Business Tax Return To check the progress in the app log in to the ATO app select Your tax return for 2023 24 and your status will display To check the progress in myGov sign in to myGov select ATO from your linked services from the home page select Manage tax returns then select the income year you are checking and your status will display

First I would confirm whether your Company has a ABN and TFN Second I would confirm whether your Company is GST Registered ABN and GST can be checked at ABN Lookup If your Company is GST Registered check that 4 BAS have been lodged Given your facts these would be As a business you ll need to declare income you earn from your side hustles You can claim some deductions too If you re a sole trader with more than one business you ll use the same ABN for each For example you run a hair dressing business and are an influencer on the side you d use the same ABN for both

Business Tax Return

Business Tax Return

https://www.midstreet.com/hs-fs/hubfs/Tax-Return-Example.png?width=3000&name=Tax-Return-Example.png

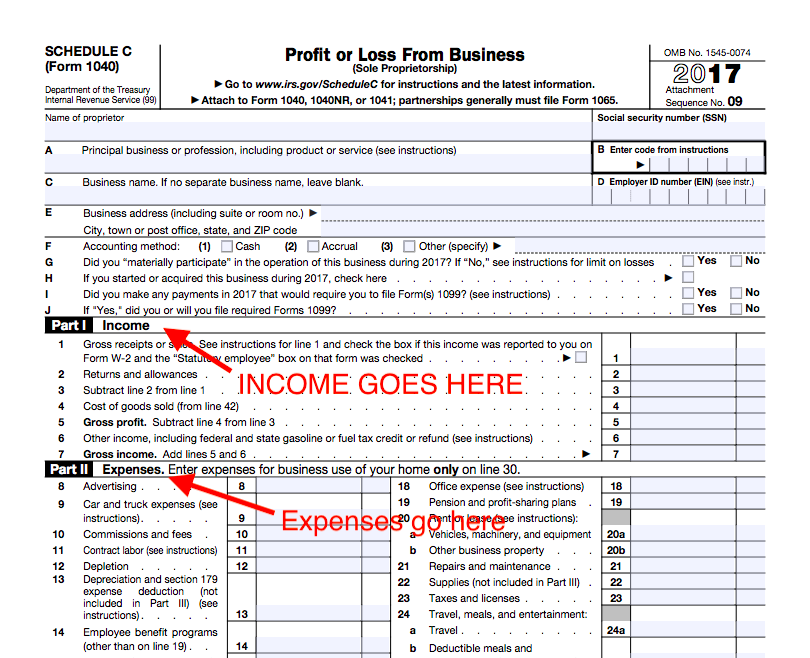

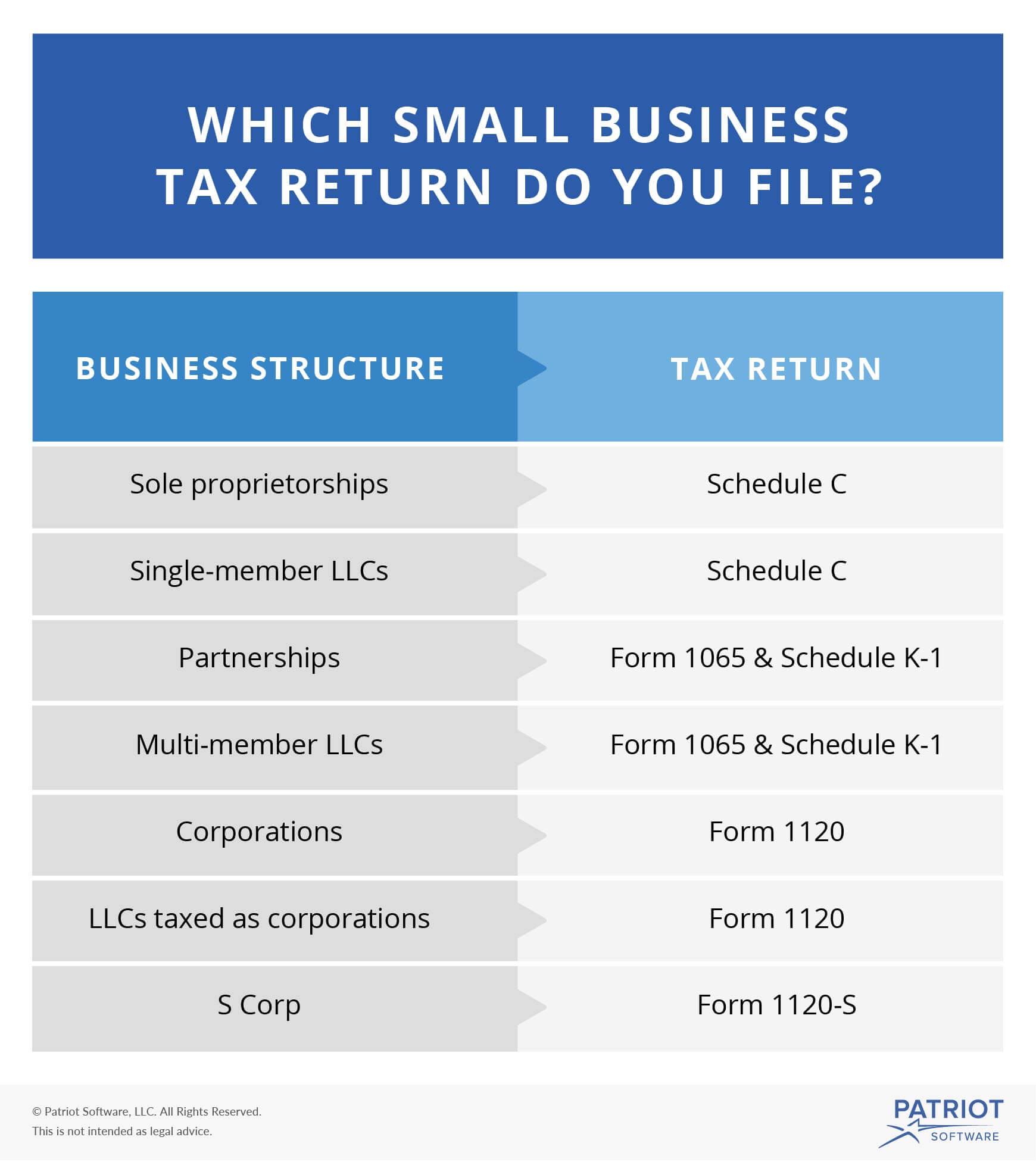

LLC Tax Filing What You Need To Know As A Solo Entrepreneur Business

https://growthlab.com/wp-content/uploads/2018/07/Screen-Shot-2018-07-03-at-7.19.51-AM.png

