Can Home Improvement Loan Be Tax Deductible Web 4 Aug 2021 nbsp 0183 32 Home improvement loans are also tax deductible when you buy a home At the time of purchase you can take out additional money to make renovations That money is built into your mortgage You then get tax

Web 27 Feb 2023 nbsp 0183 32 Home improvement loans generally aren t eligible for federal tax deductions even when used for eligible renovations or property improvements Unlike home equity loans which can Web 25 Mai 2023 nbsp 0183 32 Y es you can write off home improvements but should always consult a tax professional According to the IRS you can deduct interest paid on home equity loans if they re used to buy build or substantially improve a taxpayer s home that secures the loan The IRS defines this under Publication 936 called the Home Mortgage Interest

Can Home Improvement Loan Be Tax Deductible

Can Home Improvement Loan Be Tax Deductible

https://newviewroofing.com/wp-content/uploads/2019/04/file.jpg

What Home Improvements Are Tax Deductible YouTube

https://i.ytimg.com/vi/xfYwh0s16mQ/maxresdefault.jpg

Home Improvement Loans Pros Cons McDonough Construction

https://mcdonoughconstructionllc.com/wp-content/uploads/2020/09/AdobeStock_248582467-1-scaled.jpeg

Web 22 Juni 2023 nbsp 0183 32 Home improvement tax deduction Qualifying improvements to your home that qualify for tax deductions What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks Web 3 Feb 2023 nbsp 0183 32 You can t deduct capital improvements from your taxes until you sell your home What is a capital improvement The IRS defines a capital improvement as an improvement that Adds to

Web Discover if your home improvement expenses are tax deductible Learn the rules and guidelines of home improvement loans in our comprehensive guide Web Home improvement loan You can also fully deduct in the year paid points paid on a loan to substantially improve your main home if you meet the first six tests listed earlier

Download Can Home Improvement Loan Be Tax Deductible

More picture related to Can Home Improvement Loan Be Tax Deductible

Ergeon How Your Fence Can Be Tax Deductible

https://assets-global.website-files.com/5ad551c41ca0c52724be6c55/6059e280542a77693a187cdc_Tax deductible.jpg

Tax deductible Ways Of Giving For Ukraine Business News

https://i0.wp.com/imageio.forbes.com/specials-images/imageserve/62212aac2112de3b8fb8fc94/0x0.jpg

What Home Improvement Loans Are Tax Deductible Revolution Report

https://time.com/nextadvisor/wp-content/uploads/2021/02/na-home-equity-loans-tax-deductible-1000x512.jpg

Web 19 Okt 2023 nbsp 0183 32 Federal Tax Deductions for Home Renovation Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 October 19 2023 8 08 AM OVERVIEW There are a number of ways that you can use home renovations and improvements to minimize your taxes TABLE OF CONTENTS Looking to spruce up Web You can no longer claim the deduction for 2022 Reminders Home equity loan interest No matter when the indebtedness was incurred you can no longer deduct the interest from a loan secured by your home to the extent the loan proceeds weren t used to buy build or substantially improve your home Home mortgage interest

Web Are Home Improvement Loans Tax Deductible Compare monthly payment options from several lenders in under 2 minutes Check Offers Excellent 4 7 out of 5 based on 623 reviews Can You Deduct Home Improvement Loans For Taxes Web 6 Home improvements Necessary improvements to your home may be tax deductible For example you might need to update the home for medical reasons or to make the home accessible for someone with

7 Things To Consider Before You Apply For A Home Loan In India Loan

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEipxWF8H_Aq7SeppBfytkFg6LPVk_hhk5a5cXFvwS_UNDLECUyitau3mUyhjEaLNaQS5iRo3s-qhqVVpeVWOSeJz7iGqHLjeakyCZ7pfee6AcHTqZsjBJMzUpw_C-m9XLAw9PiNnOaGwKvL0ZoftkxTfy_U1ATlZ_XpOLkfzb7rj7Ak2tnmKwIcSrh8Sg/s16000/home loan in india.jpg

Are Home Improvement Loans Tax Deductible Not Always SuperMoney

https://d15584r18i7pqj.cloudfront.net/wp-content/uploads/2018/06/Are-Home-Improvement-Loans-Tax-Deductible.jpg

https://www.supermoney.com/are-home-improvement-loans-tax-deductible

Web 4 Aug 2021 nbsp 0183 32 Home improvement loans are also tax deductible when you buy a home At the time of purchase you can take out additional money to make renovations That money is built into your mortgage You then get tax

https://www.bankrate.com/.../are-home-improvement-loans-tax-deductible

Web 27 Feb 2023 nbsp 0183 32 Home improvement loans generally aren t eligible for federal tax deductions even when used for eligible renovations or property improvements Unlike home equity loans which can

