Can I Claim Conveyance Allowance In Itr An allowance is assumed to be taxable under the head Salary unless it is specifically

How much exemption can I claim on conveyance allowance Exemption on conveyance allowance can be claimed under Section 10 14 ii of the Income Tax Act The maximum amount that can be claimed in a year is To claim the conveyance allowance exemption employees must submit Form 10D along with their income tax return Form 10D must be signed by the employer and must contain information such as the employee s name

Can I Claim Conveyance Allowance In Itr

Can I Claim Conveyance Allowance In Itr

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/12/Template-11.png

Conveyance Allowance Chart 2022 New Conveyance Allowance 2022

https://i.ytimg.com/vi/bhoLTvtVaJ8/maxresdefault.jpg

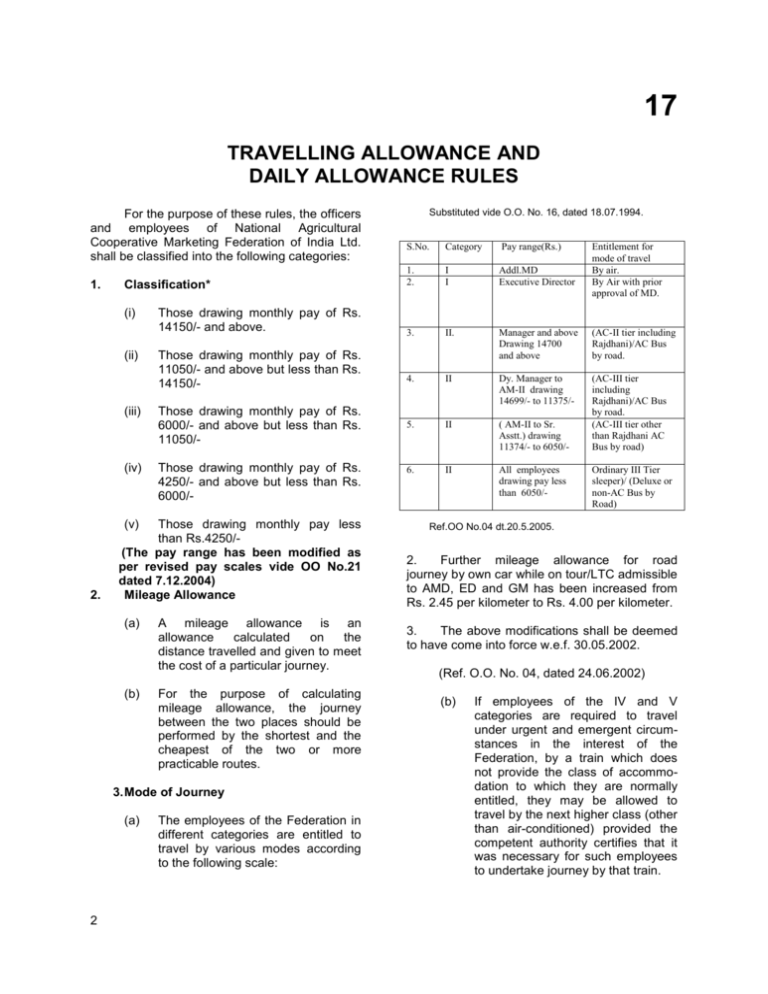

17 Travelling Allowance And Daily Allowance Rules

https://s3.studylib.net/store/data/007809872_2-69f425c552b50b716e03a025a56db87d-768x994.png

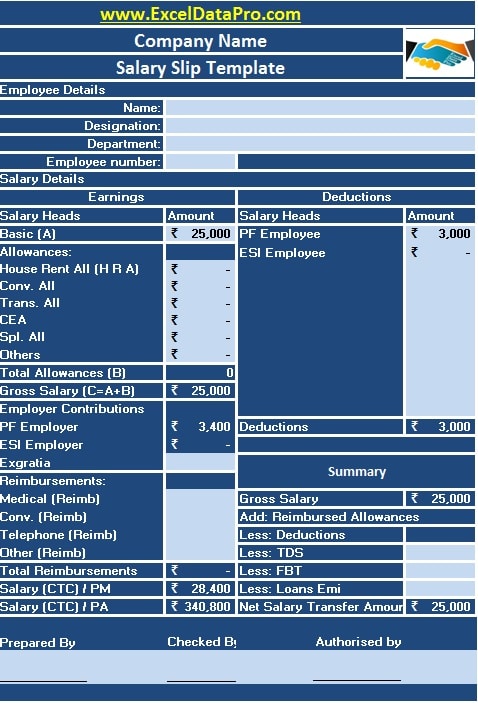

If you are wondering how to claim an exemption under Section 10 you can do it How much transport and conveyance allowance can I claim This allowance is completely exempt from tax However Transport allowance up to INR 1600 per month or INR 19 200 per year was being claimed as an