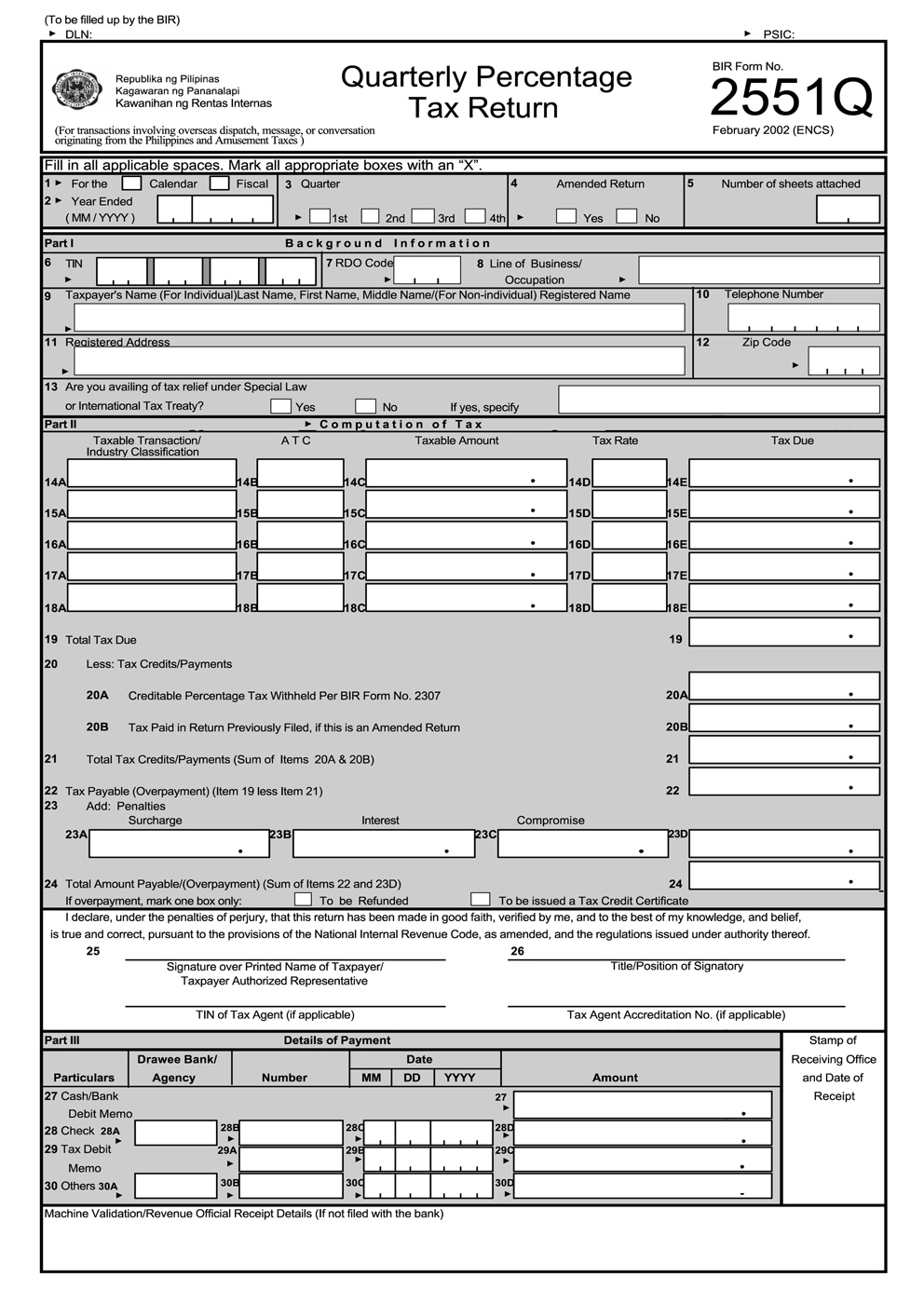

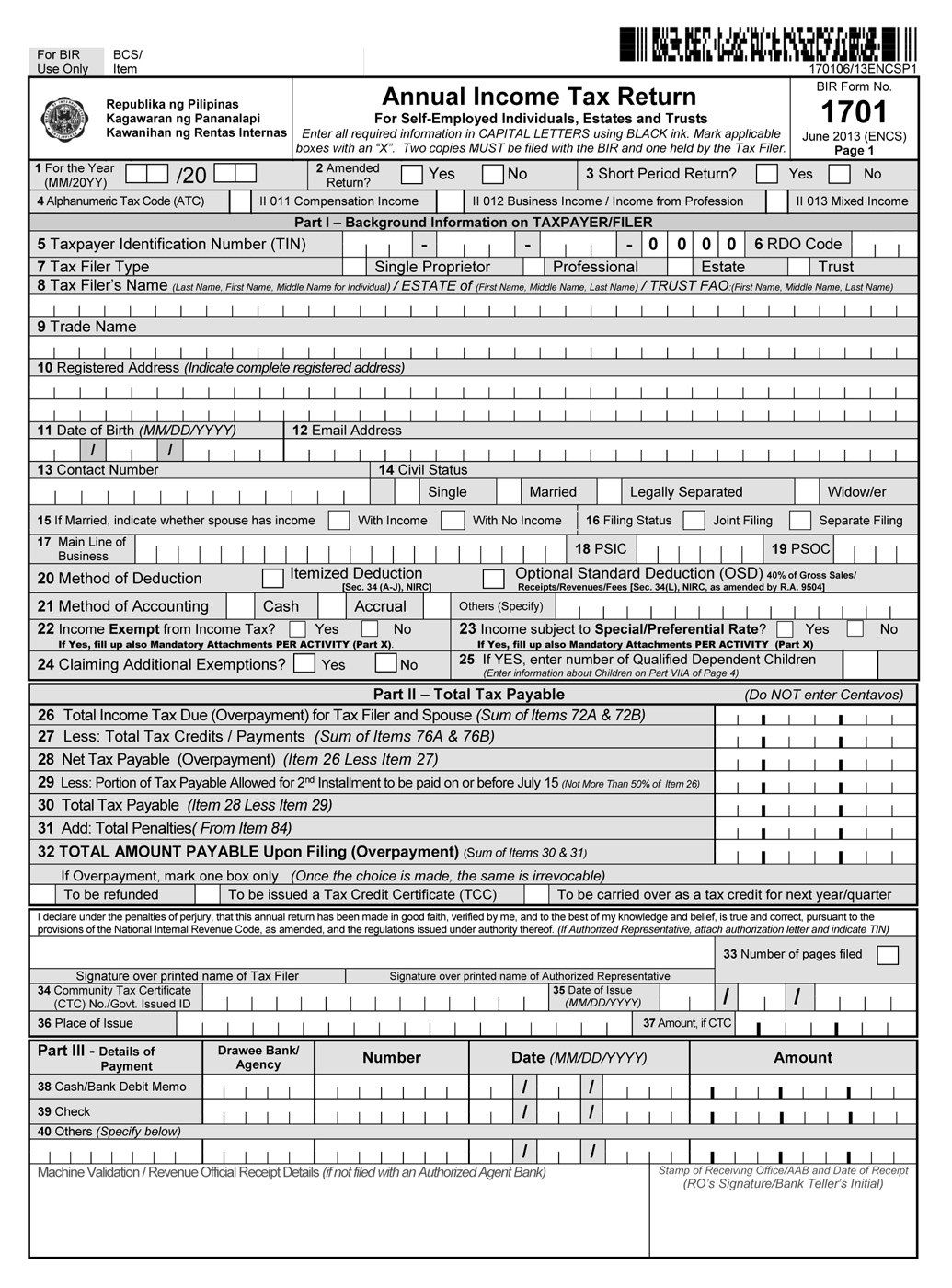

What Are The Taxes A Small Business Needs To Pay Info Plus Forms And

https://ifranchise.ph/wp-content/uploads/2017/06/BIR-Form-2551Q-Quarterly-Percentage-Tax-Return.jpg

2018 Income 500 expenses 2 500 therefore Loss 2 000 2 00 gets caried forward add Loss from 2017 meaning carry forward loss is now 3000 2019 Income 5 000 expenses 1 000 so profit 4 000 Now use carry forward loss of 3 000 and profit 1 000 ATO Certified Response RachaelB Community Support Community Support You ll be reporting this income under the business income section on your tax return You won t have any tax withheld to report from your business income as you wouldn t have had anyone withhold tax on your behalf like you do with salary and wages Gross payment will be any income you ve received from Dasher and Ubereats delivery

Katherine ADL Initiate Initiate 16 Feb 2023 Edited on 16 Feb 2023 Hi bgroper Most of the properties on Airbnb has rental income If this rentla income and other income in totally is less than 18 200 and no tax witheld no other business income you should be able to do non lodgment via my gov Lets you claim 67c per hour worked from home This method includes the additional running expenses you incur That means you can t claim your phone bill separately you ll need to work out your deduction by calculating the actual additional expenses you ve incurred How to claim your 2024 working from home deductions

