Business Gas Tax Deduction Verkko 25 marrask 2023 nbsp 0183 32 Business Expenses Any expenses incurred in the ordinary course of business Business expenses are deductible and are always netted against

Verkko 18 jouluk 2023 nbsp 0183 32 Multiply business miles driven by the IRS rate To find out your business tax deduction amount multiply your business Verkko A tax deduction write off is a justified business expense that is subtracted from the entrepreneur s adjusted gross income The more deductions there are the smaller the sum of adjusted gross income

Business Gas Tax Deduction

Business Gas Tax Deduction

https://blog.ipleaders.in/wp-content/uploads/2020/11/Tax-Deduction-blog-1.jpg

Tax Benefits Of Investing In Oil And Gas Drilling

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/18029/images/NBpXMn1SR2yvFWk1V2Ym_Screen_Shot_2022-03-11_at_8.46.43_AM.png

Tax Deduction Taxable Income Deduction Viva Business Consulting

https://www.vivabcs.com.vn/assets/uploads/2017/03/Tips-on-taxable-income-deduction-1.jpg

Verkko The gas tax deduction was an allowable business expense for tax years before 2018 Employee business expenses are no longer deductible on an individual tax return Verkko 17 rivi 228 nbsp 0183 32 The following table summarizes the optional standard mileage rates for employees self employed individuals or other taxpayers to use in computing the

Verkko 1 tammik 2019 nbsp 0183 32 The Global oil and gas tax guide summarizes the oil and gas corporate tax regimes in 86 countries and also provides a directory of EY oil and gas Verkko 1 helmik 2019 nbsp 0183 32 By Fraser Sherman Updated February 01 2019 To write off the cost of driving for work you can apply the IRS per mile write off to the number of miles you

Download Business Gas Tax Deduction

More picture related to Business Gas Tax Deduction

Oil And Gas Tax Deductions Benefits From Investments

https://www.cefmoilandgasinvestments.com/cefm_content/uploads/2018/11/chart1.png

Oil And Gas Investments Tax Deductions Lure Investors

https://www.arescotx.com/wp-content/uploads/tax-advantaged-investments.png

How To Get The Most Out Of A Gas Tax Deduction Save Money

https://assets-global.website-files.com/637e5892fb4b6db88a62cc0a/6396e9fc10c58244d1ef6d1b_60ed96aaf0dd147475c97473_man-filling-up-gas.jpeg

Verkko Fuel Tax Credits Reinstated and Extended Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and Verkko 5 tammik 2023 nbsp 0183 32 The Section 179 deduction allows business owners to deduct up to 1 080 000 of property placed in service during the tax year This includes new and used business property and off the

Verkko For tax years beginning after 2017 you may be entitled to take a deduction of up to 20 of your qualified business income from your qualified trade or business plus 20 of Verkko 11 maalisk 2019 nbsp 0183 32 Claim the deduction on line 21 of Schedule A of the 1040 tax form when you itemize your 2017 deductions Deduction Restrictions You are only

8 Tax Itemized Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/10/small-business-tax-deduction-worksheet_449384.png

Oil And Gas Tax Deductions Benefits From Investments

https://www.cefmoilandgasinvestments.com/cefm_content/uploads/2018/11/chart2-768x171.png

https://www.investopedia.com/terms/b/businessexpenses.asp

Verkko 25 marrask 2023 nbsp 0183 32 Business Expenses Any expenses incurred in the ordinary course of business Business expenses are deductible and are always netted against

https://www.patriotsoftware.com/.../calculate-b…

Verkko 18 jouluk 2023 nbsp 0183 32 Multiply business miles driven by the IRS rate To find out your business tax deduction amount multiply your business

