Can A Student Claim Rent On Income Tax In Ontario Can a Student Claim Rent on Tax Return in Canada A student cannot claim rent on a tax return in Canada as a deduction or credit However students in

If you are a first year or an upper year student who lives in a dorm or other on campus housing you are eligible to claim the cost of your room on your tax return and get a 25 The Ontario Income Tax Act stipulates that all students living in designated university tax exempted student residences are limited to an Ontario Energy and Property Tax Credit

Can A Student Claim Rent On Income Tax In Ontario

Can A Student Claim Rent On Income Tax In Ontario

https://filingtaxes.ca/wp-content/uploads/2021/11/Taxes-you-will-You-Pay-on-Used-Cars-in-Canada-1.jpg

Different Ways To Save Income Tax In India Under Section 80C

https://i.pinimg.com/originals/2b/99/cb/2b99cb347a93577e2e11ab53512dc436.png

How Are Income Taxes Calculated The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10-1.jpg

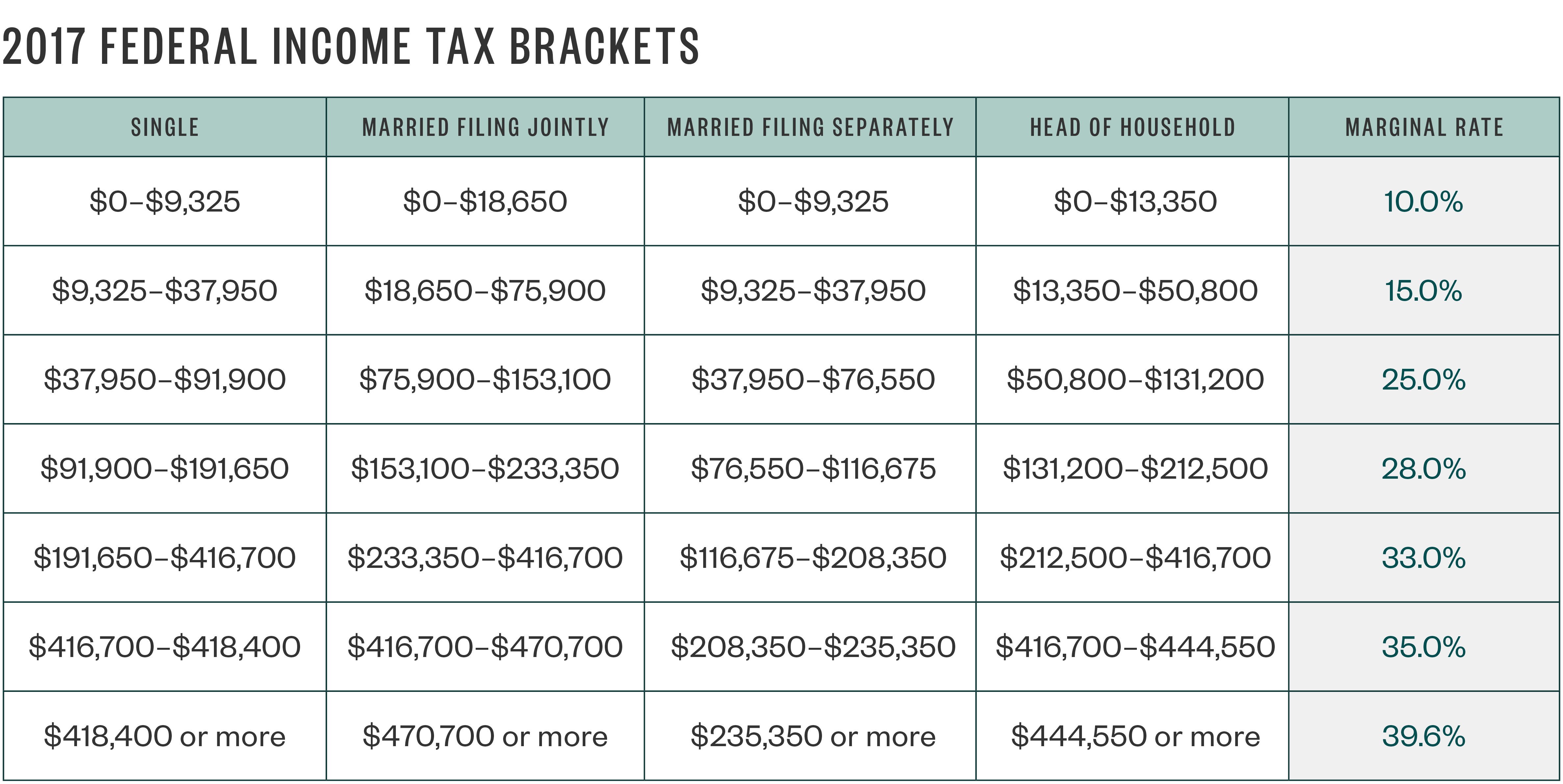

If you paid rent in Ontario and had a lower income you may be able to claim a tax credit Learn more in this article and get your maximum tax refund The Ontario Income Tax Act stipulates that all students living in designated university student residences are limited to an Ontario Energy and Property Tax Credit claim

Similar to the OTB only one person per household can claim the renter s tax credit Unlike the OTB if you share accommodations with roommates only one of you can claim an No the rental expense cannot be claimed as either a tax deduction or a tax credit However the student may be eligible for the Ontario Energy and

Download Can A Student Claim Rent On Income Tax In Ontario

