Call Hmrc Tax Return Monday to Friday 8am to 8pm Saturday 8am to 4pm Closed on Sundays and bank holidays Phone Call HMRC for help with questions about PAYE and Income Tax including issues with your tax

Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601 Contacting the HM Revenue Customs Income Tax Office by phone or in writing The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain

Call Hmrc Tax Return

Call Hmrc Tax Return

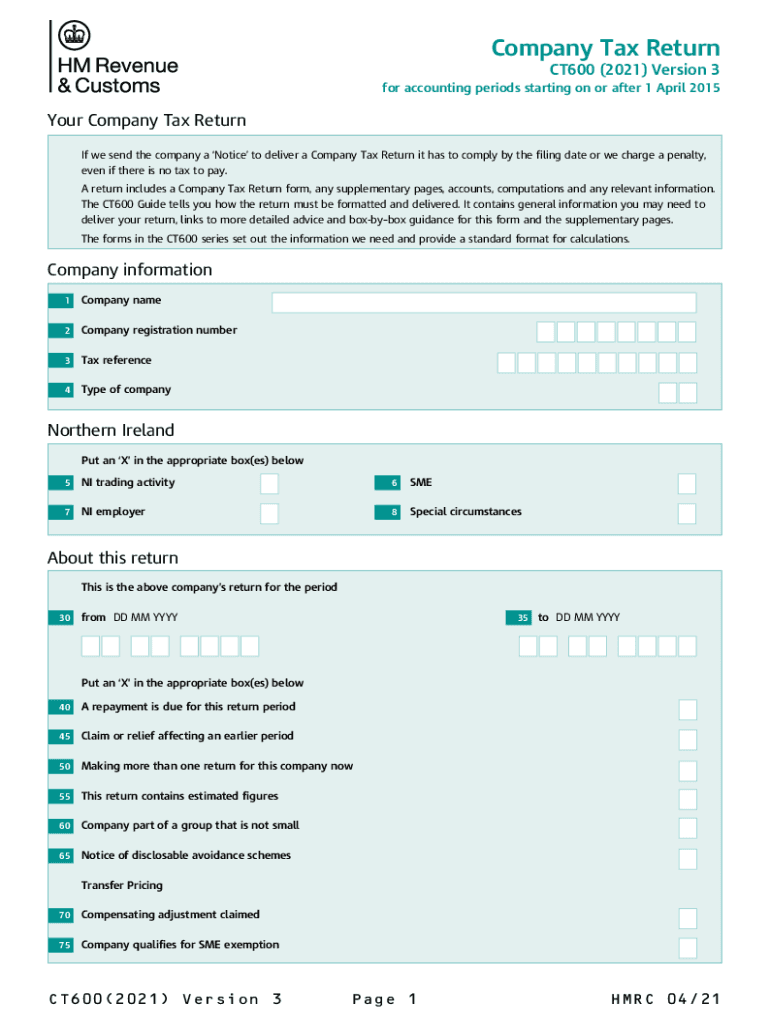

https://www.signnow.com/preview/560/820/560820246/large.png

HMRC No Longer Fining 100 For Late Tax Returns Market Business News

http://marketbusinessnews.com/wp-content/uploads/2015/02/HMRC.jpg

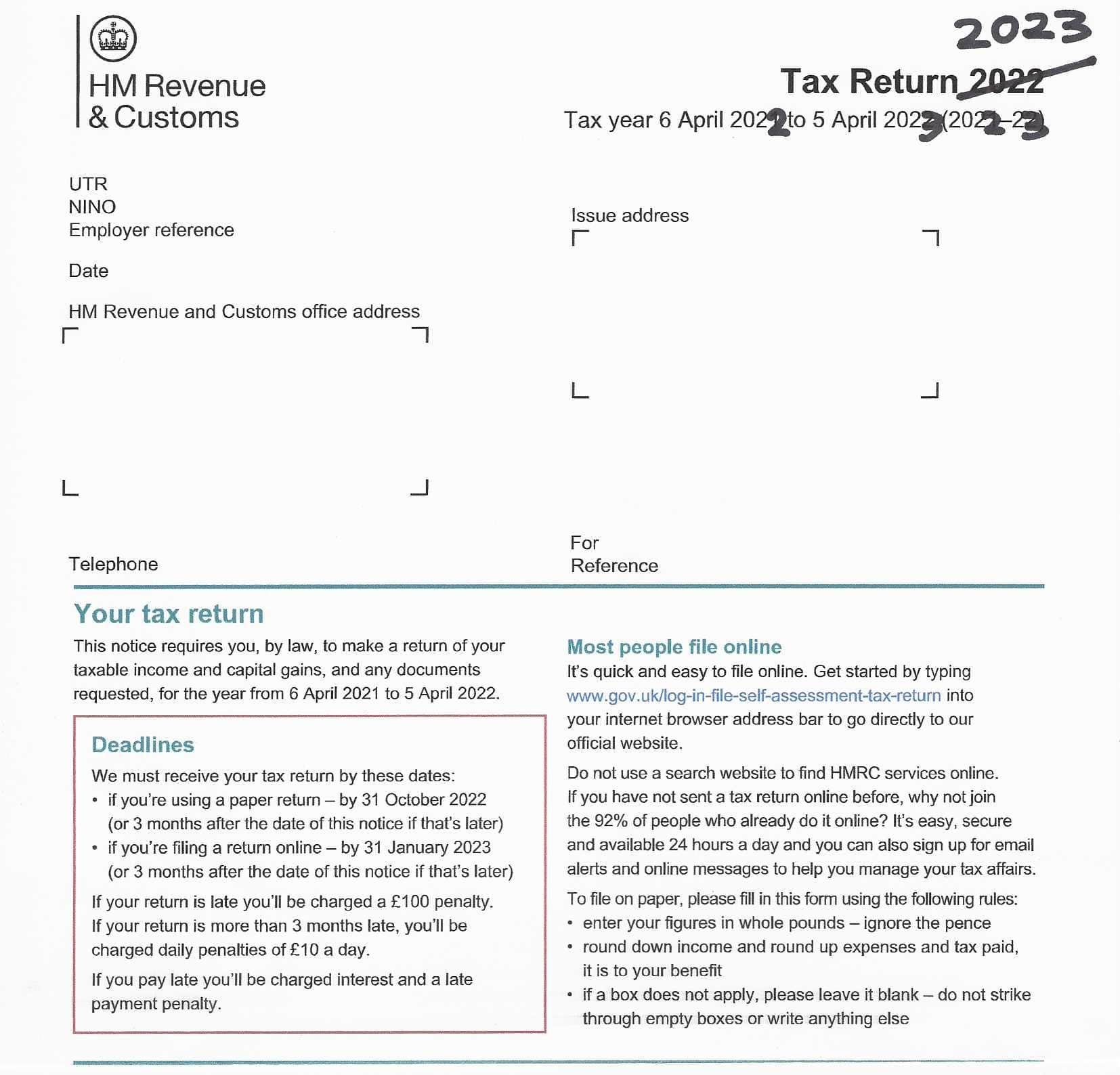

Trying To Locate The 2023 HMRC Paper Tax Return Form Online

https://taxhelp.uk.com/wp-content/uploads/Where-is-the-2023-HMRC-SA100-Tax-Return-Form-m.jpg

