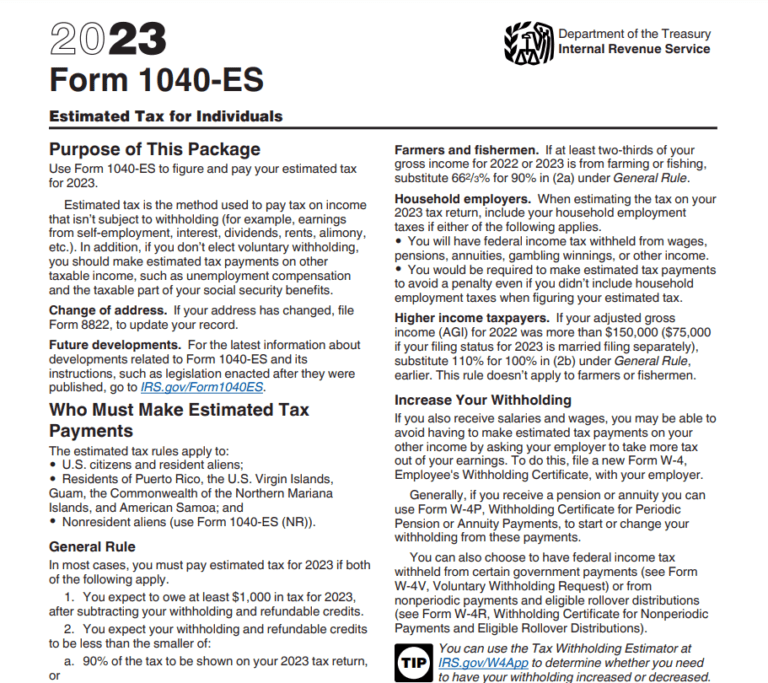

Georgia Rebate Check 2024 HB 162 allows for a tax refund out of the State s surplus to Georgia filers who meet eligibility requirements You may be eligible for the HB 162 Surplus Tax Refund if you Keep reading to learn more about the eligibility requirements and how to check the status of your Surplus Refund

ATLANTA Georgia is one of several U S states lowering individual income tax rates in 2024 meaning more financial relief for taxpayers in the Peach State Gov Brian Kemp signed HB 1437 into law on April 26 2022 The new law replacd the graduated personal income tax with a flat rate of 5 49 which took effect Jan 1 2024 with gradual rate reductions until the flat rate reaches 4 99 The deadline to file 2023 individual income tax returns without an extension is April 15 2024 Individuals Most refunds are issued within 3 weeks from the date a return is received by the Department However it may take up to 12 weeks to process First time filers and those who have not filed in five or more years will receive a paper

Georgia Rebate Check 2024

Georgia Rebate Check 2024

https://cdn.thegeorgiavirtue.com/wp-content/uploads/2021/12/11083944/GA_POWER_REBATE_CHECK_1.jpg

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Georgia Tax Rebate Schedule When Can You Expect Your Refund Marca

https://phantom-marca.unidadeditorial.es/833ac641bd0aded8e3724f763ee84d4d/resize/1200/f/jpg/assets/multimedia/imagenes/2022/04/04/16490645502029.jpg

The 2023 Georgia tax rebates have come thanks to legislation known as House Bill 162 The bill provides a one time tax credit i e surplus tax refund for individual Georgia taxpayers who Georgia tax refund checks property tax break what to know 11alive Right Now Atlanta GA 34 Gov Brian Kemp made the two economic proposals in a press conference on Thursday as he

People who filed tax returns in both 2021 and 2022 are eligible to receive the money which the Department of Revenue will start issuing in six to eight weeks Taxpayers must file their taxes before they can get the refund Single tax filers and married people who file separately will get 250 Head of household filers will get 375 and married Single filers and married individuals who file separately could receive a maximum refund of 250 Head of household filers could receive a maximum refund of 375 Married individuals who file joint returns could receive a maximum refund of 500 The refund amount will be based on an individual s tax liability for Tax Year 2021

Download Georgia Rebate Check 2024

More picture related to Georgia Rebate Check 2024

One time Tax Rebate Checks For Idaho Residents KLEW

https://klewtv.com/resources/media2/16x9/full/1015/center/80/bcd0e069-efe3-406d-b87f-b52ab4b43fd3-large16x9_IdahoTaxRebateCheckpic.jpg

