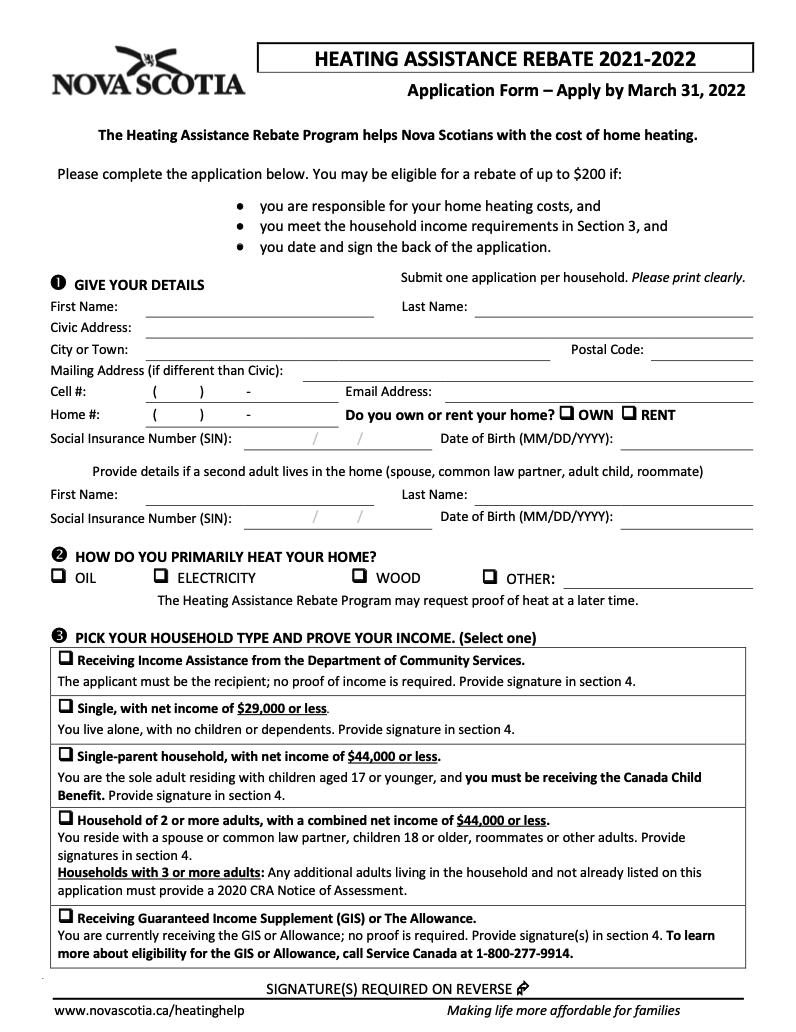

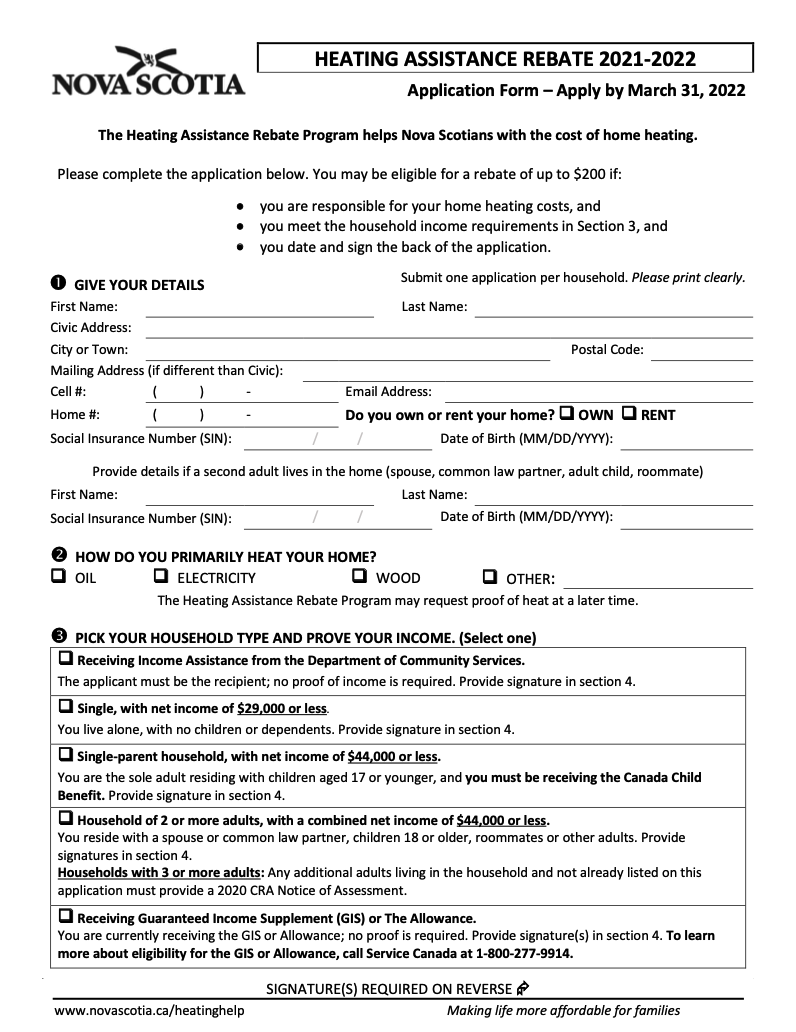

2024 Heating Rebate These rebates apply to equipment installed on or before May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Visit focusonenergy for requirements terms and conditions APPLY ONLINE FOR FASTER PROCESSING 1 Utility Account Holder Information Customer Name

Energy Efficient Home Improvement Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Check focusonenergy for current rebate amounts

2024 Heating Rebate

2024 Heating Rebate

https://printablerebateform.net/wp-content/uploads/2022/02/Heating-Rebate-Nova-Scotia-2022.png

NWC Tryouts 2023 2024 NWC Alliance

https://nwcalliancesoccer.demosphere-secure.com/_files/tryouts-2023-2024/NWC 2023-2024.JPG

Buy 2024 Wall 2024 Jan 2024 Dec 2024 12 X 24 Open 12 Month Wall 2024 With Unruled

https://m.media-amazon.com/images/I/81J20wwDaLL.jpg

Exact timing will vary across programs but generally DOE expects households to be able to access these rebates in much of the country in 2024 accessing rebates to electrify heat that can meet the primary heating source requirement does not depend on whether the home has an existing duct system For example if the capacity needed to meet Efective January 1 2024 only customers who have removed or disabled their pre existing heating systems will be eligible for whole home heat pump rebates The following approved disablement methods will be listed on the 2024 Whole Home Heat Pump Verification Form and verified during post installation inspections Boilers and Furnaces

About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates What HVAC Tax Incentives Are Available for Homeowners Energy Efficient Home Improvement income tax credits are available for central air conditioning systems boilers furnaces air source heat pumps and biomass stoves that reach benchmarks for high efficiency The credits apply to units purchased and installed between January 1 2023 and December 31 2034

Download 2024 Heating Rebate

More picture related to 2024 Heating Rebate

Tolminator 2024

