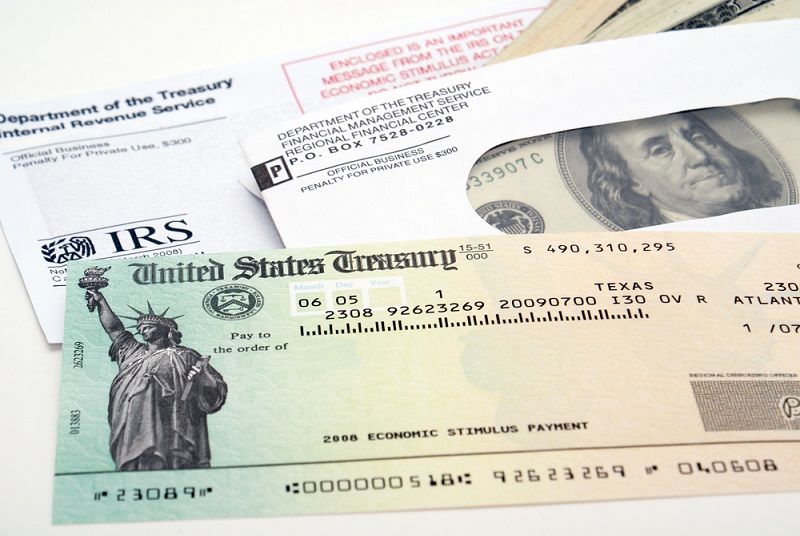

Business Tax Refund You can receive a refund of self assessed taxes in the following situations The VAT balance of your company is negative i e you have more VAT to deduct than to

