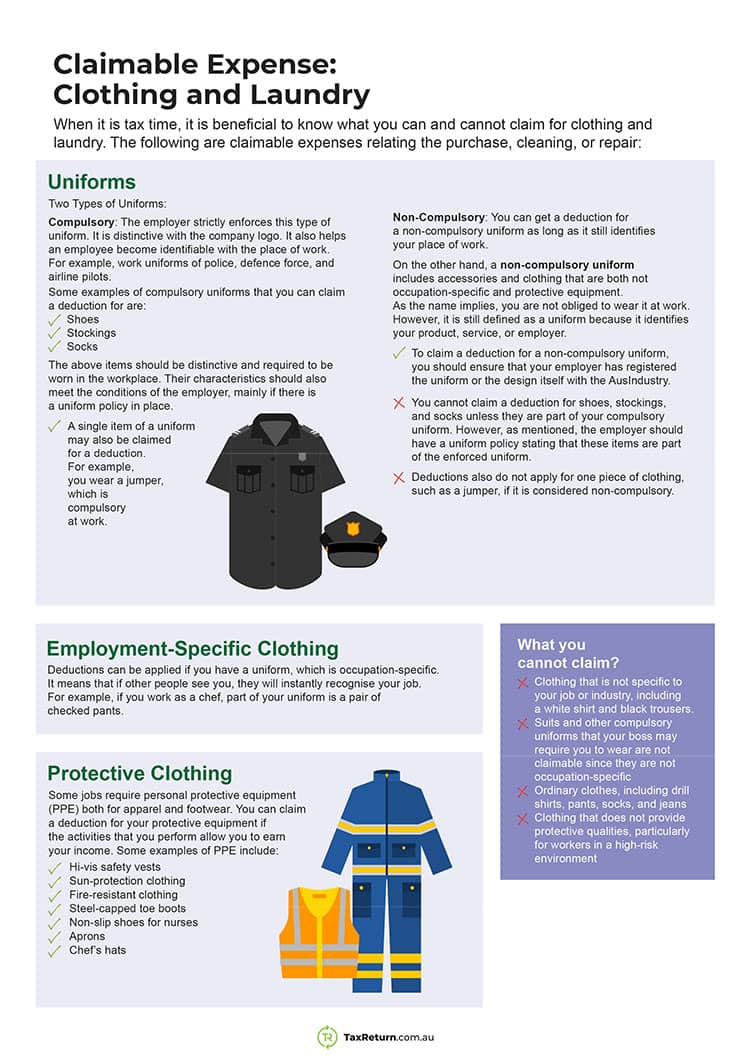

Can I Claim Clothing Expenses On My Taxes That s right the IRS allows for certain items of clothing to be written off as business expenses depending on how they re used Eligible pieces of clothing can be claimed alongside your other deductible expenses on Schedule C of your tax return You have to be self employed to write off your work clothes

As a result clothing that could be part of an everyday wardrobe is not allowable for tax relief 2 Is it a uniform If you have to buy a uniform that identifies clearly what you do you can put that into your accounts and claim tax relief on it An example would be a uniform for a self employed nurse June 22 2022 This article is Tax Professional approved Clothing is one of the more contested tax deductions and it tends to get rejected a lot But this doesn t mean you should avoid deducting work related clothing expenses on your tax return altogether

