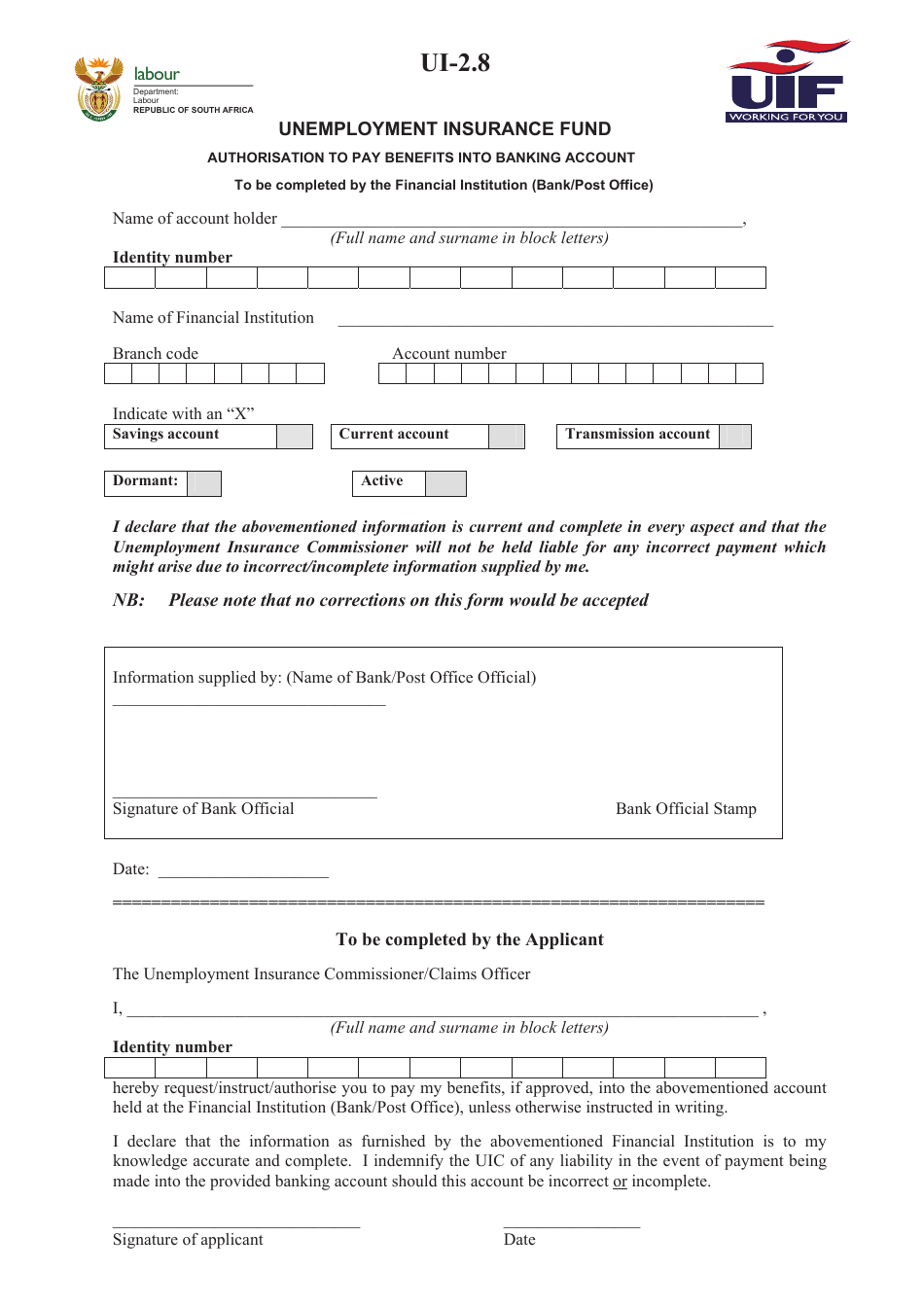

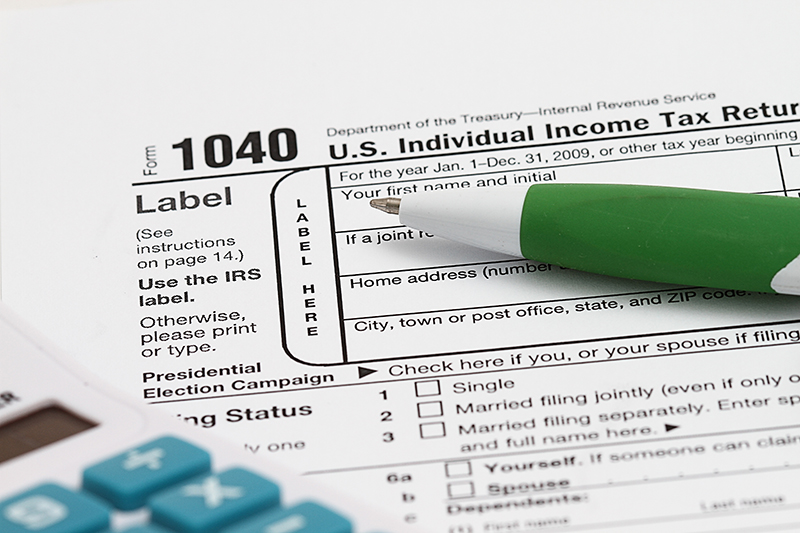

Can I Claim My House On My Taxes 2022 If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your deductions on Schedule A of Form 1040 File 100 FREE with expert help 37 of filers qualify

The standard deduction is set at these figures for the 2022 tax year 12 950 for single taxpayers and married taxpayers filing separate returns 25 900 for married taxpayers filing jointly and qualifying widow ers Property taxes are deductible in the year they re paid not the year they re assessed So if you got your property tax bill in December 2023 and you didn t pay it until this year 2024 you d have to wait until 2025 when you file your 2024 taxes to deduct those property taxes 4

Can I Claim My House On My Taxes 2022

Can I Claim My House On My Taxes 2022

https://i.ytimg.com/vi/uMe0NrvXYH8/maxresdefault.jpg

Can I Claim My Child As A Dependent On My Tax Return Gardner Quad Squad

https://imggarden.gardnerquadsquad.com/do_i_have_to_include_my_dependent_childs_income_on_tax_return.png

What Happens If You Don t Pay Your Taxes A Complete Guide All

https://www.allthingsfinance.net/wp-content/uploads/2020/04/image1-56-1536x1086.jpg

SOLVED by TurboTax 1722 Updated 2 weeks ago If you just bought a house you may be able to deduct Mortgage interest including points Property real estate tax Mortgage insurance PMI or MIP Unless it s a rental you won t be able to deduct homeowner s insurance repairs or home improvements Also moving expenses are no First time homeowners should make themselves familiar with authorized deductions programs that can assist with home ownership and the use of housing allowances that can be beneficial IRS Tax Tip 2022 138 September 8 2022 Making the dream of owning a home a reality is a big step for many people

