Tax Exemption On Housing Loan Interest Section Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a

The government introduced Section 80EEA to provide interest deduction on low cost housing loans from FY 2019 20 until 31 March 2022 Tax benefits were extended in Budget First time buyers of affordable property can claim Rs 3 50 lakhs as interest deduction by combining the benefits under Section 24 and Section 80EEA Better still if the property is jointly owned the co borrowers can

Tax Exemption On Housing Loan Interest Section

Tax Exemption On Housing Loan Interest Section

https://i.ytimg.com/vi/M-wUkSDKAfk/maxresdefault.jpg

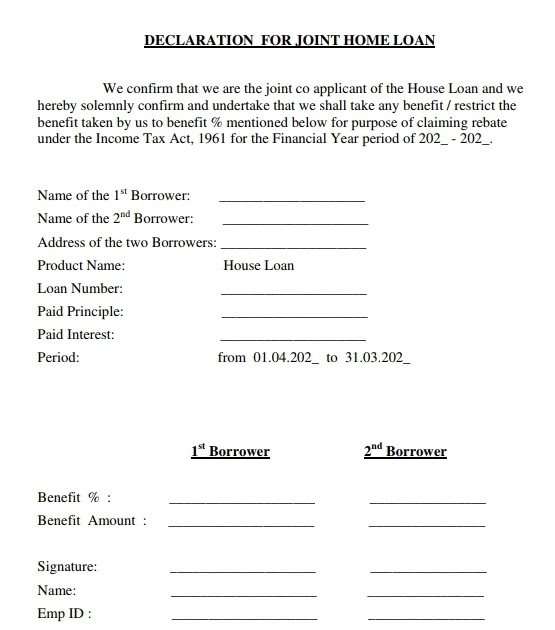

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution or a housing finance company You can claim a deduction of up to Rs 50 000 per Overall the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of INR 3 50 000 upto 2 00 000 in section 24 and upto

Section 80EEA provides extended tax deductions of up to Rs 1 50 000 for first time homebuyers in India An individual is permitted to claim this particular benefit over and above the Section 80EE of the Income Tax Act introduced in the Financial Year 2013 14 offers an additional deduction on interest payments made towards home loans This deduction

Download Tax Exemption On Housing Loan Interest Section

More picture related to Tax Exemption On Housing Loan Interest Section

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/Home-Loan-Comparison-768x513.png

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/House-Property/Images/Deductions-U-S-24.jpg

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

https://taxguru.in/wp-content/uploads/2022/01/Conditions-to-claim.jpg

Amount and period of deduction under section 80E of the Income Tax Act Entire interest amount paid during the Financial Year towards higher educational loan is allowable as Tax relief is available for interest on loans where the borrowed money is used for certain specific purposes You can also claim relief for alternative finance payments paid on a

Introduced under the budget of 2019 a fresh provision known as section 80EEA extended tax advantages for housing loan interest deductions up to Rs 1 5 lakh for affordable housing from Section 80EEA of Income Tax Act offers first time homebuyers Rs 1 50 lakh deduction against home loan interest payment Know eligibility documents

Section 24 Of Income Tax Act Deduction For Home Loan Interest

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/09/section-24-of-income-tax-act.jpg

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

https://www.realestate-tokyo.com/media/15205/housing-loan-tax-exemption.jpg

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a

https://cleartax.in/s/section-80eea-deduction-affordable-housing

The government introduced Section 80EEA to provide interest deduction on low cost housing loans from FY 2019 20 until 31 March 2022 Tax benefits were extended in Budget

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Section 24 Of Income Tax Act Deduction For Home Loan Interest

How To Claim Tax Exemption On Home Loan Without Paying Interest In

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Joint Home Loan Declaration Form For Income Tax Savings And Non

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

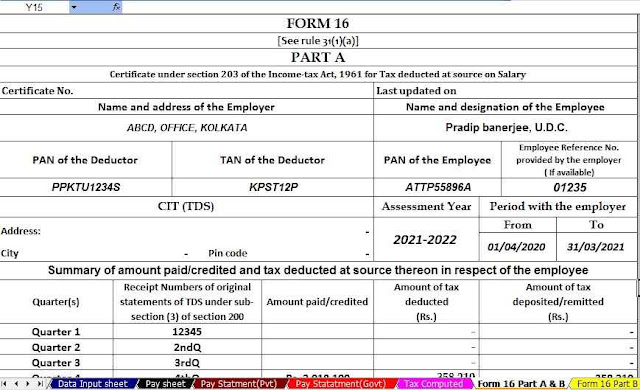

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

How To Fill Housing Loan Interest And Principal In Income Tax Return

Tax Exemption On Housing Loan Interest Section - Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs 1 50 000 under