First Time Buyer Tax Rebate Web 15 nov 2022 nbsp 0183 32 Buying a Home Are There Credits for First Time Homebuyers From grants to tax breaks incentives abound to help achieve ownership By The Investopedia Team Updated November 15 2022

Web 25 mai 2023 nbsp 0183 32 1 First Time Buyers Status To be eligible for First time Buyers relief you must be a first time buyer This means you should not have previously owned or had a major interest in any residential Web 15 mars 2021 nbsp 0183 32 If you re buying a home for the first time claiming the First Time Home Buyers Tax Credit can land you a total tax rebate of

First Time Buyer Tax Rebate

First Time Buyer Tax Rebate

https://images.squarespace-cdn.com/content/v1/58aca60d725e25aeb6a9a567/1617207187253-2YKI4VQM183GW1Z9LY9I/Rebates.jpg

First Time Buyer Tax Rebate Ppt Powerpoint Presentation Model Clipart

https://www.slideteam.net/media/catalog/product/cache/1280x720/f/i/first_time_buyer_tax_rebate_ppt_powerpoint_presentation_model_clipart_cpb_slide01.jpg

Tax Credits Rebates For First Time Home Buyers In Toronto Buying

https://i.pinimg.com/originals/7f/7c/80/7f7c80dc755922f1de0181fccd1a2824.png

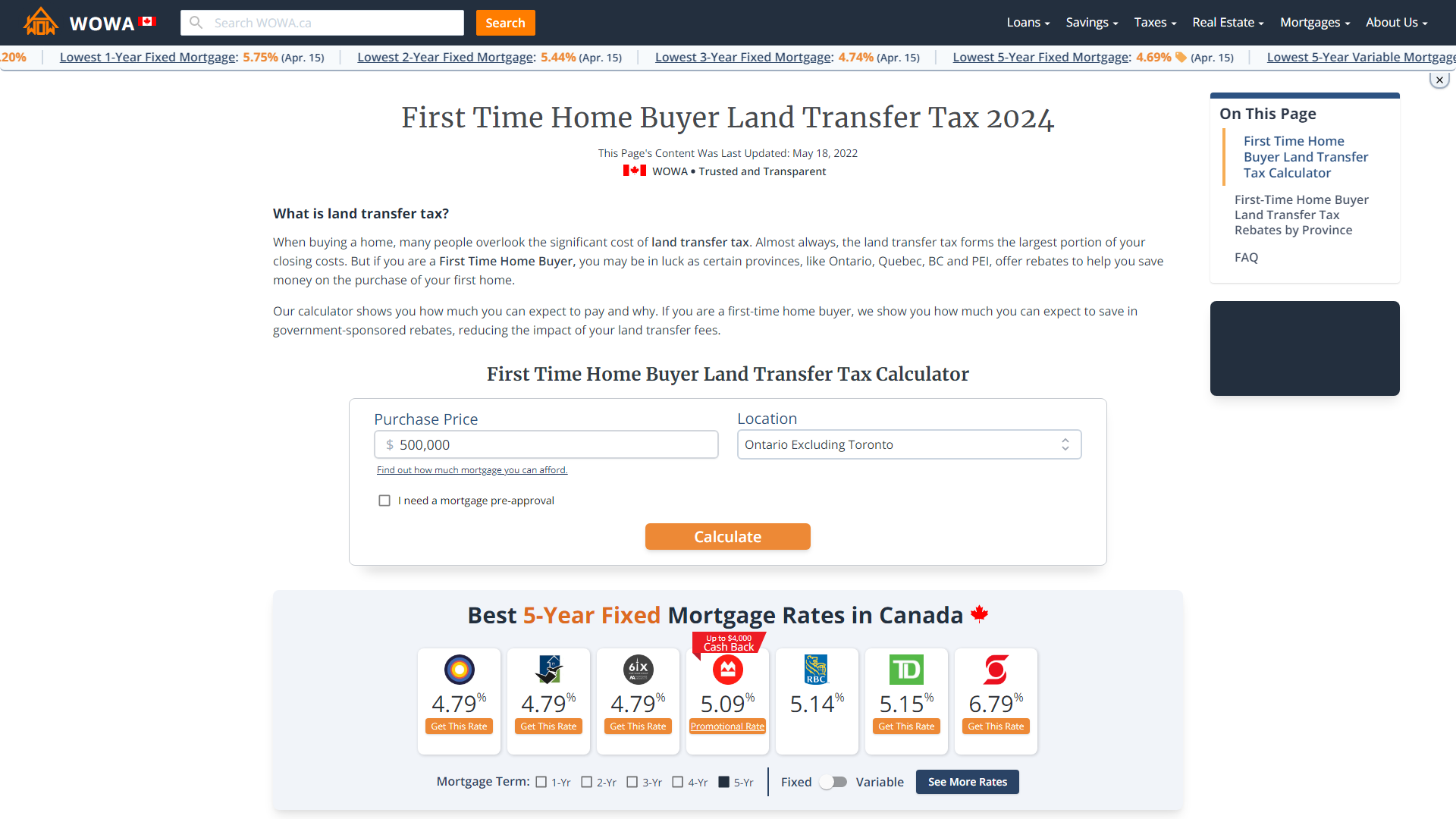

Web 23 mai 2023 nbsp 0183 32 After the passage of new legislation in December of 2022 eligible first time home buyers can claim a 10 000 non refundable income tax credit double what they could before which could Web 29 oct 2019 nbsp 0183 32 First time buyers can claim relief of income tax paid over the previous three years of up to 5 per cent of the total value of the property up to a maximum of 20 000

Web 27 juin 2022 nbsp 0183 32 25 000 To learn more about your mortgage payment try our Mortgage Payment Calculator Results Your Monthly Payment 1 965 Mortgage Amount Incl Web Beginning January 1 2017 no land transfer tax would be payable by qualifying first time purchasers on the first 368 000 of the value of the consideration for eligible homes

Download First Time Buyer Tax Rebate

More picture related to First Time Buyer Tax Rebate

First Time Home Buyer Income Tax Credits Rebates And Benefits

https://canadian-data.com/wp-content/uploads/2023/04/First-Time-Home-Buyer.jpg

First Time Home Buyer Grants Tax Rebates Living In London Ontario

https://i.ytimg.com/vi/aLo1c5kSbGY/maxresdefault.jpg

Stamp Duty Cut Off For First Time Buyers Jason Dunn Trending

https://wowa.ca/static/img/opengraph/calculators/first-time-home-buyer-land-transfer-tax.png

