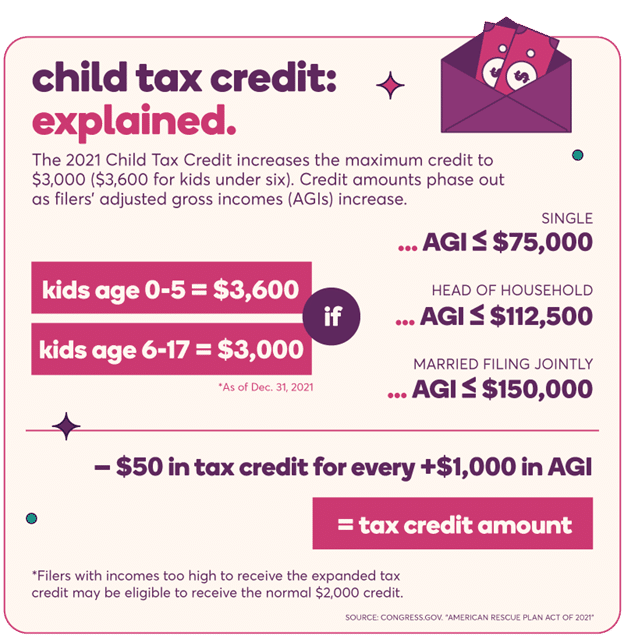

Calculate Child Care Tax Credit 2023 In detail the latest child tax credit scheme allows each family to claim up to 3 600 for every child below the age of 6 and up to 3 000 for every child below the age of 18

The Child Tax Credit 2023 Is a Refundable Credit for Qualifying Children Use this Tool to Calculate Your CTC for Your Dependent s How to Calculate the Childcare Tax Credit Start the tool below to get your credit qualification details This tax credit is nonrefundable so it does not generate a refund on its

Calculate Child Care Tax Credit 2023

Calculate Child Care Tax Credit 2023

https://media.cheggcdn.com/media/c7a/c7a7e54f-d046-435c-826a-3945e90aad03/php4ulBhq

Solved Calculate The Amount Of The Child And Dependent Care Chegg

https://media.cheggcdn.com/study/c1e/c1e6c6b2-2420-432b-bc09-0a6b45cd2a4c/image

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 The Child and Dependent Care Credit or CDCC is a nonrefundable tax credit which can reduce your tax liability if you paid for childcare during the year Use the tool below to determine if you are eligible

