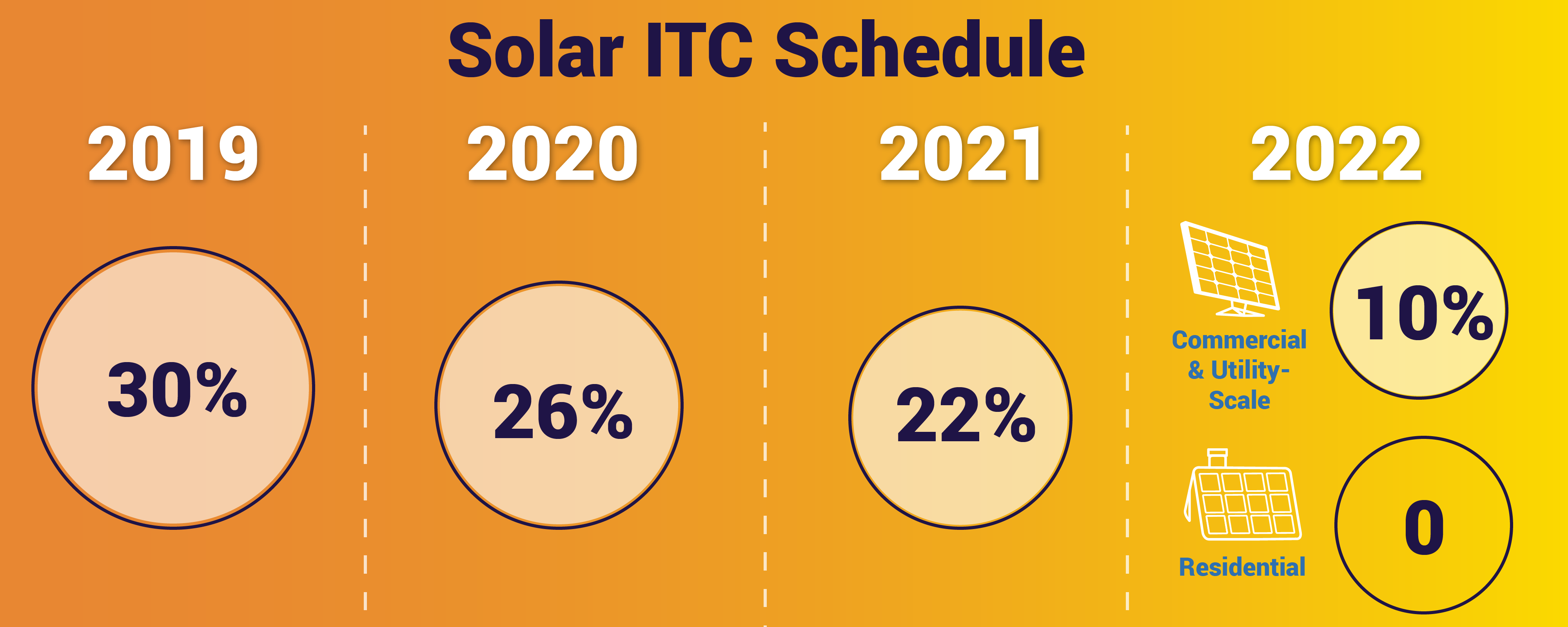

Federal Tax Rebate For Solar 2023 Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