Any amount paid above the conveyance allowance limit is charged to tax under the head Under the New tax regime you can claim tax exemption for the following Transport allowances in case of a specially abled person Conveyance allowance received to meet the conveyance expenditure incurred as part of

Download Can I Claim Conveyance Allowance In Itr

More picture related to Can I Claim Conveyance Allowance In Itr

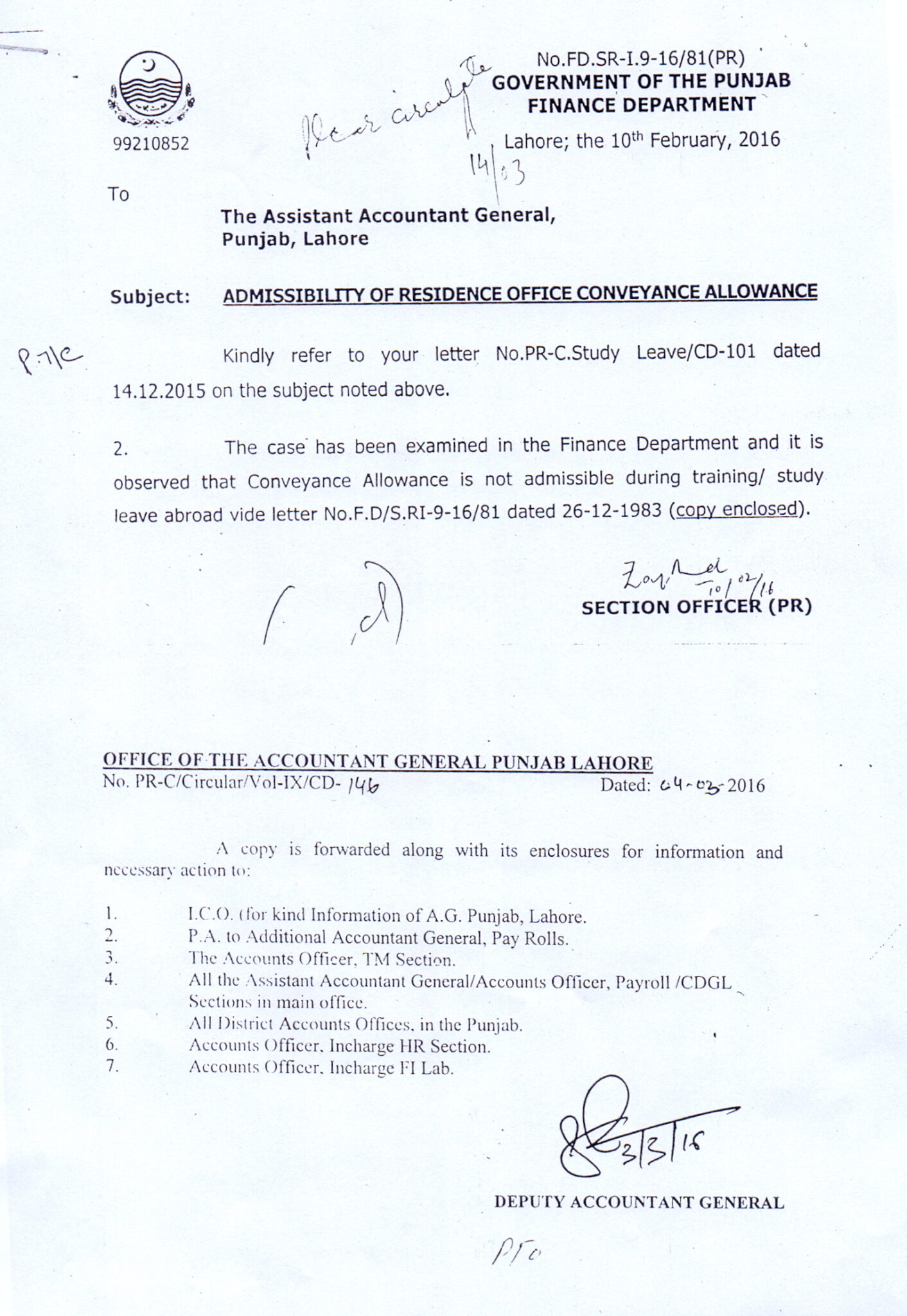

Recovery Of Conveyance Allowance Utility Allowance

https://i0.wp.com/infoghar.com/wp-content/uploads/2021/09/Conveyance-allowance-deductions-e1632489116685.png?fit=840%2C704&ssl=1

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

Conveyance Allowance GOVT EMPLOYEE MATTERS

https://govtemployeematters.com/wp-content/uploads/2021/02/Conveyance-Allow.-Admissibility-1412x2048.jpg

