Hmrc Self Employed Tax Rebate Web 13 juil 2023 nbsp 0183 32 If you ve left employment and received your last pay before 5 April the previous tax year use form 38 to claim a refund Claim online The quickest way to

Web 3 mars 2016 nbsp 0183 32 complete Self Assessment tax returns except current year claims are claiming for expenses over 163 2 500 are claiming for more than 5 different jobs When Web 23 ao 251 t 2023 nbsp 0183 32 And if you are self employed and complete an annual Self Assessment then you will need to complete your tax return before

Hmrc Self Employed Tax Rebate

Hmrc Self Employed Tax Rebate

https://pdfimages.wondershare.com/pdf-forms/hmrc.png

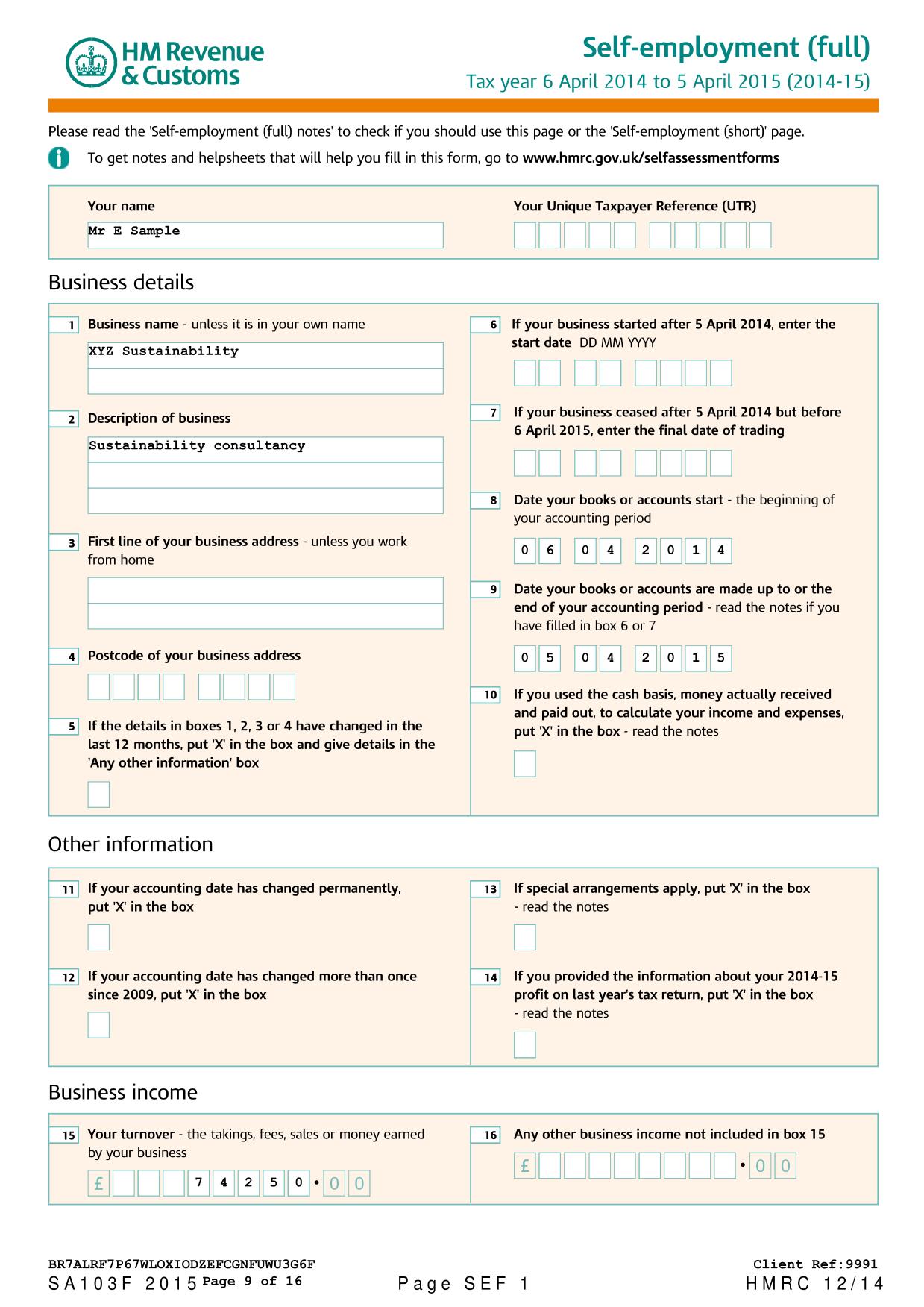

Hmrc Self employed Short Form Notes Employment Form

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/10/hmrc-self-employed-short-form-notes.jpg?w=1024&ssl=1

