Can An Individual Claim Vat Back Not everyone can claim VAT back To be eligible you must be a VAT registered business This means you ve registered with HM Revenue and Customs

This notice explains how businesses established outside of the UK can reclaim VAT incurred in the UK It also explains that UK and Isle of Man businesses can You can reclaim VAT paid on goods or services bought before you registered for VAT if you bought them within 4 years for goods you still have or goods that were used to make

Can An Individual Claim Vat Back

Can An Individual Claim Vat Back

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

How To Claim VAT Back On Expenses Accounting Education Business

https://i.pinimg.com/originals/cd/cb/3e/cdcb3e969a7204deb4cf7a6386aff6d2.png

How To Claim Back VAT VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

Retailers can either refund the VAT directly or use an intermediary One of these parties may charge a fee which may be withheld from the refunded VAT amount More on VAT You must state how much VAT your business has been charged within the accounting period for goods and services you can claim VAT back on If a purchase is also for

You may be able to claim a refund of VAT charged in an EU member state on or after 1 January 2021 if you re VAT registered in the UK Who can claim back VAT You can only claim back VAT if you are a VAT registered business Your business must be registered for VAT if your VAT taxable

Download Can An Individual Claim Vat Back

More picture related to Can An Individual Claim Vat Back

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

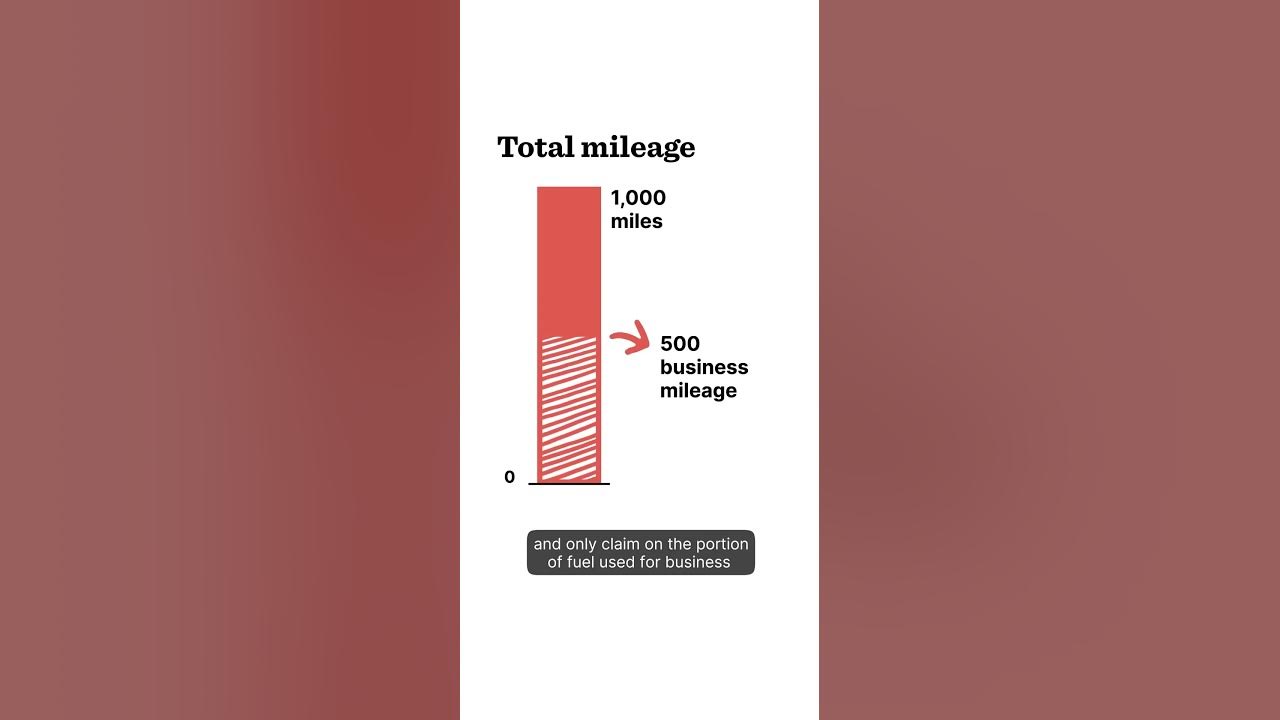

Can You Claim VAT Back On Fuel YouTube

https://i.ytimg.com/vi/749I1hBjINc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4HgAKAD4oCDAgAEAEYfyA3KDUwDw==&rs=AOn4CLDi0gj9PvsXVLxYspSIj3mVyqob1g

How To Claim VAT Back On Expenses Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/07/claiming-back-vat.png

If you re registered for VAT you can claim that back You do this by reporting how much VAT you paid during a period of time HMRC balances the amount you ve paid against If you meet the conditions you can use the system to claim back VAT on invoices for goods only You will need to use 13 th Directive process for everything else such as VAT on

While visitors to the UK won t be able to reclaim VAT on items they purchase and take home with them any non EU visitors who purchase items in store and have What can you claim VAT back for There are many things that you can claim VAT back for as a self employed individual It is important to keep in mind that everything you

Can You Claim Vat Back On Fuel Without A Receipt RECHARGUE YOUR LIFE

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1.jpg

SELF EMPLOYED BUSINESS EXPENSES WHAT CAN YOU CLAIM Clear Accounts UK

https://www.clearaccountsuk.com/wp-content/uploads/2014/03/Fotolia_57453722_S.jpg

https://www.protaxaccountant.co.uk/post/how-to-claim-vat-back

Not everyone can claim VAT back To be eligible you must be a VAT registered business This means you ve registered with HM Revenue and Customs

https://www.gov.uk/guidance/refunds-of-uk-vat-for...

This notice explains how businesses established outside of the UK can reclaim VAT incurred in the UK It also explains that UK and Isle of Man businesses can

Why Businesses Are Allowed To Claim VAT Back Online Accounting Guide

Can You Claim Vat Back On Fuel Without A Receipt RECHARGUE YOUR LIFE

How To Claim A VAT Refund Everything You Need To Know

How To Claim VAT Refund An EU Guide

How To Claim VAT Back On Expenses Finance Blog Bookkeeping Software

The Right To Claim Back VAT

The Right To Claim Back VAT

Discover 88 About Register Trademark Australia Cool NEC

All You Need To Know About VAT In South Africa Contador Accountants

SARS EFiling How To Submit Your ITR12 YouTube

Can An Individual Claim Vat Back - Retailers can either refund the VAT directly or use an intermediary One of these parties may charge a fee which may be withheld from the refunded VAT amount More on VAT