Benefit Of Tax Saving Fixed Deposit Tax Benefits Investments in tax saving fixed deposits are eligible for a deduction of up to 1 5 Lakhs under Section 80C of the Income Tax Act This deduction

Tax saving fixed deposits provide a reliable avenue for individuals to save on taxes while securing their funds This comprehensive guide explores their features eligibility and Tax Deductions under Section 80C The primary benefit of tax saving FDs is the tax deduction they offer under Section 80C of the Income Tax Act You can claim a

Benefit Of Tax Saving Fixed Deposit

Benefit Of Tax Saving Fixed Deposit

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/01/tax-saving-fd.jpg

HDFC Sales Benefits Of Tax Saving Fixed Deposit Scheme

https://64.media.tumblr.com/bcf5bcbdd6db2039457e4577172d13dd/49a69b36d9eed0f7-13/s1280x1920/49fca08bcb3d6e97cbac10d7903d690c2a3c645d.jpg

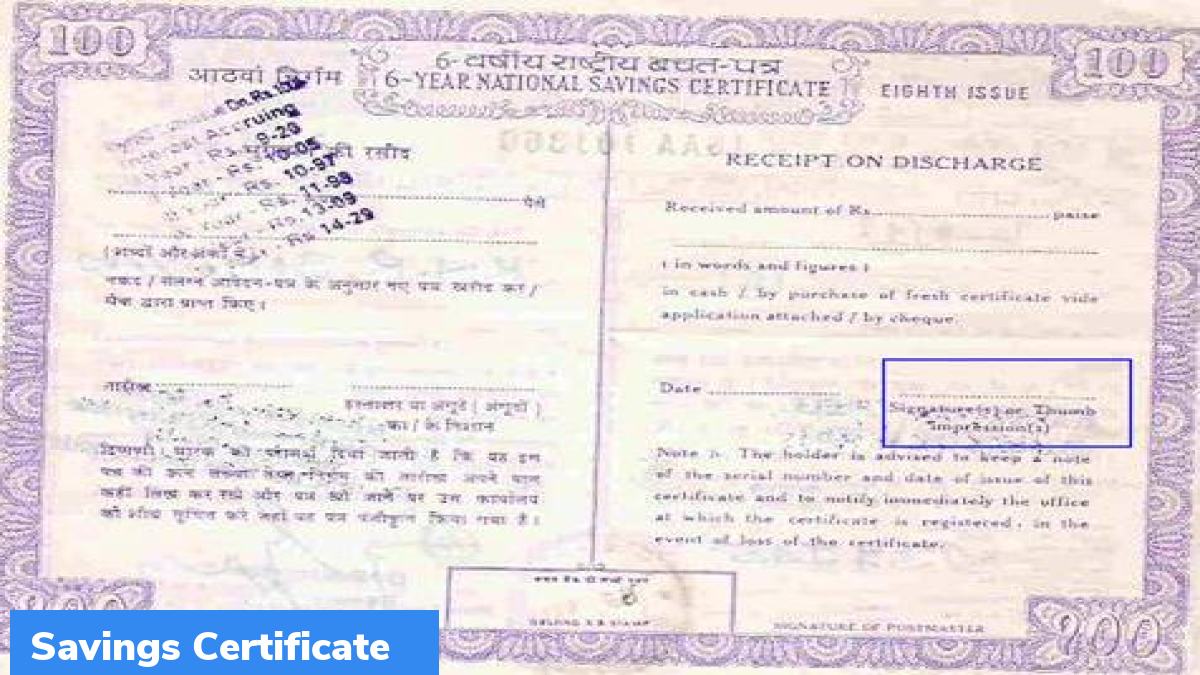

National Savings Certificates Meaning Interest Rates And Tax Benefits

https://life.futuregenerali.in/media/idlfvqbq/national-savings-certificates.jpg

One of the most significant advantages of tax saving fixed deposits is the tax benefit they provide under Section 80C of the Income Tax Act Investors can claim a deduction Minimum Amount Rs 100 in Multiples of Rs 100 Maximum amount Rs 1 5 Lakhs in a FY Tenure 5 Years Lock In Can be booked with Monthly and quarterly payout

