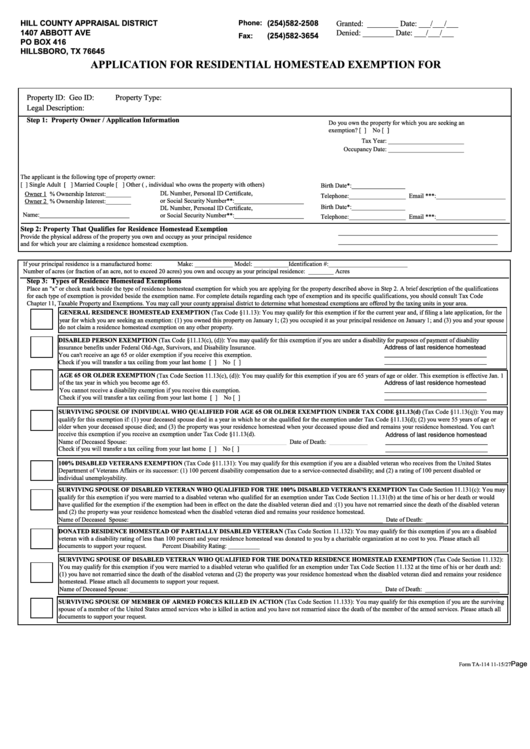

Bexar County Appraisal District Homestead Exemption Form File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between Jan 1 and April 30 of the year for which the

