British Columbia Property Tax Rebate Web When you own lease or gain an interest in a property e g land home etc located in B C you must pay property taxes Annual property tax When you own or lease a property

Web Refunds for property taxes If you have overpaid your property taxes or successfully appealed your property assessment you may have a credit on your account If your Web 27 juin 2022 nbsp 0183 32 25 000 To learn more about your mortgage payment try our Mortgage Payment Calculator Results Your Monthly Payment 1 965 Mortgage Amount Incl

British Columbia Property Tax Rebate

British Columbia Property Tax Rebate

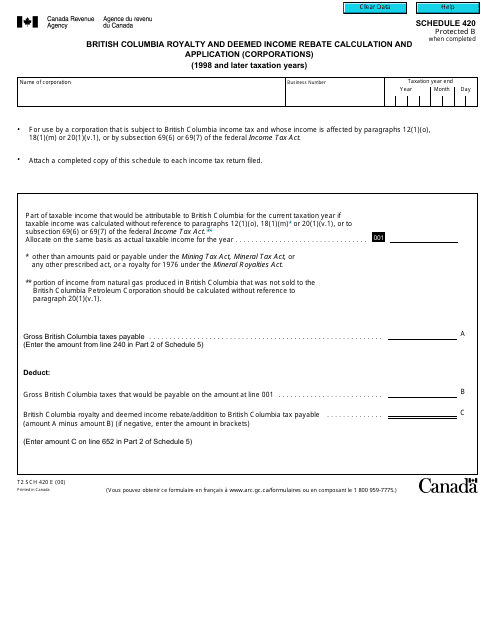

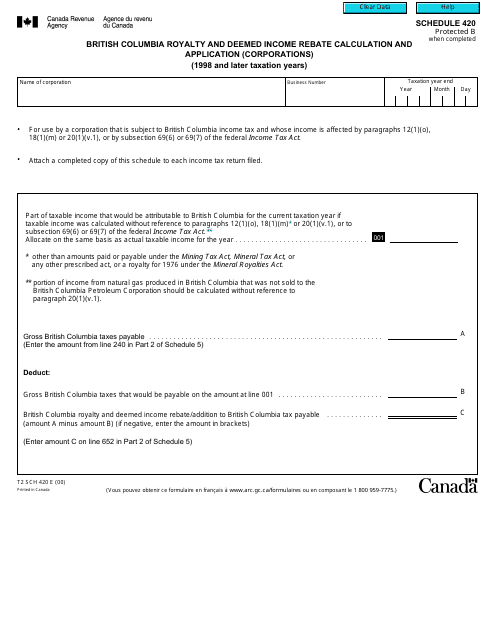

https://data.templateroller.com/pdf_docs_html/1868/18683/1868391/form-t2-schedule-420-british-columbia-royalty-and-deemed-income-rebate-calculation-and-application-corporations-1998-and-later-taxation-years-canada_big.png

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

https://www.senatorstadelman.com/images/PropertyTaxRebate_2022_FB.JPG

Muth Encourages Eligible Residents To Apply For Extended Property Tax

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Web 16 f 233 vr 2016 nbsp 0183 32 If you qualify for the exemption you may be eligible for either a full or partial exemption from the tax If you paid property transfer tax when you purchased vacant Web The B C new residential rental property rebate is equal to 71 43 of the provincial part of the HST paid on the purchase or self supply of the new housing up to a maximum

Web 2 mars 2013 nbsp 0183 32 Tax Calculator The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association The information used to make Web 1 mars 2023 nbsp 0183 32 The B C government has been handing out one time rebates despite projecting a budget deficit Finance minister Katrine Conroy says the tradeoff is worth it And put another way the maximum