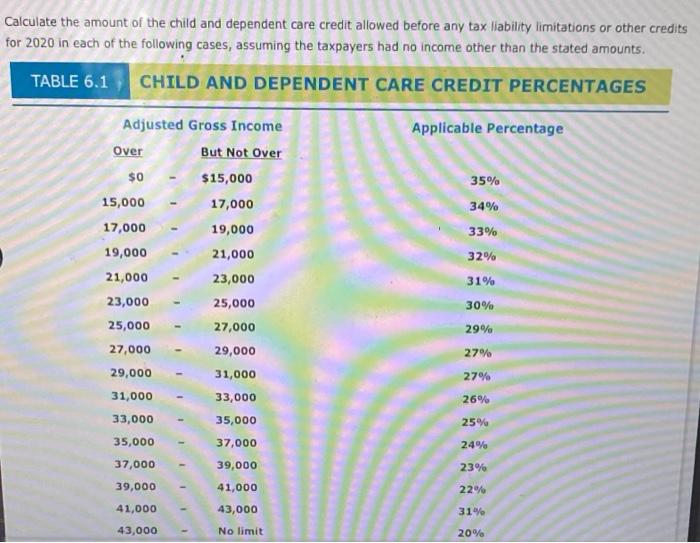

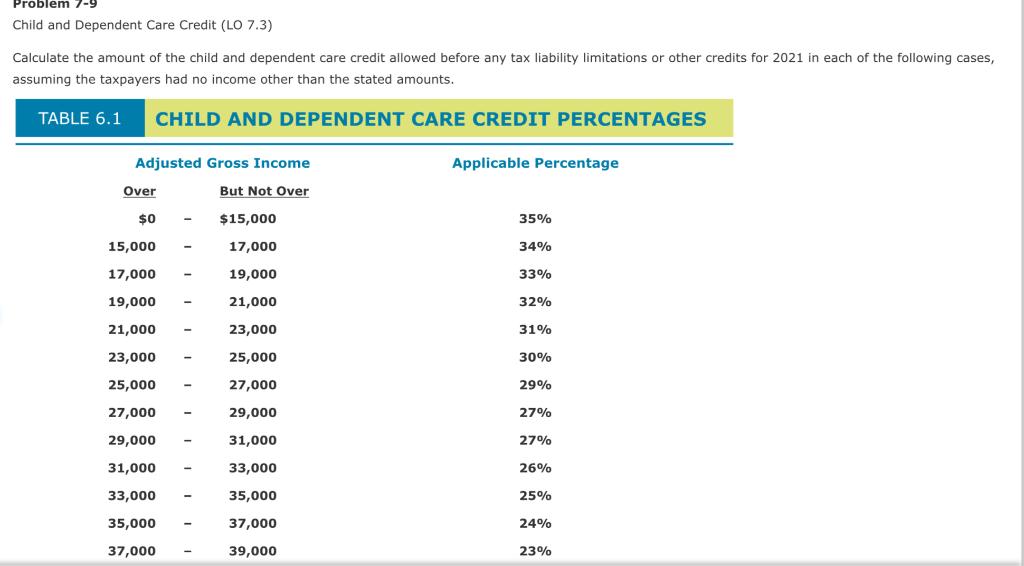

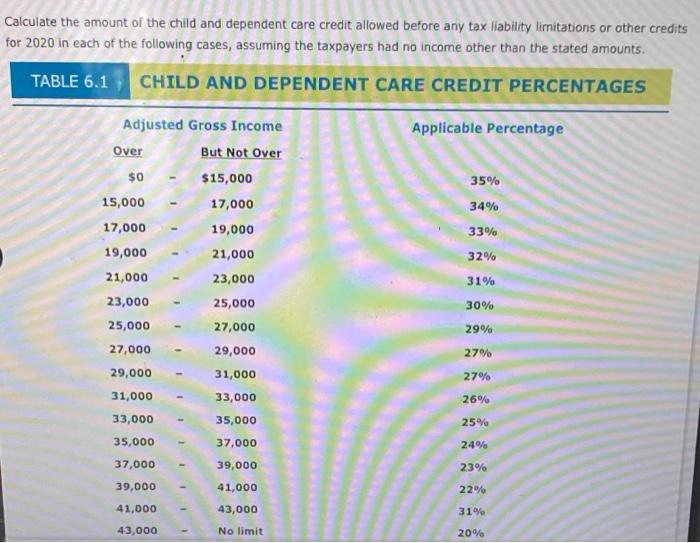

For the tax year 2022 filing in April 2023 taxpayers earning less than 43 000 can claim the Child and Dependent Care Credit There is a slab for determining the child dependent care credit threshold based on the Modified Compare the value of contributing to a DCFSA vs taking the Dependent Care Tax Credit with this quick and easy comparison calculator tool

Download Calculate Child Care Tax Credit 2023

More picture related to Calculate Child Care Tax Credit 2023

Child And Dependent Care Tax Credit What Is It How Does It Work

https://images.squarespace-cdn.com/content/v1/5e57c4f3791e5603fafc86ef/1bf45e9b-5d50-4c12-a2db-2083fbbed6f4/what-is-child-dependent-care-tax-credit.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Understanding The 2023 Child Care Tax Credit Types Eligibility And

https://images.squarespace-cdn.com/content/v1/5d940768938dd828fc033675/77a228a5-aaee-47f8-a4be-e62a1c4783b2/Web+capture_25-10-2023_224527_showme.redstarplugin.com.jpeg

Child Care Tax Credit Calculator Use this tool to estimate your Child Care Tax Credit You must first enter your adjusted gross income and number of children Please note this calculator will not store or use your data The CDCTC is a tax credit designed to help working families afford the high cost of child care so that parents can look for work and stay employed This credit allows working parents to claim up to 6 000 in child

Calculate the credit using Form 2441 Child and Dependent Care Expenses Don t confuse this credit with the child tax credit What is a nonrefundable credit A nonrefundable credit is a That leaves just 1 000 to calculate the Child and Dependent Care Credit assuming that your AGI or your spouse s if you re married is more than 1 000 Here s the math to calculate the

