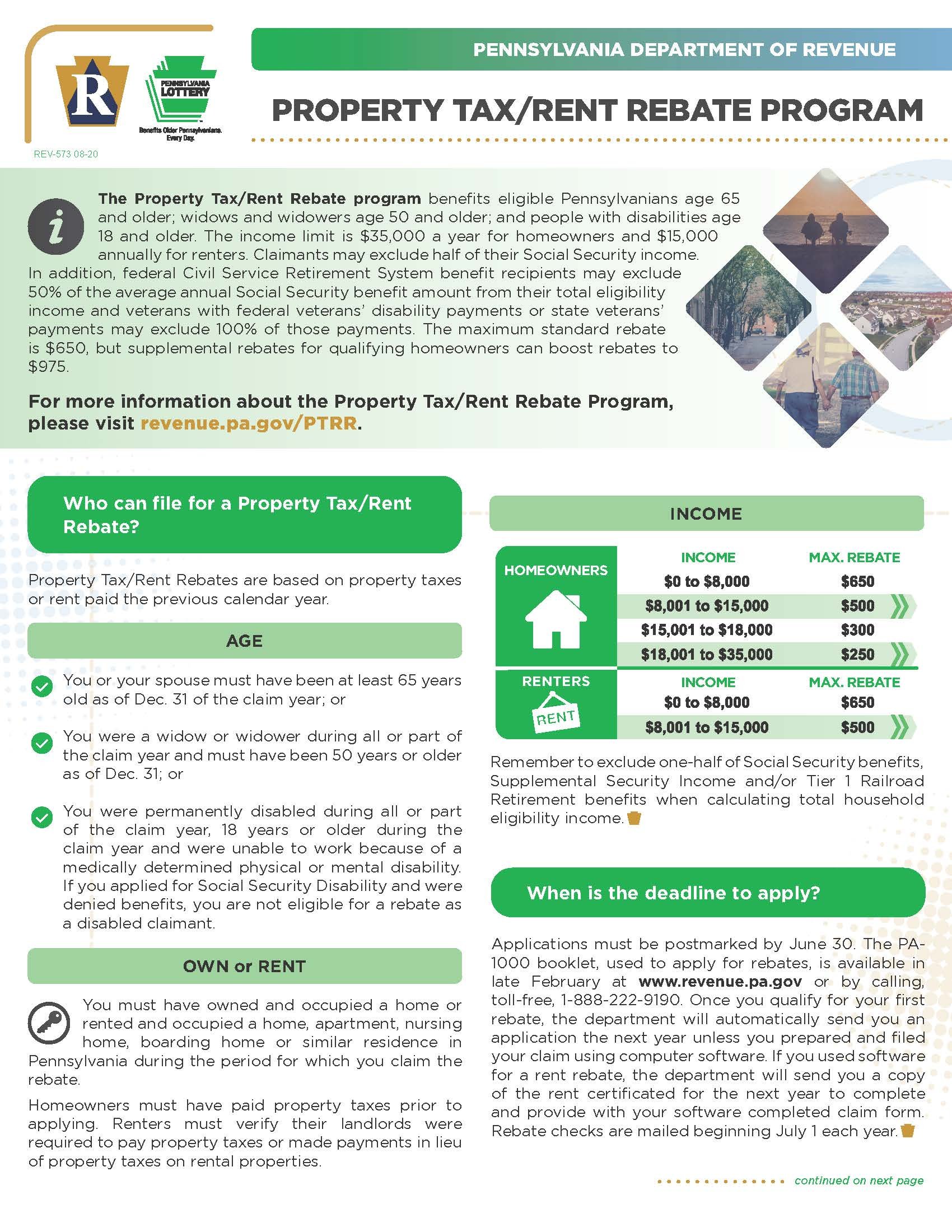

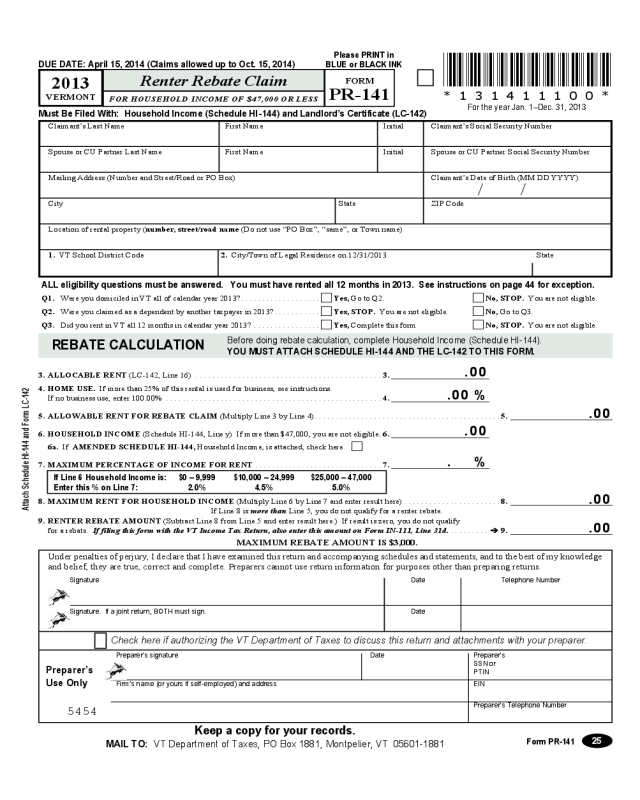

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Nov 22 2023 December is here which means the 2024 tax filing season is coming soon The IRS usually starts accepting e filed income tax returns in the last week of January each year The IRS is releasing Notice 2024 7 which explains how the agency is providing failure to pay penalty relief to eligible taxpayers affected by the COVID 19 pandemic to help them meet their federal tax obligations

IRS offers additional time for in person service Many Taxpayer Assistance Centers to offer extended in person office hours through April 16 Get the latest information Pay your taxes Get your refund status Find IRS forms and answers to tax questions We help you understand and meet your federal tax responsibilities Strategic Operating Plan In 2024 we re launching a new pilot tax filing service called Direct File If you re eligible and choose to participate file your 2023 federal tax return online for free directly with IRS It will be rolled out in phases and is expected to be more widely available in mid March

