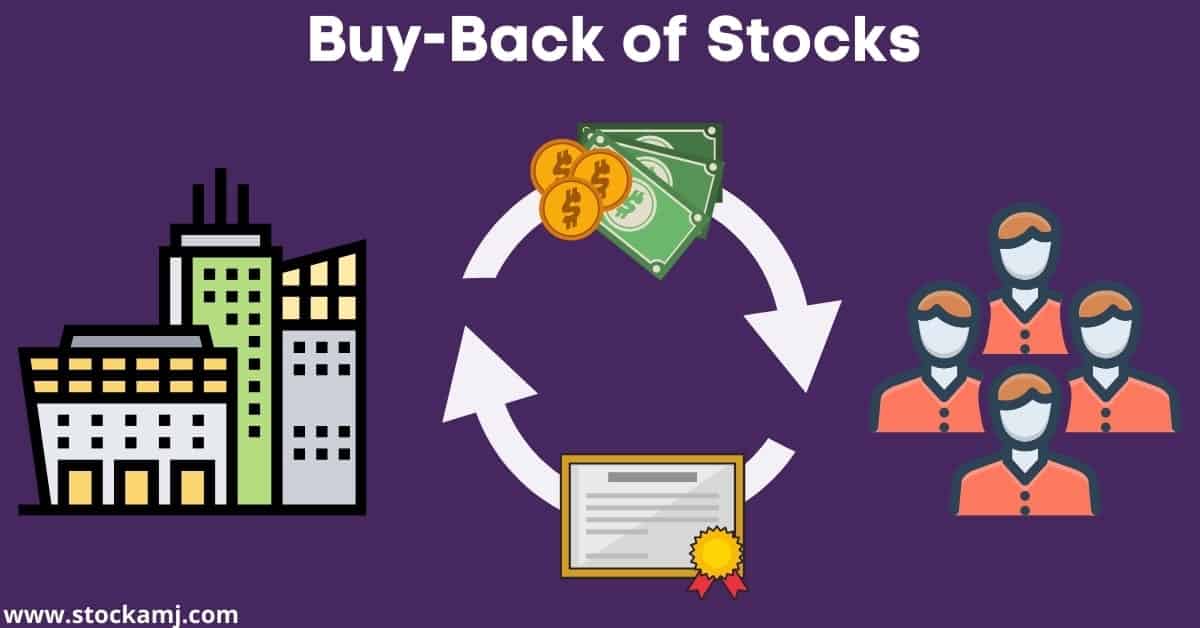

Buyback Accounting Treatment A share buyback is when a company buys up its own stock from investors in order to increase the value of the remaining shares or to increase assets and equity In order to account for share buyback you need to calculate how the shares you purchase affect the rest of the stock

The accounting treatment for a forward repurchase contract depends on the settlement alternatives built into the contract and the nature of the reporting entity s obligation to repurchase its shares See FG 5 5 for information on ASC 480 9 2 2 1 Physically settled forward repurchase contracts A share buyback occurs when a business purchases its own shares and then either cancels them or holds them in treasury for re issue at a later date To implement a buyback a business may acquire its shares in the open market in much the same way as any other investor

Buyback Accounting Treatment

Buyback Accounting Treatment

https://www.stockamj.com/wp-content/uploads/2021/04/Buy-back-of-shares.jpg

Farm Accounting Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/bkkacc/bookkeeping-and-accounting-header.png

https://c.pxhere.com/photos/56/c5/accounting_blur_budget_cash_change_close_up_coins_collection-914012.jpg!d

A share repurchase or buyback refers to a company purchasing its own shares in the marketplace When a company buys back its shares it usually means that a firm is confident about its future Accounting for share buybacks Posted by Steve Collings It is not uncommon to hear of companies purchasing their own shares from shareholders Typical scenarios include shareholders who wish to sell their shares in a company where other shareholders may not wish to buy them or where the shareholders are unable to raise the cash to purchase them

1 Introduction 2 Legal aspects 3 Taxation 4 Accounting 5 Impact distributable profits have on purchase of own shares 6 Reporting 7 General business planning issues 8 Ethical considerations for the adviser Appendix 1 Summary of the law relating to company buy back of own shares Government Grants Accounting Treatment Equity Method Investments Accounting for Joint Ventures Learn about the accounting treatment of share repurchase programs including key impacts journal entries and disclosure rules Understand the benefits and implications of share buybacks

Download Buyback Accounting Treatment

More picture related to Buyback Accounting Treatment

Accounting For Investment Properties In Malaysia Jun 13 2022 Johor

https://cdn1.npcdn.net/image/1655128830aada66161e0c4315e52d28c90ac81970.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Share Buybacks Financial Edge

https://financial-edge-staging-media.s3-eu-west-2.amazonaws.com/2020/11/Share-Buybacks-4.png

Simplicontent

https://img.tradepub.com/free/w_aaaa1208/images/w_aaaa1208c8.jpg

Tax and accounting treatment of share repurchases In addition a company may not initiate a share repurchase or establish a plan under Rule 10b5 1 to do so in the future as described below at a time when the company possesses material nonpublic information Chapter 9 Share repurchase and treasury stock Menu Accounting and reporting Accounting and reporting Effective dates of FASB standards PBEs Your go to resource for timely and relevant accounting auditing reporting and business insights Follow along as we demonstrate how to use the site