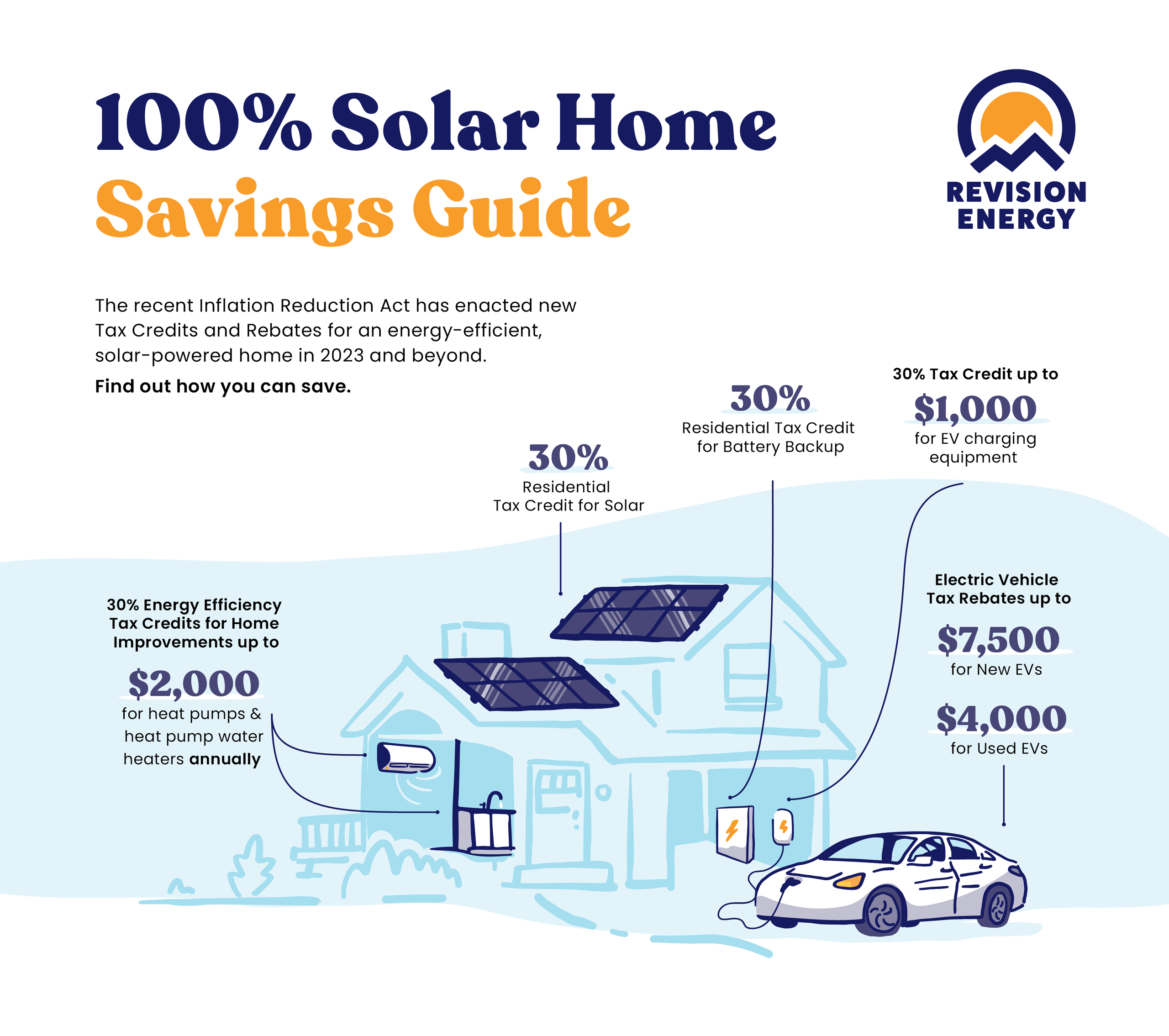

Web 14 mars 2023 nbsp 0183 32 The solar panel tax credit for 2023 taxes filed in 2024 is 30 of eligible costs It will remain at 30 for the tax year 2023 through 2032 Web 28 ao 251 t 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

Federal Tax Rebate For Solar 2023

Federal Tax Rebate For Solar 2023

https://cdn10.bigcommerce.com/s-3yc5xwvk/product_images/uploaded_images/federal-rebate-for-solar.png?t=1460888427

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

Residential Homeowner s Guide To Federal Tax Rebates For Solar Power In

https://blog.calculatesolarsavings.com/wp-content/uploads/2023/02/2023-federal-solar-tax-rebate-500x500.png

Web 21 avr 2023 nbsp 0183 32 Solar systems installed before 2033 are eligible for a tax credit equal to 30 of the costs of installing solar panels A 20 000 solar system would receive a tax credit of 6 000 to what you owe in federal Web 4 mai 2023 nbsp 0183 32 IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 Taxpayers who make energy

