Buying A New House Tax Deductions If you re looking for your first home you should know that you can get a tax break for buying a house The IRS encourages

As a newly minted homeowner you may be wondering if there s a tax deduction for buying a house Unfortunately most of the expenses you paid when buying your home are not deductible in the year of purchase New homeowners should put reviewing the tax deductions programs and housing allowances they may be eligible for on their move in to do list Deductible

Buying A New House Tax Deductions

Buying A New House Tax Deductions

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-scaled.jpg

Tax Deductions What s New MahoneySabol

https://mahoneysabol.com/wp-content/uploads/2019/12/Article_TaxDeductions.jpg

Home Selling Tax Deductions Mortgage Free Mortgage Tips Mortgage

https://i.pinimg.com/originals/e4/5f/3a/e45f3afda73fad34112ce7bf9c5a04f1.jpg

When tax time rolls around each year many homeowners like you search for tax breaks Luckily there are many tax deductions for homeowners that could amount to several thousand dollars There are Homeowners can generally deduct home mortgage interest home equity loan or home equity line of credit HELOC interest mortgage points and state and local tax SALT deductions

If you sold a qualified home you can make deductions up until the time you sold your home which includes mortgage interest points and real estate property There is no specific broad federal tax credit in the United States solely for buying a new house Tax credits and incentives related to homeownership can vary over

Download Buying A New House Tax Deductions

More picture related to Buying A New House Tax Deductions

5 Tax Deductions When Selling A Home Selling House Tax Deductions

https://i.pinimg.com/originals/6e/04/47/6e04478e1452ed28bdedcae05ab5f3ab.png

Home Buying Tax Deductions What s Tax Deductible Buying A House Tax

https://i.pinimg.com/originals/7c/0c/10/7c0c10b07eb95303663bc0d1664923dc.jpg

Brilliant Tax Write Off Template Stores Inventory Excel Format

https://i.pinimg.com/originals/50/36/b5/5036b5533c4f7b4622b69c4de19a3101.jpg

You can deduct mortgage interest property taxes and other expenses up to specific limits if you itemize deductions on your tax return There are deductions available to you as a homeowner that can reduce your tax bill Here are some other things to keep in mind If you itemize your deductions

The property tax deduction is great for homeowners Here s how it works in 2023 2024 and what you can do to save money To help you come next tax season here are tax credits and deductions you can get when you buy a house and additional tax breaks that come with homeownership

5 Tax Deductions When Selling A Home

https://na.rdcpix.com/1074548527/5ad54e4fb8f27aadf25f27bdc914db96w-c0xd-w640_h480_q80.jpg

Buying A House In 2017 Here Are 4 Tax Moves To Make Now Homeowners

https://www.homeinsuranceking.com/blog/wp-content/uploads/2016/12/new-home-purchase-tax-tips.jpg

https://www.thebalancemoney.com/do-you-ge…

If you re looking for your first home you should know that you can get a tax break for buying a house The IRS encourages

https://www.hrblock.com/tax-center/filing...

As a newly minted homeowner you may be wondering if there s a tax deduction for buying a house Unfortunately most of the expenses you paid when buying your home are not deductible in the year of purchase

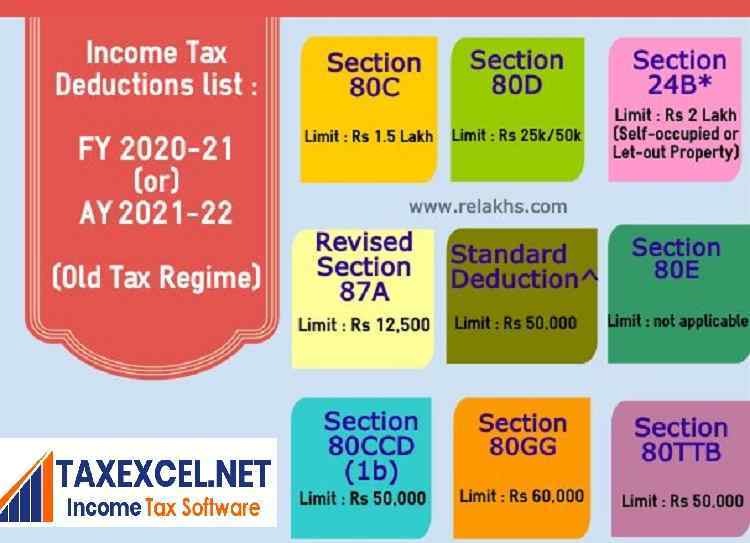

Income Tax Deductions F Y 2021 22 A Y 2022 23 With Automated Income

5 Tax Deductions When Selling A Home

House Tax Plan May Shift Use Of Corporate Debt The New York Times

Income Tax Deductions Income Tax Deductions Self Employed

7 Popular Tax Deductions When Selling Your Home 2021 Guide

Take Claims About State And Local Tax Deductions With A Grain Of Salt

Take Claims About State And Local Tax Deductions With A Grain Of Salt

Home Buying Tax Deductions What s Tax Deductible Buying A House Tax

Home Buying Tax Deductions What s Tax Deductible Buying A House Tax

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Buying A New House Tax Deductions - There is no specific broad federal tax credit in the United States solely for buying a new house Tax credits and incentives related to homeownership can vary over