Minutes Of EGM By Shareholders For Closure Of The Company Lupon gov ph

https://www.informdirect.co.uk/wp-content/uploads/2014/07/Registering-company-as-dormant-with-HMRC-Corporation-tax-information-for-new-companies-728x1024.png

Web If you pay the 20 basic rate of tax and claim tax relief on 163 6 a week you would get 163 1 20 per week in tax relief 20 of 163 6 You ll usually get tax relief through a change to your Web You can usually claim working tax credits as a self employed person if you get a fostering allowance and your expenses aren t more than your allowance ie you don t make a

Web 10 janv 2022 nbsp 0183 32 When you must tell HMRC In most cases if you re not eligible and have to pay the grant back you must tell us within 90 days of receiving the grant For the fourth Web 5 avr 2017 nbsp 0183 32 If you re self employed the self employed ready reckoner tool can help you budget for your tax bill You may be able to claim a refund if you ve paid too much tax

Download Hmrc Self Employed Tax Rebate

More picture related to Hmrc Self Employed Tax Rebate

How You Can Claim Your Tax Rebate Using The Free HMRC App

https://static.wixstatic.com/media/a2fe96_ce7953fc84144d4792e135b217e3aae4~mv2.png/v1/fill/w_600,h_320,al_c,q_85,enc_auto/a2fe96_ce7953fc84144d4792e135b217e3aae4~mv2.png