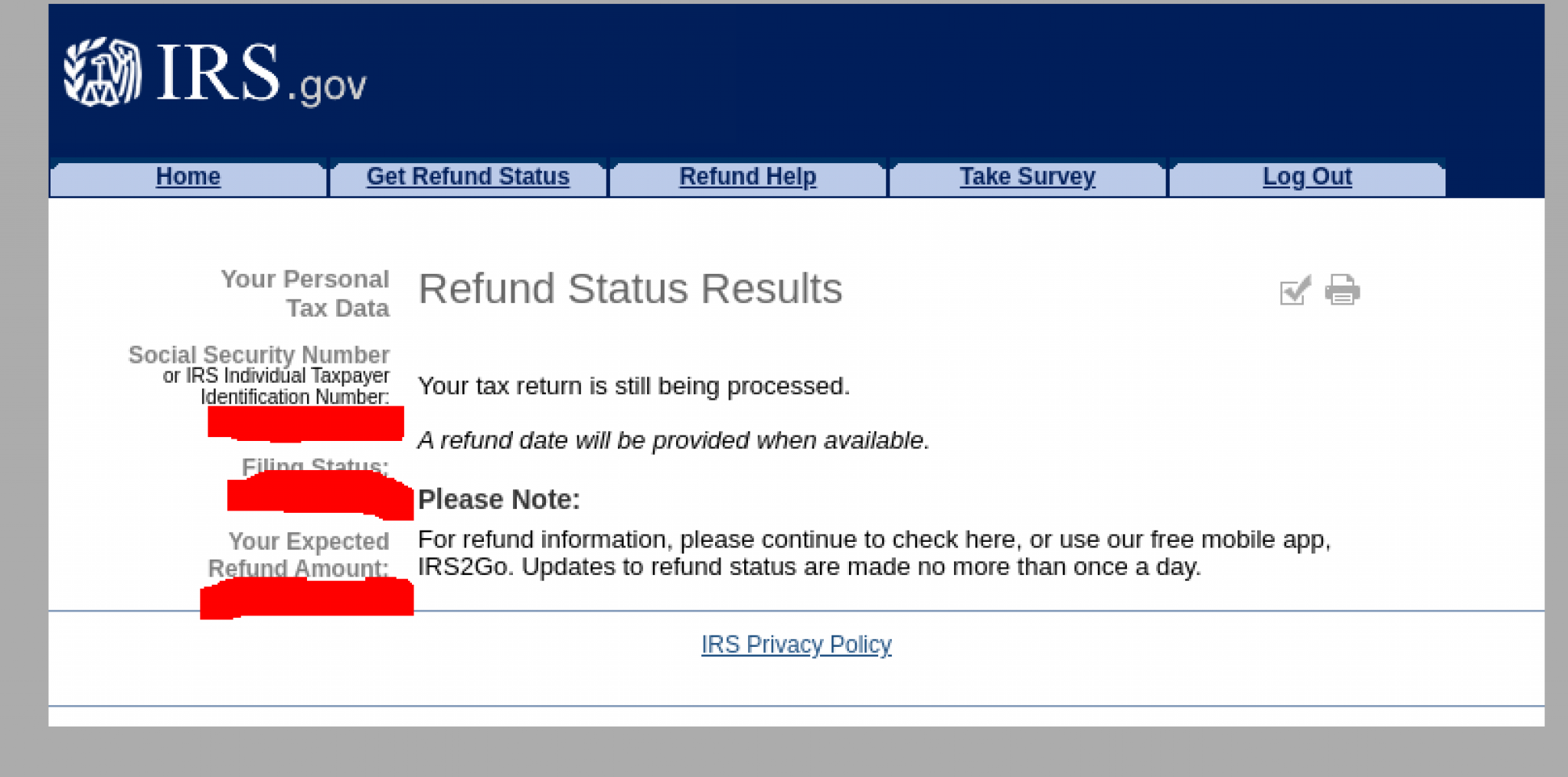

If you have paid too much tax in withholding or prepayments we refund the excess back to you when the tax year is over You can see the date and amount of your Use the IRS Where s My Refund tool to get updates on your refund and access other important tax return information

Business Tax Refund

Business Tax Refund

https://www.patriotsoftware.com/wp-content/uploads/2019/12/tax-forms-small-business-owners-file.jpg

Latest Updates On IRS Where s My Refund Check Status 2022 EEFRI

https://eefri.org/wp-content/uploads/2022/11/IRS-wheres-My-Refund-2048x1015.png

11 Biggest Tax Refund Tips You Probably Didn t Know Middle Class Dad

https://i.pinimg.com/736x/ee/68/fc/ee68fc4bb54ecc0d3de3564c4e11b8af.jpg

Find tax information and tools for businesses including Employer ID Number EIN Employment Tax Estimated Tax and the Foreign Account Tax Compliance Act FATCA Find out how to claim tax credits and refunds for businesses and tax exempt entities affected by COVID 19 Learn about the Employee Retention Credit the Paid Leave

This web page offers various tax tools for individual taxpayers businesses and tax professionals but does not provide any information on business tax refund To Learn about the employee retention credit paid leave credits and deferral of employment tax deposits for businesses and tax exempt entities affected by the coronavirus

Download Business Tax Refund

More picture related to Business Tax Refund

IRS Refund Status Bar Disappeared Online Refund Status

https://i0.wp.com/www.refundstatus.com/wp-content/uploads/2016/01/12540209_450510698467051_1759650536_n.jpg?fit=960%2C728&ssl=1