This means that if the employer pays its employee s conveyance allowance of INR 8 000 monthly 100 taxable then also you can claim an exemption on conveyance allowance only on INR 1 600 The remaining INR 6400 would be The complete amount of INR 1 600 for a month may be claimed by the employee as tax exemptions under the conveyance allowance Claiming the Allowance To claim the exemption of conveyance allowance that is granted for

Q Can I get a tax exemption on my conveyance allowance A Yes you can Currently section 87A allows individuals to claim a rebate of Rs 12 500 under the old tax

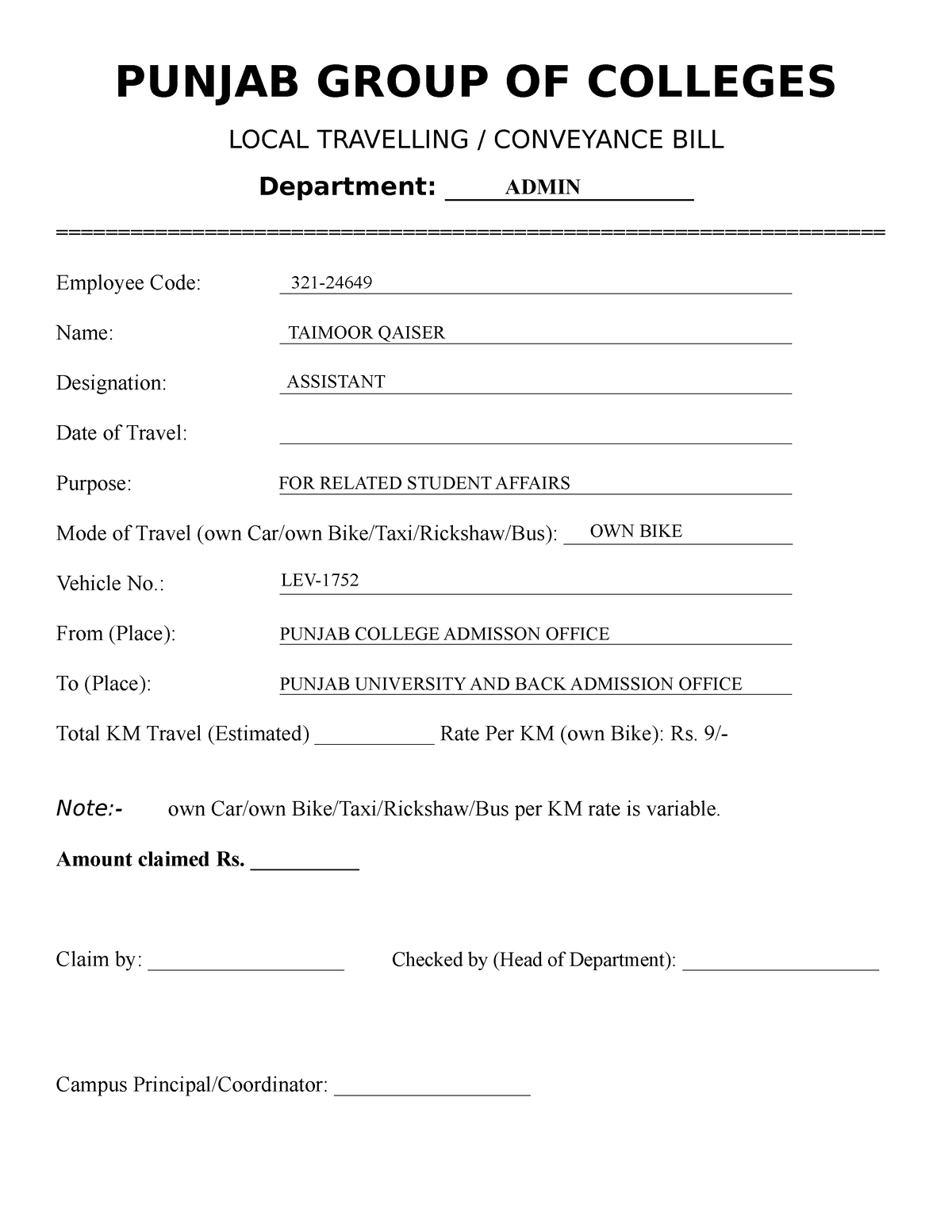

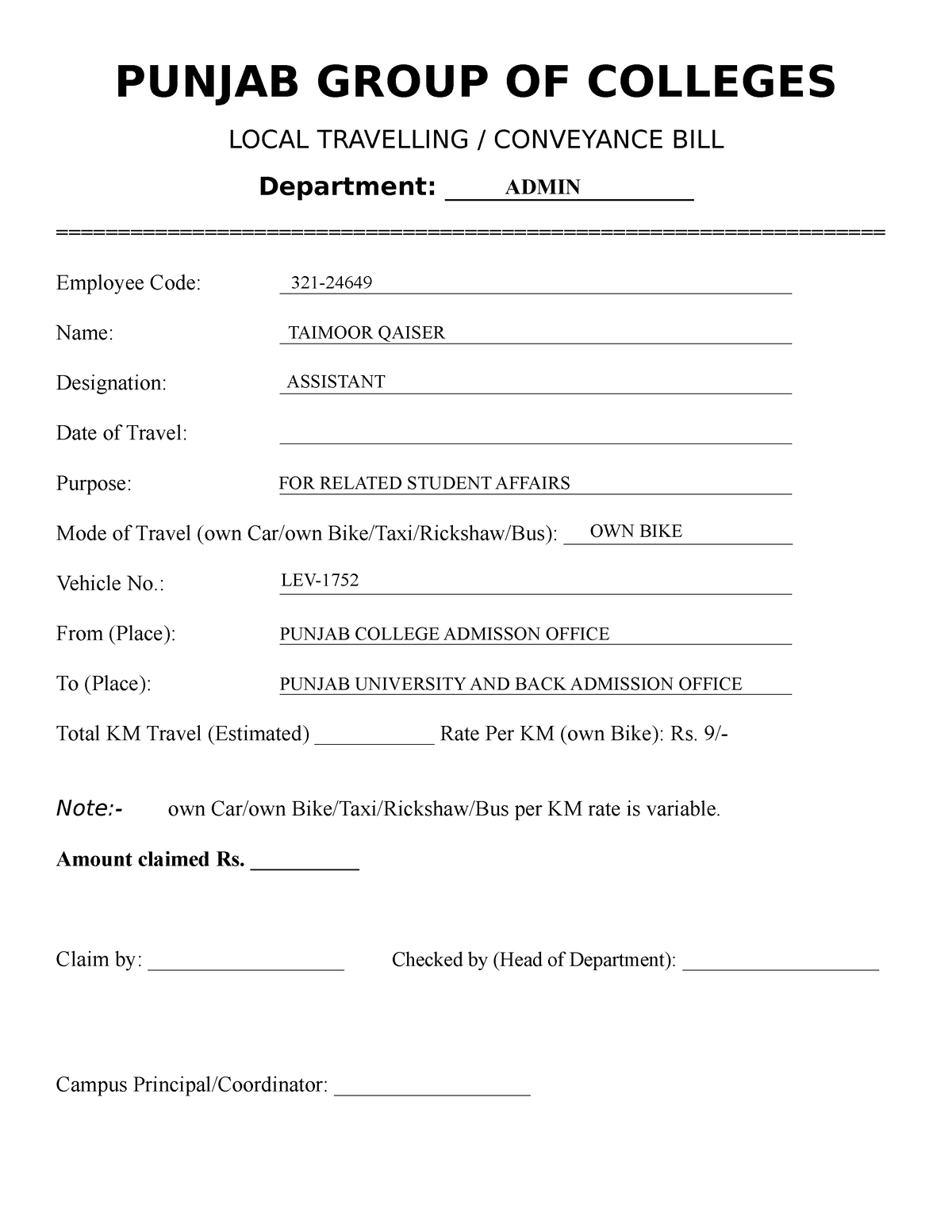

Conveyance Bill Format LOCAL TRAVELLING CONVEYANCE BILL Department

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/aa0d3f393ce20de43b6195cd529570d7/thumb_1200_1553.png

Conveyance Allowance Is Not Part Of Wages For ESI Purpose SC

https://www.businessmanager.in/wp-content/uploads/2022/05/Conveyance-allowance-is-not-part-of-wages-for-ESI-purpose.jpg

https://incometaxindia.gov.in/Tutorials/80...

An allowance is assumed to be taxable under the head Salary unless it is specifically

https://www.bankbazaar.com/tax/conveyan…

How much exemption can I claim on conveyance allowance Exemption on conveyance allowance can be claimed under Section 10 14 ii of the Income Tax Act The maximum amount that can be claimed in a year is

Conveyance Allowance Explained Under Income Tax Act

Conveyance Bill Format LOCAL TRAVELLING CONVEYANCE BILL Department

Mangalore Today Latest Main News Of Mangalore Udupi Page Employees

Conveyance Allowance Exemption Calculation Features Etc

Conveyance Allowance For Govt Employees In All Pakistan L Conveyance

Rate Of Conveyance Allowance In 7th Pay Commission Modification DoE

Rate Of Conveyance Allowance In 7th Pay Commission Modification DoE

Employees Allowed To Claim I T Exemption On Conveyance Allowance Under

Conveyance Form

What Is Conveyance Allowance ExcelDataPro

Can I Claim Conveyance Allowance In Itr - Employees can claim various tax benefits and deductions by providing proofs