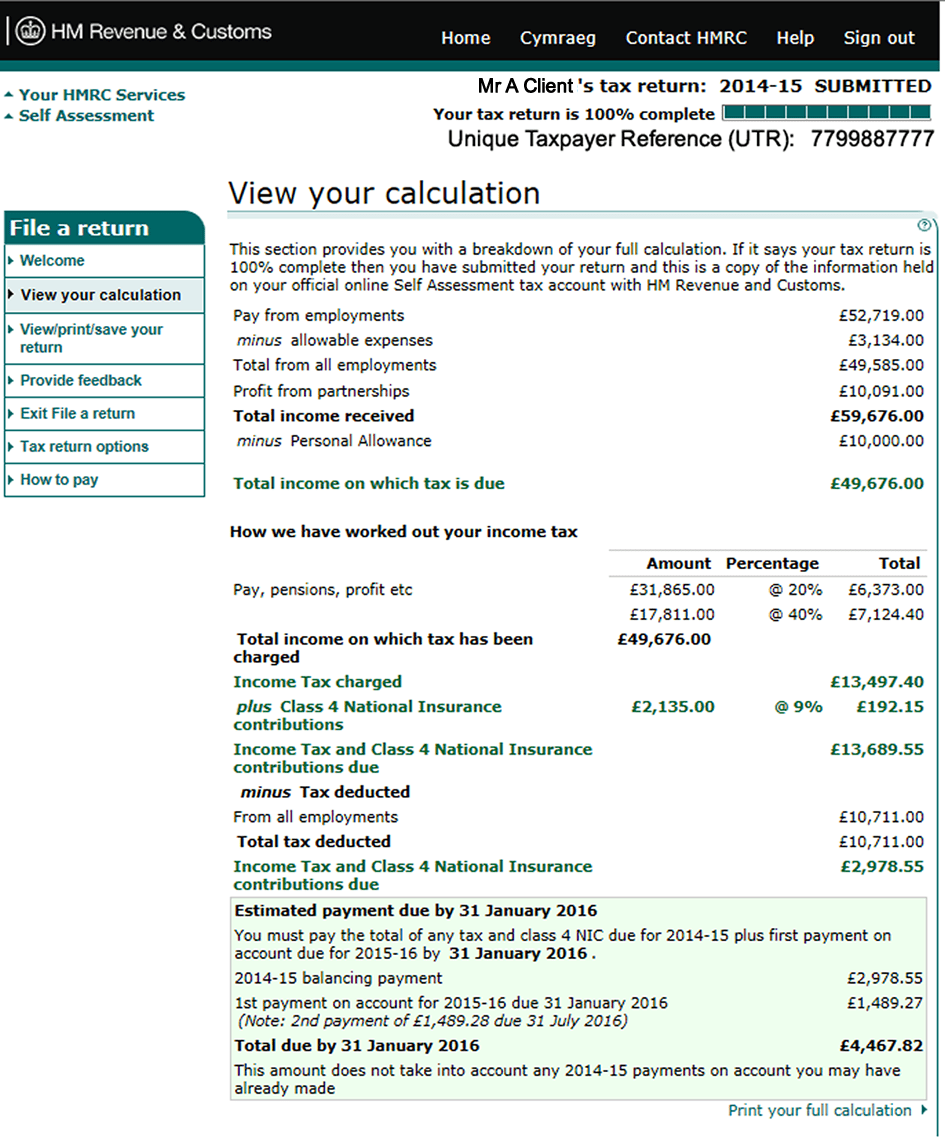

HMRC Tax Refunds Tax Rebates 3 Options Explained

https://www.ratednearme.com/wp-content/uploads/employee-tax-calculation.jpg

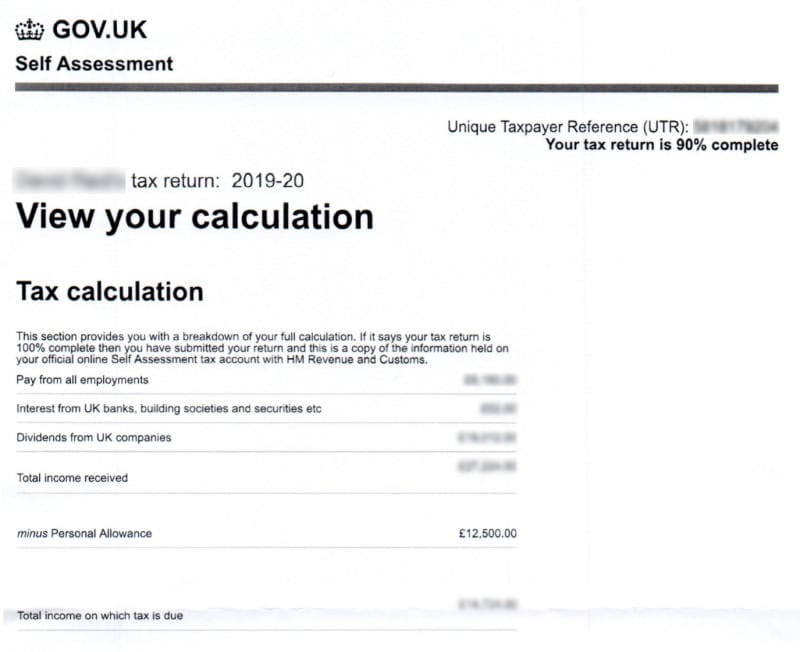

Downloading Your SA302s And Tax Year Overviews From The HMRC Website

http://www.amortgagenow.co.uk/wp-content/uploads/2016/03/FC_viewcalculation.png

Web If you are self employed and complete a self assessment tax return you may be owed a refund if your tax return contained errors or incorrect information For those who are or are usually paid via their employer Web 6 avr 2023 nbsp 0183 32 April 6 2023 2 02 pm On occasion people are overcharged on their tax bill there is a system in place for you to receive money back from HMRC You may be

Web 25 ao 251 t 2023 nbsp 0183 32 You can use our income tax calculator to find out how much you ll pay In 2023 24 self employed workers and employees pay 0 on the first 163 12 570 you earn Web 6 avr 2023 nbsp 0183 32 If you re self employed you ll be charged tax based on the amount of profit you ve made in a tax year but there are a number of expenses you can claim that will