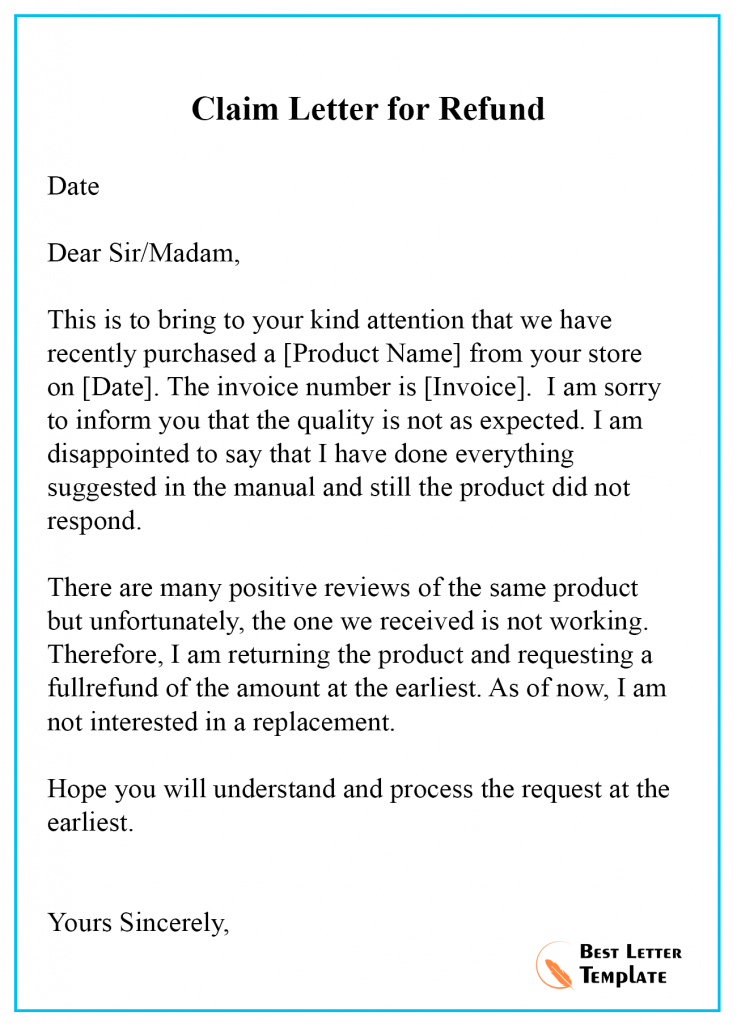

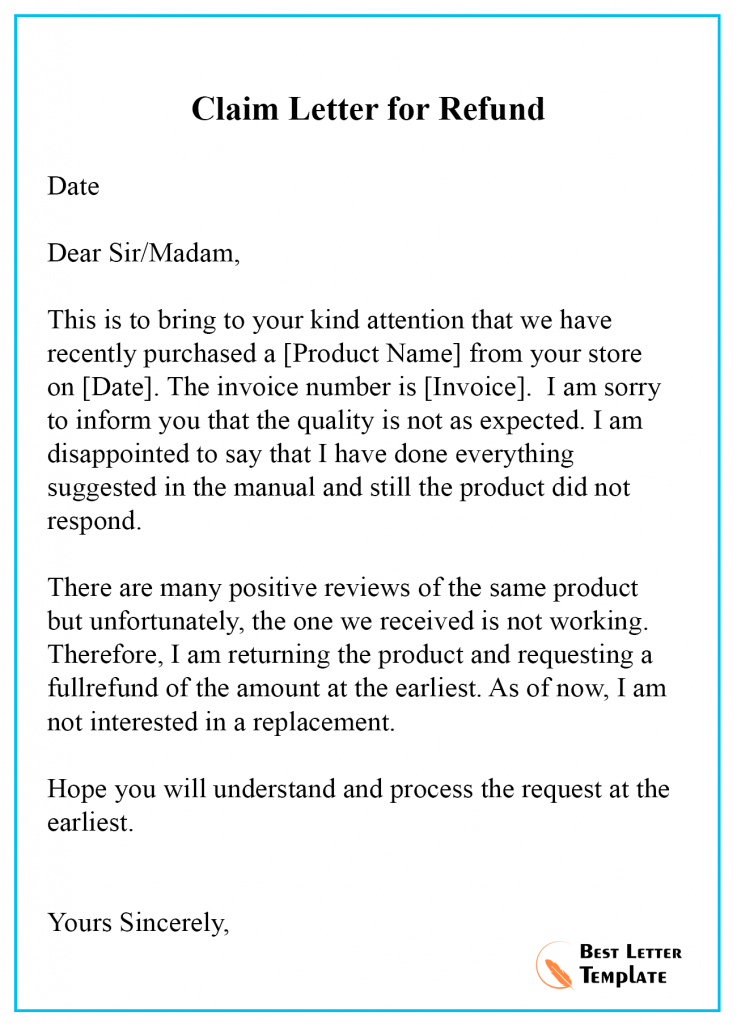

How To Write A Refund Letter For Overpayment Allardyce Pen

https://i2.wp.com/bestlettertemplate.com/wp-content/uploads/2019/05/How-to-Write-a-Refund-Request-Letter-01.png

Where s My Refund How To Track Your Tax Refund 2022 Money

https://img.money.com/2022/03/News-Check-Your-Tax-Refund-Status.jpg?quality=85

If your business is eligible for the ERC for 2020 and you have not yet claimed the credit you can file amended payroll tax forms to claim the credit and receive your tax refund Your small business may be eligible for tax refund especially if you increase your business deductions to decrease your business income Here s how it works