Download Irs Tax Rebate December 2024

More picture related to Irs Tax Rebate December 2024

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Tax Refund Gambaran

https://g.foolcdn.com/editorial/images/230742/getty-tax-refund.jpg

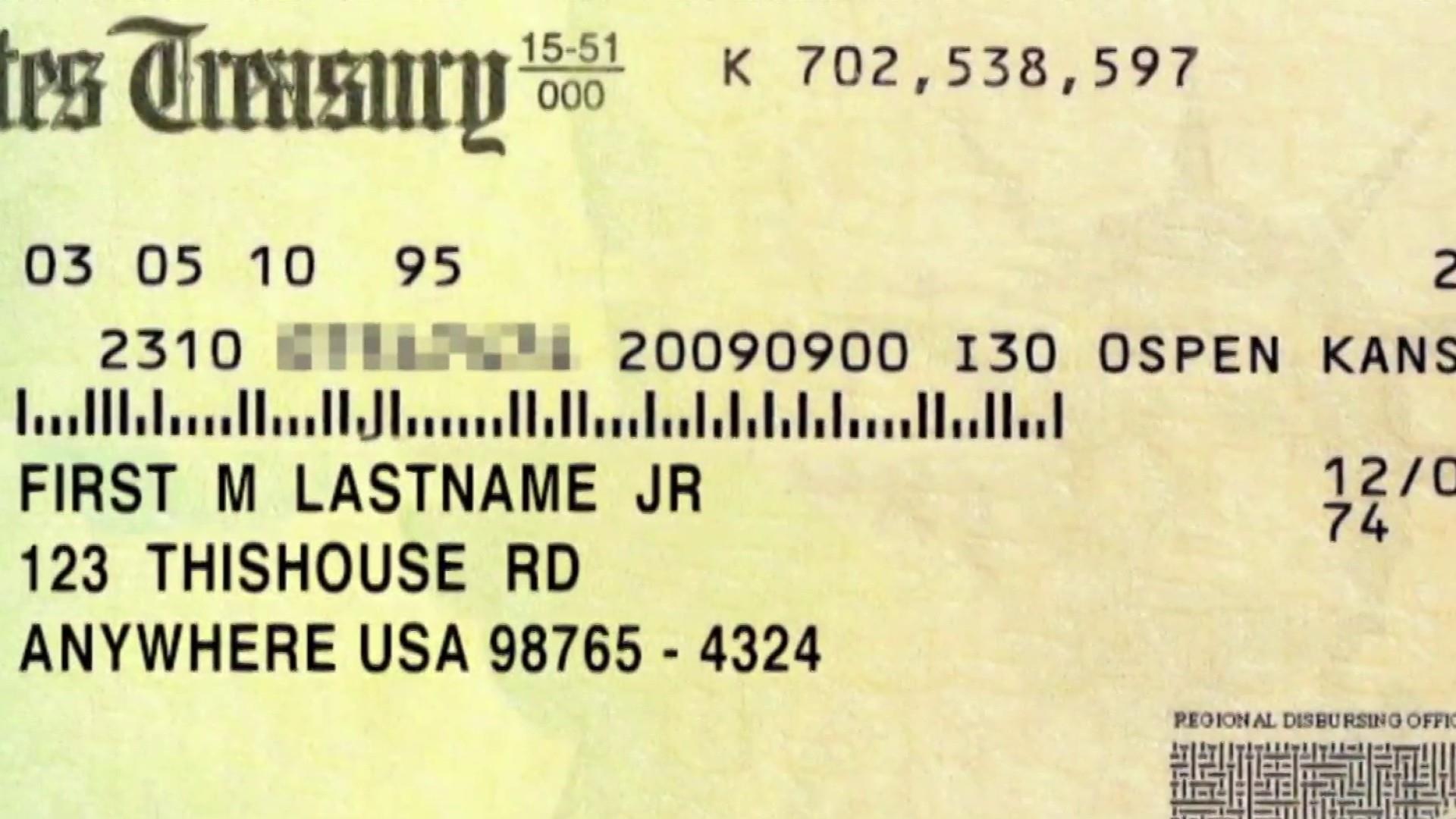

IRS Free File Available Today Claim Recovery Rebate Credit And Other Tax Credits

https://internationalworldofbusiness.com/wp-content/uploads/2021/01/0000000000-1024x538.jpeg

The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help These tax providers are participating in IRS Free File in 2024 Tax Tip 2024 03 Jan 22 2024 IRS Free File is now available for the 2024 filing season With this program eligible taxpayers can prepare and file their federal tax returns using free tax software from trusted IRS Free File partners

JANUARY 26 2024 Tax Season Has Arrived How to Get Your Refund Faster The IRS starts accepting returns on January 29 Take the dread out of filing with these 5 tips While the IRS lets you The 2024 tax season officially opens Monday meaning the IRS will begin accepting and processing returns for the 2023 tax year The deadline to file is April 15

Recovery Rebate Credit Line 30 Form 1040 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

3 Ways To Find Out How Much You Will Owe The IRS Tax Debt Relief Services

https://cig-alvi8tax.agilecollab.com/app/uploads/2019/04/tax-IRS-debt.jpg

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

