California Tax Returns Due Date Extended This extension applies to the 2023 tax returns normally due on Tax Day April 15 2024 As a result individuals and businesses in the affected areas now have until June 17 2024 to file

Calendar year tax exempt organization returns normally due on May 15 2024 The IRS urges anyone who needs an additional tax filing extension beyond June Important Dates for Income Tax When the due date falls on a weekend or holiday the deadline to file and pay without penalty is extended to the next business day

California Tax Returns Due Date Extended

California Tax Returns Due Date Extended

https://i.ytimg.com/vi/rUBXXk5uRAA/maxresdefault.jpg

FBR Tax Return Last Date 2023 Extended

https://studies.com.pk/wp-content/uploads/2022/10/FBR-Tax-Return-Last-Date-Extended.jpg

E file Your California Tax Return For Free StudioGlyphic

http://www.studioglyphic.com/blog/wp-content/uploads/2009/02/8194660049_6fa13d1263_k-672x372.jpg

Sacramento The California Franchise Tax Board today confirmed that most Californians have until November 16 2023 to file and pay their tax year 2022 taxes to avoid penalties Individuals whose tax returns and payments are due on April 18 2023 Quarterly estimated tax payments due January 17 2023 April 18 2023 June 15 2023

Individuals whose tax returns and payments are due on April 18 2023 Quarterly estimated tax payments due January 17 2023 March 15 2023 April 18 If you can t file by April 15 you have an automatic six month extension to file your return until October 15 You don t have to file a written request to receive the extension

Download California Tax Returns Due Date Extended

More picture related to California Tax Returns Due Date Extended

Coronavirus Last Date To File IT Returns Extended Ummid

https://www.ummid.com/news/2020/march/24.03.2020/tax-return-due-date.jpg

Why IRS Says Californians May Want To Hold Off On Filing Tax Returns

https://s.hdnux.com/photos/01/31/27/55/23427950/3/1200x0.jpg

California Dems Pass Law Requiring Trump s Tax Returns To Run

https://moneyandmarkets.com/wp-content/uploads/2019/07/California-Trump-tax-returns.jpg

The California Franchise Tax Board confirmed that most Californians have until Nov 16 2023 to file and pay their 2022 state taxes to avoid penalties WASHINGTON Victims of severe winter storms flooding and mudslides in California beginning Jan 8 2023 now have until Oct 16 2023 to file various

The new deadline of Oct 16 applies to California and federal individual and business tax returns and payments The tax deadline in California is Nov 16 2023 if you lived in a federally declared disaster area included in at least one of three different declarations This deadline applies to filing

California Franchise Tax Board FTB And Unfiled Taxes FAQ Klasing

https://klasing-associates.com/wp-content/uploads/2017/02/photodune-3298491-tax-return-s.jpg

