What Is Tax Rebate In India Tax rebate is a refund on taxes when the tax liability is less than the taxes the individual has paid Taxpayers usually get a refund on their income tax if they have paid more than what they owe The tax refund money is given back at

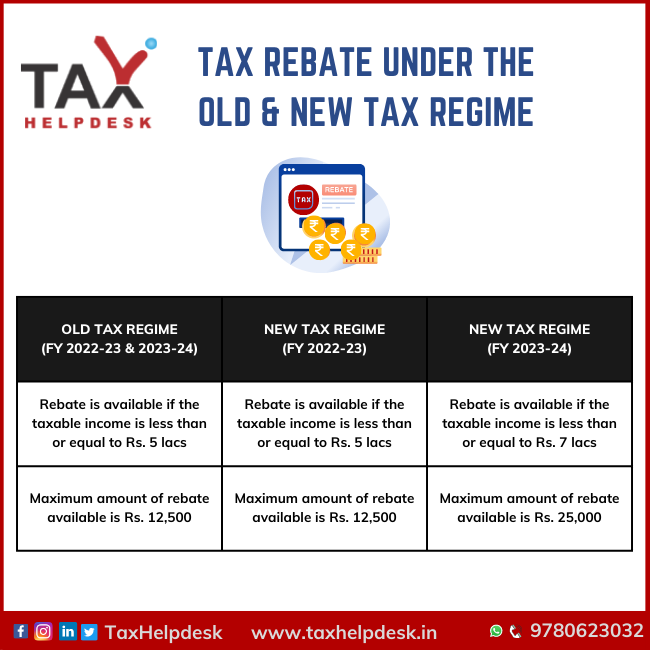

Income Tax Rebate What is rebate in income tax Income tax rebate is a benefit provided by the government to taxpayers that allows them to reduce their total tax liability It is the reduction in the amount of tax to the taxpayers by the government in order to promote savings and investment Tax rebate and TDS Unlike tax exemptions and tax deductions income tax rebates are supposed to be claimed from the total tax payable For example a tax rebate of Rs 12 500 is available for taxpayers with an annual income of up to Rs 5 lakh as applicable to the financial year 2023 24 for taxpayers who

What Is Tax Rebate In India

What Is Tax Rebate In India

https://www.moneysavingexpert.com/content/dam/hero-tax-hmrc.jpeg

More Than 30 000 Homes Get Council Tax Rebate In West Berkshire

https://www.newburytoday.co.uk/_media/img/XWR3OS658K3AP70S77XD.jpg

One time Tax Rebate In Virginia YouTube

https://i.ytimg.com/vi/bRn9omj7C-Q/maxresdefault.jpg

A tax rebate reduces your tax amount However the tax rebate is allowed only to resident individuals However the tax slabs are applicable to all whether individuals HUFs AOPs etc or whether resident or non resident So while computing taxes they will first be calculated as per the slab rates Income Tax Rebate In India A Detailed Guide Explore plan Calculate Premium Download Brochure Email February 06 2024

Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their tax liability On the other hand those with incomes over Rs 7 lakh will have to pay tax as per the slabs of the new tax regime It is a benefit provided by the government to incentivize and provide relief to certain categories of taxpayers The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23

Download What Is Tax Rebate In India

More picture related to What Is Tax Rebate In India

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

What Is Parenthood Tax Rebate In 2023 Heads Up Mom

https://headsupmom.com/wp-content/uploads/2022/12/What-is-Parenthood-Tax-Rebate-768x432.jpg

Income Tax rebate is the refund or reduction amount offered by the Income Tax when you file your taxes All you need to know about an Income Tax Rebate In the most generic terms an income tax rebate is a refund that you as a taxpayer are eligible for in case the taxes you pay exceed your liability A tax rebate is a refund that you are eligible for if the taxes paid by you exceed your tax liability For example if your tax liability is amounting to Rs 20 000 but if the bank pays the Government a TDS that amounts to Rs 30 000 on your behalf you are eligible for a tax rebate

Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their taxable income does not exceed Rs 5 lakh in a financial year This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having Total Income up to 50 lakh and having income from Business or Profession which is computed on a presumptive basis u s 44AD 44ADA 44AE

How To Calculate Tax Rebate In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Calculate-tax-rebate.jpg

Tax Rebate Under The Old New Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2023/06/Tax-rebate-under-the-old-new-tax-regime.png

https://www.bankbazaar.com/tax/tax-rebate.html

Tax rebate is a refund on taxes when the tax liability is less than the taxes the individual has paid Taxpayers usually get a refund on their income tax if they have paid more than what they owe The tax refund money is given back at

https://www.bajajfinserv.in/insights/income-tax-rebate

Income Tax Rebate What is rebate in income tax Income tax rebate is a benefit provided by the government to taxpayers that allows them to reduce their total tax liability It is the reduction in the amount of tax to the taxpayers by the government in order to promote savings and investment

What Is A Tax Rebate How To Claim It

How To Calculate Tax Rebate In Income Tax Of Bangladesh

Find Out How A Tax Rebate Can Help You Reduce Your Tax

How Can Taxpayers Obtain Income Tax Rebate In India

Tax Rebate Defined taxservices Www smarttaxservicestx Tax

Where To Invest For Tax Rebate In Bangladesh L Learn Everything L

Where To Invest For Tax Rebate In Bangladesh L Learn Everything L

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

2022 Tax Brackets JeanXyzander

Buying A New House Get 15 Tax Rebate If You Are Vaccinated In This

What Is Tax Rebate In India - It is a benefit provided by the government to incentivize and provide relief to certain categories of taxpayers The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23