The maximum credit for the 2023 tax year is 7 430 up from 6 935 the prior year But Social Security beneficiaries may get hit with higher taxes Jaeger warned That s because the threshold

https://www.irs.gov/newsroom/get-ready-to-file-in-2024-whats-new-and-what-to-consider

Given the complexity of the new provision and the large number of individual taxpayers affected the IRS is planning for a threshold of 5 000 for tax year 2024 as part of a phase in to implement the 600 reporting threshold enacted under the American Rescue Plan ARP

The 1 IRS Tax Relief Program Tax Forgiveness Tax Help In 2022 Irs Taxes Tax Help Relief

Recovery Rebate Credit Line 30 Form 1040 PrintableRebateForm

IRS Ends Up Correcting Tax Return Mistakes For Recovery Rebate Credit

Irs Form 941 2023 Printable Forms Free Online

IRS Form 656 The Offer In Compromise Application Lake Placid New York Global Gate IRS Tax

Minnesota Fillable Tax Forms Printable Forms Free Online

Minnesota Fillable Tax Forms Printable Forms Free Online

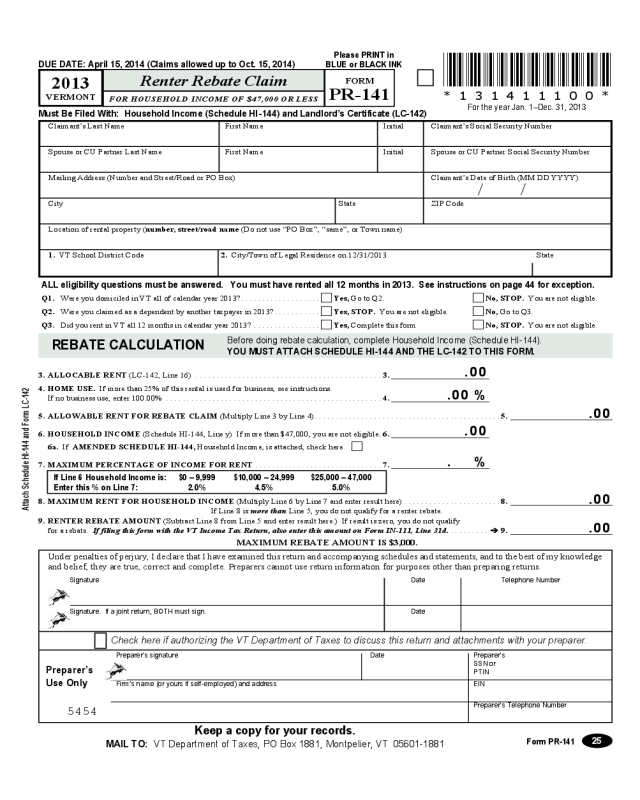

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Irs Tax Rebate Status Additive Motor

The Electric Car Tax Credit What You Need To Know OsVehicle

Irs Tax Rebate December 2024 - The IRS is releasing Notice 2024 7 which explains how the agency is providing failure to pay penalty relief to eligible taxpayers affected by the COVID 19 pandemic to help them meet their federal tax obligations