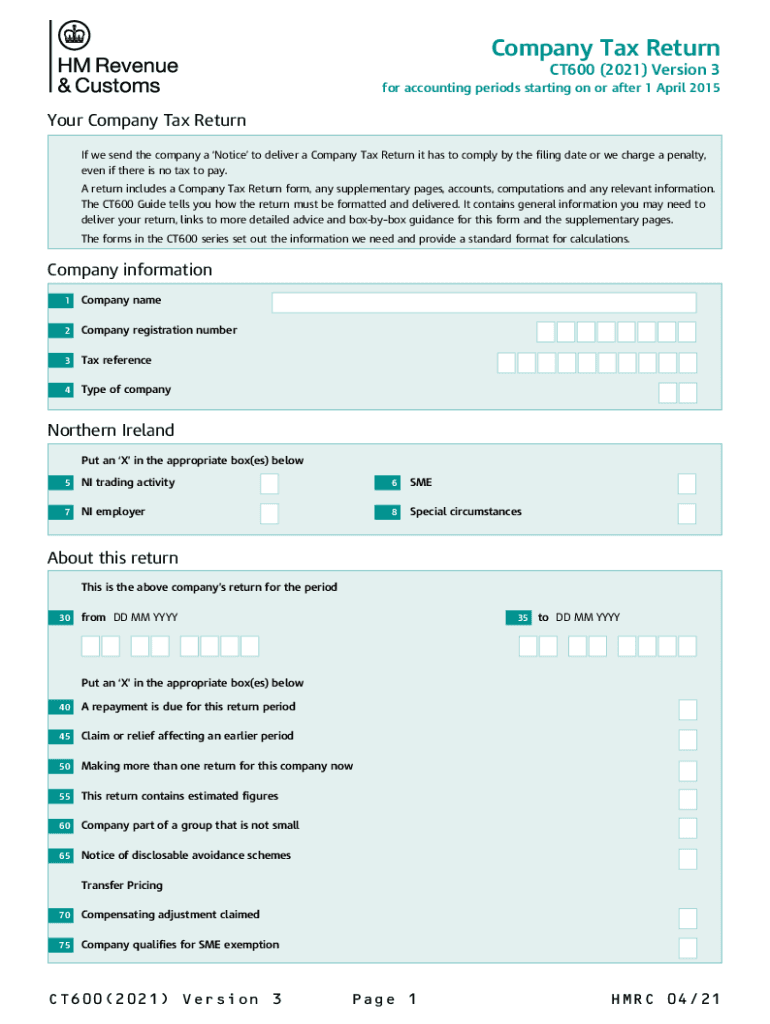

By Ben Locker on 2nd February 2023 Home Blog HMRC How to contact HMRC and avoid the phone queues IMPORTANT NOTE since publishing this piece we have received several calls to our own phone line from people who are clearly trying to contact HMRC THP is an accountancy firm and has no connection to HMRC 5 April 2022 Only use this form if your end of year date is 5 April 2022 If you started trading between 6 April 2020 and 5 April 2021 and made your first books up to 5 April 2021 put 05 04 2022 in box 3 4 If you made up your first books for a 12 month period after 5 April 2021 put that date in box 3 4

The best time to call is 8am There is a whole host of advice online which claims calling HMRC later in the week and in the afternoon helps reduce the time you spend in the queue Fortunately you can still speak to HMRC by phone live chat or post In this guide we ll cover everything you need to know about contacting HMRC including phone numbers email addresses and postal addresses as well as alternative means of contact or finding the answers to your questions

