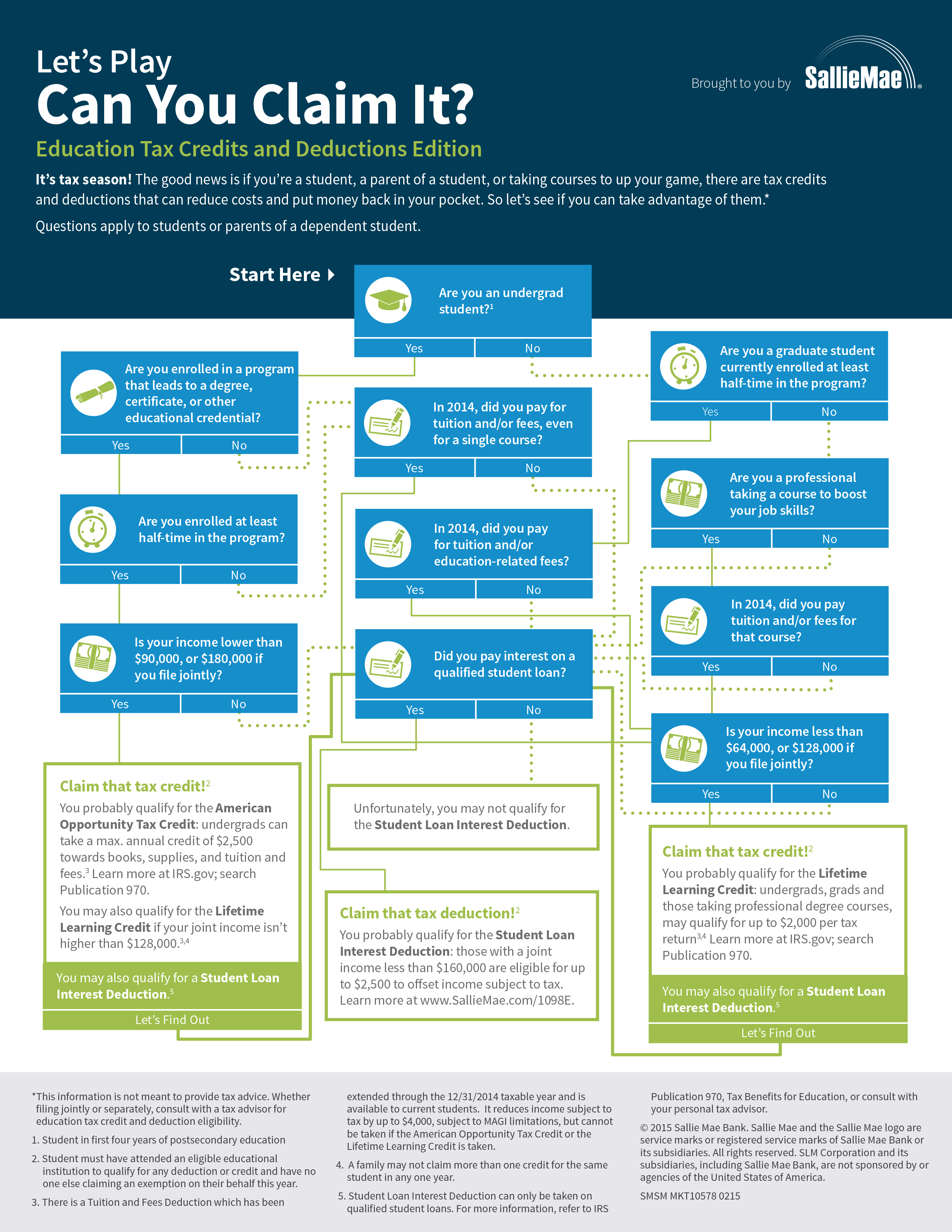

Can I Claim Ppe On Tax 84 rowsUse this list to check if you can claim a fixed amount of tax relief

You may be able to claim a deduction for personal protective equipment PPE you buy and use at work You must incur the expense for the protective items equipment or You cannot claim tax relief for PPE If your job requires you to use PPE your employer should either give you PPE free of charge ask you to buy it and reimburse you the

Can I Claim Ppe On Tax

Can I Claim Ppe On Tax

http://www.madammoney.com/wp-content/uploads/2015/03/TaxTipsVisualCorpComm_FNL.jpg

