Can Hsa Funds Be Transferred To Ira To roll over IRA funds into your HSA you can contact your IRA recordkeeper and request the transfer Most allow you to do this online over the phone or by mail The process reflects the one you d

You can roll over funds from an IRA to an HSA but you must be eligible to make HSA contributions and cannot roll over more than the annual contribution limit for the year To rollover IRA funds into your HSA you can contact your IRA recordkeeper and request the transfer Most allow you to do this online over the phone or by mail

Can Hsa Funds Be Transferred To Ira

Can Hsa Funds Be Transferred To Ira

https://myhealthmath.com/wp-content/uploads/2022/08/HSA-Investments-Blog.png

Expenses Can Hsa Funds Be Used For Dog Care PetShun

https://petshun.com/images/resources/can-i-use-hsa-for-dog_20230604230747.webp

Can HSA Funds Be Withdrawn Under 1 Min YouTube

https://i.ytimg.com/vi/e9A3t47Na6Q/maxresdefault.jpg

When transferring funds from an IRA to an HSA The IRS allows customers to complete a once per lifetime transfer from an IRA account to an HSA Below are a few of the An IRA to HSA rollover is usually a one time financial move that could help you bolster your savings for qualified medical expenses You can also fund your HSA

You can move funds from an IRA to an HSA only if you re eligible to contribute to your HSA In other words you need to do the transfer while you re covered If you want qualify for an HSA and want to fund it but are short of funds you might be able to fund the HSA from your IRA using a qualified HSA funding

