Bond Income Tax Rebate Web 17 f 233 vr 2023 nbsp 0183 32 You can buy up to 10 000 in electronic I bonds per person in a calendar year with an online account at TreasuryDirect gov Plus you can buy up to 5 000 more in paper bonds per tax return

Web 20 avr 2023 nbsp 0183 32 You can use all or part of your tax refund to purchase I bonds Your request for bonds must be in increments of 50 Any remaining refund amount not used to Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such

Bond Income Tax Rebate

Bond Income Tax Rebate

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Stock And Number REC Long Term Infrastructure Bonds Are Tax Rebate U s

http://2.bp.blogspot.com/-VoDYpl970BM/Txw2dcllJsI/AAAAAAAAC6E/a0m5JyoPDcI/s1600/image001.gif

Web excludable from income for federal income tax purposes if the bond is an arbitrage bond This lesson provides an introduction to the various concepts statutory provisions and Web Direct subsidy bonds bond issuers receive cash rebates from the government to subsidize their net interest payments Also this structure is used under the U S federal

Web 29 sept 2021 nbsp 0183 32 This can result in gains being taxed at rates of up to 45 losing almost half the profit UK based or onshore investment bonds provide the bondholder with a tax Web 10 oct 2021 nbsp 0183 32 1 Interest Typically bonds bear an interest rate required to be paid to bondholders at regular intervals depending on the type of bond you are investing your money in Such interest income is taxed at an

Download Bond Income Tax Rebate

More picture related to Bond Income Tax Rebate

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Taxes From A To Z 2014 E Is For EE Bonds

https://blogs-images.forbes.com/kellyphillipserb/files/2014/03/ee.png

What Is An Indemnity Bond Quora

https://qph.cf2.quoracdn.net/main-qimg-ef50db5264400264369fe6e725f640c4-lq

Web Bond type Tax benefits under Section 80CCF can be availed only through investment in certain tax saving bonds issued by banks or corporations after gaining permission from Web Tax free Bonds Tax saving Bonds Interest income you earn is tax exempt Just the initial investment is tax exempt Falls under Section 10 of the Income Tax Act Falls

Web 13 janv 2022 nbsp 0183 32 This recalculates the purchase price after the effect of inflation on the bond which lowers your capital gains to reduce taxability on your income If the indexation benefits are not opted for the 10 tax Web 11 sept 2023 nbsp 0183 32 Updated On 04 Sep 2023 According to the Income Tax Act long term capital gains LTCG are taxed However Sections 54 54F and 54EC allow you to

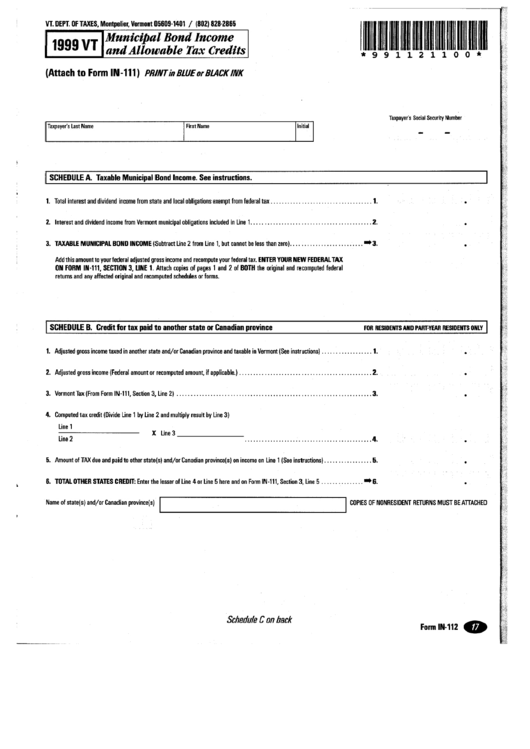

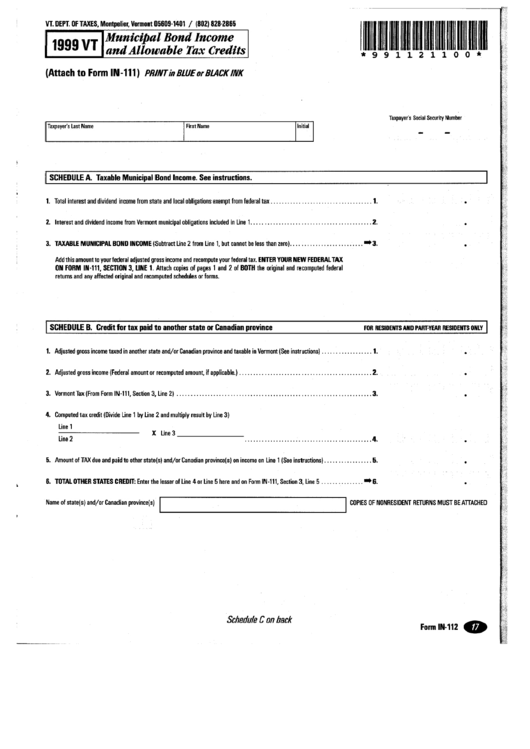

Form In 112 Municipal Bond Income And Allowable Tax Credits 1999

https://data.formsbank.com/pdf_docs_html/261/2613/261351/page_1_thumb_big.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

https://www.nytimes.com/2023/02/17/your-money…

Web 17 f 233 vr 2023 nbsp 0183 32 You can buy up to 10 000 in electronic I bonds per person in a calendar year with an online account at TreasuryDirect gov Plus you can buy up to 5 000 more in paper bonds per tax return

https://www.irs.gov/refunds/using-your-income-tax-refund-to-save-by...

Web 20 avr 2023 nbsp 0183 32 You can use all or part of your tax refund to purchase I bonds Your request for bonds must be in increments of 50 Any remaining refund amount not used to

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Form In 112 Municipal Bond Income And Allowable Tax Credits 1999

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Fillable Form 8888 Savings Bonds Irs Financial Institutions

P55 Tax Rebate Form Business Printable Rebate Form

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Pin On Tigri

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Pin On Things For My Wall

Bond Income Tax Rebate - Web 24 juil 2023 nbsp 0183 32 Publication 915 Social Security and Equivalent Railroad Retirement Benefits This publication explains the federal income tax rules for social security benefits and