Income Tax Rebate On Mutual Fund Investment Web Investors in mutual fund trusts must report the rebates as income in the taxation year of payment Investors will receive a T3 or Releve 16 Quebec with the fee rebate included

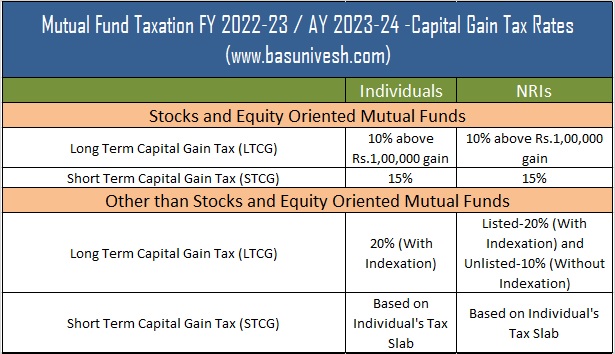

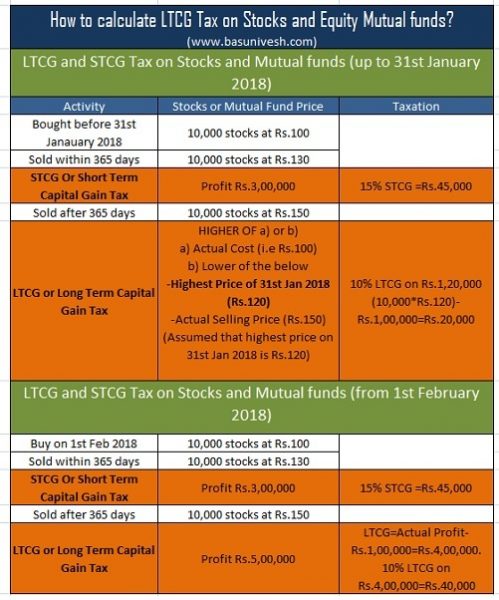

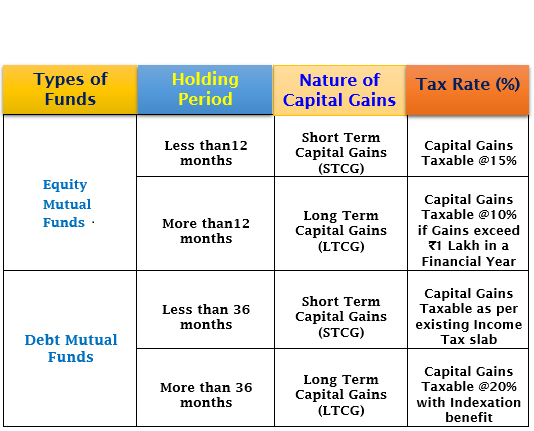

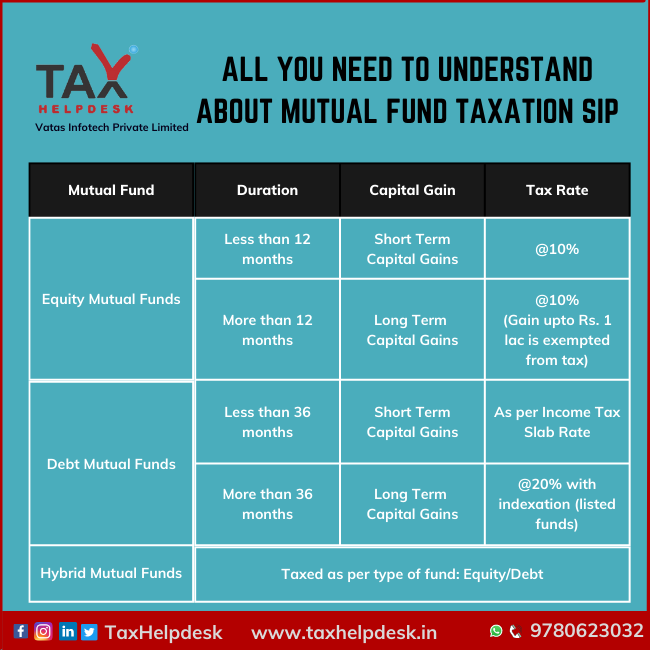

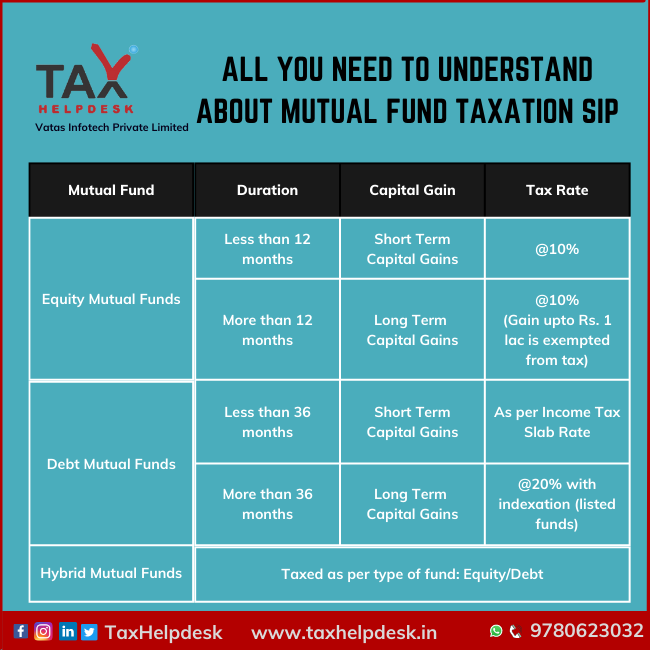

Web 10 ao 251 t 2017 nbsp 0183 32 Can mutual fund investments help me get a rebate on income tax Are wealth taxes applicable to MF investments According to the Wealth Tax Act mutual Web 19 sept 2022 nbsp 0183 32 As of today LTCG income tax on mutual funds equity oriented schemes is charged at the rate of 10 on capital gains in excess of 1 lakh as per section 112A of the Income Tax Act 1961 For

Income Tax Rebate On Mutual Fund Investment

Income Tax Rebate On Mutual Fund Investment

https://assets1.cleartax-cdn.com/s/img/2017/08/02121249/EBDSP-info-1-1024x714.png

Top 10 Best SIP Mutual Funds To Invest In India In 2022 Finansdirekt24 se

https://www.basunivesh.com/wp-content/uploads/2022/02/Mutual-Fund-Taxation-FY-2022-23.jpg

Basics Of Mutual Fund Investment Beginners Guide 2020

https://getmoneyrich.com/wp-content/uploads/2009/11/Mutual-Fund-Investment-Income-Tax-Benefits2.png

