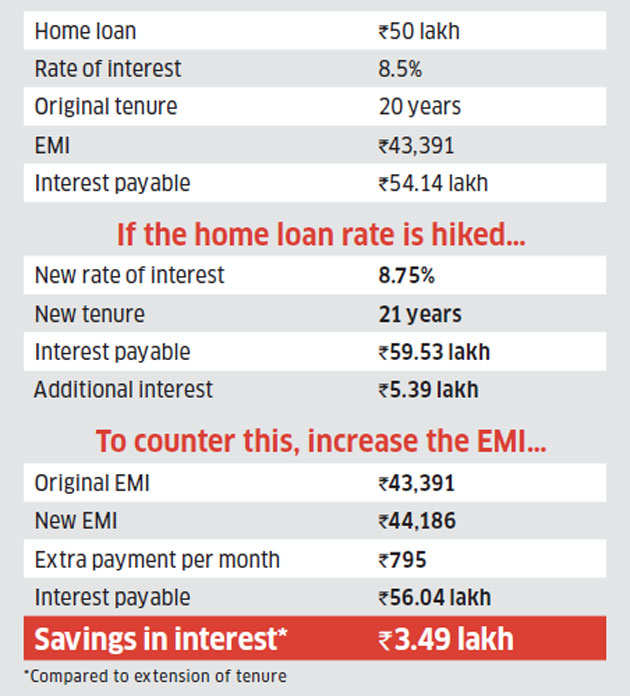

Tax Rebate On Interest Of Housing Loan Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Tax Rebate On Interest Of Housing Loan

Tax Rebate On Interest Of Housing Loan

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Web What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income

Web 11 sept 2023 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24 b As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh Web Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You

Download Tax Rebate On Interest Of Housing Loan

More picture related to Tax Rebate On Interest Of Housing Loan

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

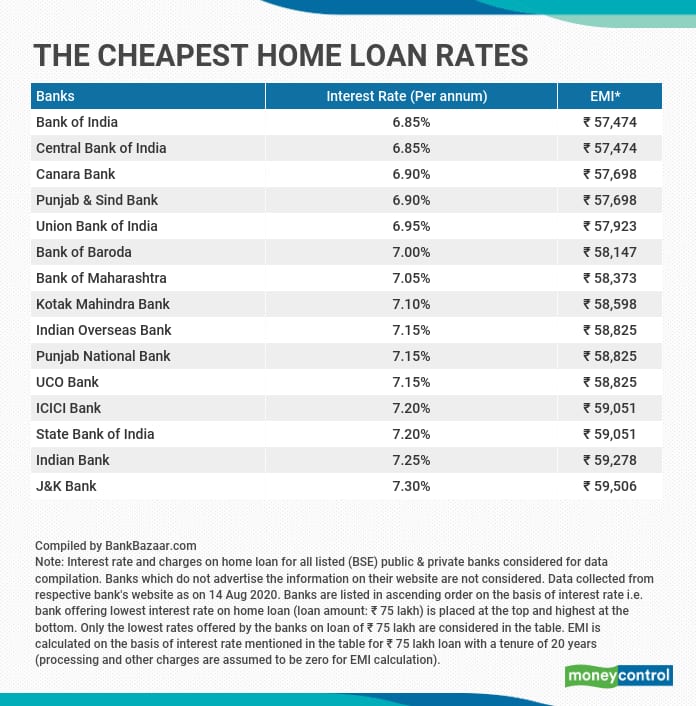

Sbi Home Loan Interest Rate Today Sale Discount Save 49 Jlcatj gob mx

https://images.moneycontrol.com/static-mcnews/2020/08/Loan-Aug-28.png

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Web The total claimed tax rebate is Rs 3 50 000 So the remaining amount is Rs 4 50 000 As we know there is no tax obligation for amount up to Rs 2 50 000 The taxable income will Web 26 juil 2018 nbsp 0183 32 1 260 313 Views 953 comments Home loan entitles Individuals to Deduction Under Section 80C of up to Rs 1 50 Lakh and Interest Deduction under section 24 of up

Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your Web 31 mars 2022 nbsp 0183 32 know about home loan Tax benefit Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and tax benefit on

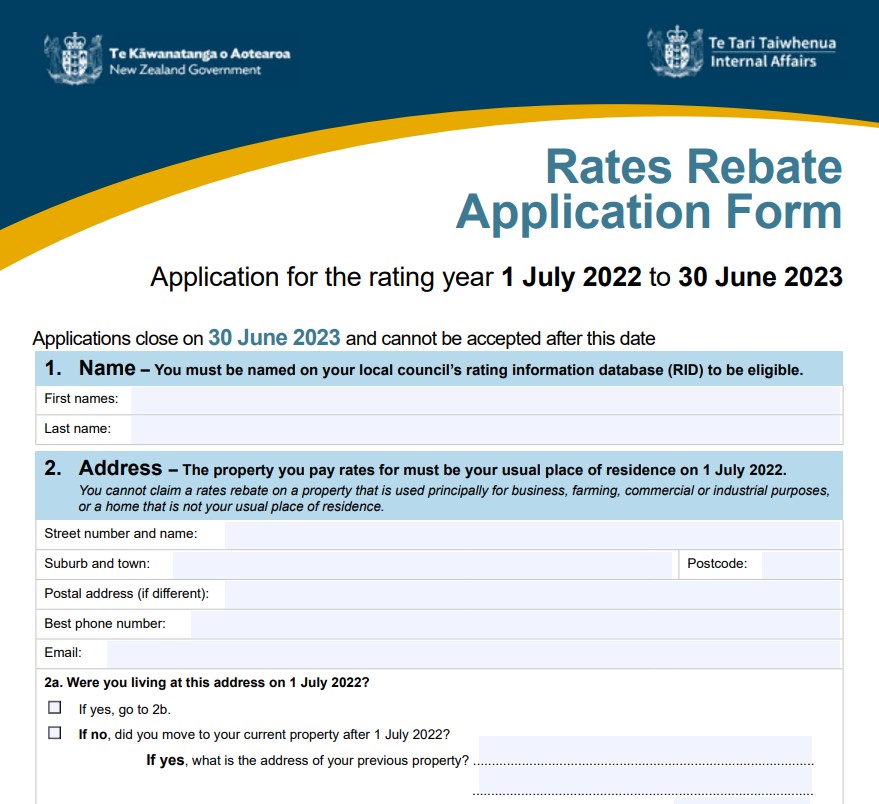

Gst New Housing Rebate Application Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Housing-Rebate-Form-2023.jpg

Hst New Housing Rebate Ontario Forms Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax-benefits

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Oct 2016 Best Home Loan Interest Rates In 2016