Can I Claim Clothing Expenses On My Taxes

Can I Claim Clothing Expenses On My Taxes

https://oneclicklife.com.au/wp-content/uploads/2022/08/LMITO-1024x874.jpg

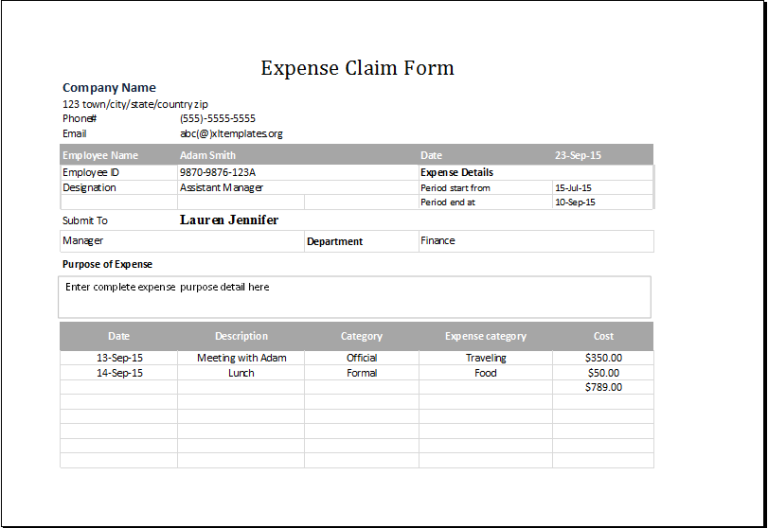

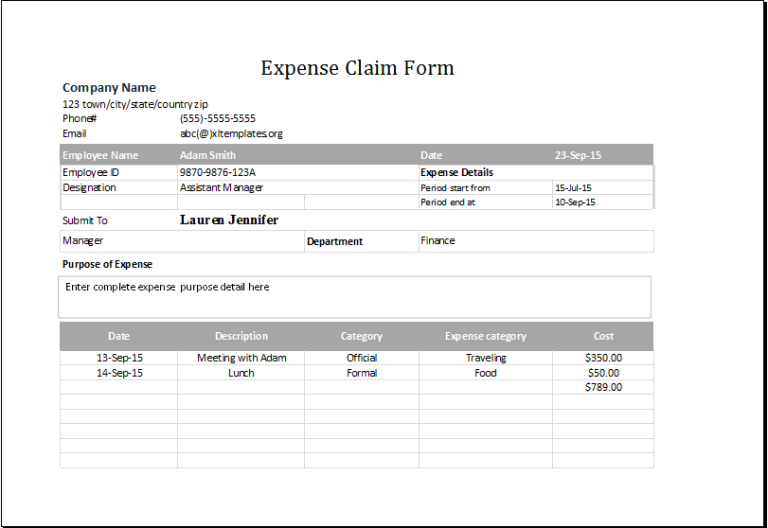

Expenses Claim Form Template Excel

https://www.xltemplates.org/wp-content/uploads/2016/02/expense-claim-form-1-768x528.png

Cobb Amos Estate Agents As A Landlord What Expenses Can I Claim

https://cobbamos.com/wp-content/uploads/2021/05/Expenses-1-scaled.jpg

Generally if you provide a benefit such as special clothing an allowance or a reimbursement for special clothing to your employee the benefit is taxable Depending on your situation the benefit may not be taxable under the CRA s administrative policy Non taxable situation 1 1 Everyday Clothing are Not a Business Expense 1 2 Branded Clothing are a Business Expense 1 3 Uniforms are a Business Expense 1 4 Protective Clothing are a Business Expense 1 5 Costumes are a Business Expense 2 Claiming for Laundry If You re Self Employed 3 How to Claim for Clothing On Your Tax Return

For clothes to qualify as a tax deduction the attire needs to be in line with industry standards and it needs to be essential to run your business The basic rule of this deduction is that if you can wear the uniform or clothing Determine the eligibility of your work clothes for tax deductions Expenses should be ordinary and necessary for your occupation and not suitable for everyday wear Keep track of your work clothes expenses including receipts and a

Download Can I Claim Clothing Expenses On My Taxes

More picture related to Can I Claim Clothing Expenses On My Taxes

3 Ways To Stay On Top Of Your Taxes ArticleCity

https://www.articlecity.com/wp-content/uploads/2017/02/taxpreparation.jpg

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

https://i.pinimg.com/736x/ca/91/af/ca91afb9dd1f2cde5eb4104f3d88c4ce.jpg

Can I Claim It As A Work Expense R vipkid

https://preview.redd.it/fg9i1r5wyvg41.jpg?auto=webp&s=9d5ef0a08f6007cab30a273fd5f2ec5baf541209