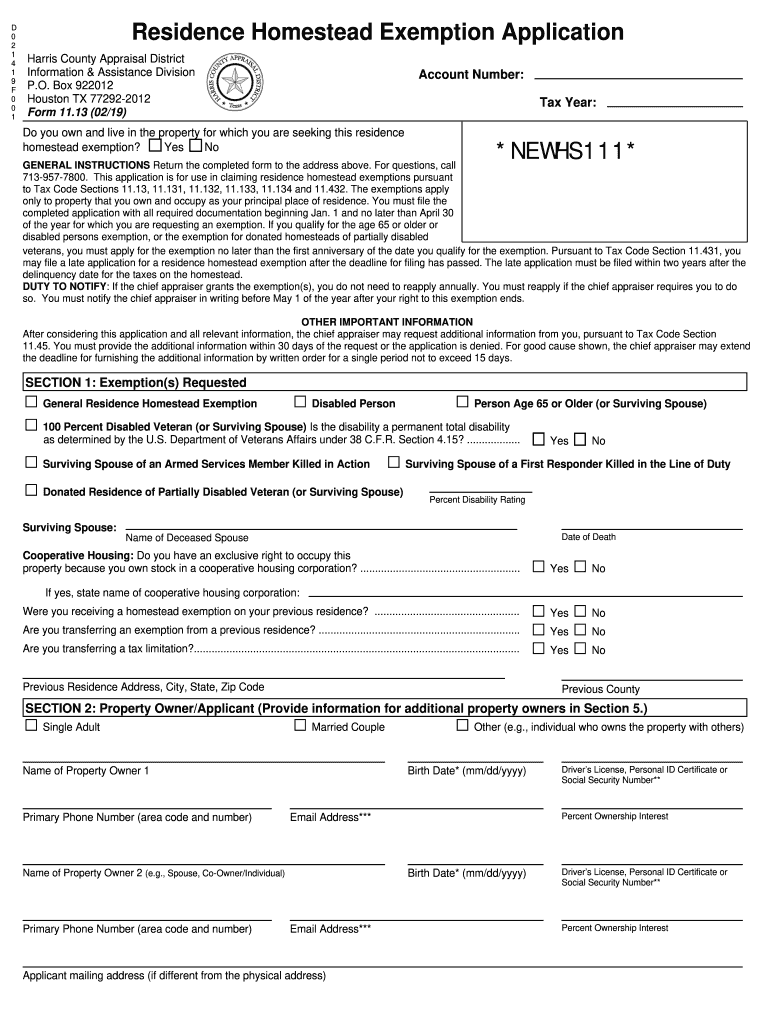

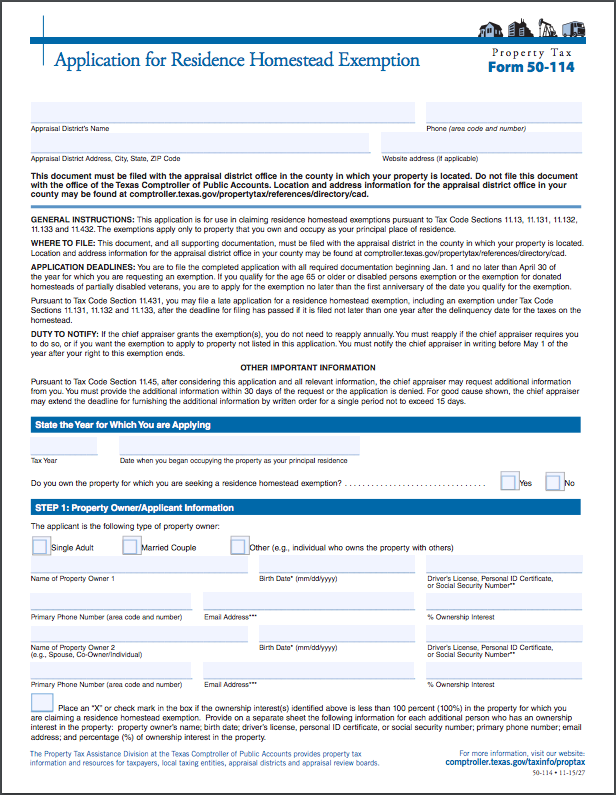

Application exemption and request forms 50 114 Homestead Exemption Disabled Over 65 100 Disabled Vet more 50 264 Property Acquired Or Sold Previously Exempt under 11 182 GENERAL INSTRUCTIONS This application is for use in claiming general homestead exemptions pursuant to Tax Code 11 13 and 11 131 The exemptions apply to your

Bexar County Appraisal District Homestead Exemption Form

Bexar County Appraisal District Homestead Exemption Form

https://www.exemptform.com/wp-content/uploads/2022/08/2019-2021-form-tx-hcad-11-13-fill-online-printable-fillable-blank-6.png

Fillable Online Dallas County Appraisal District Homestead Exemption

https://www.pdffiller.com/preview/680/428/680428234/large.png

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-4.png?fit=530%2C749&ssl=1

FILING INSTRUCTIONS Attach the completed and notarized affidavit to your Residence Homestead Exemption Application for filing with the appraisal district office in each county in To apply for an exemption call the Bexar Appraisal District at 210 224 2432 You may also contact their agency directly by email or visit their website to obtain the necessary forms The

GENERAL INFORMATION Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the If none Click Here to print and complete a Residential Homestead Exemption application and then mail to BCAD P O Box 830248 San Antonio TX 78283 For more information please call 210 335 2251