More picture related to Can A Student Claim Rent On Income Tax In Ontario

Cukai Pendapatan How To File Income Tax In Malaysia JobStreet Malaysia

https://media.graphassets.com/j9n1ArmpRreKvI9fooEq

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Top 1 Pay Nearly Half Of Federal Income Taxes

https://image.cnbcfm.com/api/v1/image/102558054-538528619.jpg?v=1532564324

There s no tax deduction for paying rent But you should be able to claim it for the trillium benefit If you get reassessed they won t even look at a lease So a lease doesn t matter Rent for Student residence Ontario Frequently Asked Questions FAQs Customer Service 110 Promotions Pricing Rental income Claim for percentage of

To claim rent on your taxes in Ontario you need to fill out Form T776 Statement of Real Estate Rentals This form allows you to report your rental income If you were a student in 2023 the Guide P105 Students and Income Tax will give you helpful information about filing your 2023 Income Tax and Benefit Return If you are in

5 Tax Tips For Students BCJ Group

https://www.bcjgroup.ca/assets/uploads/2017/04/taxtipsforstudent.jpg

What Can A Student Claim On Tax Deductions Universal Taxation

https://www.universaltaxation.com.au/wp-content/uploads/2018/08/What-Can-a-Student-Claim-on-Tax-Deductions-1-720x380.jpg

https://accountor.ca/blog/taxation/claiming-rent...

Can a Student Claim Rent on Tax Return in Canada A student cannot claim rent on a tax return in Canada as a deduction or credit However students in

https://uwaterloo.ca/.../paying-rent-tax-requirements-and-liabilities

If you are a first year or an upper year student who lives in a dorm or other on campus housing you are eligible to claim the cost of your room on your tax return and get a 25

