Tax Rebate Options In India Web Tax rebate is available for individuals and Hindu Undivided Families residing in India

Web 13 juin 2023 nbsp 0183 32 Resident individuals are eligible for a tax rebate of the lower of the income Web 21 sept 2022 nbsp 0183 32 Know everything about how you can save tax at least 78 000 in India Get to know about Income Tax Act tax planning amp list of tax saving investment options

Tax Rebate Options In India

Tax Rebate Options In India

https://www.basunivesh.com/wp-content/uploads/2018/04/Best-Tax-Saving-Options-for-2018-19.jpg

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Important Information You Need To Know About Tax Rebate For Taxpayers

https://thelogicalindian.com/wp-content/uploads/2019/02/Screenshot_44.png

Web 1 avr 2016 nbsp 0183 32 The tax holiday periods range from five to ten years and the percentage of Web India offers tax relief at both the central and state level Additional incentives are

Web 14 avr 2023 nbsp 0183 32 Soni highlighted that the rebate under section 87A has been hiked to Rs 7 Web This return is applicable for an Individual or Hindu Undivided Family HUF who is

Download Tax Rebate Options In India

More picture related to Tax Rebate Options In India

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

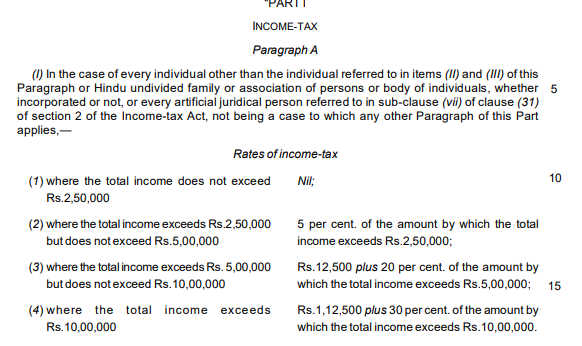

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

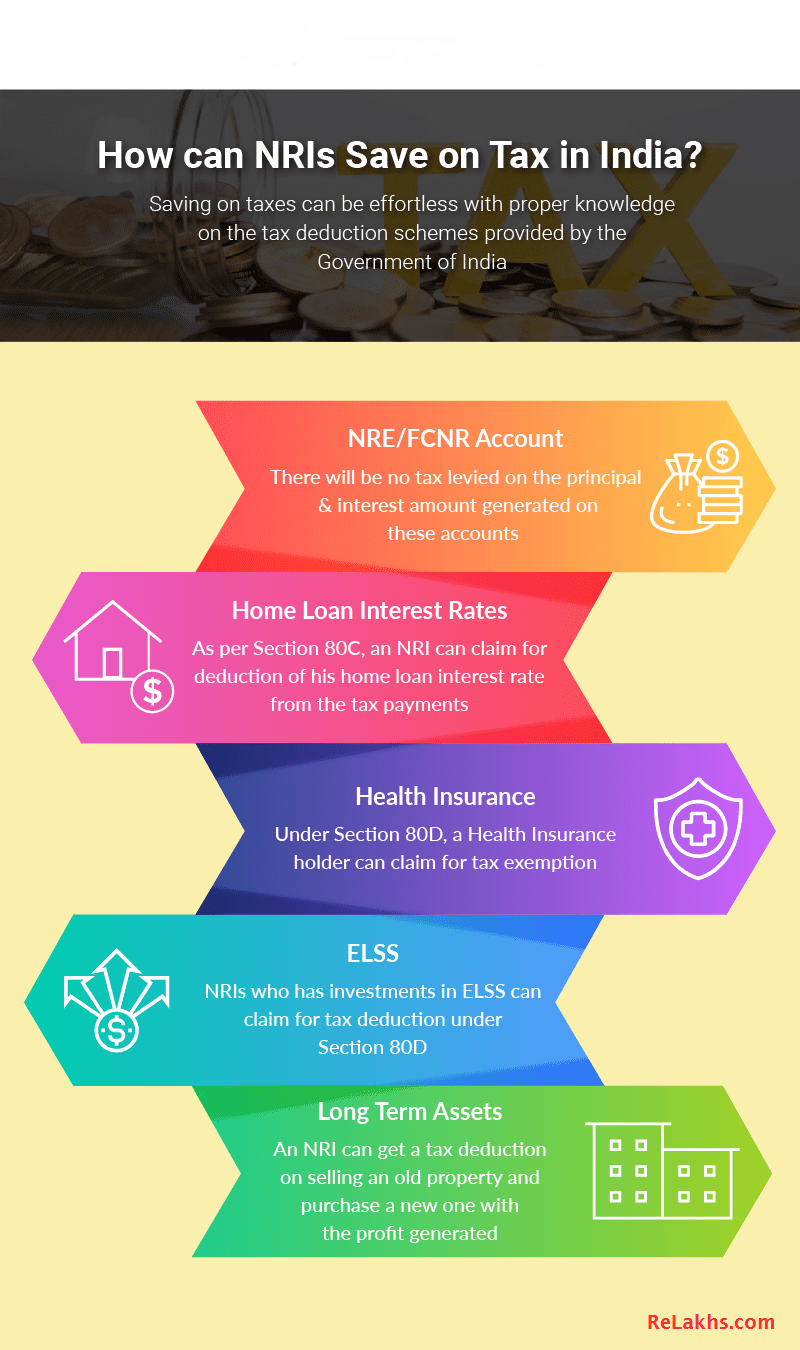

Best NRI Tax Saving Options 2020 21 How NRIs Can Save On Tax

https://www.relakhs.com/wp-content/uploads/2019/07/How-can-NRIs-Save-on-Tax-in-India-NRI-Tax-Saving-options.png

Web 1 f 233 vr 2023 nbsp 0183 32 In a huge relief to salaried and middle class Union Finance Minister Nirmala Sitharaman while presenting Union Budget 2023 24 in Parliament today said the income tax rebate has been extended on Web 14 mars 2022 nbsp 0183 32 There are multiple options to reduce the tax burden on individuals

Web 2 f 233 vr 2023 nbsp 0183 32 Income Tax Slab Budget 2023 LIVE Updates Finance Minister Nirmala Web 27 avr 2023 nbsp 0183 32 Tax exemptions can be availed by investing in the following tools Senior

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

https://www.bankbazaar.com/tax/tax-rebate.html

Web Tax rebate is available for individuals and Hindu Undivided Families residing in India

https://taxsummaries.pwc.com/india/individual/taxes-on-personal-income

Web 13 juin 2023 nbsp 0183 32 Resident individuals are eligible for a tax rebate of the lower of the income

Tax Savings Options Other Than Sec 80C For FY 2017 18 BasuNivesh

Income Tax Deductions List FY 2019 20

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

What Is The Best Tax Saving Option Keep Investing

Major Exemptions Deductions Availed By Taxpayers In India

Incometax Individual Income Taxes Urban Institute This Service

Incometax Individual Income Taxes Urban Institute This Service

Best Investment Options Best Tax Saving Schemes In India For 2012

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Tax Rebate Options In India - Web India offers tax relief at both the central and state level Additional incentives are