Gst New Housing Rebate Application Form Printable Rebate Form

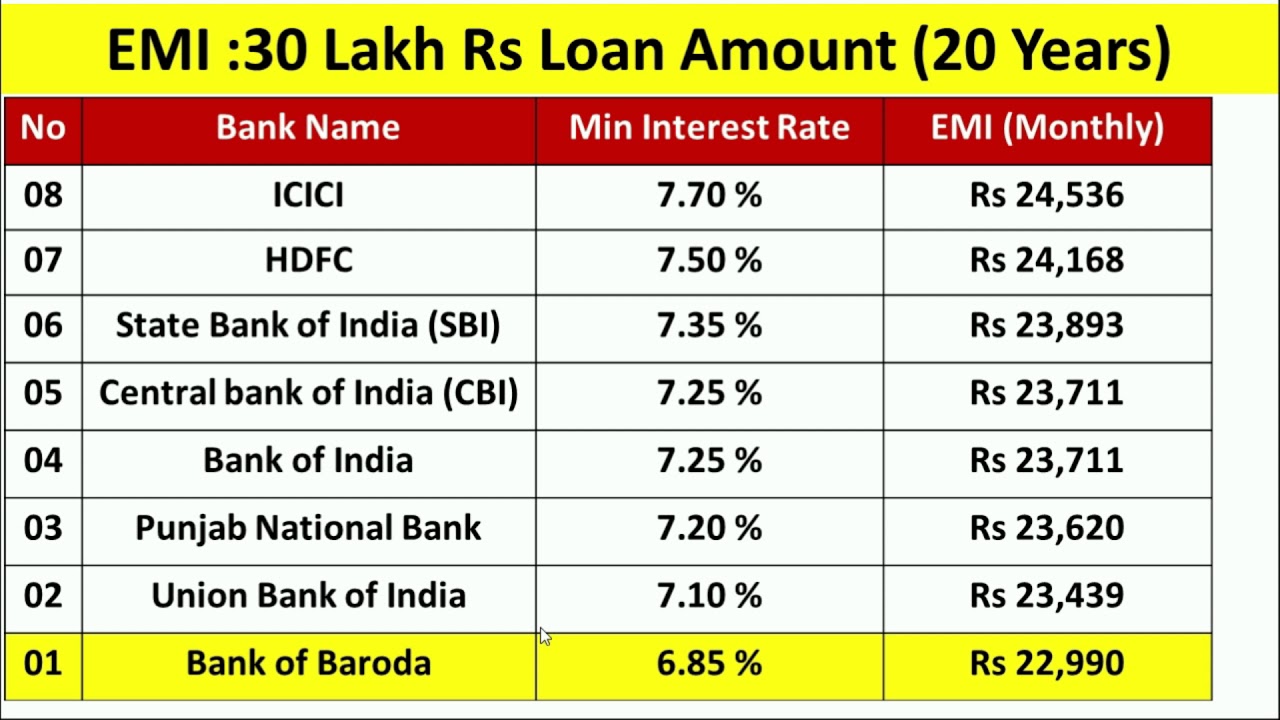

Home Loan Best Banks In India Interest EMI Charges YouTube

84 Can You Apply For Housing Benefit Online Page 3 Free To Edit

Breast Cancer Awareness Month Support Quotes

Signs That You re Paying Too Much For Your Home

Signs That You re Paying Too Much For Your Home

Home Loan Interest Rates And Repayments Parliament Of Australia

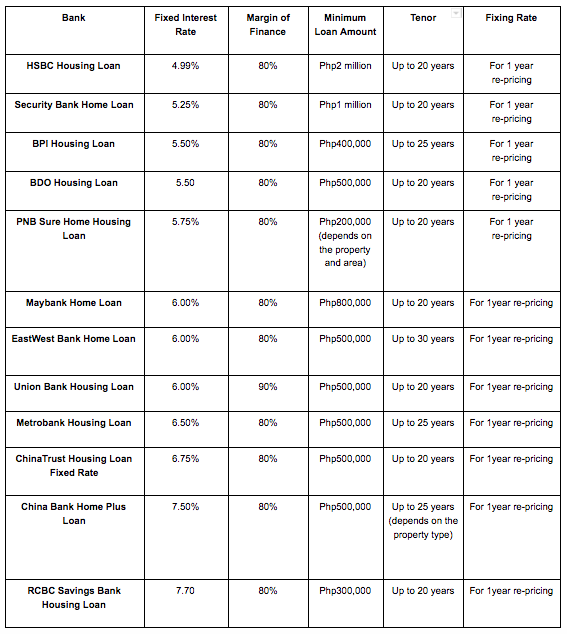

Best Housing Loan Interest Rates In The Philippines Mom On Duty

Public Bank Housing Loan Interest Rate 2019 Best Housing Loans In

Tax Rebate On Interest Of Housing Loan - Web 11 sept 2023 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24 b As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh