Sales Tax Rebate Ca Web This table lists rebates that may allow you to claim the GST HST and QST paid on certain

Web Since you have itemized the buy down rebate on the invoice you may collect sales tax Web The quot File a rebate quot service allows you to electronically file an application for the

Sales Tax Rebate Ca

Sales Tax Rebate Ca

https://cdn.gobankingrates.com/wp-content/uploads/2017/04/171108_GBR_SalesTax_1920x1080-_ea3b4bb5-e0f9-4662-9961-7c0580cb1520_.jpg

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/27/773/27773189/large.png

Salesx Tax In Ca Rentalladeg

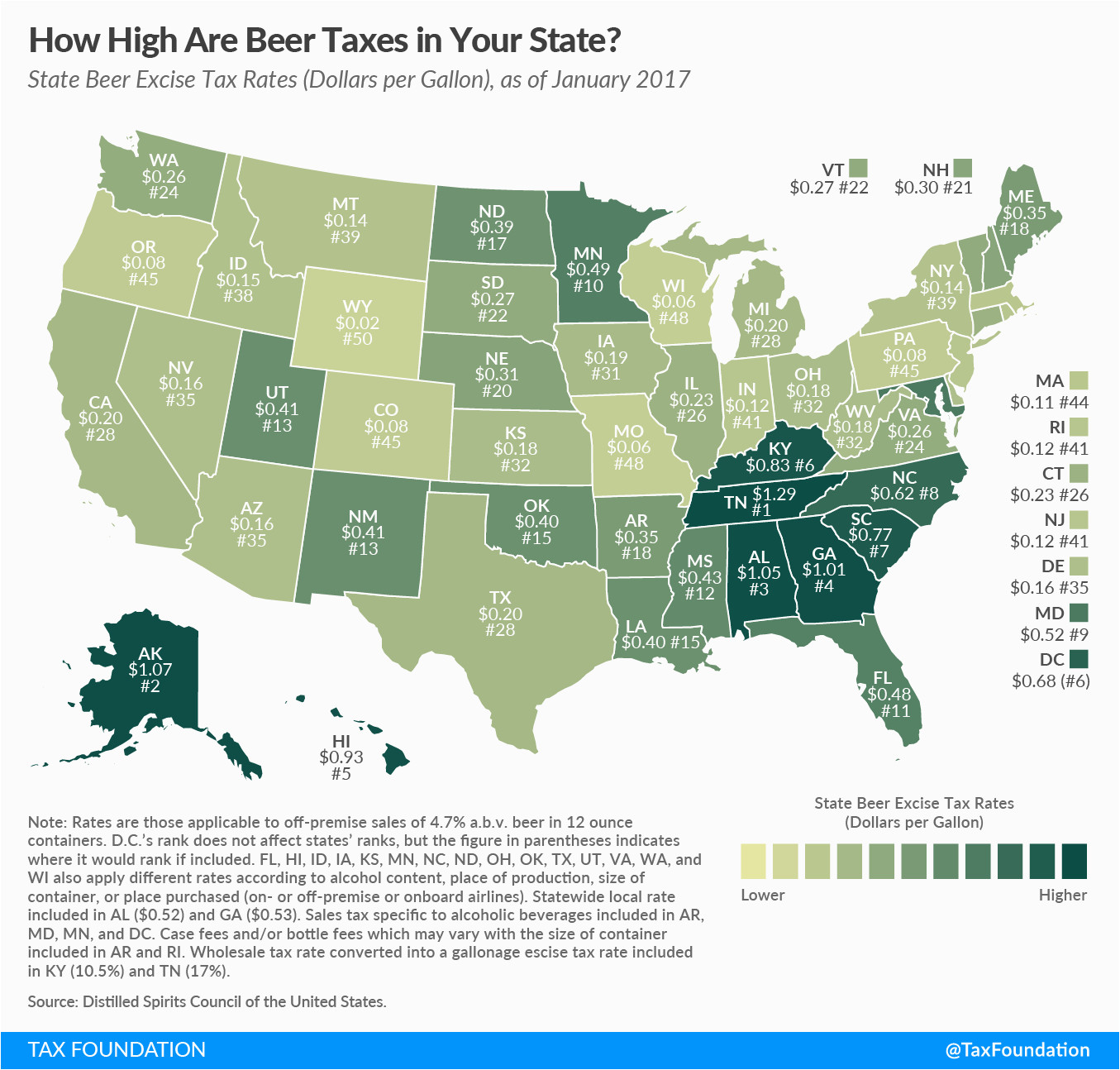

https://secretmuseum.net/wp-content/uploads/2019/01/california-sales-tax-map-how-high-are-beer-taxes-in-your-state-tax-foundation-of-california-sales-tax-map.png