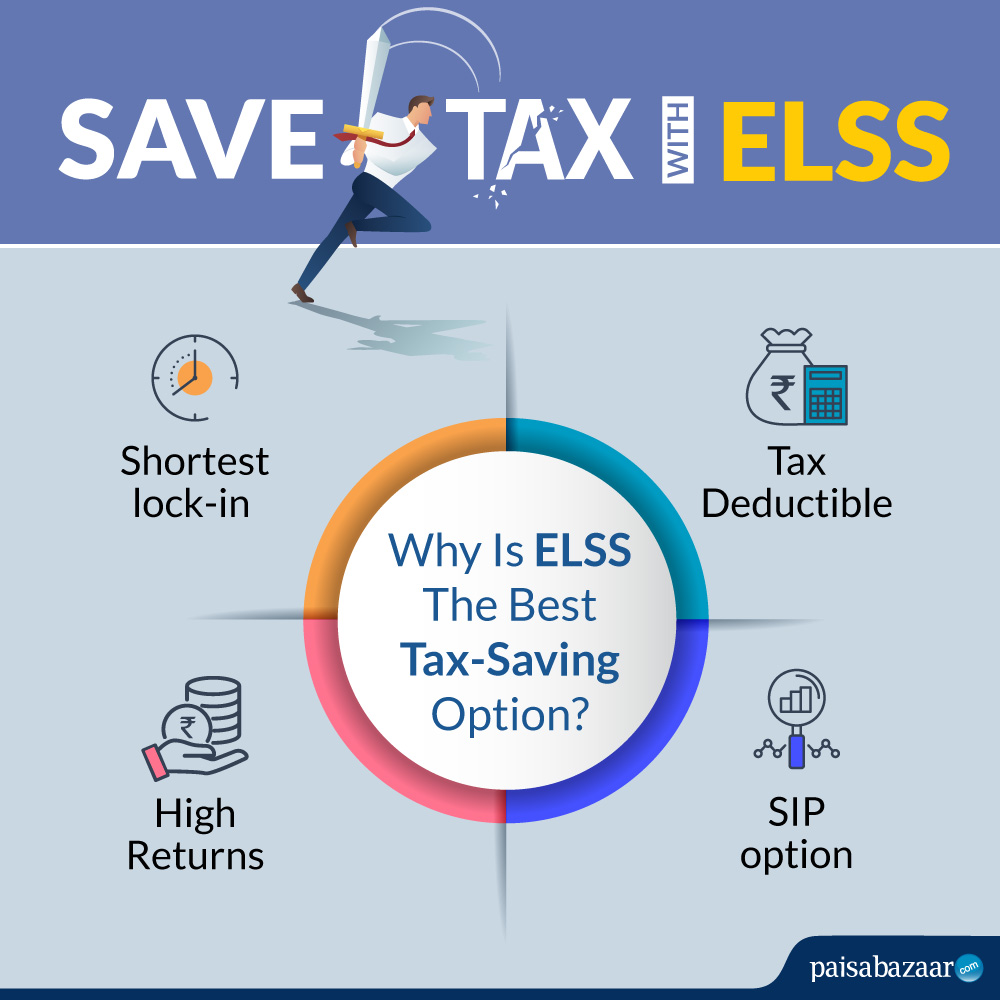

Web 8 oct 2019 nbsp 0183 32 1 Tax on mutual funds if you get dividends or interest Dividends are usually taxable income When you invest in a mutual Web 11 oct 2019 nbsp 0183 32 No all mutual funds do not qualify for tax deductions under Section 80C of the income tax Act Only investments in equity linked saving schemes or ELSSs qualify

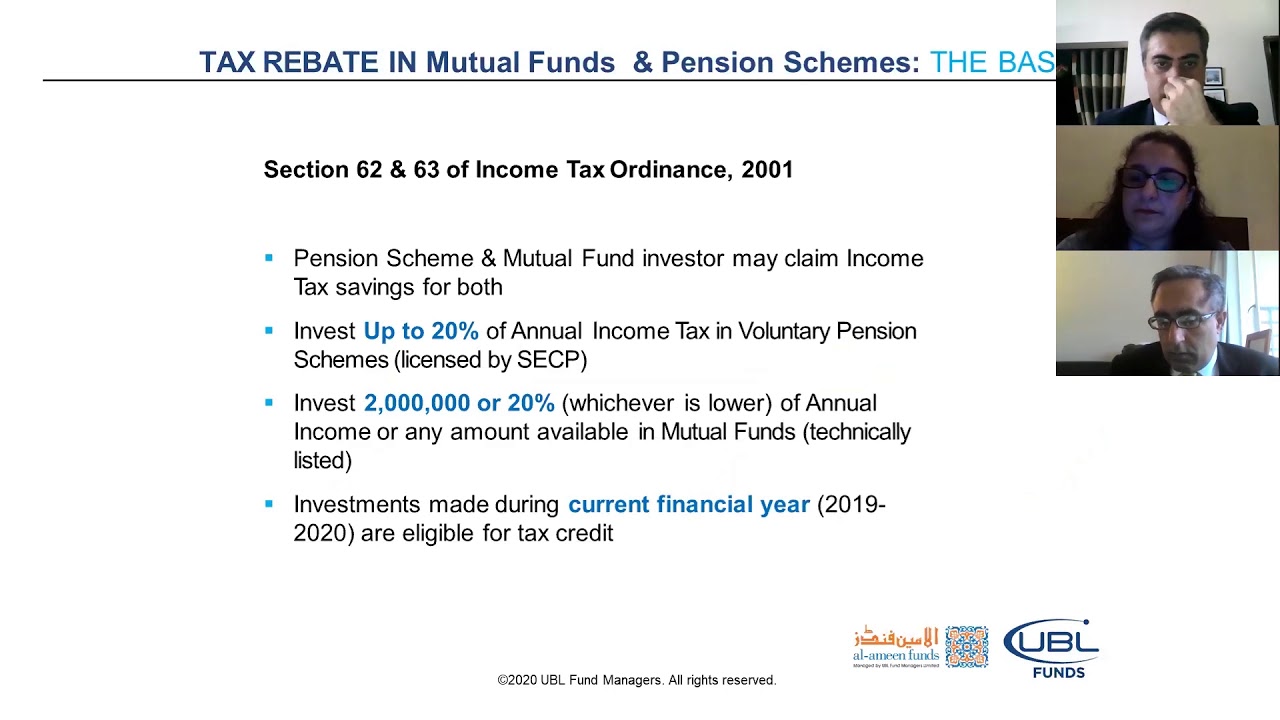

Web 21 avr 2023 nbsp 0183 32 Tax on Mutual Funds There are two types of returns that you can earn if you invest in mutual funds dividends and capital gains The returns generated from Web Step 1 Invest In Al Meezan Pension Fund upto your tax ceiling before June 30 Invest upto maximum of 20 of taxable income in Meezan Tahaffuz Pension Fund Step 2 Claim Tax Credit on the investment