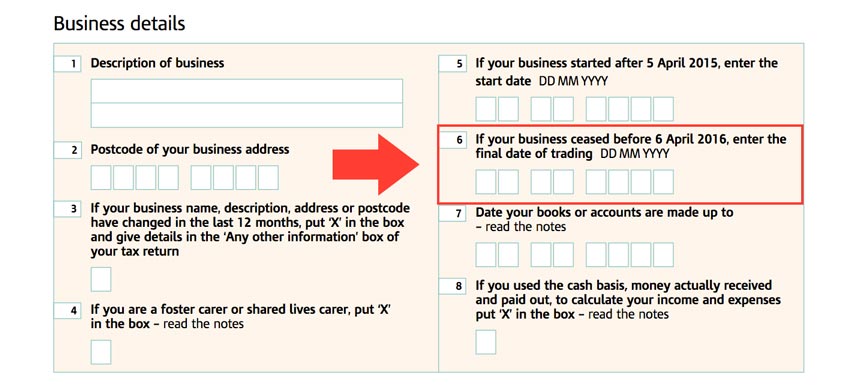

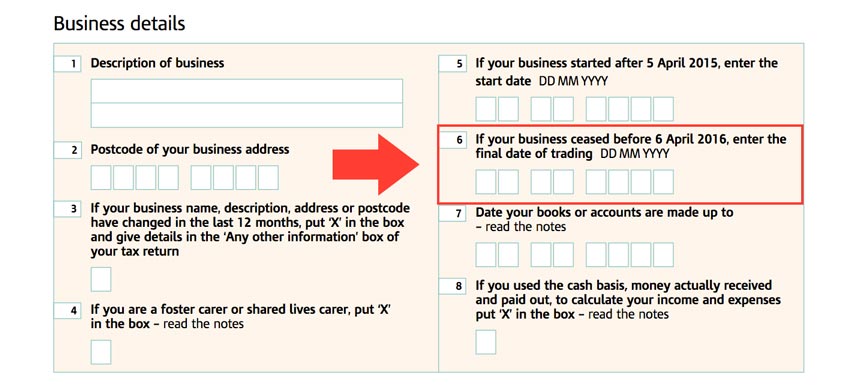

How To Stop Trading As Self Employed And Inform The HMRC

http://zlogg.co.uk/wp-content/uploads/2016/11/sa103s.jpg

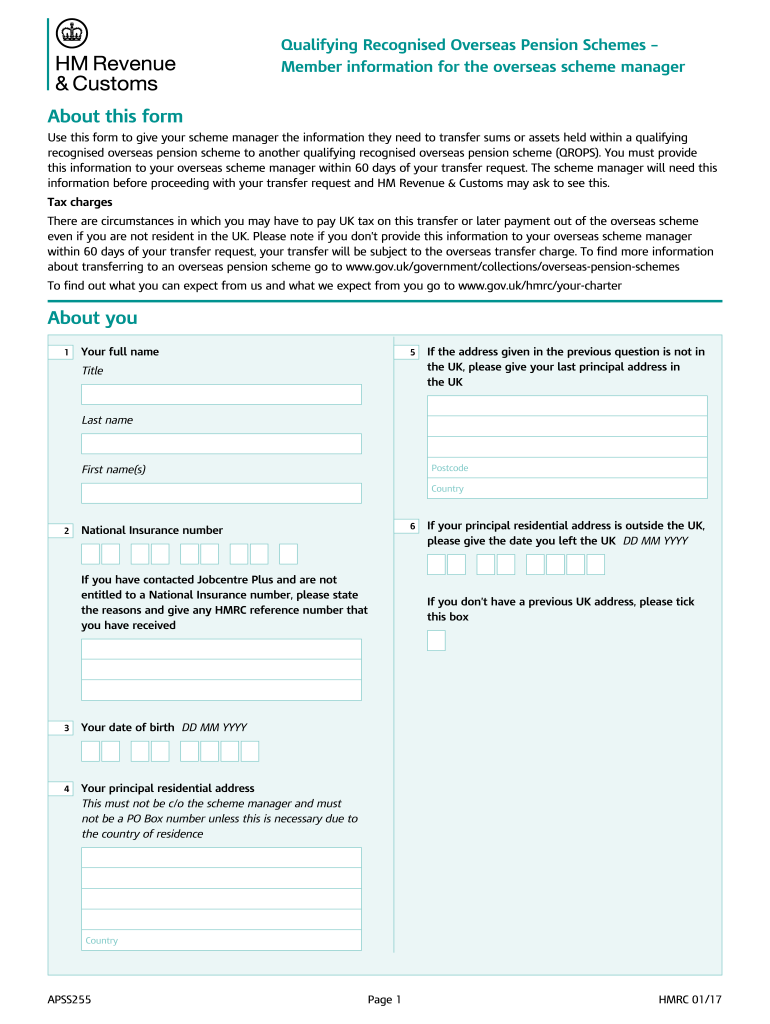

C1603 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/454/115/454115474/large.png

https://www.gov.uk/guidance/claim-back-income-tax-when-youve-stopped...