Download Business Tax Return

More picture related to Business Tax Return

How To File A Small Business Tax Return Process And Deadlines

https://www.patriotsoftware.com/wp-content/uploads/2019/12/tax-return-visual.jpg

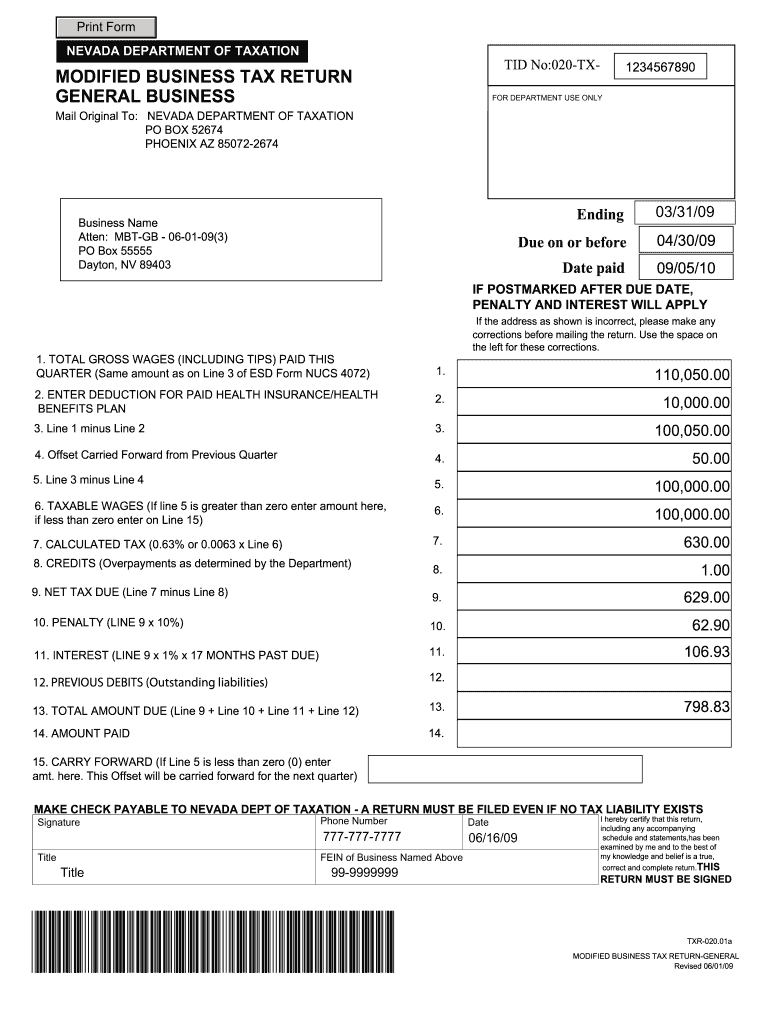

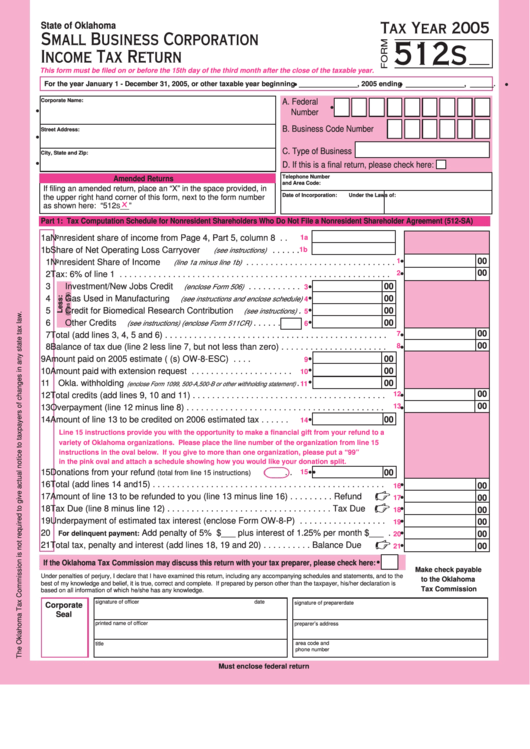

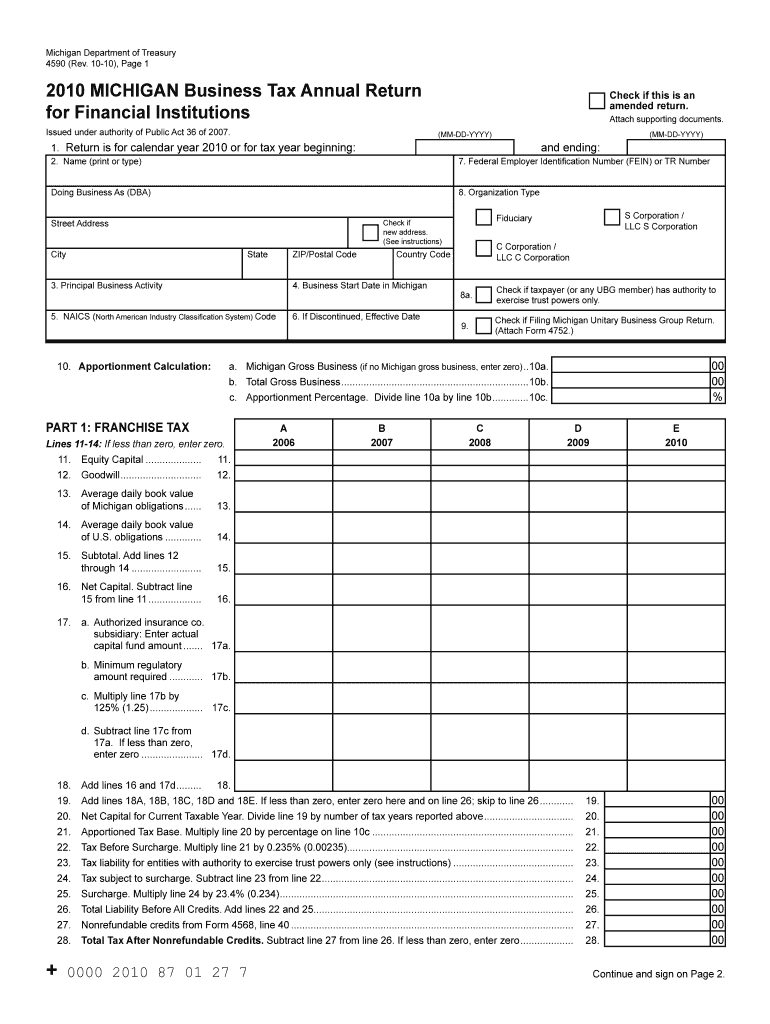

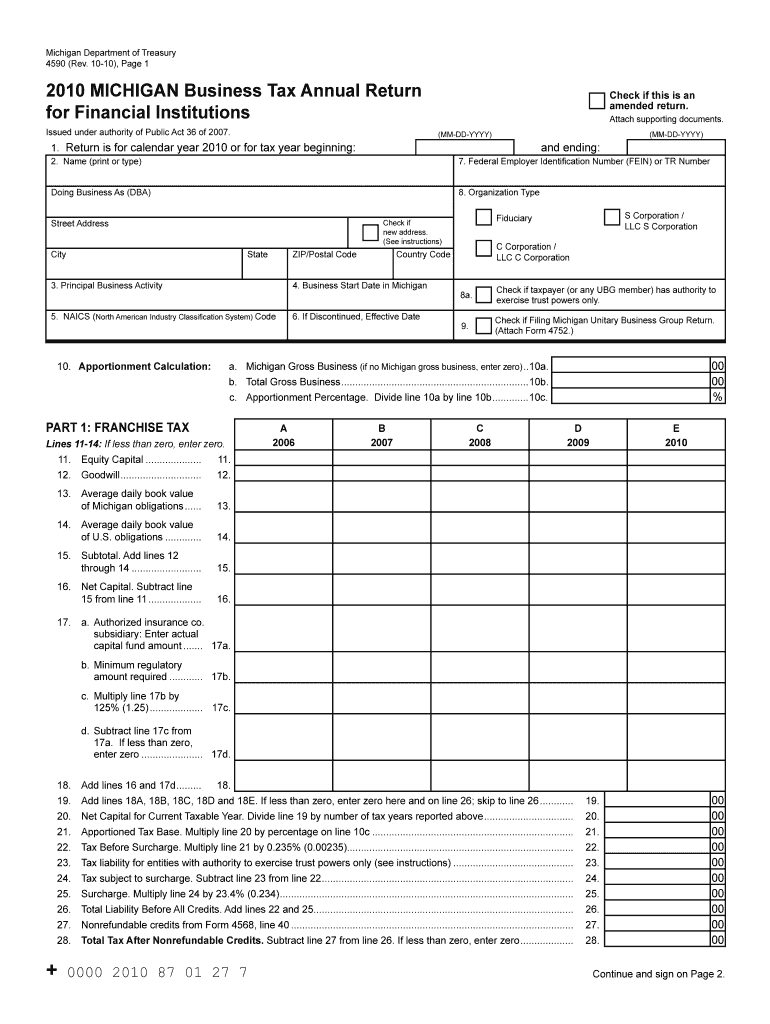

Modified Business Tax 2009 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/0/159/159908/large.png

TMI Associates Inc Business Tax Returns

https://tmiassociates.com/memberarea/images/uploaded/tmi-associates-inc/1120 1065 returns.jpg

Lodge your return because what Glenn4802 said is right We ll apply your PAYG instalments after you lodge You ll see the credit for them on your notice of assessment when its issued Liked by Newbie2004 BDL731 I m new I m new If you re after a copy of your Notice of assessment select the drop down arrow next to the relevant year and select the link If you re after more information or the year isn t available you can request copies of previous tax returns by phoning us on 13 28 61 between 8am 6pm Monday to Friday to speak with an operator

[desc-10] [desc-11]