You can t deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn t own the home until 2023 Instead you add the 1 375 to the cost basis of your home You owned the home in 2023 for 243 days May 3 to December 31 so you can take a tax deduction on your 2024 return of 946 243 365 1 425 Generally yes The SALT deduction allows you to deduct up to 10 000 5 000 if married filing separately for a combination of property taxes and either state and local income taxes or sales

Download Can I Claim My House On My Taxes 2022

More picture related to Can I Claim My House On My Taxes 2022

Can I Claim A Girlfriend As A Dependent IRS Rules Explained

https://media.marketrealist.com/brand-img/BWISEgRb0/640x335/can-you-claim-girlfriend-on-taxes-1667322618156.jpg

What Can I Claim On My Taxes Cheapism

https://cdn.cheapism.com/images/680-20160422-022407-040616_what_can_i_claim_.max-800x600.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://help.taxreliefcenter.org/wp-content/uploads/2018/08/Tax-Relief-Center-10-Taxes-You-Can-Write-Off-When-You-Work-From-Home-20180725.jpg

The person is filing married and has deductions of 16 000 That is less than the 25 900 standard deduction In this case the standard deduction makes more sense To answer the question are property taxes part of the standard deduction no Property taxes are just another deduction that can be used if you are itemizing deductions By TurboTaxUpdated 1 week ago You can claim prior years property tax in the tax year you paid them For example if you paid your 2022 property taxes in 2023 claim them on your 2023 taxes However you can t include any late