Web Retailers engaged in business in California must register with the California Department Web The manufacturer receives the rebate application and sends the purchaser a cheque for

Web Claim the QST rebate on line 459 of your Quebec provincial tax return If the QST rebate Web Claims for a rebate of the federal Goods and Services Tax GST must be made in

Download Sales Tax Rebate Ca

More picture related to Sales Tax Rebate Ca

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

https://i1.wp.com/struggleville.net/wp-content/uploads/2019/10/MenardsPriceAdjustmentRebate8502.jpg

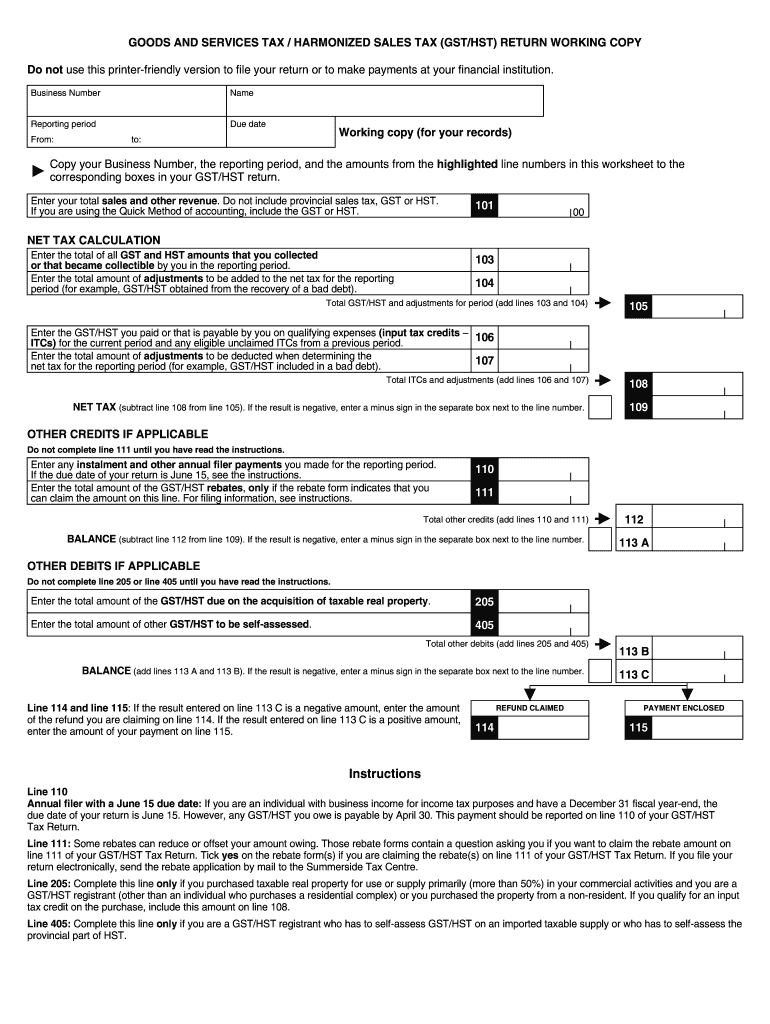

Business Gst Remittance Form Santos Czerwinski s Template

https://www.pdffiller.com/preview/100/105/100105630/large.png

Have You Received Your 150 Council Tax Rebate

https://s3-eu-west-1.amazonaws.com/creditladder-cdn/images/c459b3e3-4982-464e-8b4b-dd006b127354/Council_Tax_rebate.JPG

Web Tax rebate discounting is a process in Canada where a tax preparation firm purchases Web EXCISE TAX ACT LOI SUR LA TAXE D ACCISE Federal Sales Tax Inventory Rebate

Web 29 juil 2022 nbsp 0183 32 A rebate is for tax properly paid and is subsequently returned to a Web You can claim a GST HST or QST rebate for a reason listed below for example an

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Paulding County Homestead Exemption

https://marnafriedman.com/wp-content/uploads/2014/02/tax-rebates.png

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/...