https://tolminator.mojekarte.si/design/tolminator/img-tolminator/logo-2024-1.png

Buy Sports Illustrated Swimsuit Planner 2023 2024 Sports Illustrated Swimsuit 2023 2024

https://m.media-amazon.com/images/I/61Mvg6PqcYL.jpg

Buy 2024 Vertical 11x17 2024 Wall Runs Until June 2025 Easy Planning With The 2024

https://m.media-amazon.com/images/I/613cLQocDQL.jpg

50122 rebates in rental units must remain in those units 2 renters do not have to seek owner approval for buying an electric heat pump clothes dryer or a stove cooktop oven and 3 all renters low and moderate income must obtain owner approval for the other upgrades p 53 4 1 3 10 Clarifies that the primary source of heating and cooling 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 When HEEHRA rebates roll out in late 2024 qualified Americans will be able to save up to 8 000 on a heat pump for space heating and cooling For some that covers 100 of the cost of a major appliance which will also save them hundreds of dollars a year in energy costs

Buy Fridge 2023 2024 For Refrigerator By StriveZen 12x16 Inches Large Monthly Magnetic

https://m.media-amazon.com/images/I/61WIn2OUpGL.jpg

Buy The New 2023 2024 Calender Planner 2023 2024 With Weekly Monthly Spreads 16 month 2023

https://m.media-amazon.com/images/I/61K+PAIDa1L.jpg

https://assets.focusonenergy.com/production/inline-files/2024/RES-HVAC-Rebate-Application-APP.pdf

These rebates apply to equipment installed on or before May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Visit focusonenergy for requirements terms and conditions APPLY ONLINE FOR FASTER PROCESSING 1 Utility Account Holder Information Customer Name

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

Energy Efficient Home Improvement Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Sustainable Infrastructure Project To Transition Campus Heating To Geothermal System By 2024

Buy Fridge 2023 2024 For Refrigerator By StriveZen 12x16 Inches Large Monthly Magnetic

Video The Race For 2024 Is Heating Up As Biden Announces Reelection Bid ABC News

Buy The New 2023 2024 Calender Planner 2023 2024 With Weekly Monthly Spreads 16 month 2023