Download British Columbia Property Tax Rebate

More picture related to British Columbia Property Tax Rebate

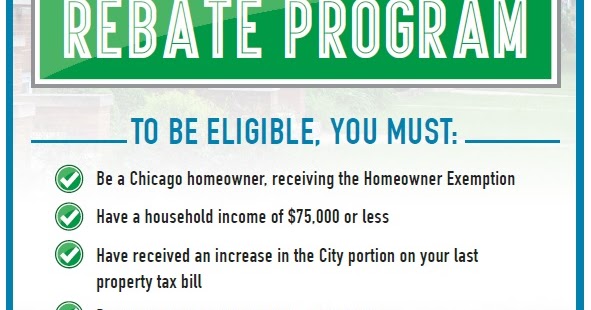

Uptown Update Property Tax Rebate Program Open Through November

https://4.bp.blogspot.com/-O9R4XCiPJUQ/WBWQyxv0nRI/AAAAAAAAN-M/A4WEO8G29mgbbWYzJj03YfOk_WrrHF4_wCLcB/w1200-h630-p-k-no-nu/TaxRebateProgram.jpg

Ptr Tax Rebate Libracha

https://data.formsbank.com/pdf_docs_html/203/2033/203353/page_1_thumb_big.png

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

Web January 7 2022 Canada s most expensive province is finally giving hard hit millionaire homeowners some help The Government of British Columbia GBC raised the Web 1 mai 2010 nbsp 0183 32 Effective May 1 2010 B C Reg 113 2010 provides the formula to calculate the amount of residential energy credit or rebate to which an eligible person is entitled

Web 28 f 233 vr 2023 nbsp 0183 32 The B C NDP has delivered in part on an election promise made in 2017 to provide a 400 rebate to renters in the province It comes in the 2023 2024 budget Web When you re paying GST on new homes in BC the tax rate is 5 subject to any rebates The tax rate is calculated as 5 of the purchase price which means that when you are

Education Property Tax Rebate Continues In 2022 City Of Portage La

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-600x450.jpg

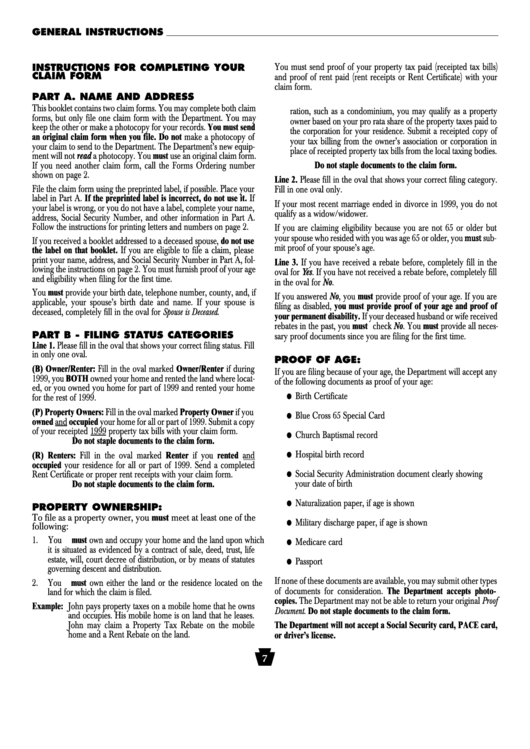

Form Pa 1000 Instructions For Completing Your Claim Form Property

https://data.formsbank.com/pdf_docs_html/338/3380/338028/page_1_thumb_big.png

https://www2.gov.bc.ca/gov/content/taxes/property-taxes

Web When you own lease or gain an interest in a property e g land home etc located in B C you must pay property taxes Annual property tax When you own or lease a property

https://www2.gov.bc.ca/.../property-taxes/annual-property-tax/pay/refund

Web Refunds for property taxes If you have overpaid your property taxes or successfully appealed your property assessment you may have a credit on your account If your