Can you claim work clothes and boots as expenses on your tax form Yes and no Confusing right Here s the low down If you are an employee you can not deduct the cost of special 1 Clothing Purchases You want to look your best while running your business especially when you have to meet with clients or customers That means investing in clothing makeup and grooming though you can t claim these costs as independent contractor business expenses

Work clothes are tax deductible if your employer requires you to wear them everyday but they cannot be worn as everyday wear such as a uniform However if your employer requires you to wear suits which can be worn as everyday wear you cannot deduct their cost even if you never wear the suits outside of work You cannot claim for everyday clothing even if you wear it for work Previous Car van and travel expenses Next Staff expenses View a printable version of the whole guide

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

https://www.fidelitycharitable.org/content/dam/fc-public/shared/infographics/tax-strategies-cash-securities-example.png.transform/viewport-max/image.20190621.png

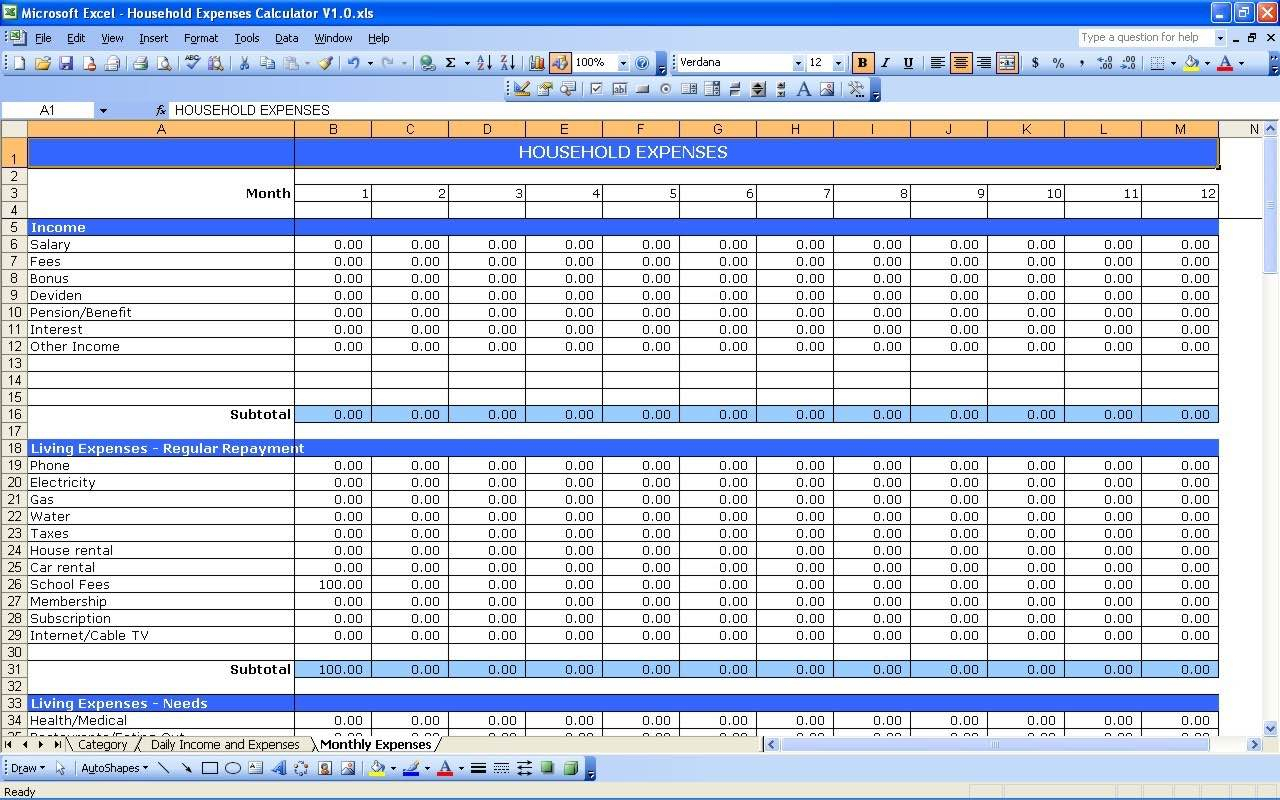

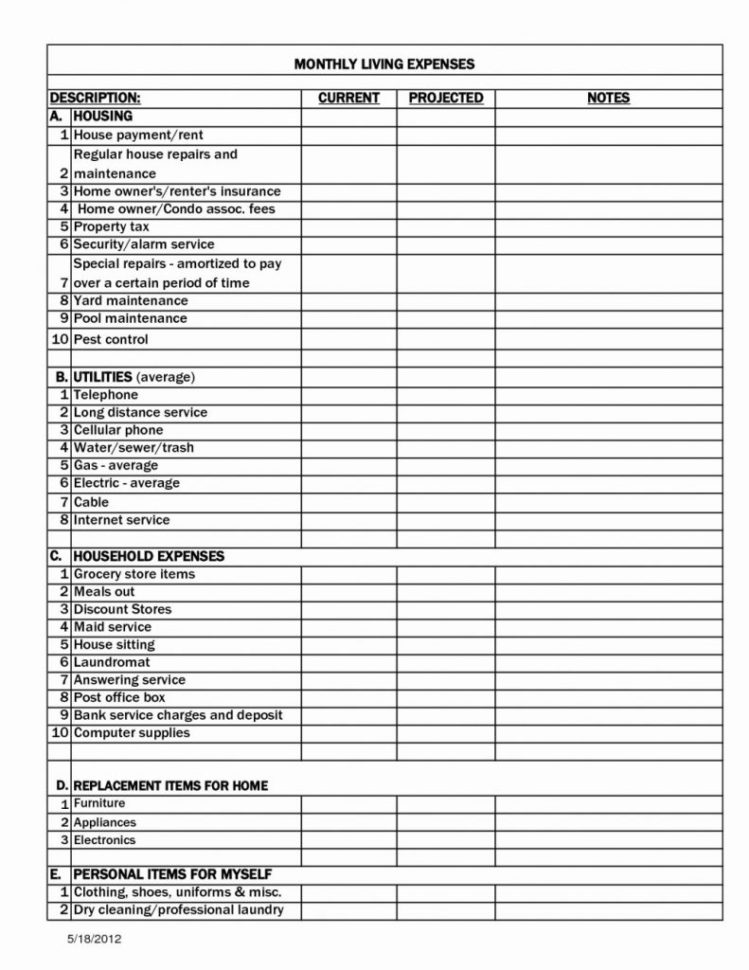

Free Income And Expenses Spreadsheet Intended For Free Monthly Expense

https://db-excel.com/wp-content/uploads/2019/01/free-income-and-expenses-spreadsheet-intended-for-free-monthly-expense-sheet-template-and-free-income-and-expenses.jpg

https://www. keepertax.com /posts/write-off-clothes-for-work

That s right the IRS allows for certain items of clothing to be written off as business expenses depending on how they re used Eligible pieces of clothing can be claimed alongside your other deductible expenses on Schedule C of your tax return You have to be self employed to write off your work clothes

https://www. freeagent.com /guides/expenses/clothing

As a result clothing that could be part of an everyday wardrobe is not allowable for tax relief 2 Is it a uniform If you have to buy a uniform that identifies clearly what you do you can put that into your accounts and claim tax relief on it An example would be a uniform for a self employed nurse