Web 13 juil 2023 nbsp 0183 32 If you ve left employment and received your last pay before 5 April the previous tax year use form 38 to claim a refund Claim online The quickest way to

https://www.gov.uk/guidance/claim-income-tax-relief-for-your...

Web 3 mars 2016 nbsp 0183 32 complete Self Assessment tax returns except current year claims are claiming for expenses over 163 2 500 are claiming for more than 5 different jobs When

HMRC Give Tax Relief Pre approval Save The Thorold Arms

How To Stop Trading As Self Employed And Inform The HMRC

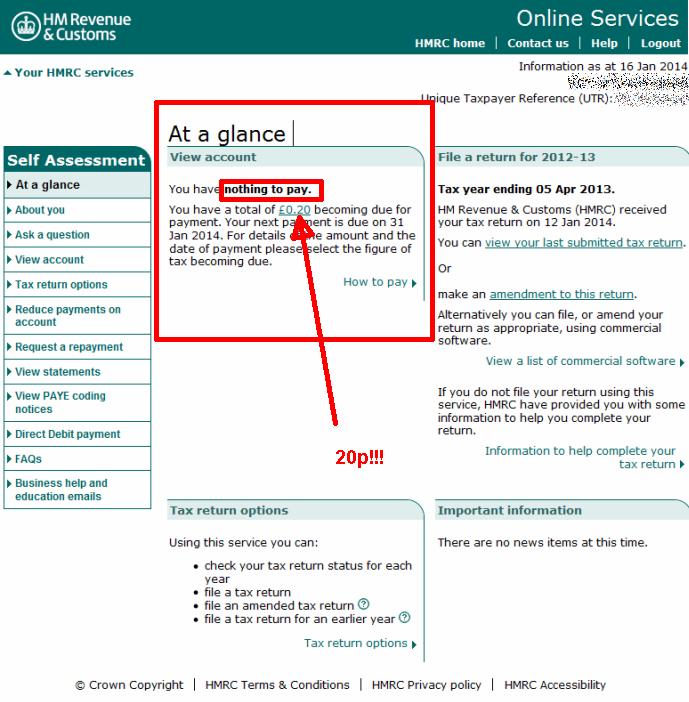

January 2014 Andysworld

HMRC Simplified Expenses Explained Goselfemployed co