Is My Business Loan Repayment Tax Deductible IIFL Finance

7 Things To Consider Before You Apply For A Home Loan In India Loan

Tax Deductible Donations Bold

What Home Improvements Are Tax Deductible Budget Dumpster In 2021

What Capital Improvements Are Tax Deductible Tax Deductions Home

Investment Expenses What s Tax Deductible Charles Schwab

Investment Expenses What s Tax Deductible Charles Schwab

Deductible Tax Home Improvements

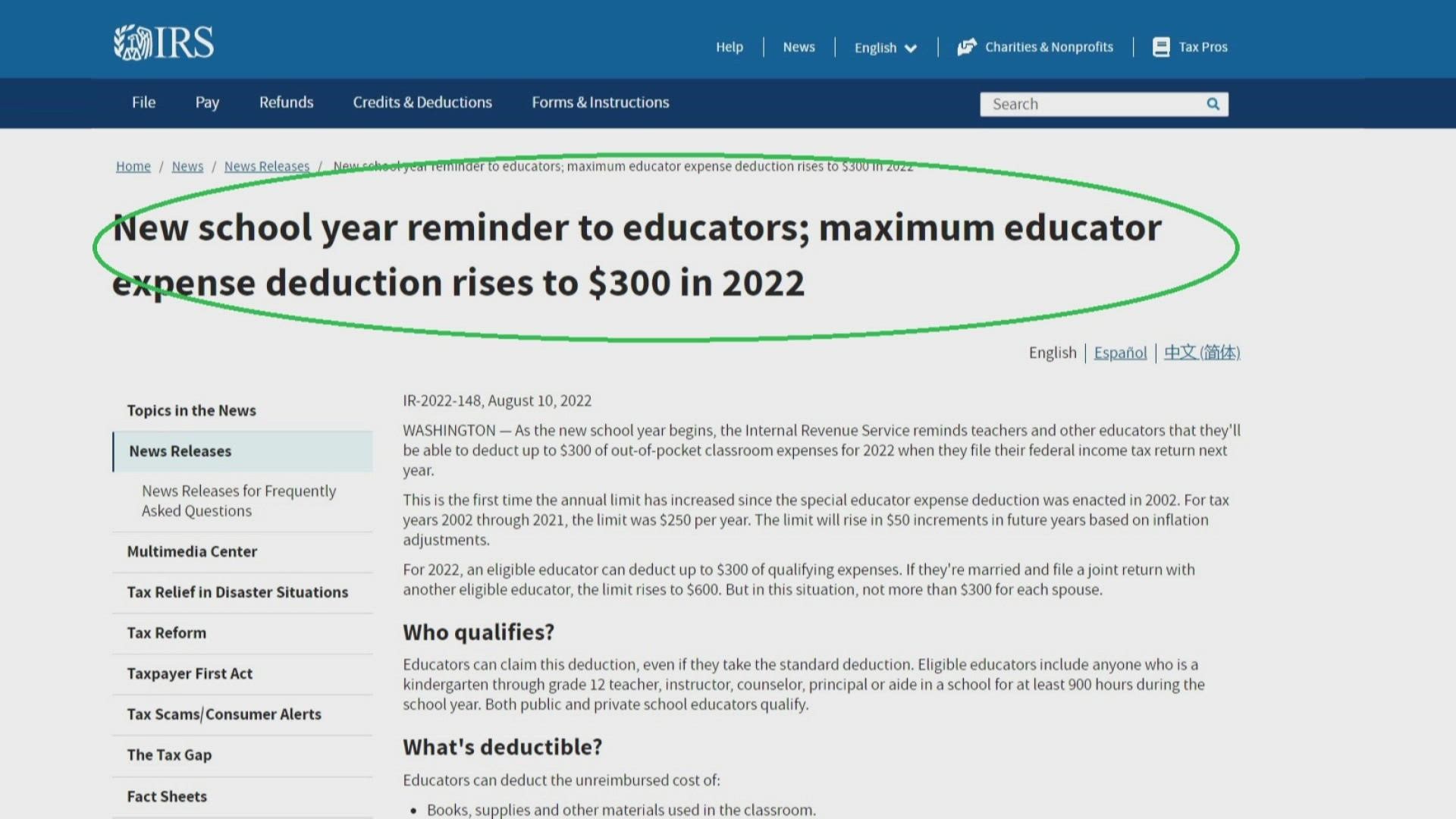

School Supplies Are Tax Deductible Wfmynews2

Is Your Business Loan Tax Deductible

Can Home Improvement Loan Be Tax Deductible - Web 10 Jan 2023 nbsp 0183 32 Key takeaways Many home improvement projects don t qualify for tax deductions But some might qualify for a tax break or have other tax implications Energy efficiency and medically necessary upgrades may be eligible for tax credits that decrease your tax burden or lead to tax refunds