Web 3 janv 2023 nbsp 0183 32 The investment tax credit ITC also known as the federal solar tax credit allows you to apply 30 percent of your solar energy system s cost as a credit to your federal tax bill The 30 percent tax credit will be available until 2033 at which point it will drop to 26 percent The ITC applies to both residential and commercial systems and Web 6 f 233 vr 2023 nbsp 0183 32 February 6 2023 On Aug 16 2022 President Joe Biden signed into law the Inflation Reduction Act of 2022 IRA which includes new and revised tax incentives for clean energy projects This alert provides a summary of the IRA impact on solar energy tax credits which were extended and significantly expanded

Download Federal Tax Rebate For Solar 2023

More picture related to Federal Tax Rebate For Solar 2023

Kinnard s LLC Innovative Solar Solutions

http://kinnardsllc.com/images/energy-tax-credit.jpg

Top Five Reasons Why Solar Now 2020 Edition

https://www.seia.org/sites/default/files/inline-images/Solar-ITC-Rampdown-Graphic.png

Solar Rebates And Tax Incentives Realsolar PowerRebate

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/solar-rebates-and-tax-incentives-realsolar.png

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar Web 10 ao 251 t 2023 nbsp 0183 32 The U S Treasury Department and the Internal Revenue Service on Thursday issued final rules for a new program that will boost tax credits for qualified solar and wind facilities in low income

Web One exception is a utility rebate for purchasing or installing solar PV at a residence consider a business that commenced construction of a solar PV system in 2023 placed it in service in 2025 and uses the calendar Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Bc Rebates For Solar Power PowerRebate

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/tax-rebates-for-solar-power-ineffective-for-low-income-americans-but-1.jpg?w=1050&ssl=1

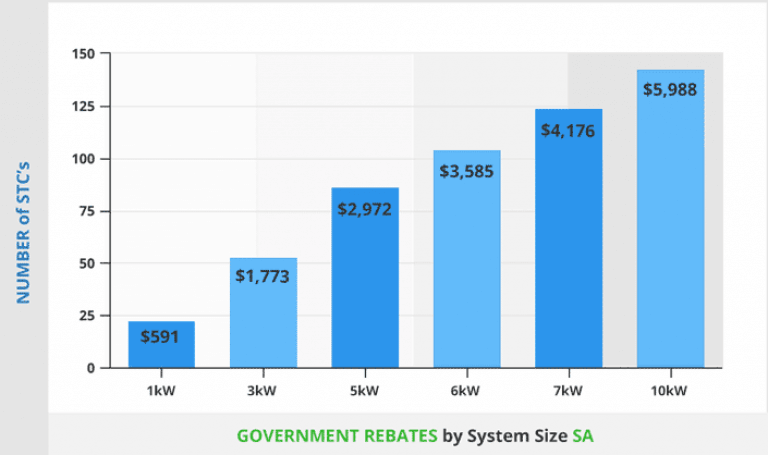

SA Solar Rebates New 2023 Guide Quick Read

https://gosolarquotes.com.au/wp-content/uploads/2021/04/government-rebates-in-SA-by-system-sizes-768x455.png

https://www.energy.gov/sites/default/files/2023-03/Homeown…

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

https://www.nerdwallet.com/article/taxes/sola…

Web 14 mars 2023 nbsp 0183 32 The solar panel tax credit for 2023 taxes filed in 2024 is 30 of eligible costs It will remain at 30 for the tax year 2023 through 2032