Web This table lists rebates that may allow you to claim the GST HST and QST paid on certain

https://www.cdtfa.ca.gov/formspubs/pub113

Web Since you have itemized the buy down rebate on the invoice you may collect sales tax

Ptr Tax Rebate Libracha

2007 Tax Rebate Tax Deduction Rebates

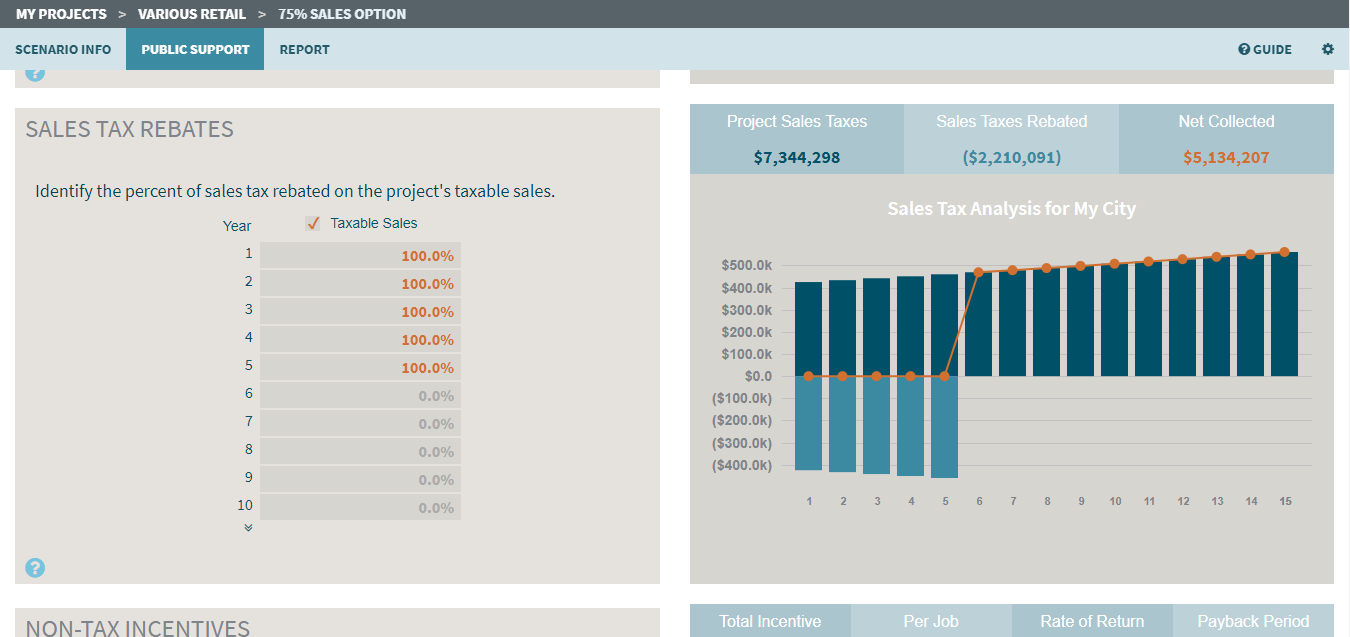

Impact DataSource

Weekly E Update

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

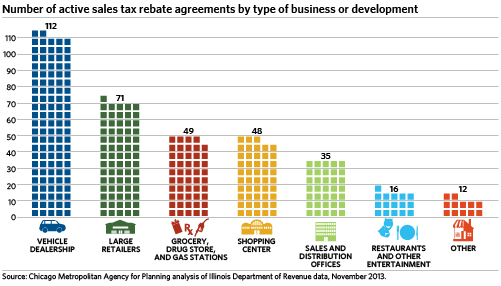

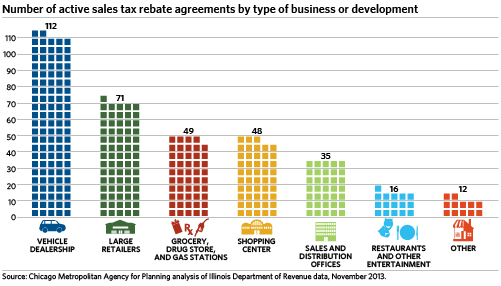

Sales Tax Rebate Database Analysis Highlights Prevalence Of Rebate

Sales Tax Rebate Database Analysis Highlights Prevalence Of Rebate

Tax Rebates Made Simple YouTube

Section 87A Tax Rebate Under Section 87A

Muth Encourages Eligible Residents To Apply For Extended Property Tax

Sales Tax Rebate Ca - Web The manufacturer receives the rebate application and sends the purchaser a cheque for