Web The new scheme offers first time buyers an income tax rebate of 5 of the purchase value of a newly built home priced up to 400 000 This translate as a tax rebate of up to Web 9 d 233 c 2013 nbsp 0183 32 The refund helps first time home buyers recover some of the cost of the province s land transfer tax up to a maximum of 2 000 or 1 000 if only one purchaser is a first time buyer In Toronto all buyers

Web In April of 2021 United States lawmakers and President Biden proposed the First Time Homebuyer Act of 2021 which would grant taxpayers a refundable tax credit called the Web 11 avr 2023 nbsp 0183 32 The Help to Buy Scheme or HTB Scheme allows first time buyers in Ireland to claim a tax rebate up to 10 of the value of a new home they are buying

First time Homebuyer Tax Credit 2021 Eligibility Ideas 2022

https://i.pinimg.com/originals/ed/95/83/ed958370f9ecd20b66bb431da0e7a58b.png

Tax Credits Rebates For First Time Home Buyers In Toronto First

https://i.pinimg.com/originals/73/83/a3/7383a34119ed5366c234bae48ff59560.jpg

https://www.investopedia.com/.../101714/credi…

Web 15 nov 2022 nbsp 0183 32 Buying a Home Are There Credits for First Time Homebuyers From grants to tax breaks incentives abound to help achieve ownership By The Investopedia Team Updated November 15 2022

https://www.ukpropertyaccountants.co.uk/tax …

Web 25 mai 2023 nbsp 0183 32 1 First Time Buyers Status To be eligible for First time Buyers relief you must be a first time buyer This means you should not have previously owned or had a major interest in any residential

Pin On Pushpinder Puri

First time Homebuyer Tax Credit 2021 Eligibility Ideas 2022

Are You To Be A First Time Home Buyer A 8000 Tax Credit Is Available

First Time Home Buyer Incentives Rebates In Ontario Canada 2022

Tax Benefits Of First Time Home Buyers BenefitsTalk

Programs Rebates And Credits For First Time Home Buyers Jennifer

Programs Rebates And Credits For First Time Home Buyers Jennifer

Micastle ca Yang Yang Broker Of Record First Time Home Buyer

Home Buying Secrets Unveiling Government Rebates For First Time Buyers

First Time Home Buyer Programs Incentives Rebates Tibetan

First Time Buyer Tax Rebate - Web 29 oct 2019 nbsp 0183 32 First time buyers can claim relief of income tax paid over the previous three years of up to 5 per cent of the total value of the property up to a maximum of 20 000