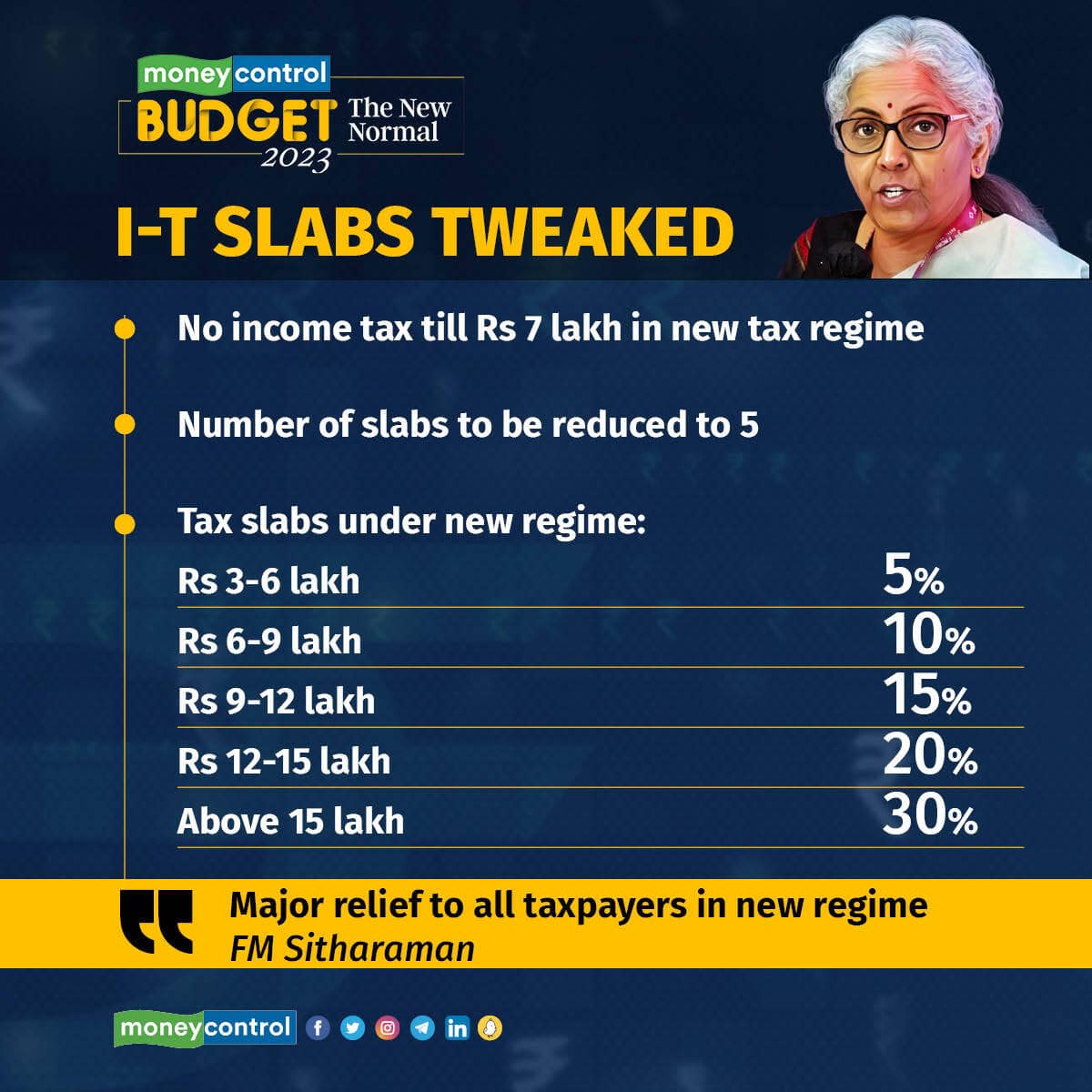

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

Bc Rebates For Solar Power PowerRebate

What The Solar Tax Rebate Means For Your Small Business

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Federal Solar Tax Credit Increases Microgrid Media

Federal Tax Rebates LatestRebate

Taking Advantage Of HVAC Rebates Federal Tax Credits With An

Federal Tax Rebate For Solar 2023 - Web 3 janv 2023 nbsp 0183 32 The investment tax credit ITC also known as the federal solar tax credit allows you to apply 30 percent of your solar energy system s cost as a credit to your federal tax bill The 30 percent tax credit will be available until 2033 at which point it will drop to 26 percent The ITC applies to both residential and commercial systems and