If you own your own home you might be able to save on your tax returns Get the most value from your home with these eight tax deductions Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500 000 if you use married filing separately status for tax years prior to 2018 Beginning in 2018 this limit is lowered to 750 000

Can I Claim Medical Expenses On My Taxes TMD Accounting

http://tmdaccounting.com/wp-content/uploads/2017/08/Can-I-Claim-Medical-Expenses-on-My-Taxes-.png

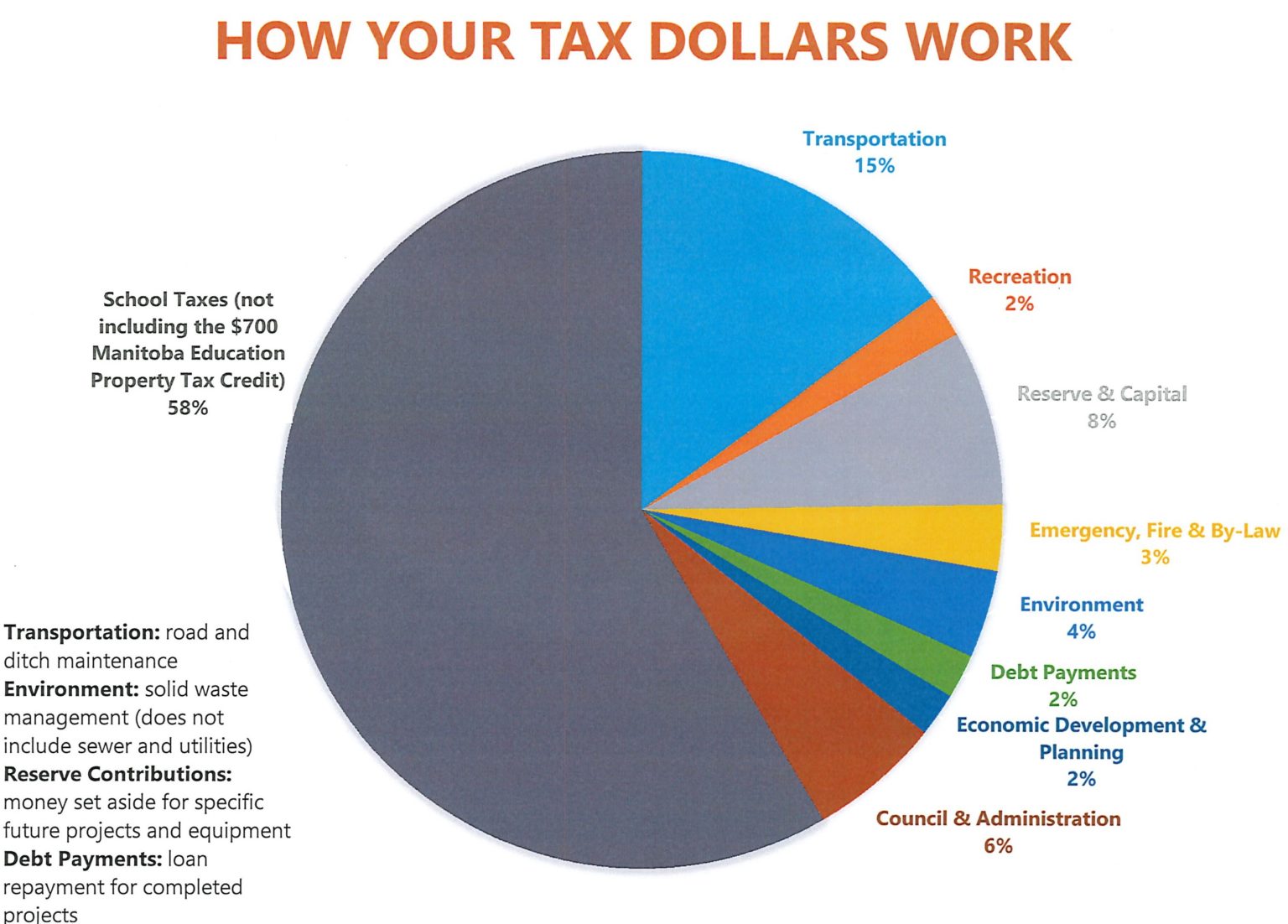

Final Pie Chart Tax Dollars 2020 Rural Municipality Of St Clements

https://rmofstclements.com/wp-content/uploads/2020/07/final-pie-chart-tax-dollars-2020-1536x1102.jpg

https://turbotax.intuit.com/tax-tips/home...