A Tax Saving Fixed Deposit FD account allows one to save taxes while earning interest It offers a tax deduction of up to Rs 1 5 lakh per year under Section 80C of the Income The benefit of tax saving fixed deposit is that the principal invested is exempt from tax i e it can be claimed as a deduction under Section 80C and the benefit of tax free bonds is

Download Benefit Of Tax Saving Fixed Deposit

More picture related to Benefit Of Tax Saving Fixed Deposit

Tax Saver Fixed Deposit Top 10 Tax Saving FDs In India

https://www.taxscan.in/wp-content/uploads/2022/12/Tax-Saver-Fixed-Deposit-Tax-Saver-Fixed-Deposit-Tax-Tax-Saving-Saving-Top-10-Tax-Saving-FDs-in-India-Taxscan.jpg

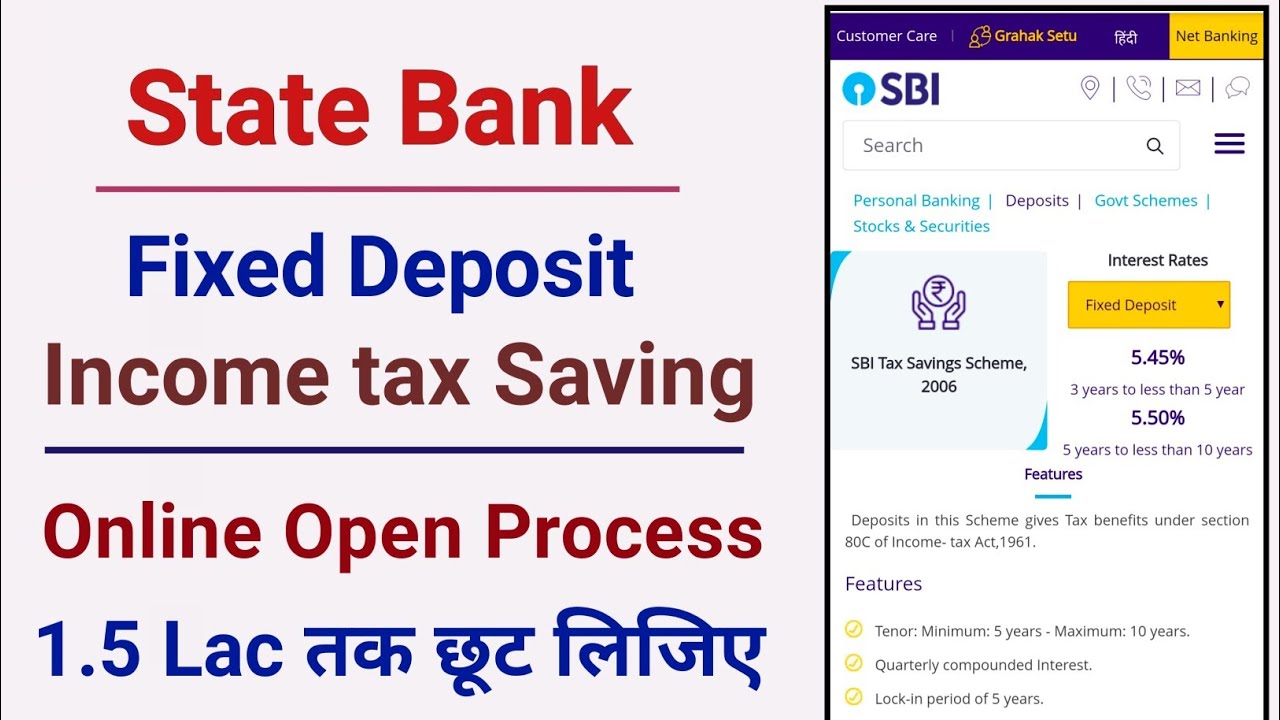

Sbi Tax Saver Fixed Deposit How To Open Tax Saver Fd In Sbi Online

https://i.ytimg.com/vi/MF15NuqozMg/maxresdefault.jpg

Fixed Deposits Your One Stop Solution For Varied Financial Needs

https://i.pinimg.com/originals/2a/0c/40/2a0c4061b8a3114028a6747de4efd18f.png

1 Tax benefits The most significant benefit of a Tax Saver Fixed Deposit is the tax advantage under Section 80C of the Income Tax Act 1961 You can claim a tax deduction of up to Rs 1 5 lakh in a Get attractive Fixed Deposit Interest Rate on your lump sum investment as well as the benefit of tax saving with Axis Bank s Tax Saver Fixed Deposit Invest from a