Download Bexar County Appraisal District Homestead Exemption Form

More picture related to Bexar County Appraisal District Homestead Exemption Form

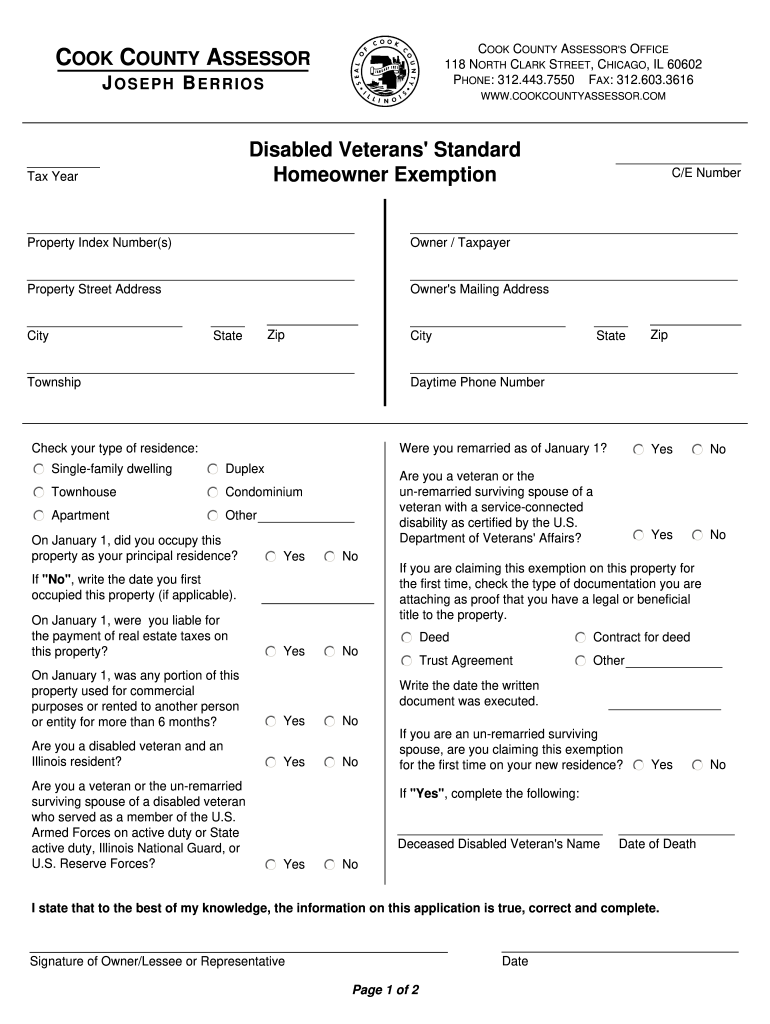

Cook County 2023 Long Time Homeowner Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/how-to-file-a-homeowners-exemption-cook-county-woproferty-2.png

Fill Free Fillable Bexar Appraisal District PDF Forms

https://var.fill.io/uploads/pdfs/html/cb99257f-61ec-4570-8ef2-72fb3b26560b/1612949252_thm.png

Public Service Announcement Residential Homestead Exemption

https://www.bexar.org/Areas/CivicSend/Assets/Uploads/5762/3388c0ee188b44c9903156a14e293eb0.gif

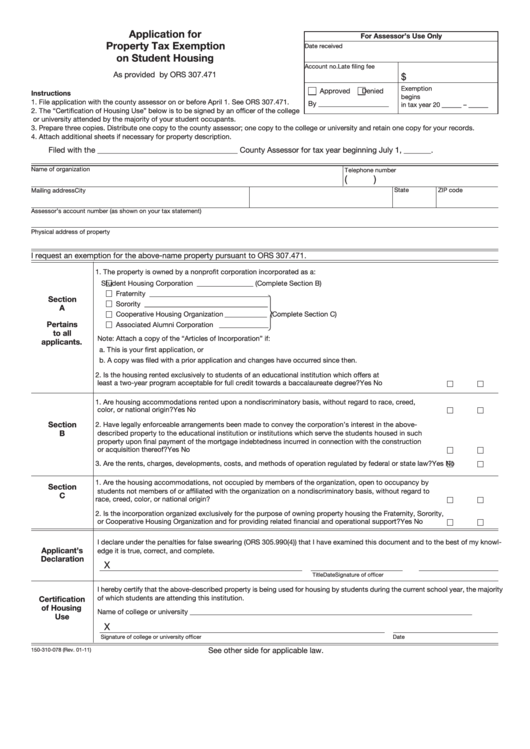

This service includes filing an exemption on your residential homestead property submitting a Notice of Protest and receiving important notices and other information online The Online Portal is also available to agents that have A qualified Texas homeowner can file for the homestead exemption by filing the form that can be downloaded below The typical deadline for filing a county appraisal district homestead

Form 50 114 can be accessed by clicking here If you have any questions or require assistance in filling out the form please contact Bexar Appraisal District at 210 224 To get the basic homestead exemption homeowners need to fill out this form and submit it to the county tax office Once a homestead exemption is approved it applies to all

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

How To File Homestead Exemption Denton County YouTube

https://i.ytimg.com/vi/SuiCaVfR8ys/maxresdefault.jpg

https://bcad.org › wp-content › uploads

File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between Jan 1 and April 30 of the year for which the

https://bcad.org › forms

Application exemption and request forms 50 114 Homestead Exemption Disabled Over 65 100 Disabled Vet more 50 264 Property Acquired Or Sold Previously Exempt under 11 182

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Harris County Homestead Exemption Form ExemptForm

Jefferson County Property Tax Exemption Form ExemptForm

Bexar Cad Homestead Exemption

Fill Free Fillable Bexar Appraisal District PDF Forms

HECHO How To Fill Out Texas Homestead Exemption 2022 YouTube

HECHO How To Fill Out Texas Homestead Exemption 2022 YouTube

How To Fill Out Homestead Exemption Form Bexar County Texas

Bexar Appraisal District Koontz Corporation

Tarrant County Appraisal District Homestead Exemption Form ExemptForm

Bexar County Appraisal District Homestead Exemption Form - How do I apply for the homestead exemption in Bexar County To apply homeowners can obtain the required form from the Bexar County office or use the 50 114 form