If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your deductions on Schedule A of Form 1040 File 100 FREE with expert help 37 of filers qualify

https://www.thebalancemoney.com/property-tax-deduction-3192847

The standard deduction is set at these figures for the 2022 tax year 12 950 for single taxpayers and married taxpayers filing separate returns 25 900 for married taxpayers filing jointly and qualifying widow ers

Can I Claim Mileage On My Taxes

Can I Claim Medical Expenses On My Taxes TMD Accounting

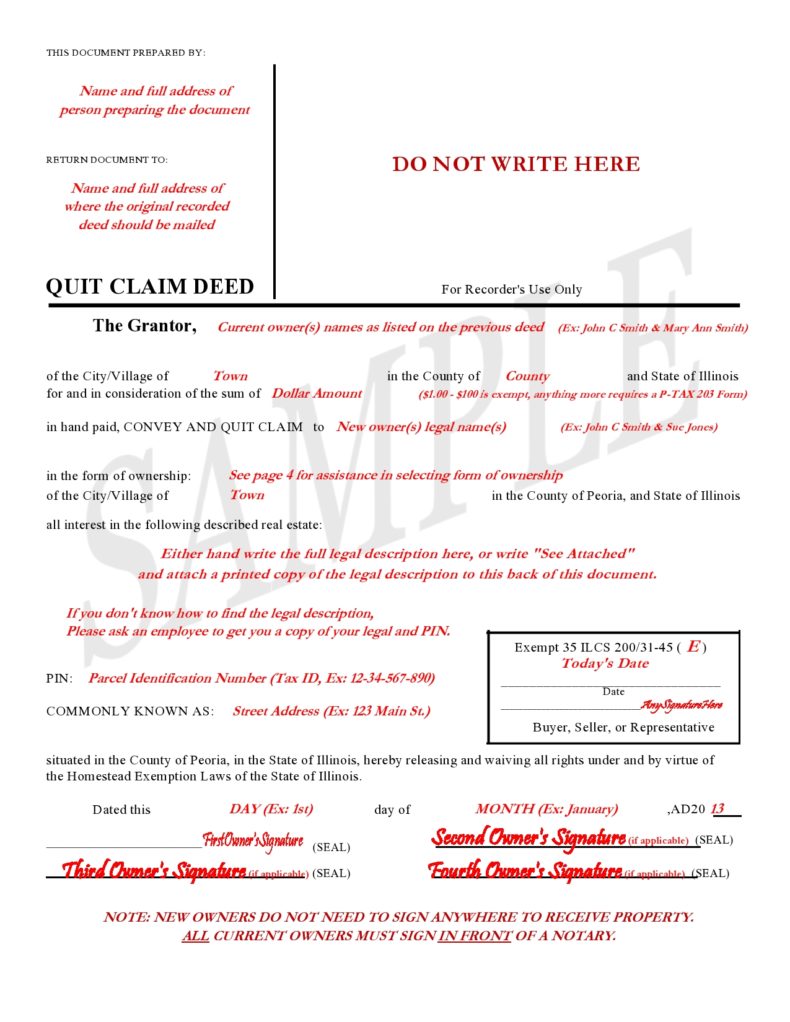

Example Of A Quit Claim Deed Completed Fill Out And Sign Printable

Can I Claim My Newborn On Taxes 2023 T2023E