A tax saving FD or Fixed Deposit is a tax saving investment option offered by banks where you can deposit money and get a higher rate of Tax saving FDs are Fixed Deposits that offer tax benefits along with earning interest income A tax deduction of up to INR 1 50 000 can be claimed under section

Tax Saving FD Tax Saving FD Interest Rates In 2021 I Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2019/02/tax-saving-fixed-deposit.jpg

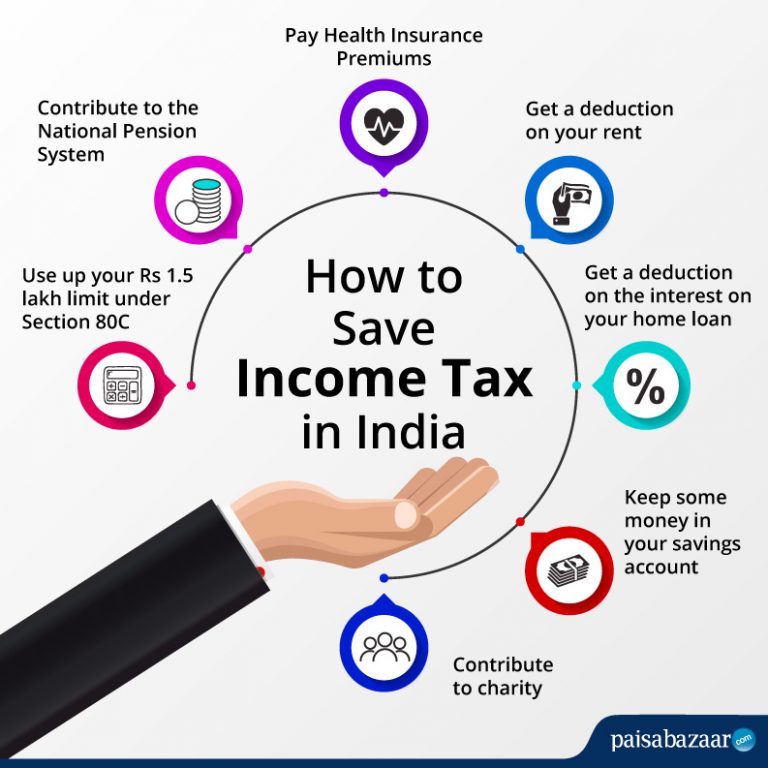

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/06/How-to-Save-Income-Tax-Photo-768x768.jpg

https://marketbusinessnews.com/benefits-and...

Tax Benefits Investments in tax saving fixed deposits are eligible for a deduction of up to 1 5 Lakhs under Section 80C of the Income Tax Act This deduction

https://www.bankoncube.com/post/the-benefits-of...

Tax saving fixed deposits provide a reliable avenue for individuals to save on taxes while securing their funds This comprehensive guide explores their features eligibility and

All You Need To Know About Investing In A Tax Saving Fixed Deposit

Tax Saving FD Tax Saving FD Interest Rates In 2021 I Paisabazaar

Tax Savings Options That You Should Know

What Is Tax Saving Benefits Of Tax Saving RBL Bank

Ada Deposito Berjangka ARO On Call Hingga Sertifikat Apa Bedanya

Tax Saver FD Fixed Deposit FD

Tax Saver FD Fixed Deposit FD

Mahila Samman Savings Certificate Mahila Samman Bachat Patra GKToday

Tax Saving FD Know The 5 Benefits Of Tax Saving Fixed Deposit RBL Bank

Tax Saving Fixed Deposit FD Meaning Features How To Open

Benefit Of Tax Saving Fixed Deposit - Some key benefits Start small As a new investor you can start with a minimum amount of Rs 10 000 Assured returns You can earn stable and safe returns at an attractive