5 5 1 Accounting for repurchase agreements The accounting for repos depends on whether 1 it is a repurchase to maturity transaction and 2 the transfer of the underlying financial asset qualifies for sale accounting under ASC 860 10 40 5 All repurchase to maturity transactions as defined should be accounted for as secured borrowings as The accounting for such buy backs can be tricky and there is a whole host of legalities to consider some of which are obvious whereas others not so This article will take a look at how the mechanics of accounting for such buybacks works and the legal considerations that should be made

Up North Accounting LLC Cloquet Cloquet MN

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100057496808019

Accounting Treatment Accounting Treatment Introduction This Paper

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7071ee6ee6dc4a1d60e486de47643b7c/thumb_1200_1553.png

https://www.wikihow.com/Account-for-Share-Buy-Back

A share buyback is when a company buys up its own stock from investors in order to increase the value of the remaining shares or to increase assets and equity In order to account for share buyback you need to calculate how the shares you purchase affect the rest of the stock

https://viewpoint.pwc.com/dt/us/en/pwc/accounting...

The accounting treatment for a forward repurchase contract depends on the settlement alternatives built into the contract and the nature of the reporting entity s obligation to repurchase its shares See FG 5 5 for information on ASC 480 9 2 2 1 Physically settled forward repurchase contracts

Boss Accounting Free Stock Photo Public Domain Pictures

Up North Accounting LLC Cloquet Cloquet MN

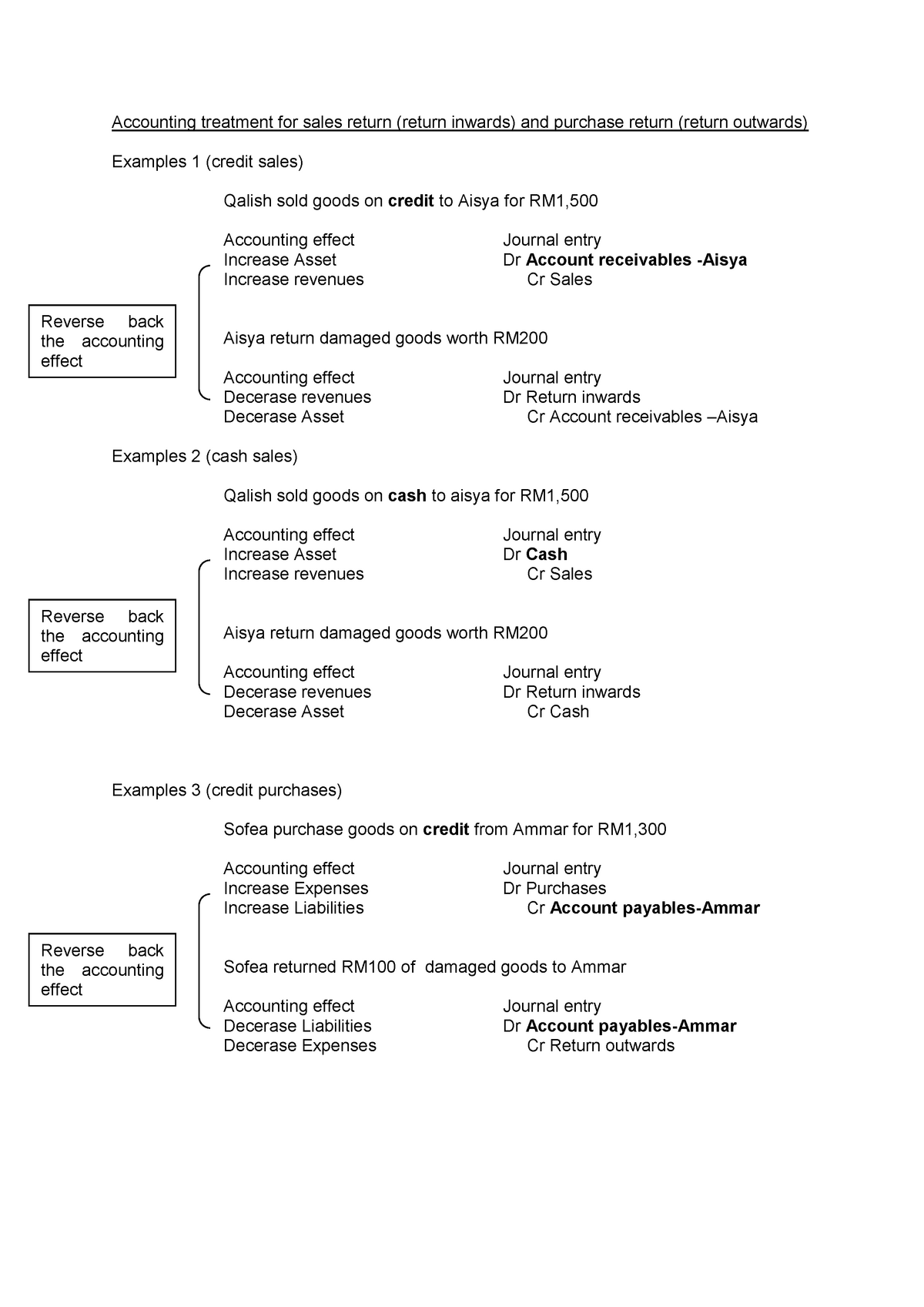

Accounting Treatment For Sales Return And Purchase Return Accounting

/buyback-f91333fa039d4d79ab430c65fc753e11.jpg)

