Ca Energy Tax Credit You can get a tax credit of up to 30 of the price of many home energy upgrades You ll get this money when you file your taxes How to claim your credits Find out what credits you can

What you need to know Eligible Californians can apply to save thousands of dollars on home energy costs through rebates now available to homeowners as part of a federal rebate program The California Energy Commission announced that the first of two Inflation Reduction Act IRA funded programs is accepting applications Rebates for energy efficiency

Ca Energy Tax Credit

Ca Energy Tax Credit

https://epic.uchicago.edu/wp-content/uploads/2022/02/iStock-1060945826-scaled.jpg

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

Energy Tax Credits Armanino

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Tax Provision Description Provides a tax credit for energy efficiency improvements of residential homes New or Modified Provision Modified and extended Credit rate increased from 10 to Tax credits for residential energy efficiency and clean energy projects were extended and expanded through the IRA The U S Department of Energy has a publication on

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through You may also be eligible for a federal tax credit of up to 600 for an electric panel upgrade To learn more visit the ENERGY STAR Electric Panel Upgrade Tax Credit web page In addition check with your utility to

Download Ca Energy Tax Credit

More picture related to Ca Energy Tax Credit

Tax Credit Calculator My Free Taxes

https://www.myfreetaxes.org/wp-content/uploads/2022/01/iStock-Tax-Credit-word-scaled.jpg

Clean Energy Tax Credit In Canada A1 SolarStore

https://a1solarstore.com/images/solar_blog_page/74/c64107325989b5c7fb937c11345990f3.png

Giving Tax Credit Where Credit Is Due

https://www.chevyhardcore.com/image/2023/12/giving-tax-credit-where-credit-is-due-2023-12-29_09-27-16_080592.jpg

Home Energy Rating System Federal Tax Credit The CEC is therefore authorized to approve equivalent calculation procedures for builders to use when applying for the new For each taxable year beginning on or after January 1 2023 and before January 1 2028 this bill would allow a credit to a taxpayer for 10 percent of the amount paid or incurred during the

27 rowsFind current credits and repealed credits with carryover or recapture provision Tax credits help reduce the amount of tax you may owe If you pay rent for your housing have a family with children or help provide money for low income college students you may be

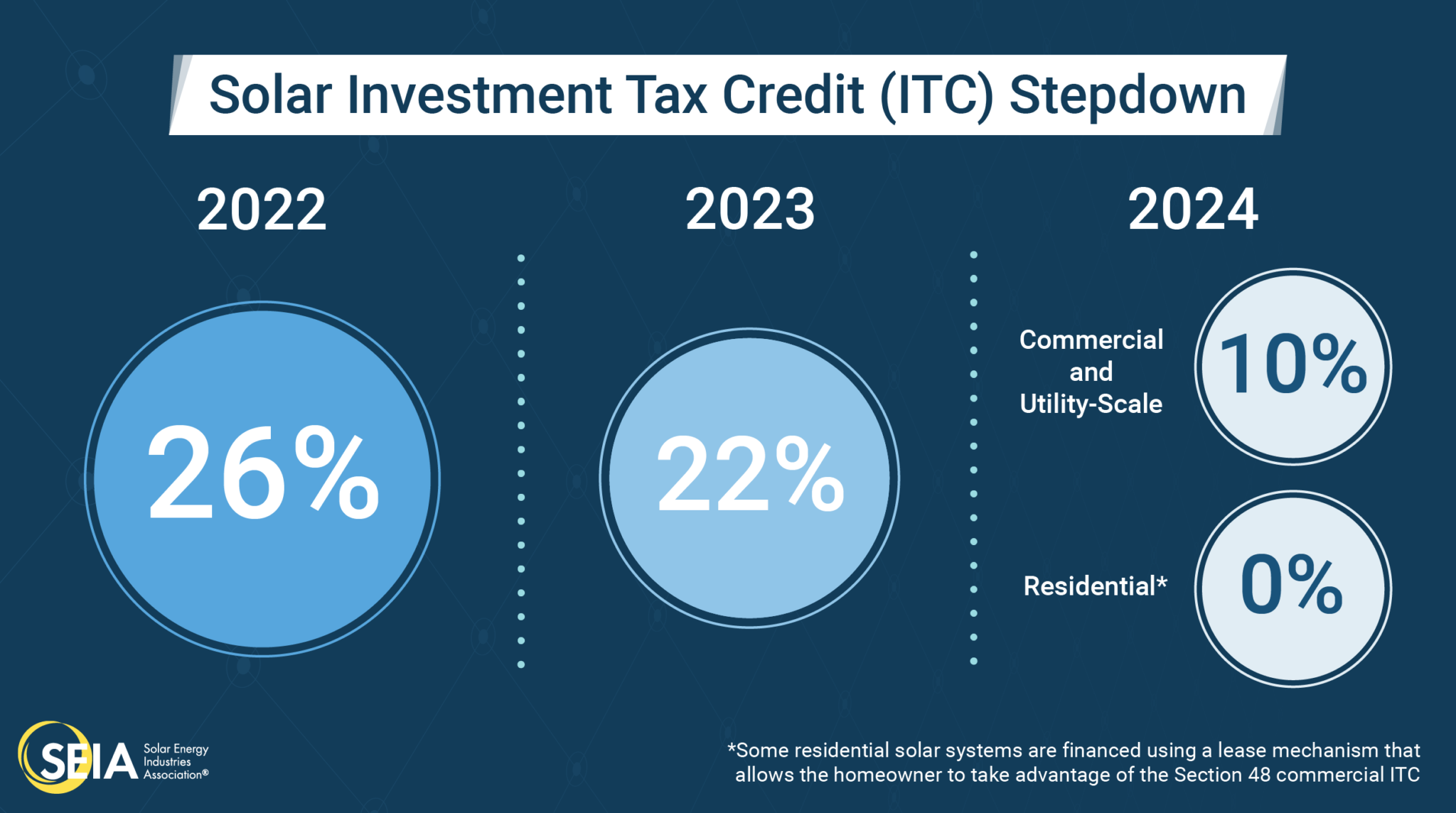

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Government Financial Aid For Solar Panel Installation Bullide

https://bullide.com/wp-content/uploads/2022/04/Soalr-Energy-Tax-Credit-Edit.jpg

https://climateaction.ca.gov › home-energy

You can get a tax credit of up to 30 of the price of many home energy upgrades You ll get this money when you file your taxes How to claim your credits Find out what credits you can

https://www.gov.ca.gov › california...

What you need to know Eligible Californians can apply to save thousands of dollars on home energy costs through rebates now available to homeowners as part of a federal rebate program

Equipment Tax Credits For Primary Residences About ENERGY STAR

Federal Solar Tax Credits For Businesses Department Of Energy

Solar Tax Credit What You Need To Know NRG Clean Power

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What

Estimate Your Tax Credit Deduction Alliantgroup

Simplifying The Complexities Of R D Tax Credits TriNet

Simplifying The Complexities Of R D Tax Credits TriNet

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

The Tax Curative Institute

Act Fast The Solar Tax Credit Will Soon Expire

Ca Energy Tax Credit - Tax credits for residential energy efficiency and clean energy projects were extended and expanded through the IRA The U S Department of Energy has a publication on