Expenses Incurred For Business Allowable As A Income Tax Deduction

8 Tax Itemized Deduction Worksheet Worksheeto

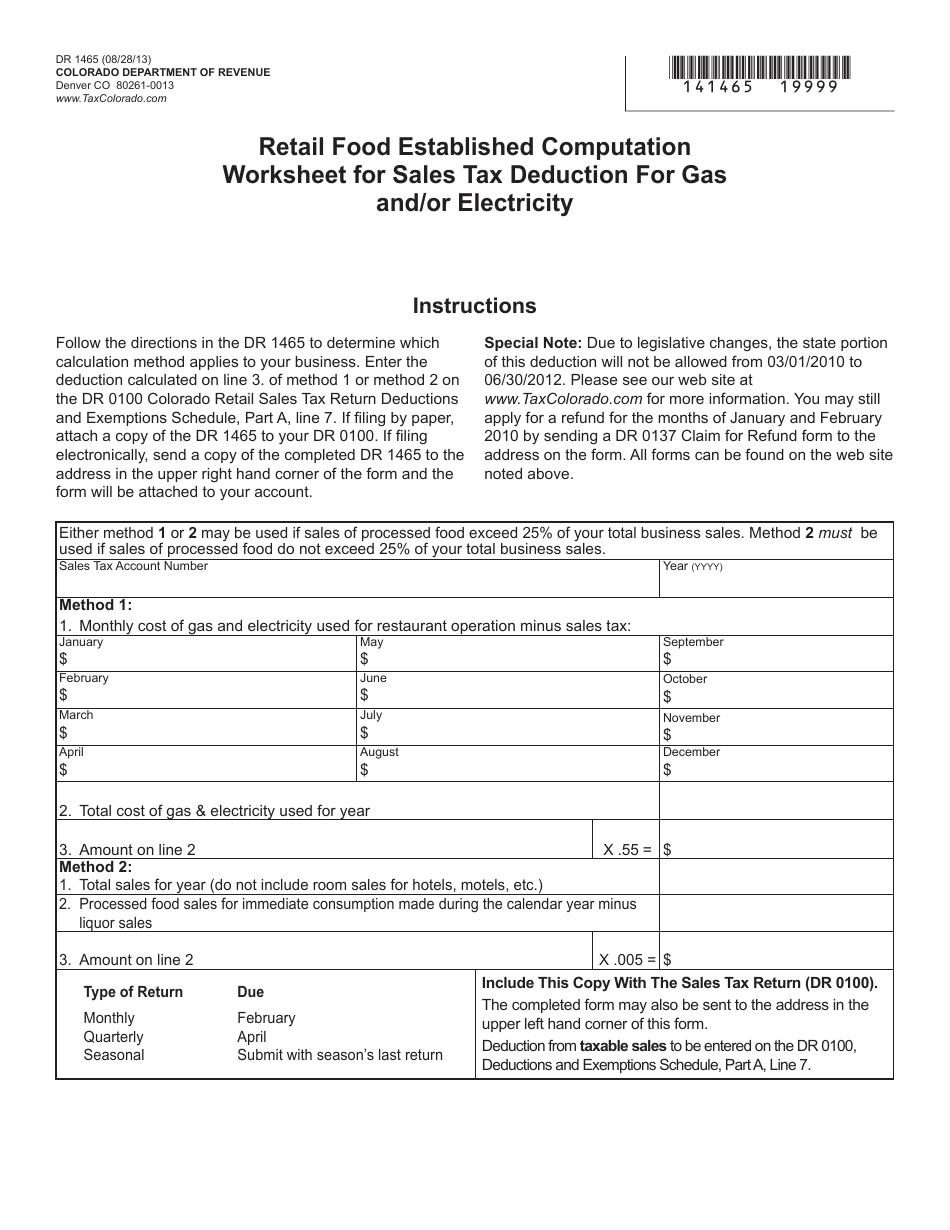

How An Electrical Tax Deduction Template Can Benefit Your Business

Form DR1465 Fill Out Sign Online And Download Fillable PDF Colorado

Tax Deduction Stock Illustration Illustration Of Credits 191806148

Sign Displaying Tax Deduction Business Approach Amount Subtracted From

Sign Displaying Tax Deduction Business Approach Amount Subtracted From

Tax Deductions For Businesses BUCHBINDER TUNICK CO

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

My Daily Kona Additional Gas Tax Being Proposed

Business Gas Tax Deduction - Verkko 1 tammik 2019 nbsp 0183 32 The Global oil and gas tax guide summarizes the oil and gas corporate tax regimes in 86 countries and also provides a directory of EY oil and gas