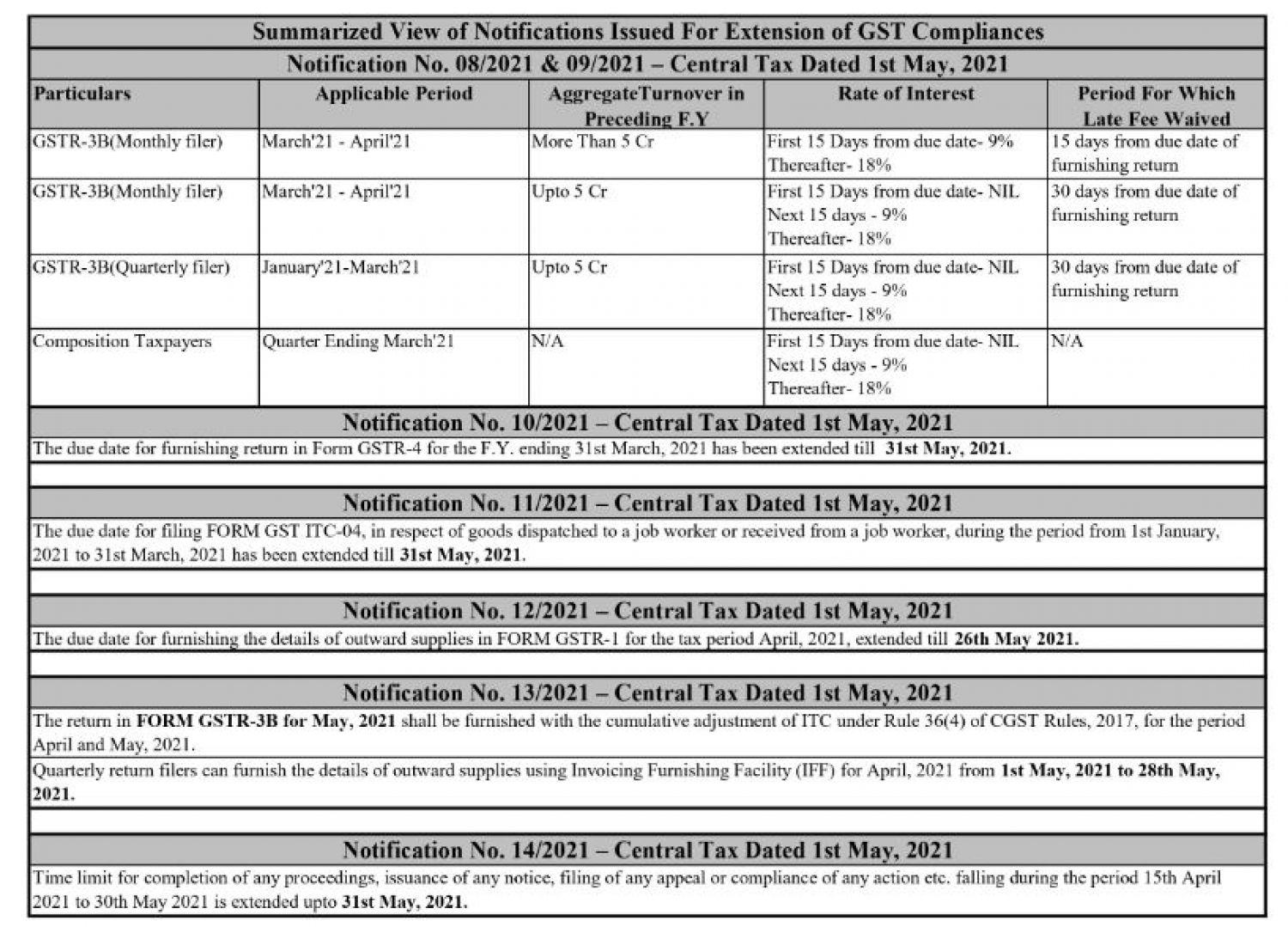

Due Dates Of Various GST Return Falling In Month Of April

https://carajput.com/art_imgs/extension-of-the-due-dates-for-different-gst-returns-in-april2021.jpg

https://www.kiplinger.com/taxes/califo…

This extension applies to the 2023 tax returns normally due on Tax Day April 15 2024 As a result individuals and businesses in the affected areas now have until June 17 2024 to file

https://www.irs.gov/newsroom/irs-announces-tax...

Calendar year tax exempt organization returns normally due on May 15 2024 The IRS urges anyone who needs an additional tax filing extension beyond June

Income Tax Returns Filing Due Dates Extended Ebizfiling

California Franchise Tax Board FTB And Unfiled Taxes FAQ Klasing

ITR DUE DATE EXTENDED FY 2018 19 L Income Tax Return Filing Due Date

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

Due Dates For GST Returns Types Of GST Returns Ebizfiling

Due Dates For GST Returns Types Of GST Returns Ebizfiling

Six Consequences If You Don t File Your Income Tax Returns By The Due

EXCEL Of Income Tax Financial Statistics xlsx WPS Free Templates

Due dates For Filing Income Tax Returns InstaFiling

California Tax Returns Due Date Extended - If you can t file by April 15 you have an automatic six month extension to file your return until October 15 You don t have to file a written request to receive the extension