Download Can Hsa Funds Be Transferred To Ira

More picture related to Can Hsa Funds Be Transferred To Ira

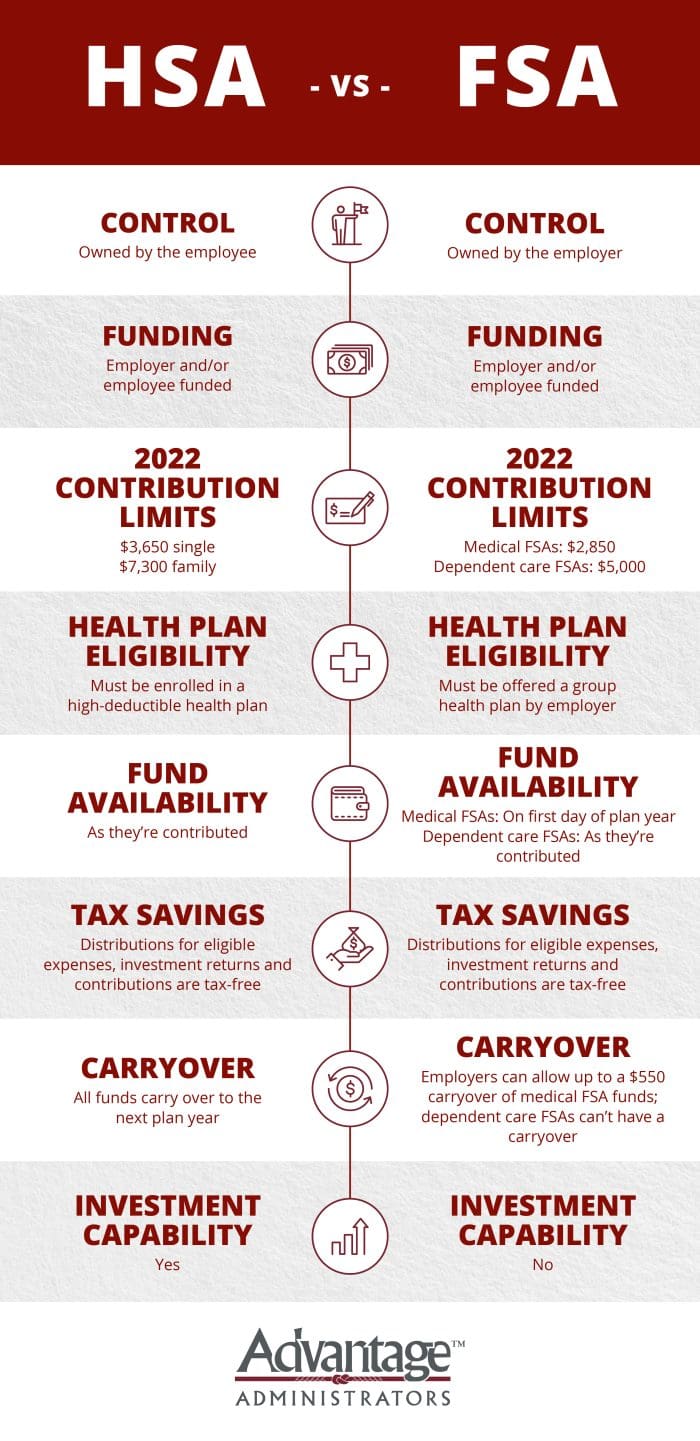

Flexible Spending Account FSA Vs Health Savings Account HSA

https://resourcingedge.com/wp-content/uploads/2019/07/FSA-vs-HSA-Resourcing-Edge.jpg

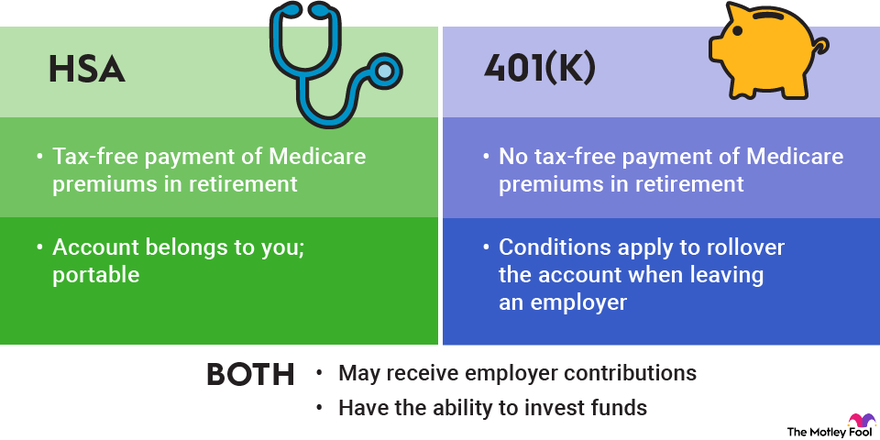

HSA Vs 401 k Which Should You Choose To Invest In The Motley Fool

https://m.foolcdn.com/media/dubs/images/HSA-vs-401k-plans-infographic.width-880.png

:max_bytes(150000):strip_icc()/HSA_Authority-b924148581ee425b896613cef31d9083.jpg)

The 6 Best Health Savings Account HSA Providers Of 2022

https://www.investopedia.com/thmb/HkiFzZlGA83vchYbmW37ygLnjCc=/1718x320/filters:no_upscale():max_bytes(150000):strip_icc()/HSA_Authority-b924148581ee425b896613cef31d9083.jpg

After age 65 your HSA now works just like a traditional IRA There are no penalties for withdrawing the money in your account you will just pay ordinary income tax on the money As such you can leverage You can only roll your HSA funds into another HSA However the government does allow a one time transfer of funds from an IRA to an HSA The transferred amount when

Savers who are focused on the wealth building features of health savings accounts HSAs are often surprised to learn that they can roll funds from an individual The HSA is funded with pretax dollars the funds grow tax deferred and distributions are tax free if used to cover qualified health expenses So with proper