Real Estate Agents Self Employment Tax Blog OvernightAccountant

https://overnightaccountant.com/images/uploads/misc_files/tax-return.jpg

Fillable Form 512s Small Business Corporation Income Tax Return

https://data.formsbank.com/pdf_docs_html/232/2329/232942/page_1_thumb_big.png

https://community.ato.gov.au › article

To check the progress in the app log in to the ATO app select Your tax return for 2023 24 and your status will display To check the progress in myGov sign in to myGov select ATO from your linked services from the home page select Manage tax returns then select the income year you are checking and your status will display

https://community.ato.gov.au › question

First I would confirm whether your Company has a ABN and TFN Second I would confirm whether your Company is GST Registered ABN and GST can be checked at ABN Lookup If your Company is GST Registered check that 4 BAS have been lodged Given your facts these would be

Sample Cover Letter For Industry

Real Estate Agents Self Employment Tax Blog OvernightAccountant

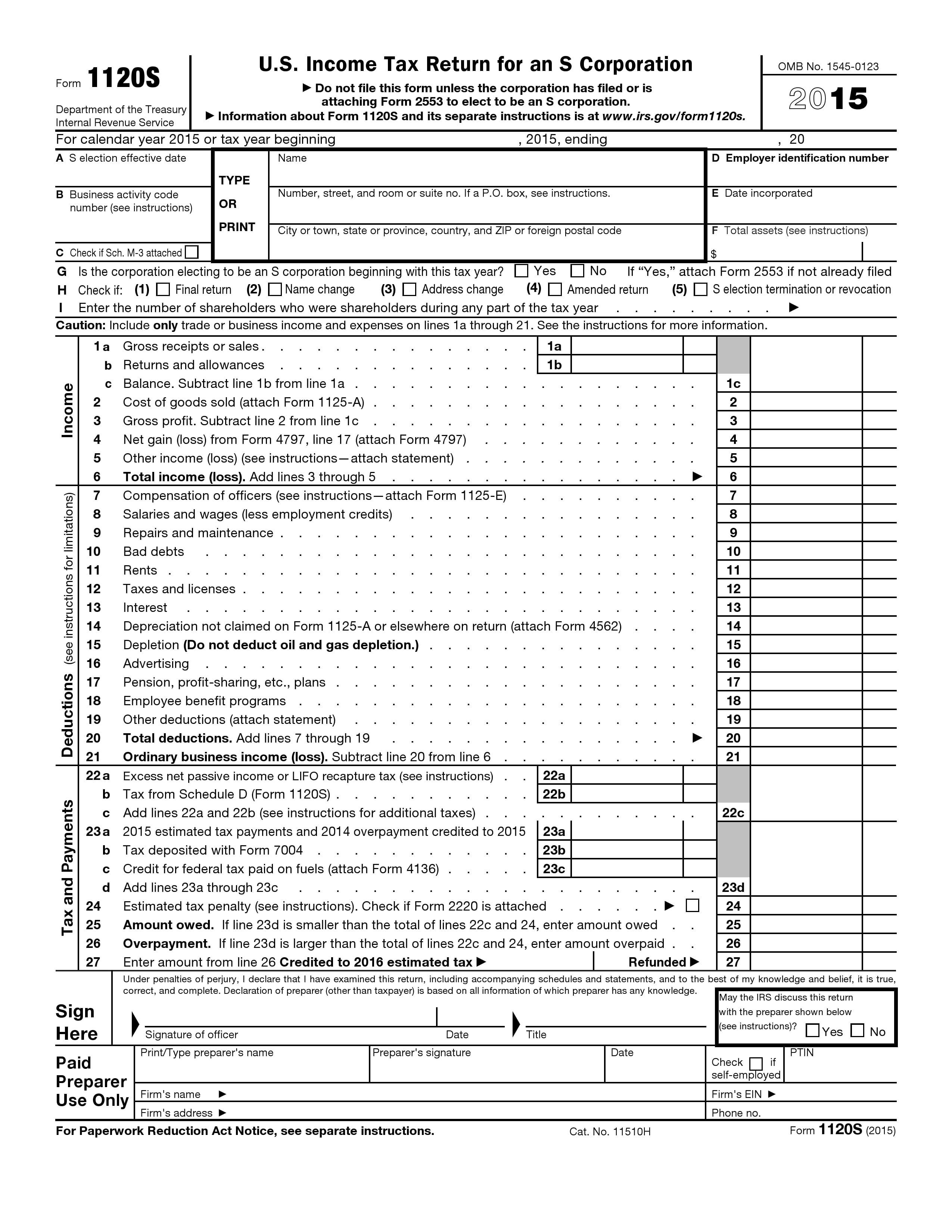

Can You Look Over This Corporate Tax Return Form 1120 I Did Based On

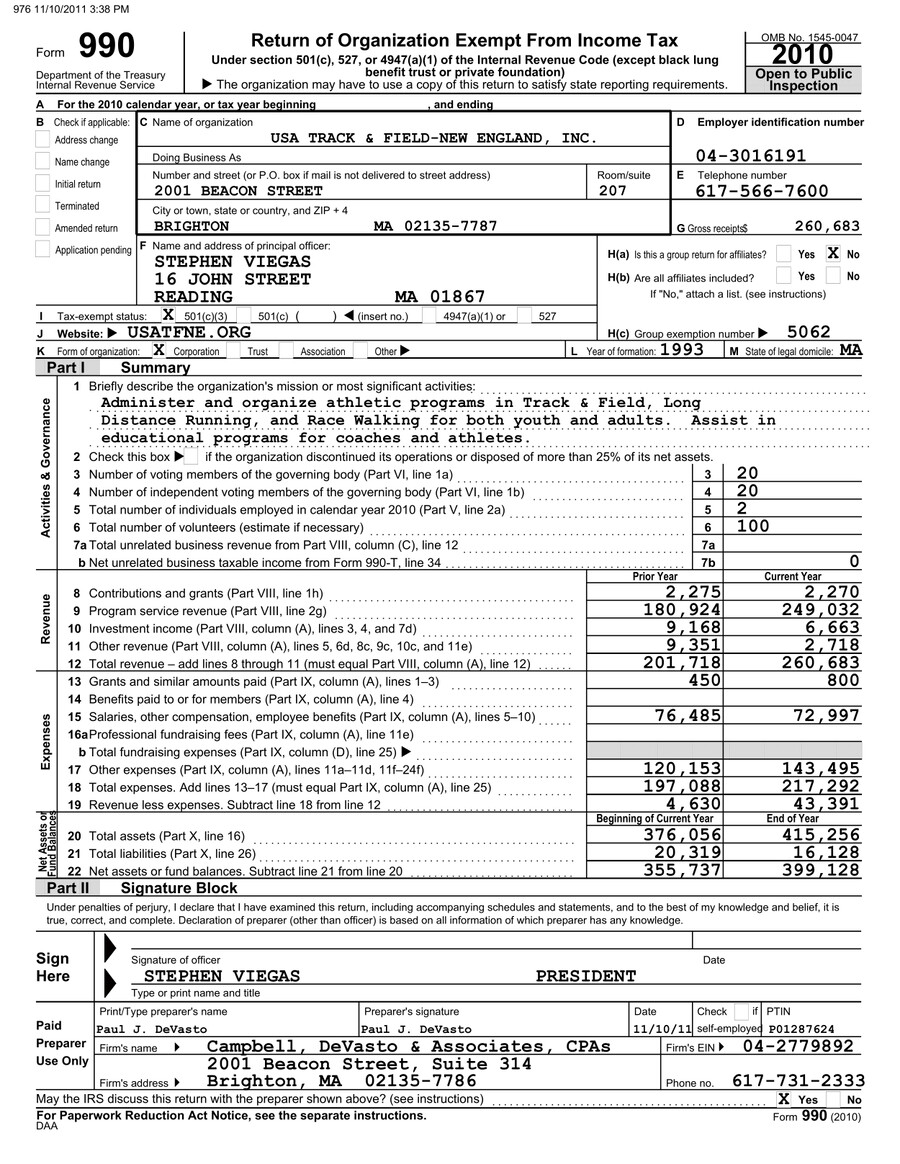

2010 Federal Tax Return By Sarah linehan Flipsnack

1120 Tax Table Brokeasshome

Business Tax Form Fill Out And Sign Printable PDF Template AirSlate

Business Tax Form Fill Out And Sign Printable PDF Template AirSlate

How To Fill Out Your Tax Return Like A Pro The New York Times

Annual Withholding Tax Table 2017 Philippines Review Home Decor

Business Tax Return Filing Company Registration In India

Business Tax Return - [desc-13]