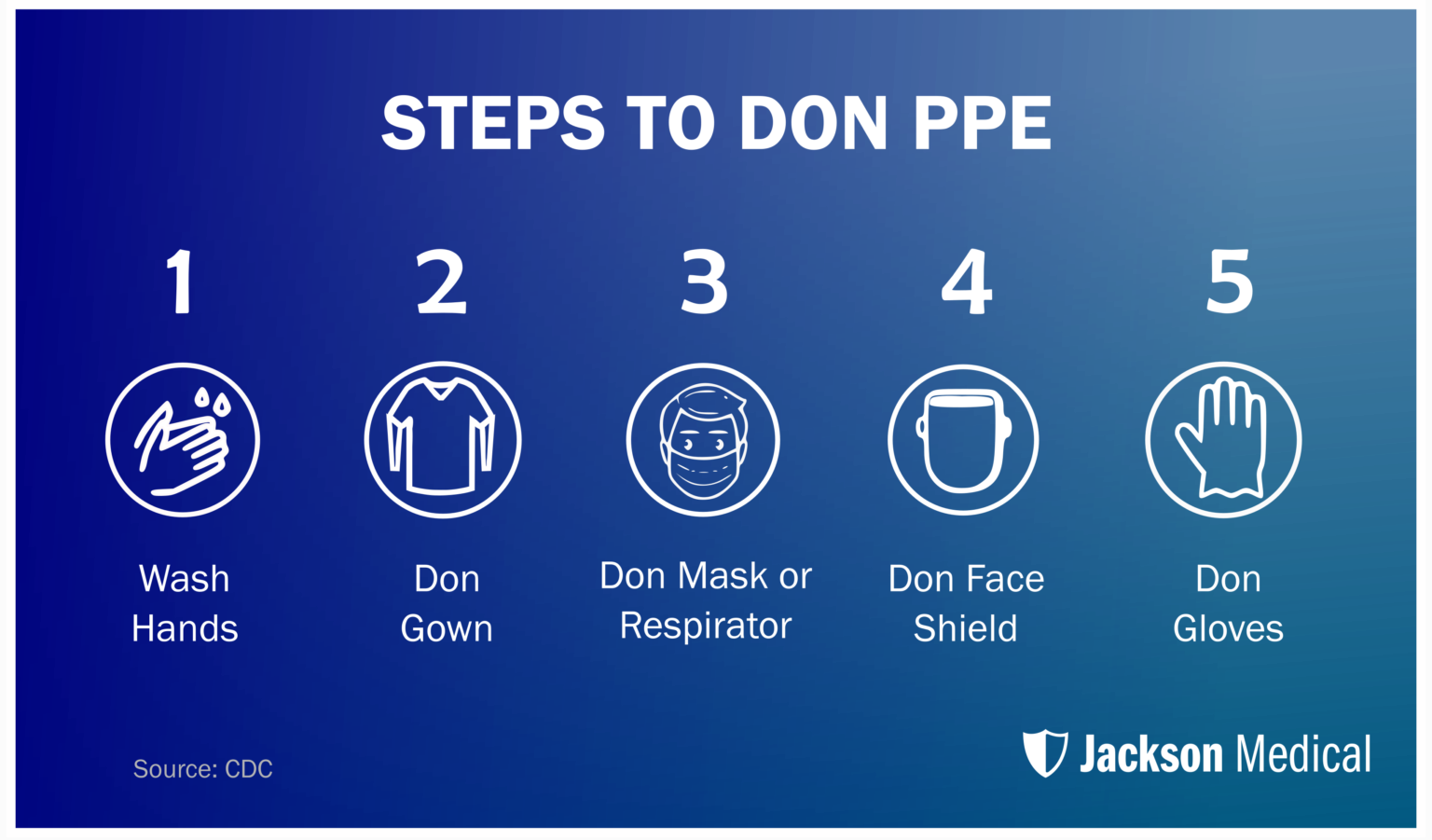

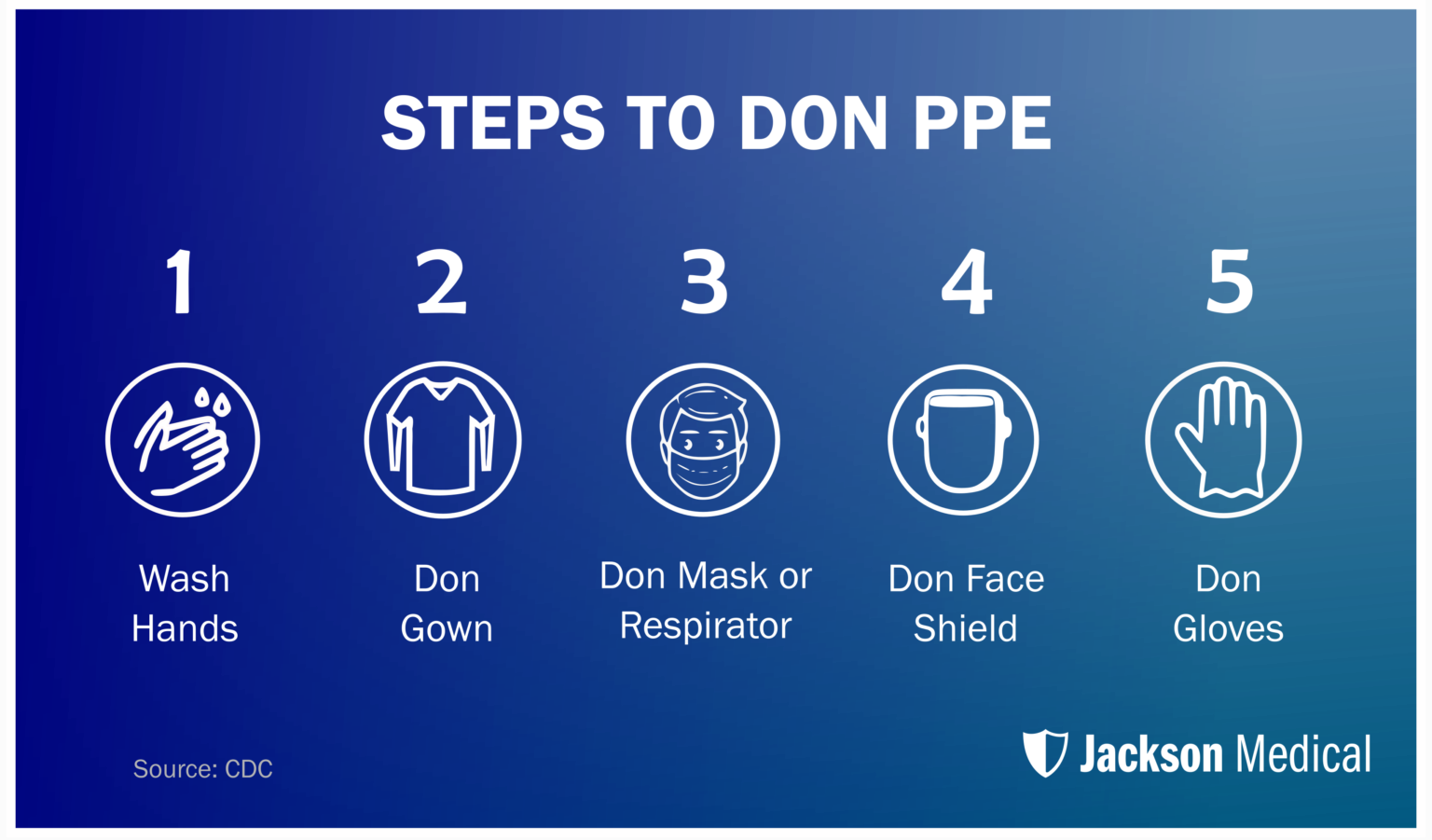

Properly Donning And Doffing PPE A How To Guide

https://jackson-medical.com/wp-content/uploads/2020/06/JM-Don-PPE-1536x901.png

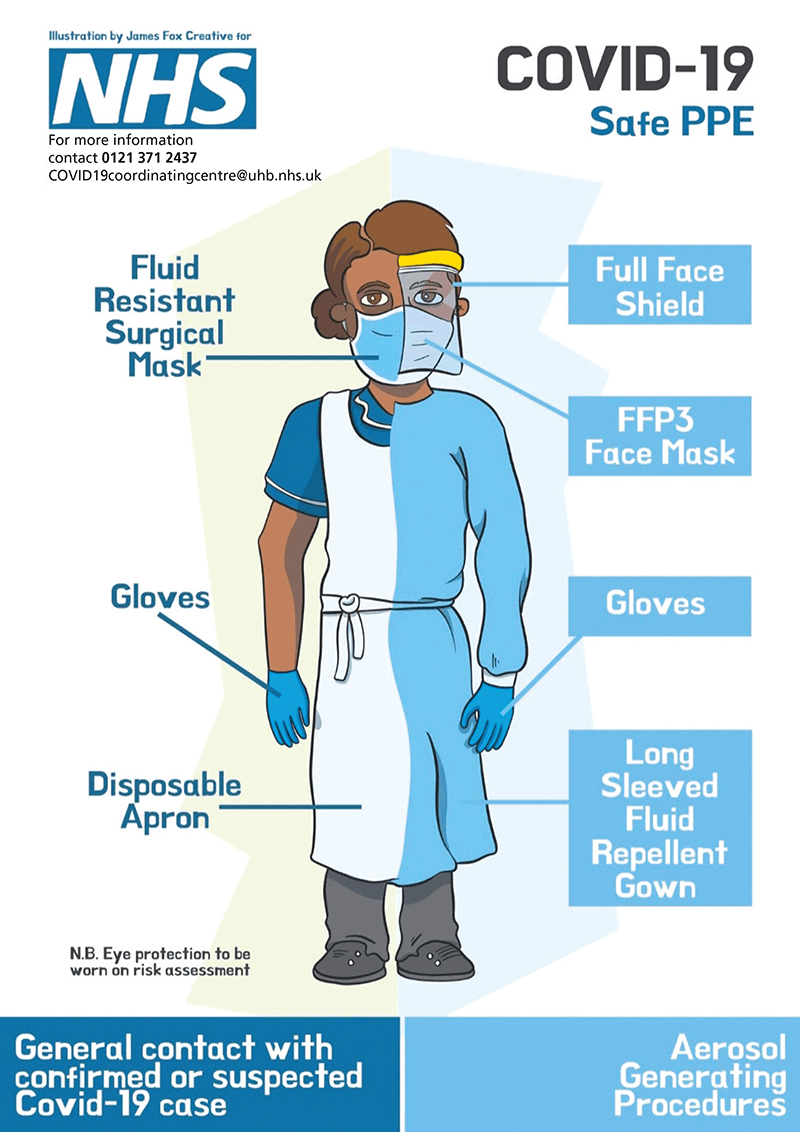

Putting On Taking Off Way Ahead Care

https://www.wayaheadcare.co.uk/wp-content/uploads/2020/04/Putting_on_PPE_Care_Homes-1060x1500.jpg

Yes individuals can deduct PPE from their taxes Individuals can deduct PPE that they purchase for themselves their spouse and their dependents to use at home or out in If you bought personal protective equipment PPE such as masks hand sanitizer and sanitizing wipes for the purpose of preventing the spread of COVID 19 in 2021 you may be eligible for a tax break

The IRS recently clarified that personal protective equipment like face masks hand sanitizer and disinfecting wipes can now be deducted as medical expenses and the tax break That means purchases of COVID 19 PPE for use by an individual taxpayer their spouse or dependents that are not covered by insurance can be deducted so long

Download Can I Claim Ppe On Tax

More picture related to Can I Claim Ppe On Tax

PPE REQUIREMENTS

https://www.w-p.co.uk/hs-fs/hubfs/ppe-requirements-graphic.png?width=1200&name=ppe-requirements-graphic.png

Describe The Most Commonly Used Personal Protective Equipment

https://www.who.int/images/default-source/searo---images/countries/bangladesh/infographics/ppe/ppe-for-different-healthcare-activities/ppe-health-care-activities-en.png?sfvrsn=ee618cc0_2

Updated Guidance On PPE Way Ahead Care

https://www.wayaheadcare.co.uk/wp-content/uploads/2020/04/COVID-19_easy_visual_guide_to_PPE_poster-1-optimised.jpg

According to the IRS COVID 19 home testing kits are an eligible medical expense under the tax code Personal protective equipment PPE such as masks hand sanitizer and sanitizing What is the most you can claim on tax without a receipt According to the Australian Taxation Office ATO if your total work related expenses are 300 or less you are not required to provide a receipt

With few exceptions you can t claim a deduction for a watch or smart watch Protective items equipment and products Deductions for items that protect you from the real and Yes the IRS Says PPE Your Expenses Are Likely Tax Deductible For tax year 2023 the IRS has renewed its stance on the deductibility of Personal Protective Equipment PPE

NSW VIC NDIS Participants Can Claim PPE NDISP

https://www.ndisp.com.au/wp-content/uploads/2020/07/NDIS-Minister-Media-Release.png

Wearing Proper Personal Protective Equipment On A Job Site

http://www.nickleelectrical.com/wp-content/uploads/2017/07/PPE.jpg

https://www.gov.uk/guidance/job-expenses-for...

84 rowsUse this list to check if you can claim a fixed amount of tax relief

https://www.ato.gov.au/individuals-and-families/...

You may be able to claim a deduction for personal protective equipment PPE you buy and use at work You must incur the expense for the protective items equipment or

PPE Record Keeping The Best Example Of PPE Record Keeping

NSW VIC NDIS Participants Can Claim PPE NDISP

6 Construction Site Safety Tips To Protect Your Team AlertMedia

Personal Protective Equipment PPE Safety Supplies Sama Majan

Electrical PPE Personal Protection Equipment Checklist Fluke

PPE Minimum Minimum Level Of PPE For This Site Seven Items

PPE Minimum Minimum Level Of PPE For This Site Seven Items

Infographic Applying And Removing PPE BootieButler

Thelostheroaudiobookfreedownload

Vereiste Persoonlijke Beschermingsmiddelen Ppe Symbool veiligheid

Can I Claim Ppe On Tax - Yes individuals can deduct PPE from their taxes Individuals can deduct PPE that they purchase for themselves their spouse and their dependents to use at home or out in