Deadline For Tax And Rent Relief Extended

Education Property Tax Rebate Continues In 2022 City Of Portage La

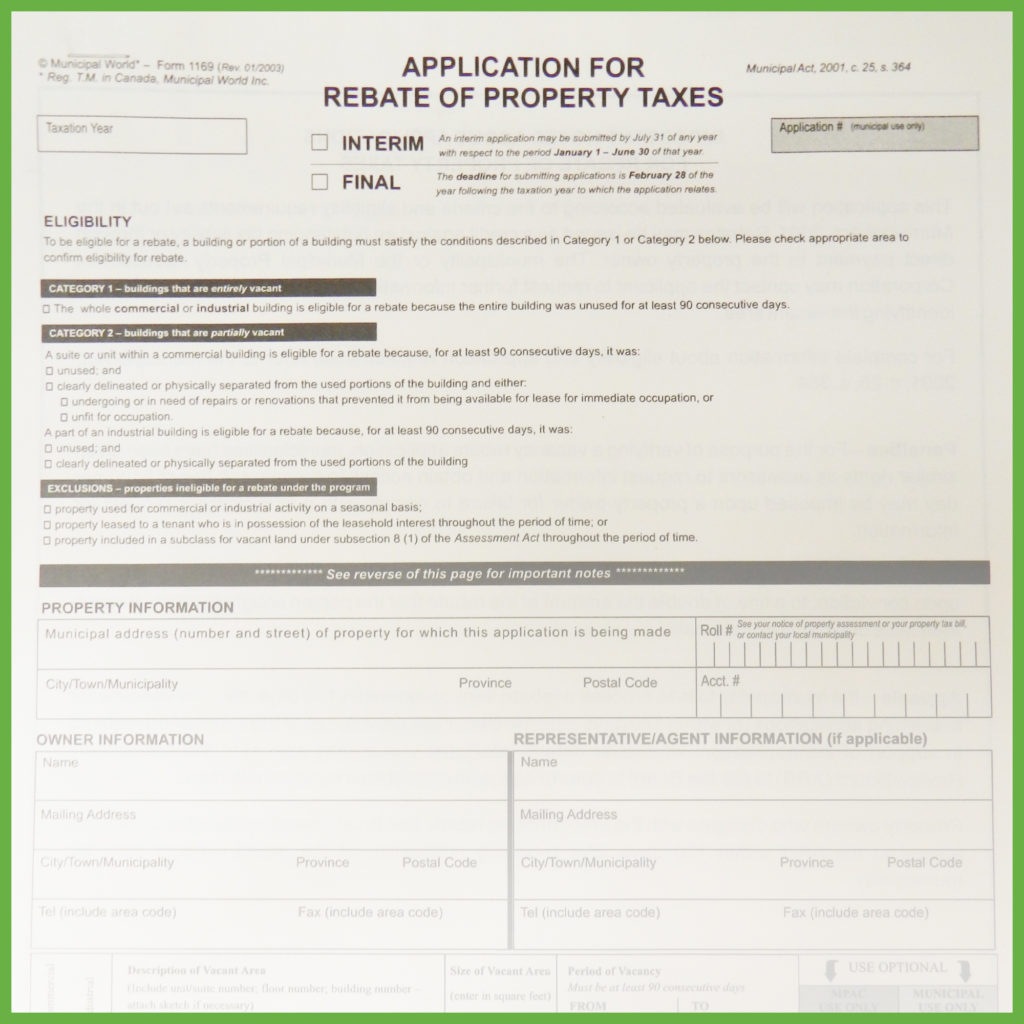

Application For Rebate Of Property Tax 2 Pages Verification Sheet

Notice Of Commencement Form Download Fillable PDF Templateroller

B C Prolongs Provincial Sales Tax Rebate REMI Network

Property Tax Rebate Application Printable Pdf Download

Property Tax Rebate Application Printable Pdf Download

PA Property Tax Rebate Forms Printable Rebate Form

Nagpur Civic Body Announces 5 Percent Rebate On Property Tax

ExploreJeffersonPA Property Tax Rent Rebate Program Application

British Columbia Property Tax Rebate - Web 2 mars 2013 nbsp 0183 32 Tax Calculator The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association The information used to make