2024 Audi Q8 E tron Quattro Efficient Heating Of The Vehicle Interior Using The Heat Pump

ASHRAE Winter Conference To Provide Guidance On Low GWP Refrigerants Construction Specifier

ASHRAE Winter Conference To Provide Guidance On Low GWP Refrigerants Construction Specifier

Heating Air Conditioning Blog By Nakoda Urban Services

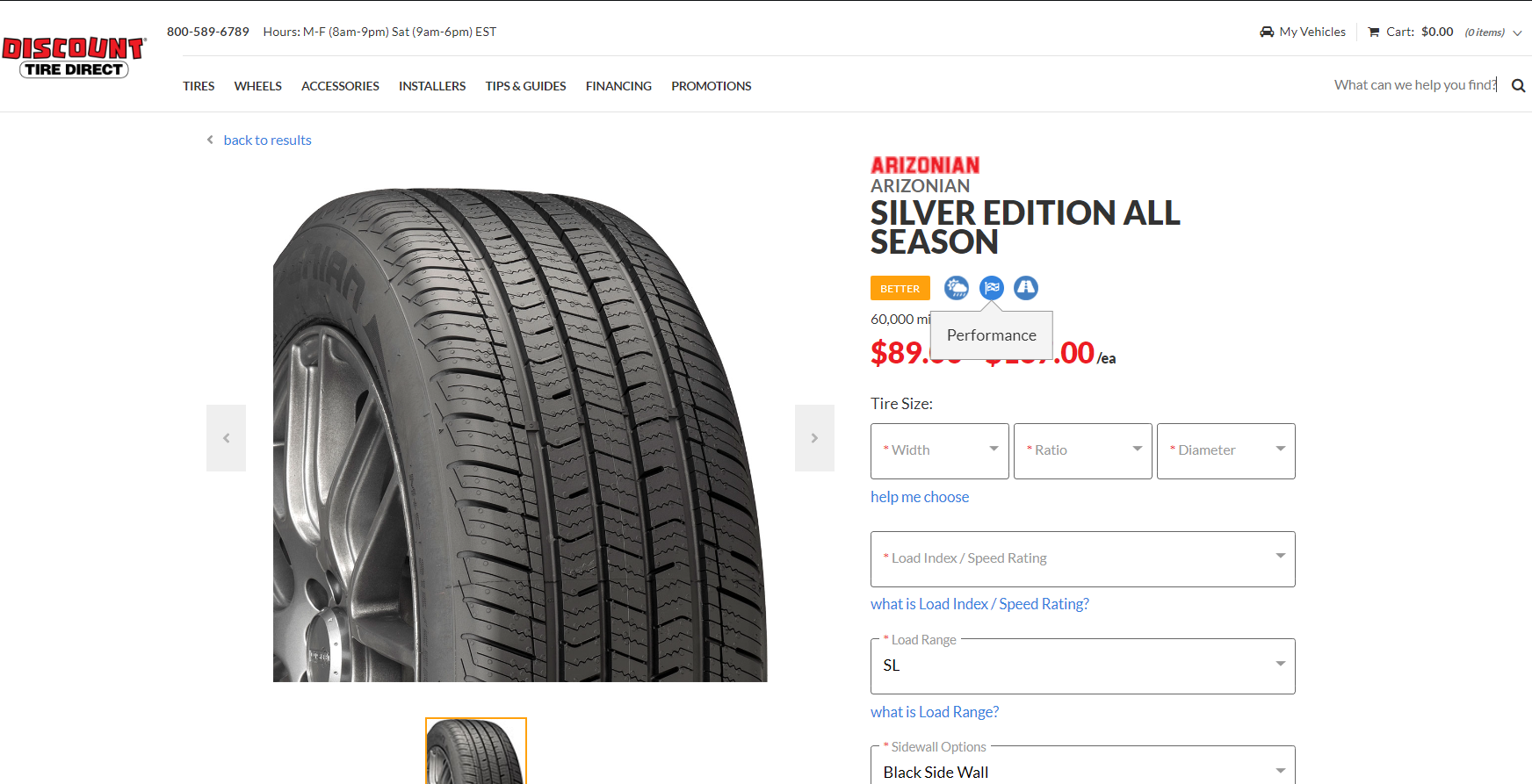

Arizonian Tire Rebate 2023 A Comprehensive Guide To Saving Big On Your Next Tire Purchase

Contact Us Affordable Heating

2024 Heating Rebate - 2024 Residential Air Source Heat Pump Rebate Form for Existing Homes ENERGIZE CONNECTICUTSM Valid for residential Eversource or United Illuminating UI residential electric service customers Customer who purchase and install a qualifying air source heat pump System for an existing home on or after January 1 2024 through December 31 2024