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

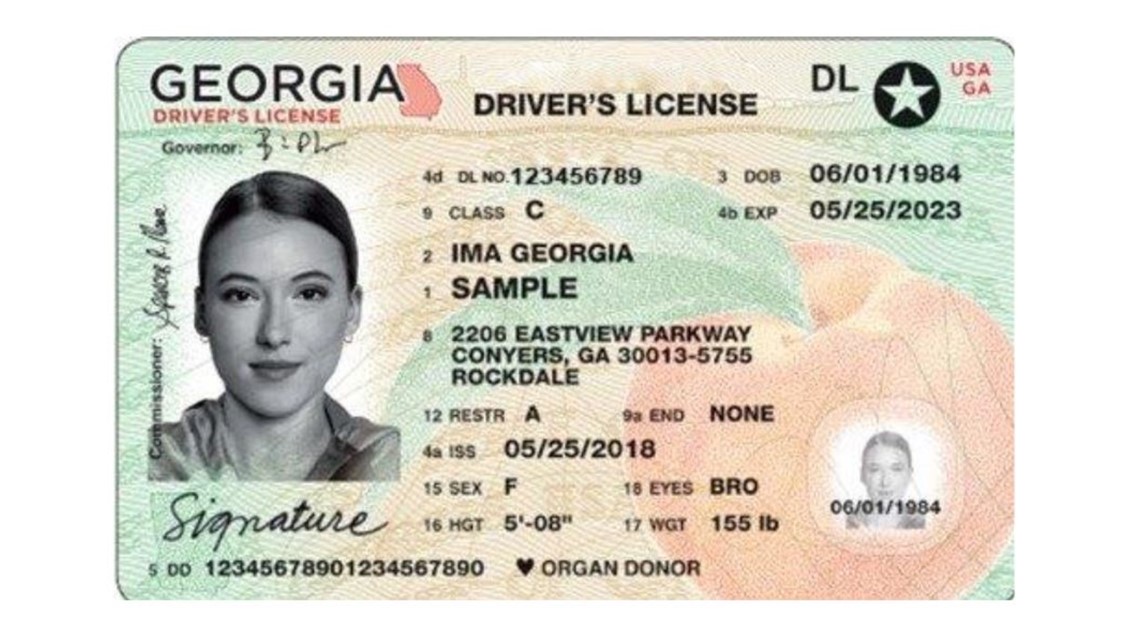

Georgia Drivers License Check Populargawer

https://media.11alive.com/assets/WXIA/images/25541755-42f0-4191-83d4-4c340d257209/25541755-42f0-4191-83d4-4c340d257209_1140x641.jpg

Most refunds will be issued by July 1 as long as you file your taxes on or before April 18 The money comes from the state s more than 1 billion surplus in funds By Jeff Amy Published 8 04 AM PST February 24 2022 ATLANTA AP Gov Brian Kemp s plan to pay 1 6 billion worth of state income tax refunds is advancing with lawmakers looking to help the Republican governor fulfill his promise to give some of Georgia s historic surplus back to taxpayers as both Kemp and legislators seek reelection

Earlier this year the state issued refund checks of between 250 500 to taxpayers ATLANTA Gov Brian Kemp announced Thursday he will seek a second round of tax rebate checks to Georgia ATLANTA Georgia taxpayers have begun receiving refunds for the second year in a row Gov Brian Kemp announced Monday House Bill 162 which the General Assembly passed in March uses part of Georgia s revenue surplus of more than 6 billion to pay for a refund of state income taxes from 2021 Georgia is once again in a position to

PA Rent Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-768x993.jpg

More CtC Educated Victories For The Rule Of Law Page 58

https://losthorizons.com/tax/taximages2/BHarriss/BHGA2016Check.jpg

https://dor.georgia.gov/georgia-surplus-tax-refund

HB 162 allows for a tax refund out of the State s surplus to Georgia filers who meet eligibility requirements You may be eligible for the HB 162 Surplus Tax Refund if you Keep reading to learn more about the eligibility requirements and how to check the status of your Surplus Refund

https://news.yahoo.com/georgia-income-tax-moves-flat-173143512.html

ATLANTA Georgia is one of several U S states lowering individual income tax rates in 2024 meaning more financial relief for taxpayers in the Peach State Gov Brian Kemp signed HB 1437 into law on April 26 2022 The new law replacd the graduated personal income tax with a flat rate of 5 49 which took effect Jan 1 2024 with gradual rate reductions until the flat rate reaches 4 99