Child And Dependent Care Tax Credit Get Ahead Colorado

https://images.squarespace-cdn.com/content/v1/6564d2f2c8c33123bbdaba64/1701106456150-IKN3BRGKF064ZU8LV88C/Other+Tax+Credits_Learn.jpg?format=1000w

Earned Income Credit Calculator 2021 DannielleThalia

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

https://www.omnicalculator.com › finance › child-tax-credit

In detail the latest child tax credit scheme allows each family to claim up to 3 600 for every child below the age of 6 and up to 3 000 for every child below the age of 18

https://www.efile.com

The Child Tax Credit 2023 Is a Refundable Credit for Qualifying Children Use this Tool to Calculate Your CTC for Your Dependent s

Child Tax Credit State s New Child Care Tax Credit Allows Up To 6 000

Child And Dependent Care Tax Credit Get Ahead Colorado

What Families Need To Know About The CTC In 2022 CLASP

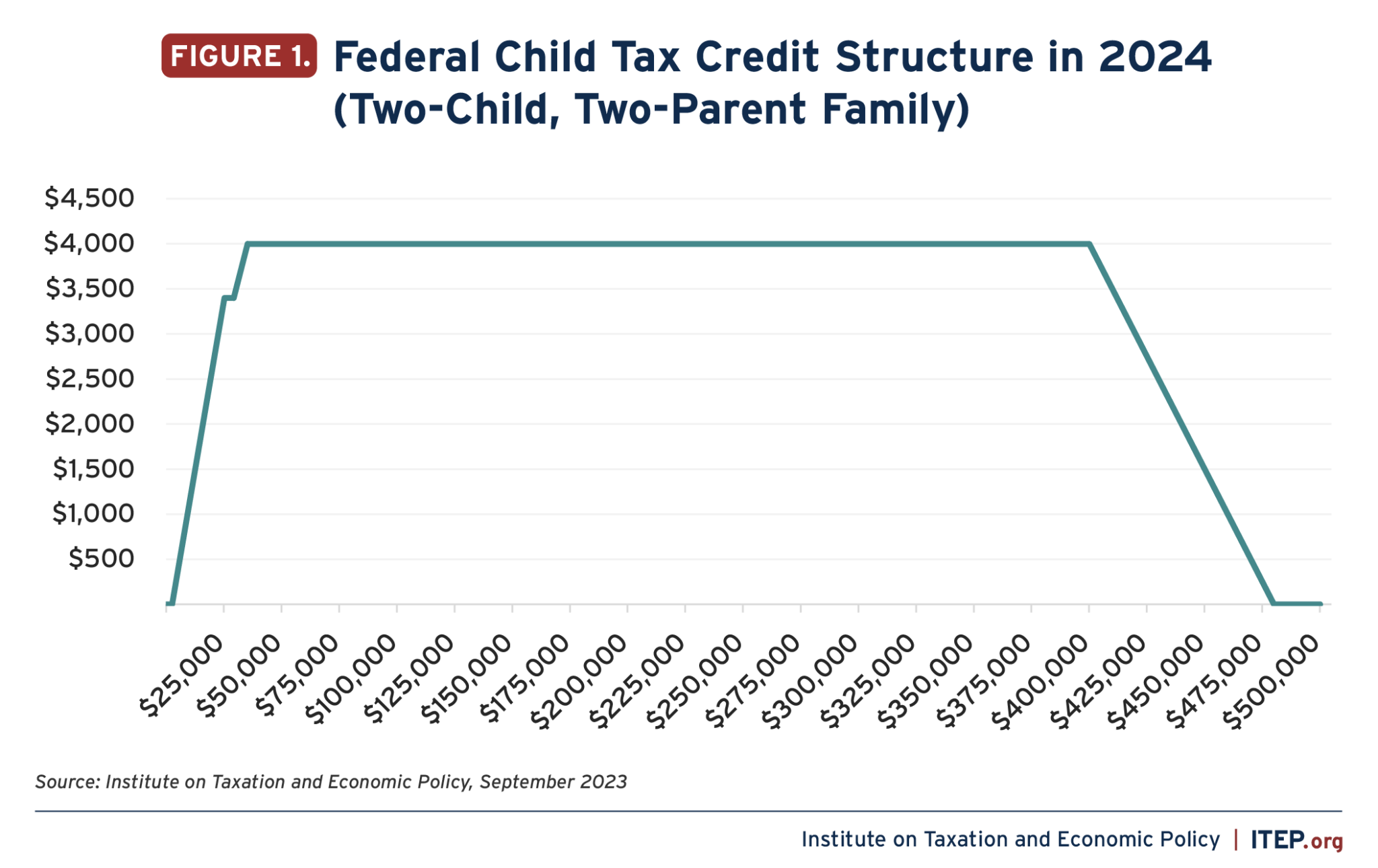

States Are Boosting Economic Security With Child Tax Credits In 2023 ITEP

Child Tax Credit Payments Begin Arriving Today For Almost One Million

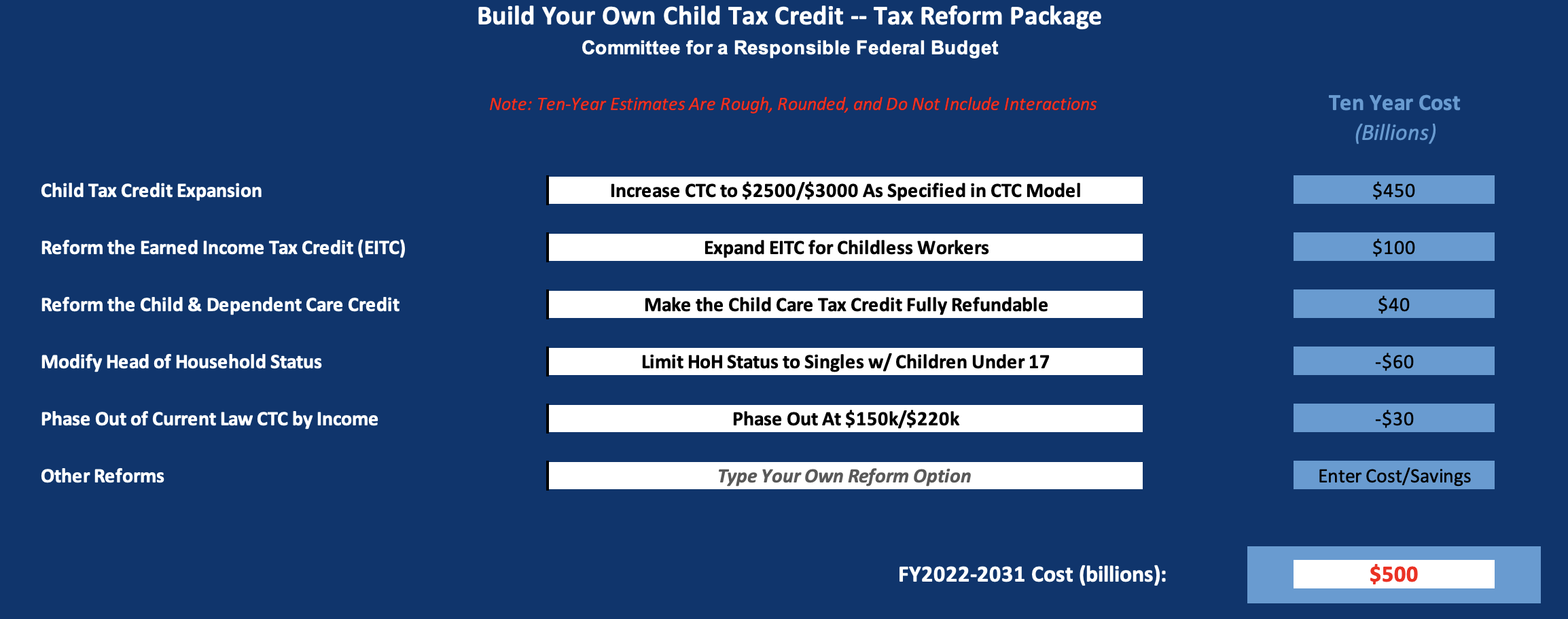

Build Your Own Child Tax Credit 2 0 2022 01 06

Build Your Own Child Tax Credit 2 0 2022 01 06

2022 Child Tax Credit Calculator Internal Revenue Code Simplified

Does The Child And Dependent Care Credit Phase Out Completely Latest

What The New Child Tax Credit Could Mean For You Now And For Your 2021

Calculate Child Care Tax Credit 2023 - For the tax year 2022 filing in April 2023 taxpayers earning less than 43 000 can claim the Child and Dependent Care Credit There is a slab for determining the child dependent care credit threshold based on the Modified