Download Income Tax Rebate On Mutual Fund Investment

More picture related to Income Tax Rebate On Mutual Fund Investment

How Does Income Tax On Mutual Funds Work Quora

https://qph.fs.quoracdn.net/main-qimg-10beff6e705468d9c1409c3f6cf30904

Mutual Funds Taxation Rules FY 2020 21 Budget 2020 2022

https://www.relakhs.com/wp-content/uploads/2020/02/Capital-Gains-Tax-Rate-on-Sale-of-Mutual-Fund-units-in-India-FY-2020-21-AY-2021-22.jpg

Mutual Fund Taxation FY 2020 21 AY2021 22 Capital Gain Tax Rates

https://www.basunivesh.com/wp-content/uploads/2019/02/calculate-LTCG-Tax-on-Stocks-and-Equity-Mutual-funds.jpg

Web 3 janv 2020 nbsp 0183 32 Use Tax loss harvesting to cut income taxes To lower tax on mutual funds try tax loss harvesting Also as an investor you can take the losses on securities that Web 12 f 233 vr 2020 nbsp 0183 32 Tax on mutual funds vastly depends on factors such as what kind of funds you have invested in equity debt or hybrid the duration of your investment long term

Web Short term capital gains assets held 12 months or less are taxed at your ordinary income tax rate whereas long term capital gains assets held for more than 12 months are Web 14 mars 2022 nbsp 0183 32 More specifically you ll pay 0 15 or 20 on qualified dividends based on your income bracket and filing status Thresholds for four kinds of filers are below for

Will Capital Gains Tax Rate Change In 2021 Regretful Weblog Frame Store

https://www.basunivesh.com/wp-content/uploads/2021/02/Mutual-Fund-Taxation-FY-2021-22-AY2022-23-1280x720.jpg

Taxation On Mutual Fund Investments Simplified Finucation

https://www.finucation.in/wp-content/uploads/2021/02/mutual-funds-taxation-happywise.png

https://www.mackenzieinvestments.com/content/dam/final/c…

Web Investors in mutual fund trusts must report the rebates as income in the taxation year of payment Investors will receive a T3 or Releve 16 Quebec with the fee rebate included

https://cleartax.in/s/different-mutual-funds-taxed

Web 10 ao 251 t 2017 nbsp 0183 32 Can mutual fund investments help me get a rebate on income tax Are wealth taxes applicable to MF investments According to the Wealth Tax Act mutual

Get Up To 40 Of Tax Rebate By Investing In Mutual And Pension Funds

Will Capital Gains Tax Rate Change In 2021 Regretful Weblog Frame Store

Best Elss Funds 2023 Invest In Top 10 Tax Saving Funds In India Gambaran

Mutual Funds Taxation Rules FY 2020 21 Capital Gains Dividends

Budget 2018 Mutual Fund Taxation FY 2018 19 BasuNivesh

Financial Archives TaxHelpdesk

Financial Archives TaxHelpdesk

Income Tax Rebate Under Section 87A

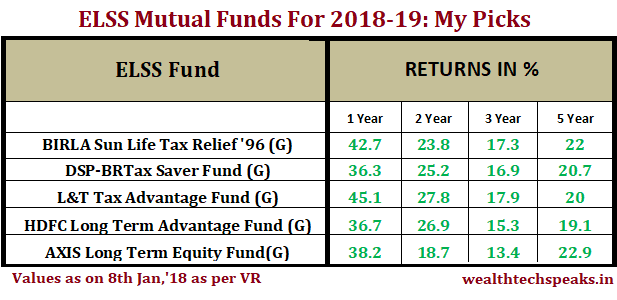

Best Performing ELSS Mutual Funds For Investment In 2018 19

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Mutual Fund Investment - Web 21 avr 2023 nbsp 0183 32 Tax on Mutual Funds There are two types of returns that you can earn if you invest in mutual funds dividends and capital gains The returns generated from