Can I Claim Healthcare Expenses On My Taxes Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about

You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower File online If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your adjusted gross income You can deduct the cost

Can I Claim Healthcare Expenses On My Taxes

Can I Claim Healthcare Expenses On My Taxes

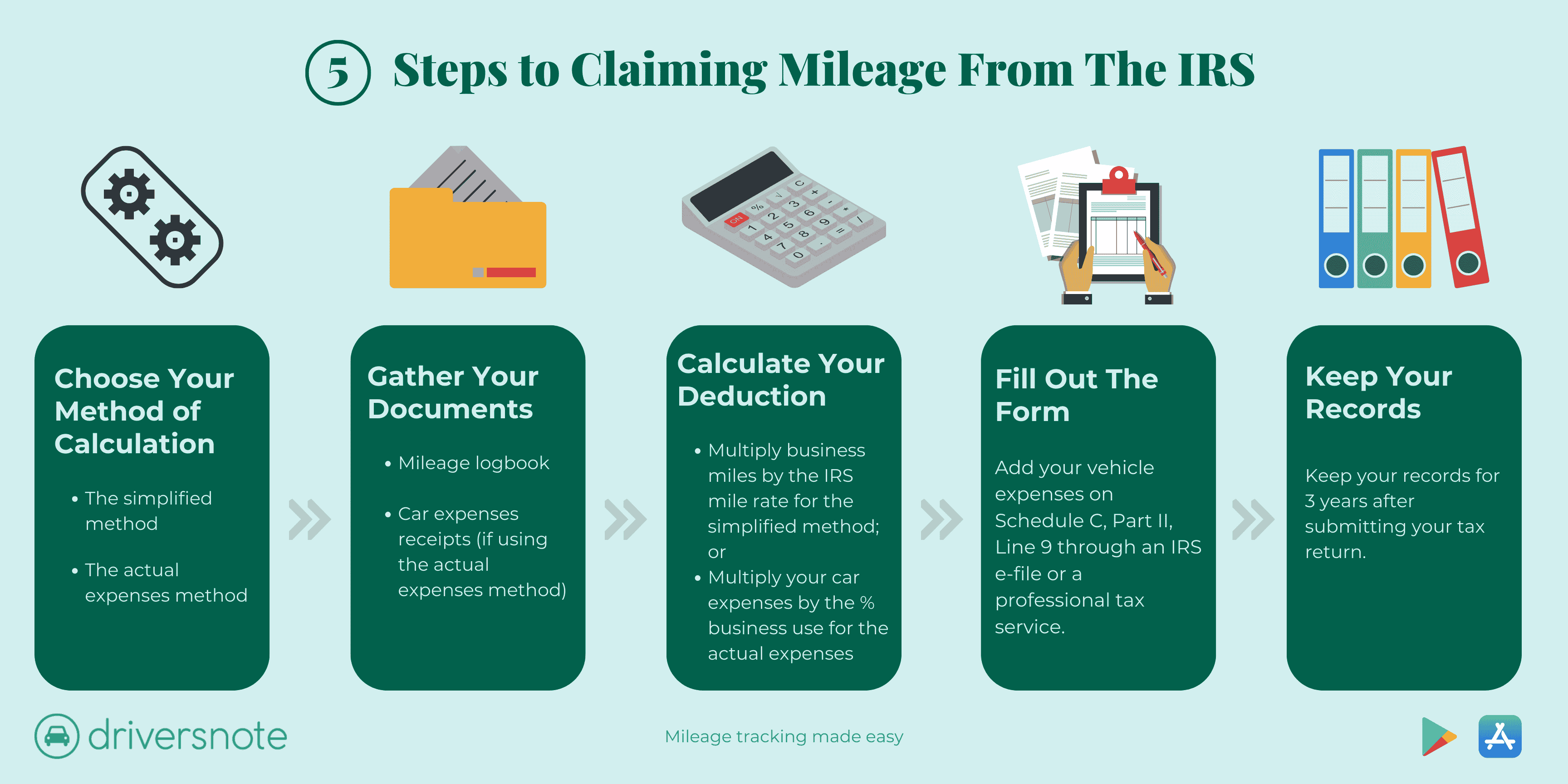

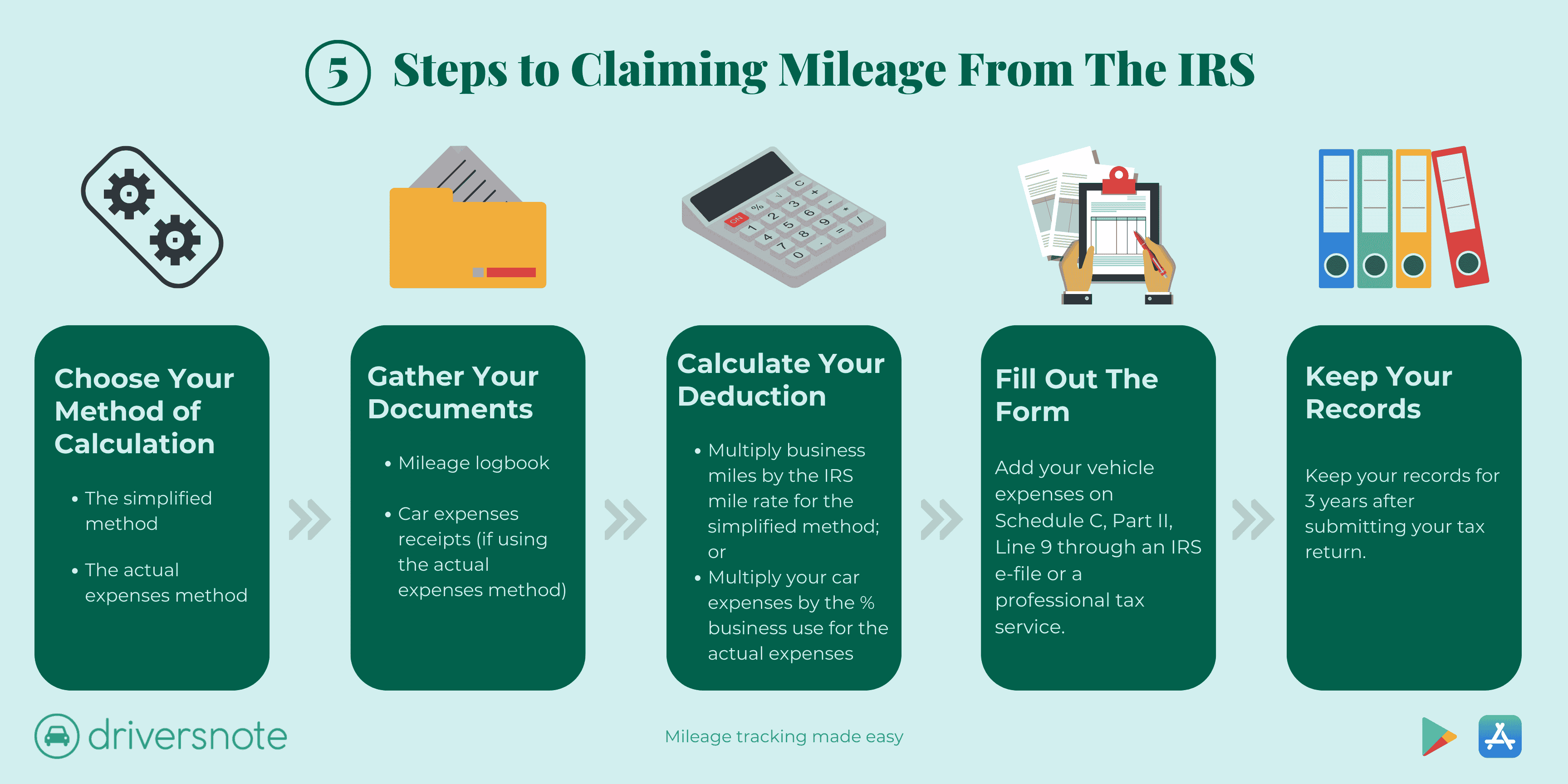

https://storage.googleapis.com/driversnote-marketing-pages/US-infographic-how-to-deduct-mileage-landscape.png

Accounts Expense Report Template Sample Images And Photos Finder

https://i.pinimg.com/originals/d0/e9/5e/d0e95eac3b3732ea691f3c344d4a2c2d.jpg

Who Is Entitled To The Low And Middle Income Tax Offset One Click Life

https://oneclicklife.com.au/wp-content/uploads/2022/08/LMITO.jpg

For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental

Remember that you can only claim medical expenses that you paid for this year whether it s for you your spouse or another dependent Dependents can include children and other relatives you If you re paying a lot of healthcare costs out of your own pocket can you deduct those medical expenses from your taxes The short answer is yes but there are

Download Can I Claim Healthcare Expenses On My Taxes

More picture related to Can I Claim Healthcare Expenses On My Taxes

Cobb Amos Estate Agents As A Landlord What Expenses Can I Claim

https://cobbamos.com/wp-content/uploads/2021/05/Expenses-1-scaled.jpg

Can I Claim Medical Expenses On My Taxes TMD Accounting

http://tmdaccounting.com/wp-content/uploads/2017/08/Can-I-Claim-Medical-Expenses-on-My-Taxes-.png

How Much Fuel Can I Claim On Taxes Leia Aqui Is It Better To Claim

