Can I Claim Tax Back On Car Allowance You ll automatically get a refund for any full remaining months of vehicle tax when you apply for exemption The refund will be sent to the address the DVLA have on their records

How to claim Car van and travel expenses You can claim allowable business expenses for vehicle insurance repairs and servicing fuel parking hire charges vehicle licence How far back can I claim for a mileage tax refund You can claim mileage tax relief for the last four tax years You don t need to be with the same employer to be able to claim

Can I Claim Tax Back On Car Allowance

Can I Claim Tax Back On Car Allowance

https://www.aradvisors.com.au/awcontent/aradvisors/images/news/teasers/maximisetaxreturn.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Car Allowance In Australia The Complete Guide Easifleet

https://www.easifleet.com.au/wp-content/uploads/2020/11/Car-Allowance.jpg

You claim the tax deduction in your income tax return as a work related car expense If you receive an allowance from your employer for car expenses you For individuals and sole traders to access ATO online and complete your tax return via myTax A secure system to interact with us online for your business tax and super needs

Mileage Allowance Relief MAR is a tax deduction for employees that have incurred business mileage and are not fully reimbursed by their employer Keep in mind You are entitled to tax relief for travel costs that you are obliged to incur in order to do your job If your employer does not pay or reimburse these expenses at all

Download Can I Claim Tax Back On Car Allowance

More picture related to Can I Claim Tax Back On Car Allowance

Hecht Group Does Pennymac Pay Property Taxes

https://img.hechtgroup.com/1663215364372.jpg

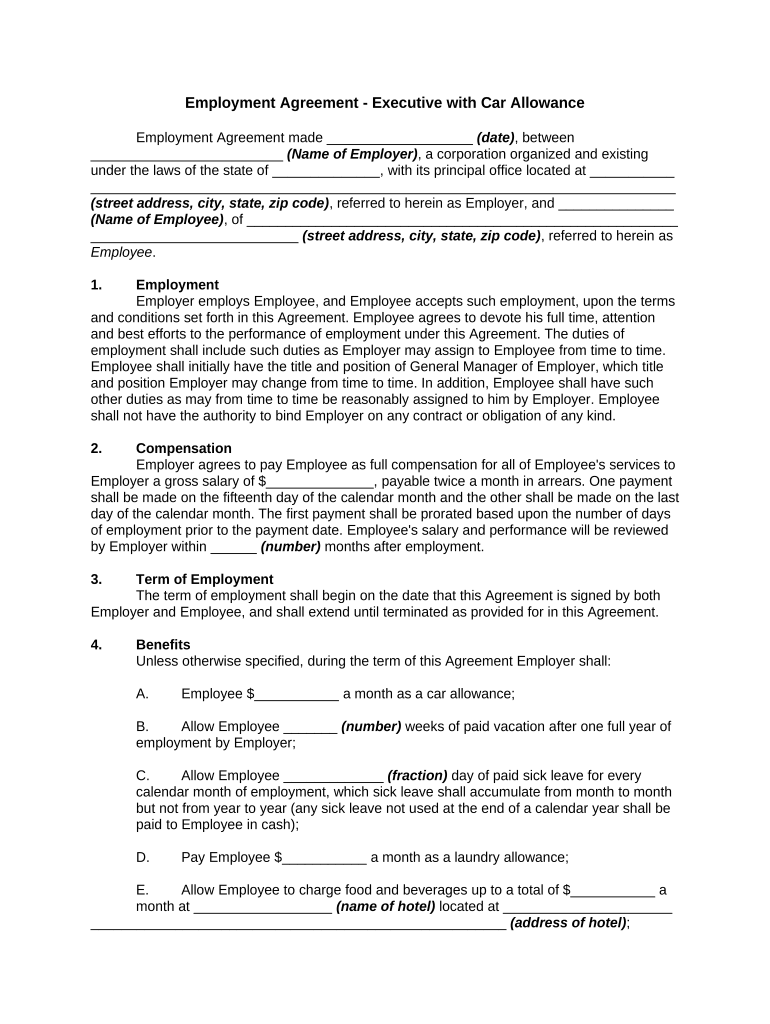

Car Allowance Agreement Template Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332110/large.png

Valoare Ocazional Cople itor Hmrc Uniform Tax Canoe Inutil Instruire

https://claimtaxbacknow.com/wp-content/uploads/2020/11/shutterstock_196039457-scaled.jpg

However if the portion reimbursed is below the HMRC Recognised amount you can make a personal claim for the remaining amount on your taxes The personal You can claim over 45p tax free as a business mileage allowance if you use your own car for a business journey Here s what you need to know

You can claim capital allowances on cars you buy and use in your business This means you can deduct part of the value from your profits before you pay tax Use writing down Are you self employed and wondering whether you can claim tax relief for your car Read through our quick guide here to make sure you re not overpaying tax

Uniform Allowance Claim Tax Back Now

https://claimtaxbacknow.com/wp-content/uploads/2020/11/shutterstock_732352393-scaled.jpg

3 Ways To Claim Tax Back WikiHow

https://www.wikihow.com/images/c/ca/Claim-Tax-Back-Step-15-Version-2.jpg

https://www.gov.uk/get-vehicle-tax-exemption-disability

You ll automatically get a refund for any full remaining months of vehicle tax when you apply for exemption The refund will be sent to the address the DVLA have on their records

https://www.gov.uk/expenses-if-youre-self-employed/travel

How to claim Car van and travel expenses You can claim allowable business expenses for vehicle insurance repairs and servicing fuel parking hire charges vehicle licence

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Uniform Allowance Claim Tax Back Now

Find Out How To Claim Tax Back From Covid 19 Tests

How Much Fuel Can I Claim On Taxes Leia Aqui Is It Better To Claim

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

What Happens If You Don t File A Tax Return Tax Time Tax Refund

What Happens If You Don t File A Tax Return Tax Time Tax Refund

Shedworking Can I Claim Tax Back On My Garden Office

Can I Claim Back Tax Paid In The US

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

Can I Claim Tax Back On Car Allowance - As a business owner you can claim a tax deduction for expenses for motor vehicles used in running your business