Can I Go To Jail For Not Paying My Taxes Lawyer Blogger

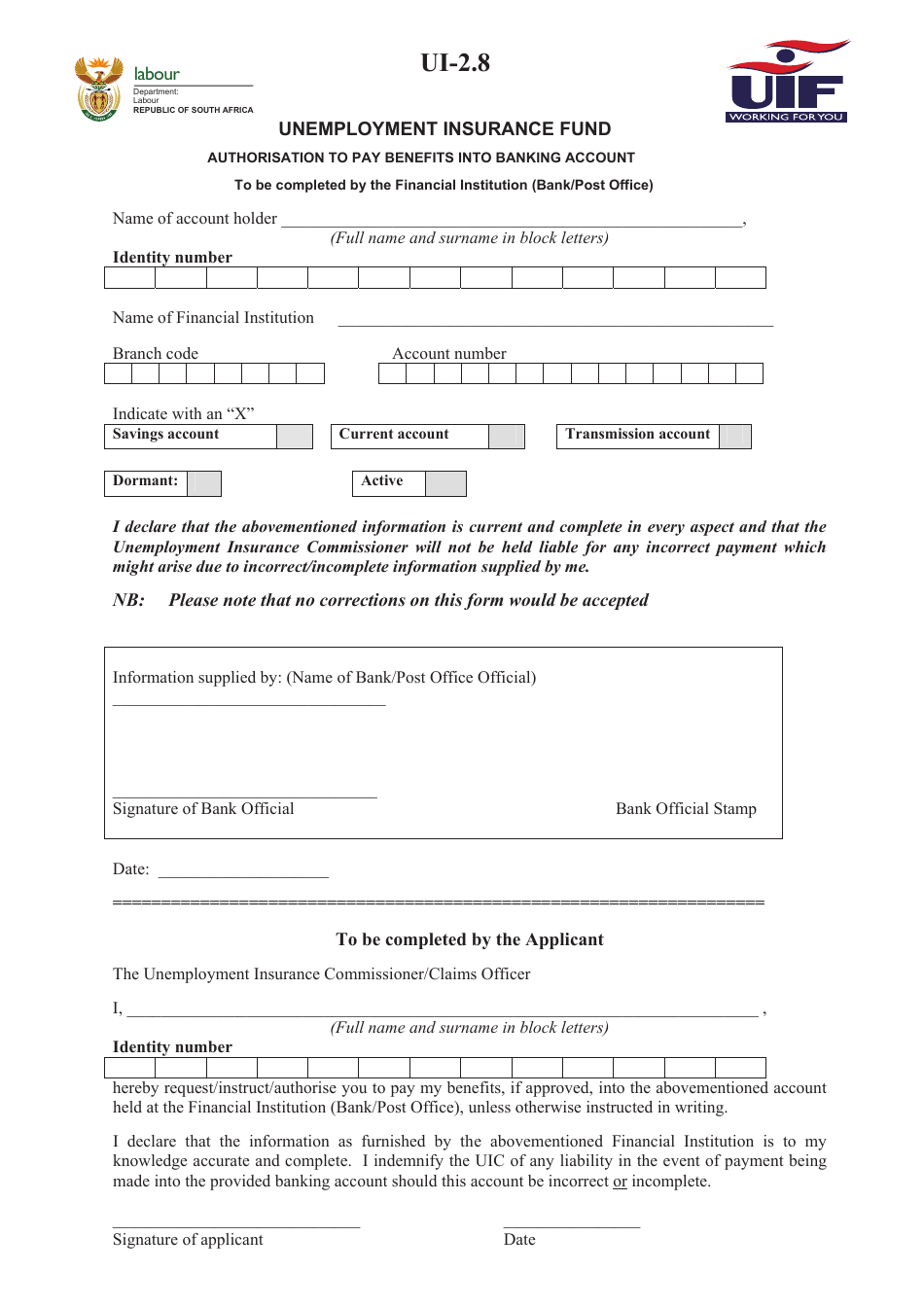

Printable Ui Clam Forms Printable Forms Free Online

Printable Ui Clam Forms Printable Forms Free Online

Can I Claim My Ex mother in law As A Dependent On My Taxes

Filing Taxes On H1B Visa The Ultimate Guide 2023

Printable Tax Deduction Cheat Sheet

Can I Claim My House On My Taxes 2022 - First time homeowners should make themselves familiar with authorized deductions programs that can assist with home ownership and the use of housing allowances that can be beneficial IRS Tax Tip 2022 138 September 8 2022 Making the dream of owning a home a reality is a big step for many people