https://cdn.mos.cms.futurecdn.net/W6XdppKMYTgYXVCSJeQb3X.jpg

In order to deduct medical expenses including health insurance from your taxes your total medical costs must exceed 7 5 of your adjusted gross income AGI You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain

Key Takeaways Medical costs that exceed 7 5 of your adjusted gross income AGI can be deducted for tax purposes You can deduct insurance premiums If your adjusted gross income AGI for the 2022 tax year was 50 000 you d need more than 3 750 50 000 x 7 5 in itemized medical expenses A costly

Can I Claim Medical Expenses On My Taxes

https://ercare24.com/wp-content/uploads/2016/08/Can-I-Claim-Medical-Expenses-on-Taxes.jpg

Fillable Online Can I Claim Medical Expenses On My Taxes H R Block Fax

https://www.pdffiller.com/preview/564/82/564082259/large.png

https://www.thebalancemoney.com/medical-e…

Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about

https://www.forbes.com/advisor/health-insur…

You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower

Can I Claim It As A Work Expense R vipkid

Can I Claim Medical Expenses On My Taxes

Tax Return Should I Claim 400 Or 3 000 For Home Office Expenses For

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

Bright Tax Reviews Read Customer Service Reviews Of Brighttax

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

Can I Go To Jail For Not Paying My Taxes Lawyer Blogger

Businesses Receiving A Compulsory Purchase Order What Can I Claim For

Example Of Taxable Supplies Jspag

Can I Claim Healthcare Expenses On My Taxes - Since there are specific rules and qualifications you must follow here s an overview of when you can and cannot claim a deduction on your health insurance