Cash Declaration HM Revenue Customs Hmrc Gov Fill Out Sign

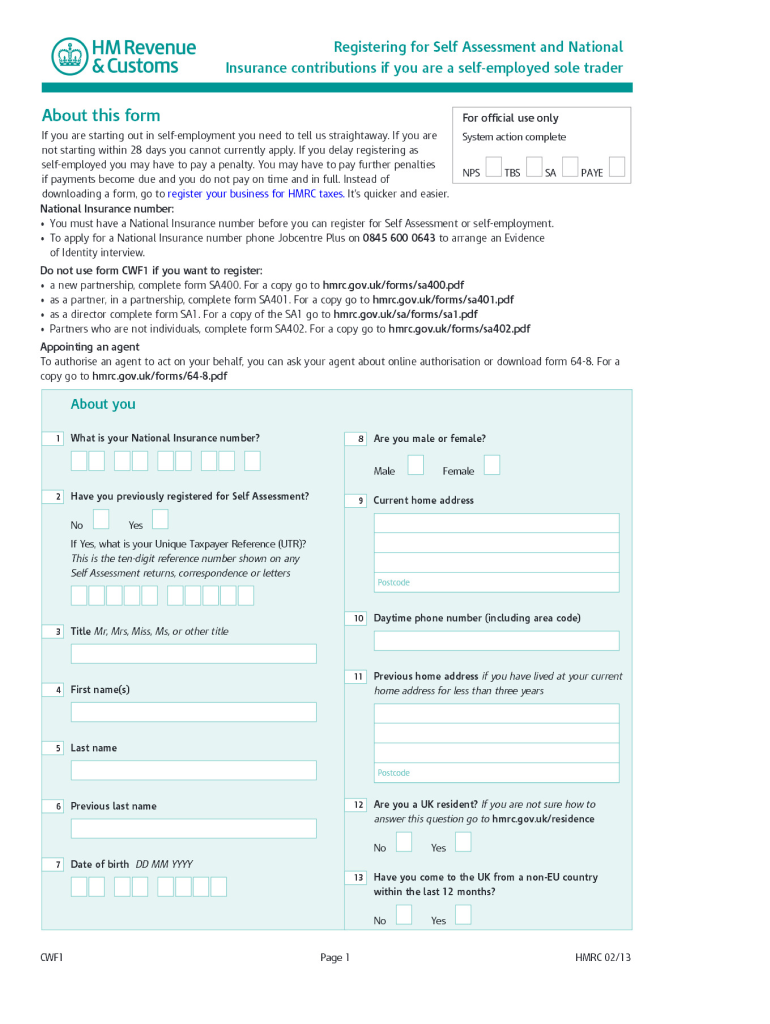

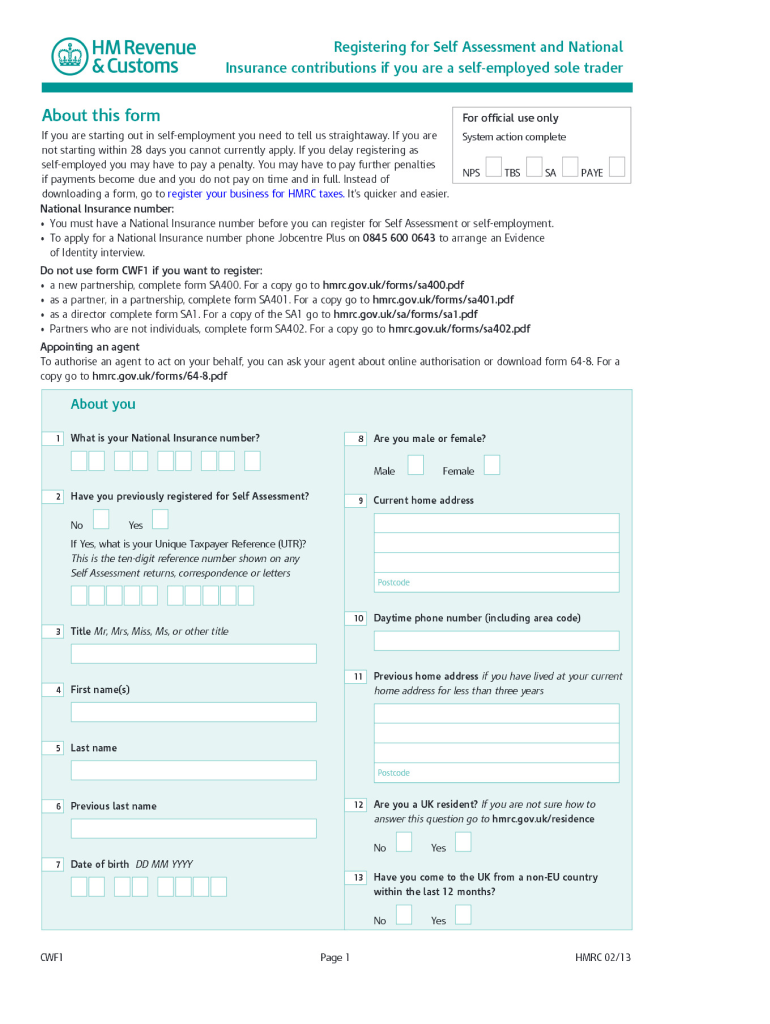

2013 2022 Form UK HMRC CWF1 Fill Online Printable Fillable Blank

2013 2022 Form UK HMRC CWF1 Fill Online Printable Fillable Blank

How To Appeal An HMRC Self Assessment Penalty SA370

What Is A Self Assessment Tax Return Form Go Self Employed

Sole Trader Personal Tax Green Accountancy

Hmrc Self Employed Tax Rebate - Web You can file your Self Assessment tax return online if you are self employed are not self employed but you still send a tax return for example because you receive income from