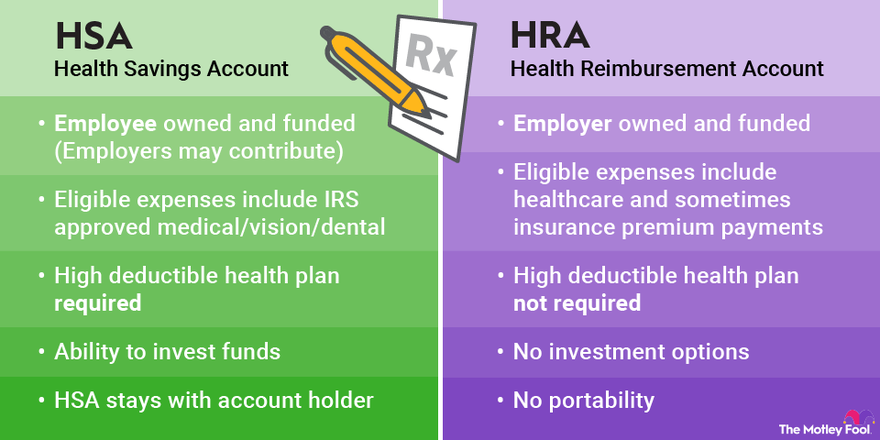

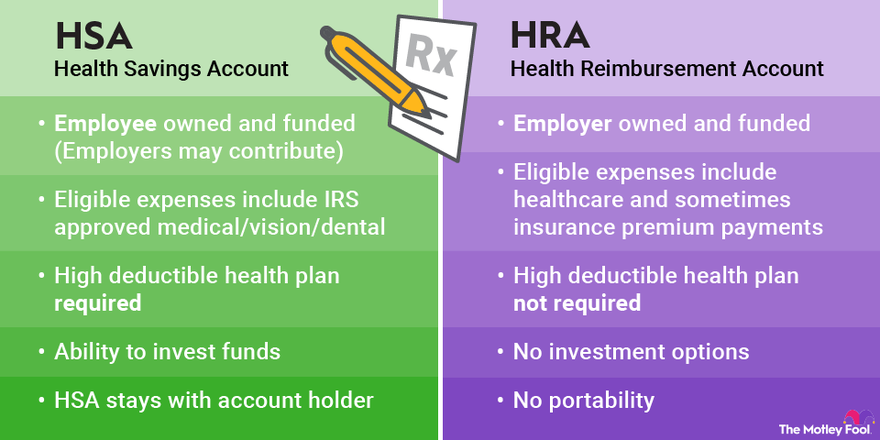

Top 17 Hra Vs Hsa Vs Fsa 2022

https://m.foolcdn.com/media/dubs/images/HRA-vs-HSA-plans-infographic.width-880.png

Using A Health Savings Account HSA To Pay For Childbirth Intrepid

https://static.twentyoverten.com/5d5413591d304774fba39eb3/9CD5sTbawrq/HSA_Childbirth_infographic.jpg

https://smartasset.com/checking-accoun…

To roll over IRA funds into your HSA you can contact your IRA recordkeeper and request the transfer Most allow you to do this online over the phone or by mail The process reflects the one you d

https://www.fool.com/retirement/plans/hsa/rollover

You can roll over funds from an IRA to an HSA but you must be eligible to make HSA contributions and cannot roll over more than the annual contribution limit for the year

5 Tips To Start Planning A Funeral Without Money In The USA

Top 17 Hra Vs Hsa Vs Fsa 2022

Strengthen Oversight Of Confidential Funds Inquirer Opinion

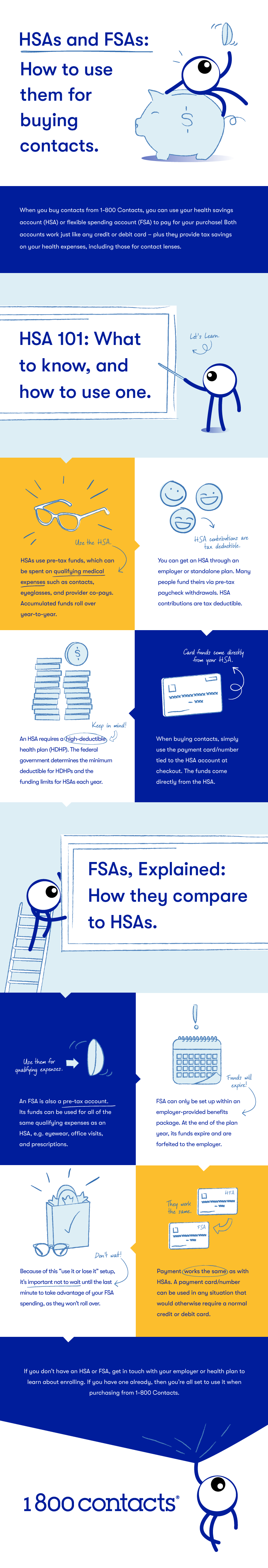

Can I Use My HSA Or FSA To Buy Contacts 1 800 Contacts

Does Hsa Carry Over To New Year 2023 Get New Year 2023 Update

USING AN HSA AS A RETIREMENT ACCOUNT RAA Blog

USING AN HSA AS A RETIREMENT ACCOUNT RAA Blog

IRS Makes Historical Increase To 2024 HSA Contribution Limits First

.png#keepProtocol)

When Should I Use My Health Savings Account

Letter To Bank To Release Funds AirSlate SignNow

Can Hsa Funds Be Transferred To Ira - You can make a tax free rollover into an HSA from an IRA but not from a 401 k 457 or other retirement plan However if you have a 401 k from a former