Download Call Hmrc Tax Return

More picture related to Call Hmrc Tax Return

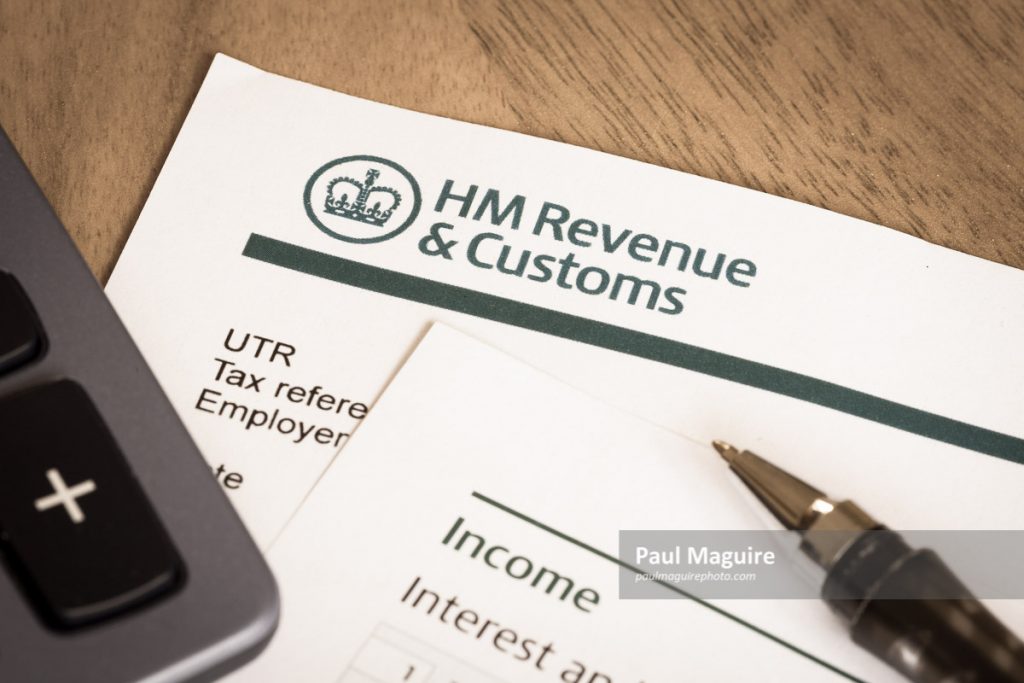

Stock Photo HMRC Tax Return Paul Maguire

https://paulmaguirephoto.com/wp-content/uploads/2020/07/c40910-1024x683.jpg

Examples Of HMRC Related Phishing Emails Suspicious Phone Calls And

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/149506/Example_of_a_scam_email.jpg

HMRC TAx Investigations Call Us On 020 8168 1680 For Your FREE

https://maxproaccountants.co.uk/wp-content/uploads/2019/07/HMRC-TAx-Investigations.jpg

The email or text call will promise a tax rebate and often ask for personal information such as your name address date of birth bank and credit card details including passwords and your mother s maiden name Need to contact HMRC Five tips for tackling delays 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not in my

Send your tax return to HMRC using the service provided by GoSimpleTax Calculate your tax bill Helpline for priority calls only Tax return customers are being warned not to call the self assessment helpline in the run up to next month s filing deadline with HMRC saying it will focus on priority calls only 05 Apr 2024 How to fill in a self assessment tax return Find out how fill out HMRC s self assessment tax return for the 2023 24 tax year and what income you need to declare Matthew Jenkin Senior writer In this article What is a self assessment tax return Who pays self assessment tax Step by step how to register for self assessment

H R BLOCK TAX RETURN PROGRAM FOR AT HOME On Mercari Tax Software Hr

https://i.pinimg.com/originals/88/7e/86/887e86a83d98bae3ff75acd7bb2e00a7.jpg

How To Check If HMRC Has Received Your Tax Return TaxScouts

https://taxscouts.com/wp-content/uploads/TaxScouts-og-image-278.png

https://www.gov.uk/government/organisations/hm...

Monday to Friday 8am to 8pm Saturday 8am to 4pm Closed on Sundays and bank holidays Phone Call HMRC for help with questions about PAYE and Income Tax including issues with your tax

https://www.lovemoney.com/guides/55286

Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601

OS Payroll Your P60 Document Explained

H R BLOCK TAX RETURN PROGRAM FOR AT HOME On Mercari Tax Software Hr

How To Obtain Your Tax Calculations And Tax Year Overviews

How To Obtain Your Tax Calculations And Tax Year Overviews

Call HMRC In The Morning For Shorter Waiting Times Untied

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC To Begin Contacting Self employed Who May Be Eligible For Support

2016 HMRC Tax Return Form

Hmrc X Rates Management And Leadership

Call Hmrc Tax Return - By Ben Locker on 2nd February 2023 Home Blog HMRC How to contact HMRC and avoid the phone queues IMPORTANT NOTE since publishing this piece we have received several calls to our own phone line from people who are clearly trying to contact HMRC THP is an accountancy firm and has no connection to HMRC