Traderider Rebate Program Verify Trade ID

PA Rent Rebate Form Printable Rebate Form

NWC Tryouts 2023 2024 NWC Alliance

Dealerships That Have The Best Rebates For Cars Right Now 2023 Carrebate

2024 Campaign Kick Off The Birmingham Jewish Federation

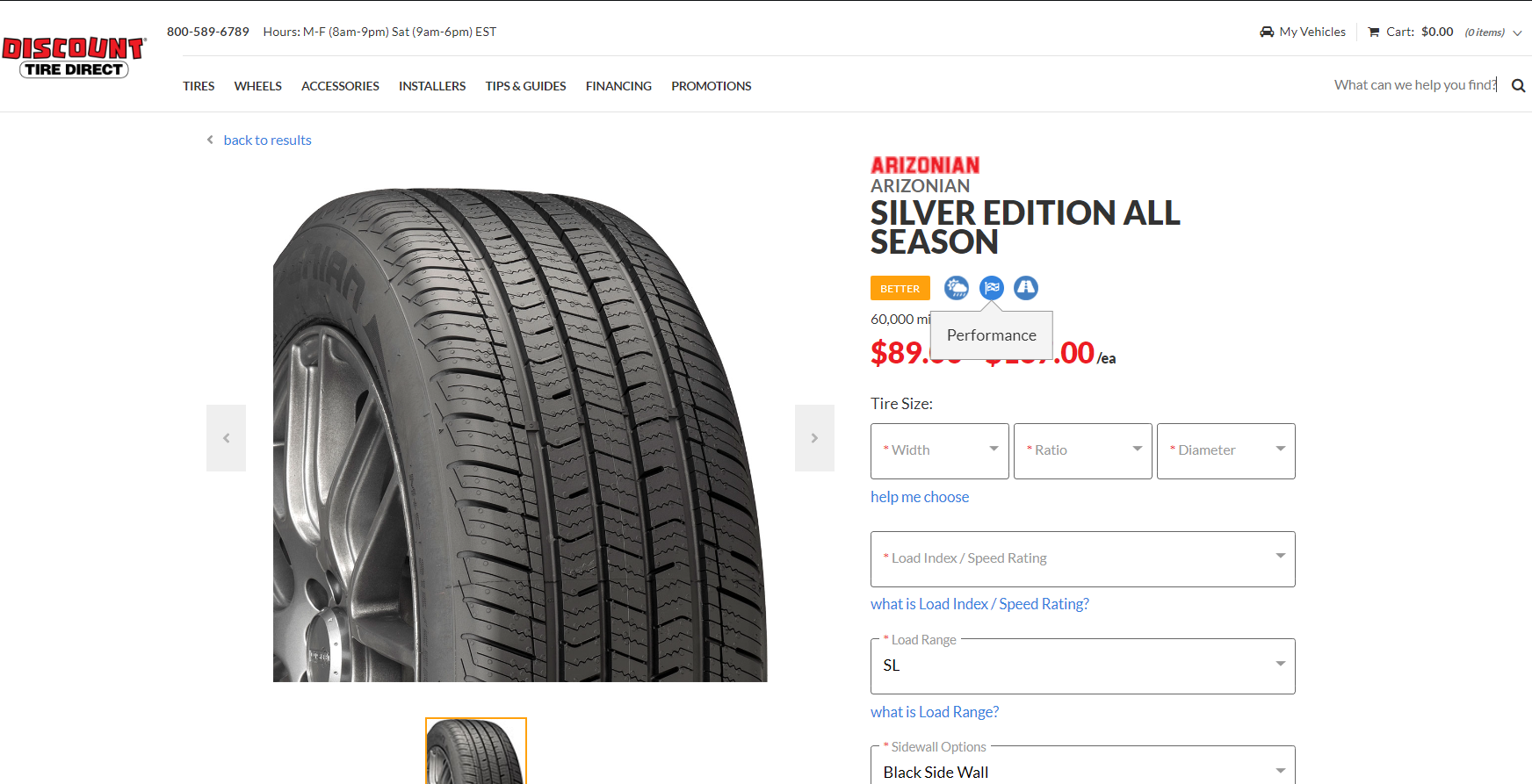

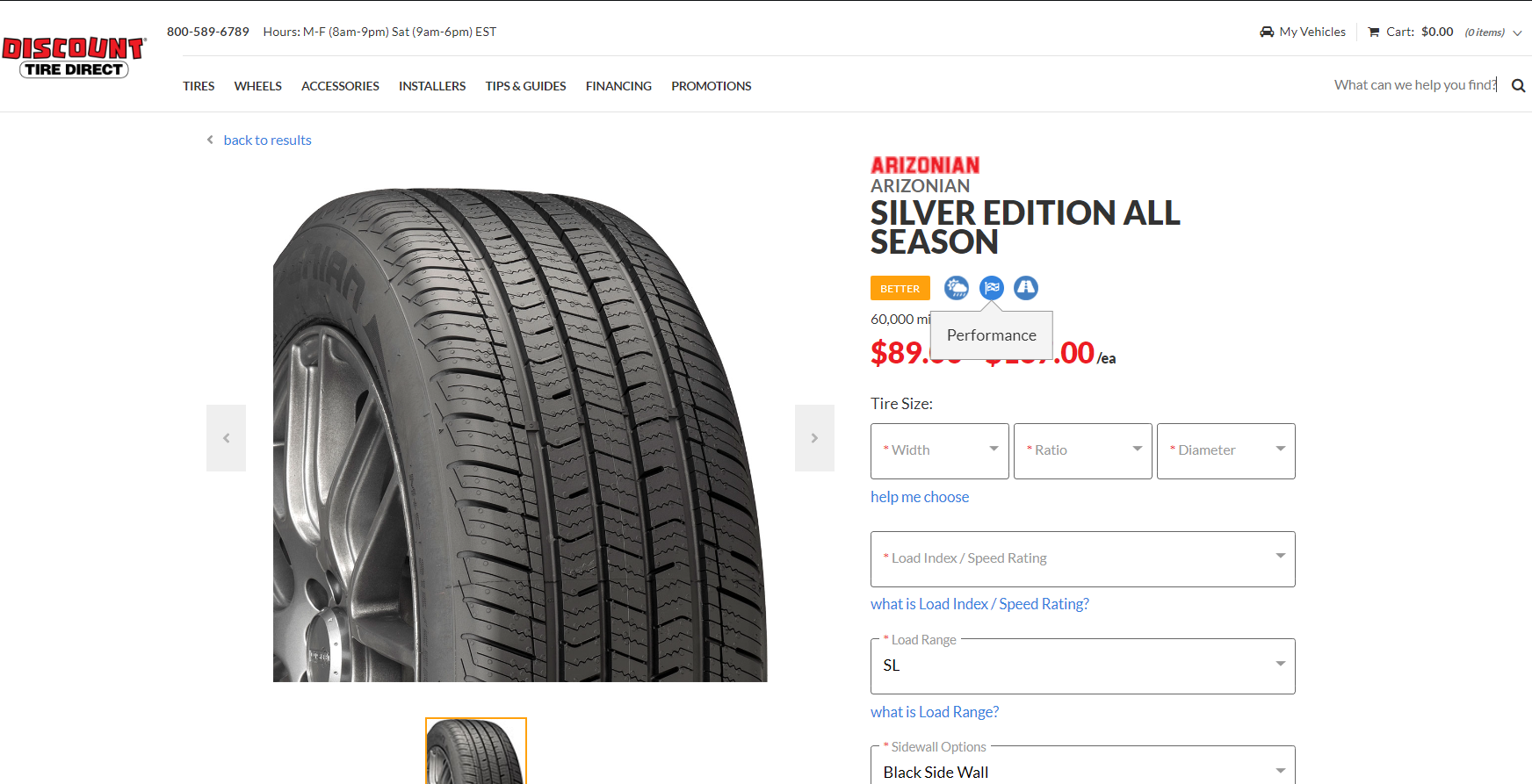

Arizonian Tire Rebate 2023 A Comprehensive Guide To Saving Big On Your Next Tire Purchase