Claimable Expenses What You Can Claim On Your Tax Return

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

Farm Expense Spreadsheet Template With Regard To Spreadsheet For Taxes

Businesses Receiving A Compulsory Purchase Order What Can I Claim For

Image Result For Hair Salon Expenses Printable Business Tax

What Self Employed Expenses Can I Claim For Simple Taxes

What Self Employed Expenses Can I Claim For Simple Taxes

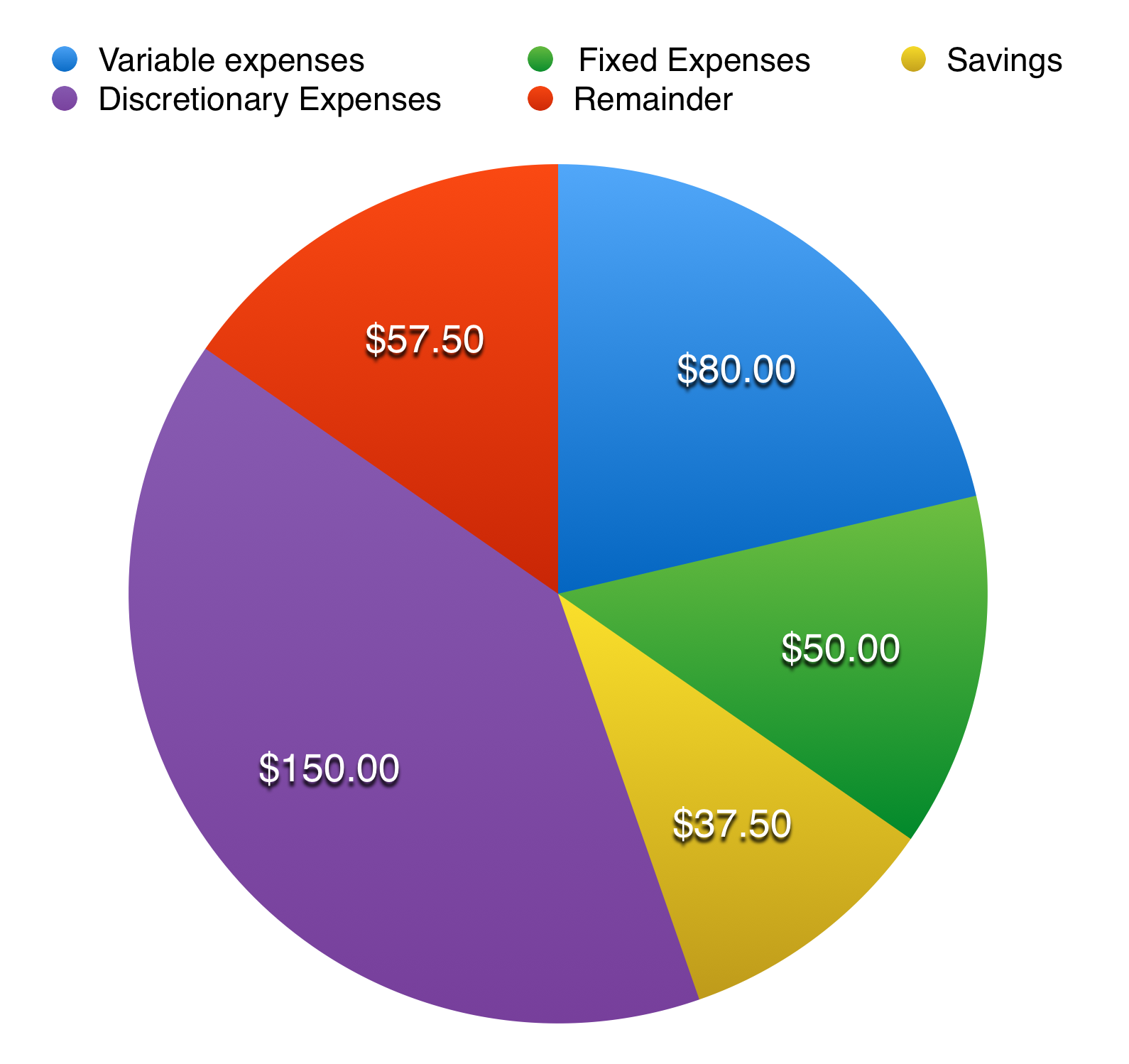

Budgeting Financial Literacy

Quick Guide Who Should Claim Medical Expenses On Taxes Canada

Travel Expenses Hmrc Self Employed RATVEL

Can I Claim Clothing Expenses On My Taxes - The answer in my case was no However your situation may be different here s how to know if your business clothes are tax deductible and how to claim them Is it Necessary and Usable Only for Work That s the key question your clothing must be required for your work and usable only for your particular work like a uniform