The Impact Of Share Repurchases On Financial Accounting

Cost Accounting Concept And Limitations Notes Learning

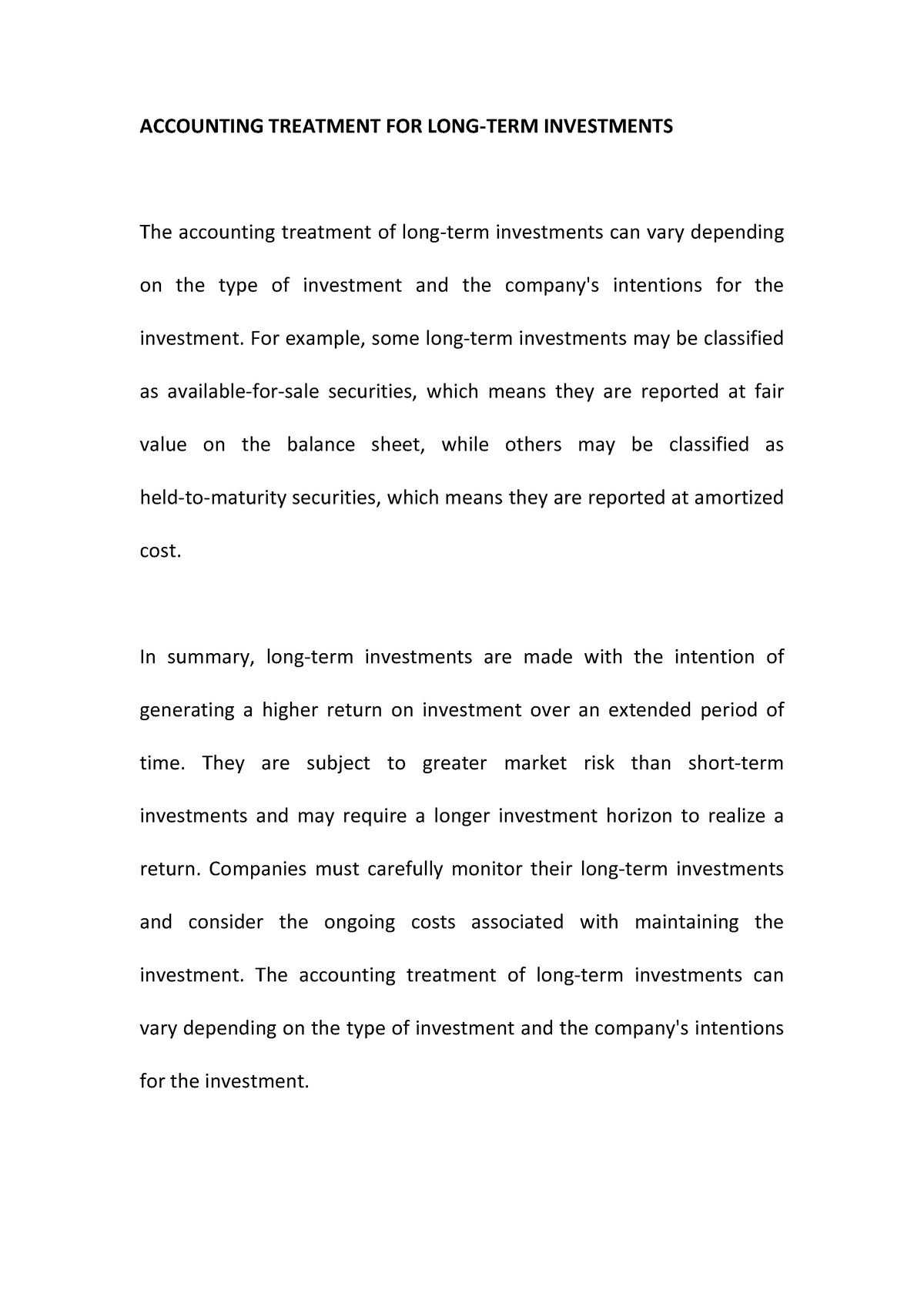

Accounting Treatment FOR LONG ACCOUNTING TREATMENT FOR LONG TERM

Accounting Treatment FOR LONG ACCOUNTING TREATMENT FOR LONG TERM

Solved Task 1 Accounting Treatment Of Issue Of Shares On 1 September

What Is Stock Buyback Formula Calculator

Simple Accounting Spreadsheet Excelxo

Buyback Accounting Treatment - Buy back scenario As per recent trends one can observe an increasing use of buy back as means of financial capital restructuring by India Inc Share buy backs predominantly help in improving key ratios and also provide protection from potential takeovers