Can Capital Gains Be Taxed As Income Income Tax and Capital Gains Tax are two entirely separate taxes with each having is own tax free element In 2023 to 2024 Income Tax has a personal allowance of

Under current law this capital gain is taxed as income but at a reduced rate top rate of 23 8 percent top rate The classification and taxation of capital gains as income is based on the Haig Simons definition of income Short term capital gains assets held for one year or less are taxed as ordinary income at a rate based on the individual s tax filing status and adjusted

Can Capital Gains Be Taxed As Income

Can Capital Gains Be Taxed As Income

https://cdn.equitymultiple.com/wp-content/uploads/2022/04/Capital-Gains-Tax-Charts-1.png

How Long Can Capital Gains Be Carried Forward

https://www.realized1031.com/hs-fs/hubfs/Images/photo/abstract/many-money-signs-IS-1221154658.jpg?width=753&height=500&name=many-money-signs-IS-1221154658.jpg

Can Capital Gains Push Me Into A Higher Tax Bracket YouTube

https://i.ytimg.com/vi/QBAn7LRC0_0/maxresdefault.jpg

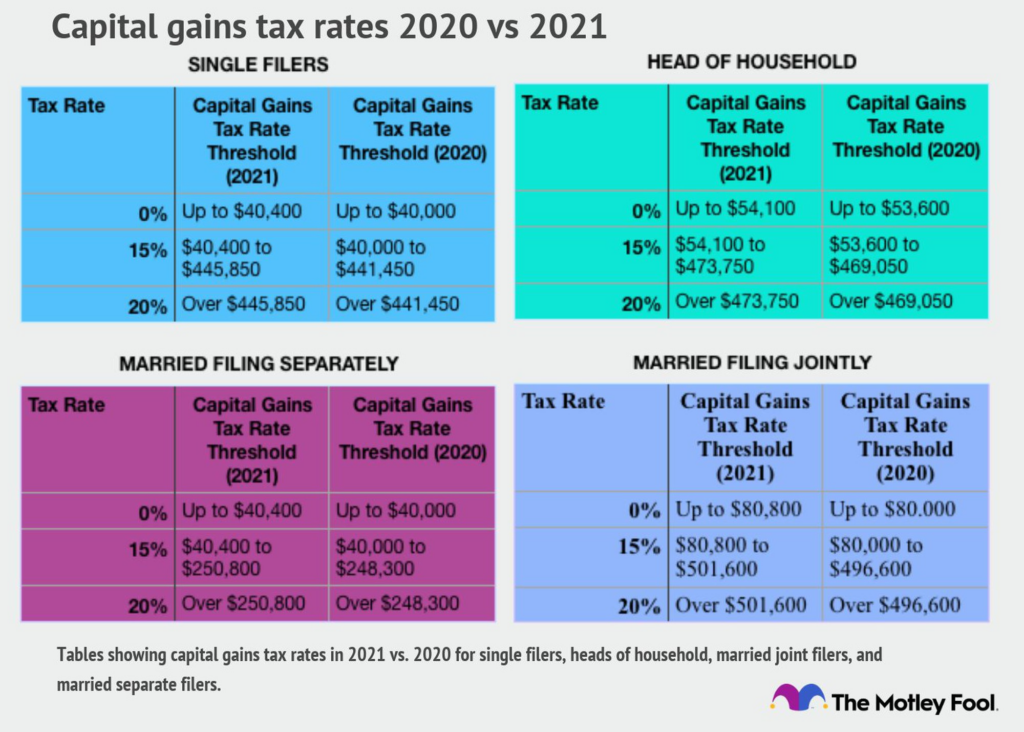

The tax rates for capital gains vary based on your income level and how long you ve held the asset Long term capital gains rates range from 0 to 20 depending on the taxpayer s income Short term capital gains however Short term capital gains are taxed as ordinary income at rates up to 37 percent long term gains are taxed at lower rates up to 20 percent Taxpayers with modified adjusted gross income above certain amounts are subject to an

Net capital gains are taxed at different rates depending on overall taxable income although some or all net capital gain may be taxed at 0 For taxable years beginning in 2024 the tax rate on Short term capital gains taxes apply to assets held for one year or less and are taxed at the investor s ordinary income tax rate which can be higher Long term capital gains taxes apply to assets

Download Can Capital Gains Be Taxed As Income

More picture related to Can Capital Gains Be Taxed As Income

How Should Capital Gains Be Taxed WSJ

https://s.wsj.net/public/resources/images/BI-AA907_TAX_J_20150225133113.jpg

Capital Gains Are The Profits You Make From Selling Your Investments

https://www.businessinsider.in/photo/79520838/Master.jpg

Are Social Security Benefits Taxed As Income Senior Security Alliance

https://seniorsecurityalliance.org/wp-content/uploads/2021/01/income-tax-4097292_1280-e1609977755433.jpg

A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares Here s how to calculate it and minimize it Until you reach the 15 Long Term Capital Gains tax bracket you pay zero on the capital gains that stack on top of your ordinary income Above that amount you are now in the 15 LTCG tax bracket and pay 15

Capital gains are taxed in the taxable year they are realized Your capital gain or loss is generally realized for tax purposes when you sell a capital asset The tax rate on capital gains depends on the nature of the gain short term or long term and the taxpayer s overall income level Short term capital gains are generally taxed at

Capital Gains Are The Profits You Make From Selling Your Investments

https://www.businessinsider.in/photo/79520921/capital-gains-are-the-profits-you-make-from-selling-your-investments-and-they-can-be-taxed-at-lower-rates.jpg?imgsize=294607

What Is Capital Gains Tax On Property And How To Calculate It

https://psgroup.in/blog/wp-content/uploads/2021/02/istockphoto-1141156865-612x612-1.jpg

https://community.hmrc.gov.uk › customerforums › cgt

Income Tax and Capital Gains Tax are two entirely separate taxes with each having is own tax free element In 2023 to 2024 Income Tax has a personal allowance of

https://taxfoundation.org › blog › should-c…

Under current law this capital gain is taxed as income but at a reduced rate top rate of 23 8 percent top rate The classification and taxation of capital gains as income is based on the Haig Simons definition of income

Closing A Business Be Tax Efficient With This Beneficial Liquidation

Capital Gains Are The Profits You Make From Selling Your Investments

Social Security Benefits Should Never Be Taxed As Income Senior

Capital Gains Tax Explained How Stocks Are Taxed YouTube

What Are The Capital Gains Tax Rates Armstrong Advisory Group

Capital Gains Tax Notes GAINS DERIVED FROM DEALINGS IN PROPERTY

Capital Gains Tax Notes GAINS DERIVED FROM DEALINGS IN PROPERTY

Three Ways Income Can Be Taxed When You Retire The Financial

Capital Gains Tax And Property CHANGES To How You Report And Pay Your

Capital Gains Tax An Unavoidable Reality Passive Income M D

Can Capital Gains Be Taxed As Income - The tax rates for capital gains vary based on your income level and how long you ve held the asset Long term capital gains rates range from 0 to 20 depending on the taxpayer s income Short term capital gains however