Personal Income Tax Rate 2018 Joanne Walsh

5 Tax Tips For Students BCJ Group

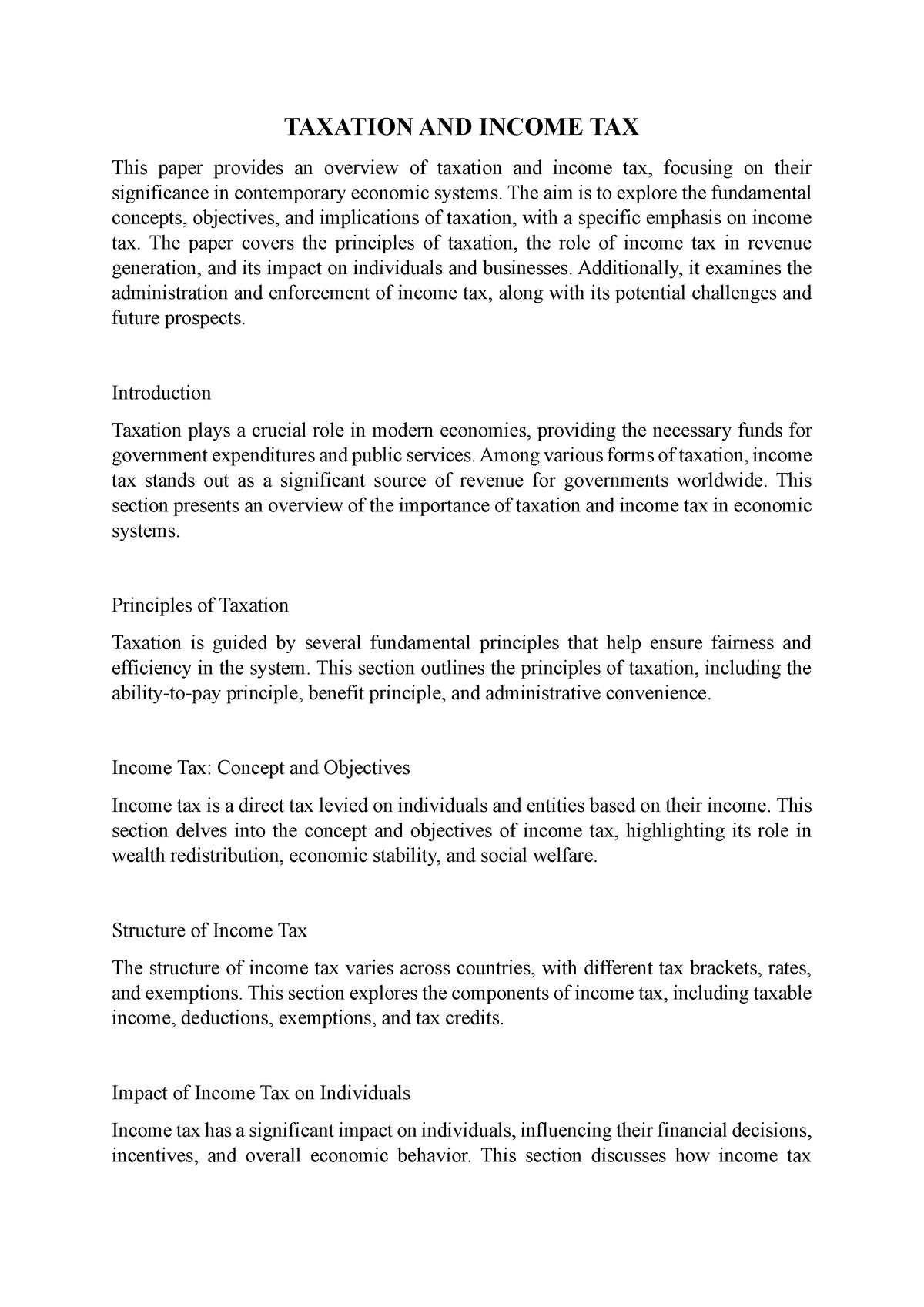

Taxation AND Income TAX TAXATION AND INCOME TAX This Paper Provides

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

2017 Irs Tax Tables Head Of Household Awesome Home

How To Claim Rent On Taxes In 2022 2023 Filing Taxes

How To Claim Rent On Taxes In 2022 2023 Filing Taxes

Tax Information Every US Citizen Working In Canada Must Know

How To Claim Rent On Taxes In 2022 Filing Taxes

How To Claim Rent On Taxes In 2022 2023 Filing Taxes

Can A Student Claim Rent On Income Tax In Ontario - Students can claim various tax credits and deductions for items such as tuition costs moving expenses and student loan interest to reduce the taxes they owe