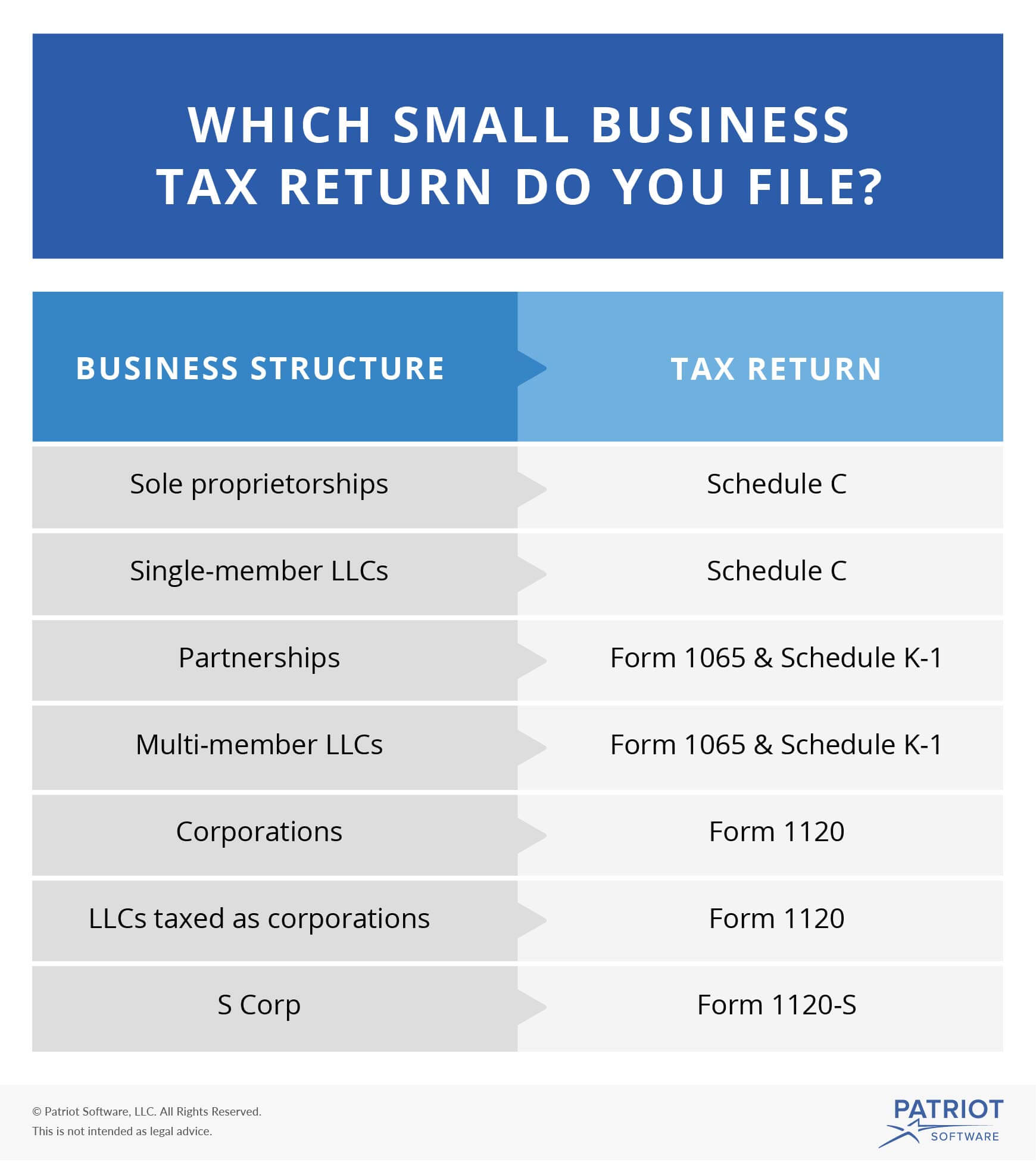

Not every business can get a tax refund However small business owners who don t qualify for a business tax refund could still see money back on their individual tax returns Learn how to prepare and file your taxes depending on your business type and entity Find out the right form deadlines and tips for reporting your business income and

Letter Of Claim Template

https://bestlettertemplate.com/wp-content/uploads/2019/04/Claim-Letter-for-Refund-737x1024.png

Smart Ways To Use Your Tax Refund DRB Capital

https://www.drbcapital.com/wp-content/uploads/2018/01/tax-refund.jpg

https://www.vero.fi/.../refunds-of-vat-and-other-taxes

You can receive a refund of self assessed taxes in the following situations The VAT balance of your company is negative i e you have more VAT to deduct than to

https://www.vero.fi/en/individuals/payments/refunds

If you have paid too much tax in withholding or prepayments we refund the excess back to you when the tax year is over You can see the date and amount of your

Can A Small Business Get A Tax Refund Bookkeepers

Letter Of Claim Template

Has Anyone Received Their Tax Refund By Paper Check Yet

Business Tax Refund Flyer Business Tax Tax Refund Tax

Request Letter For Income Tax Certificate From Bank Semioffice Vrogue

5 Ways To Reinvest Your Tax Refund Make Your Business Profitable

5 Ways To Reinvest Your Tax Refund Make Your Business Profitable

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

Tax Letter Template Format Sample And Example In Pdf Word Rezfoods

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

Business Tax Refund - We ll explore the topic of small business tax refunds including which types of businesses are eligible other taxes that could yield a refund and common tax deductions for