Arizonian Tire Rebate 2023 A Comprehensive Guide To Saving Big On Your Next Tire Purchase

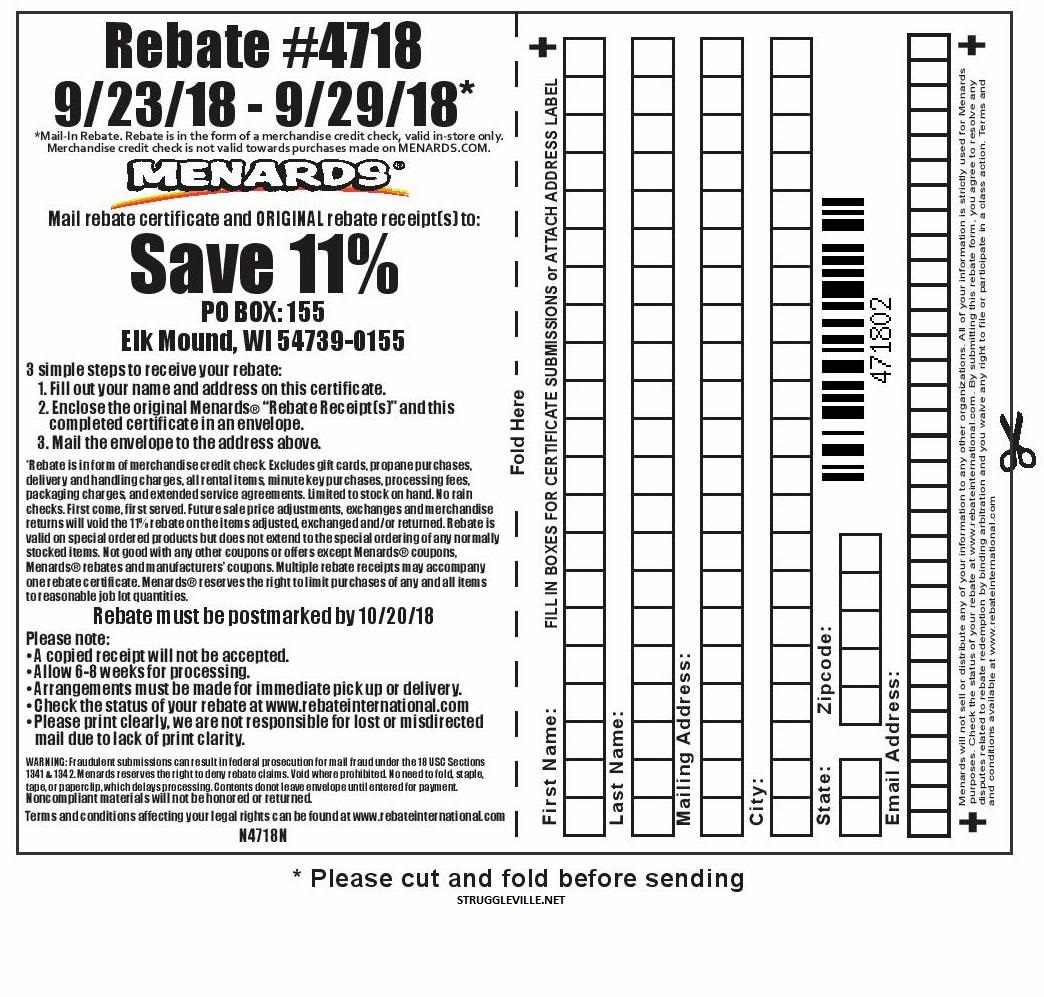

Menards Printable Rebate Form 6782 Menards RebateForm

NYS Drive Clean Rebate Form Printable Rebate Form

Md88safe

Georgia Rebate Check 2024 - By accelerating the reduction the rate for Tax Year 2024 will be 5 39 percent rather than the 5 49 percent set by HB 1437 This will mark a cut of 36 basis points from the Tax Year 2023 rate of 5 75 percent