How To Use Home Loan Interest Tax Exemption You can claim tax deductions on both the principal and interest paid towards your home loan in a financial year For the unversed home loan tax deductions are offered under

House Rent Allowance HRA and home loan repayments both offer tax benefits to taxpayers If you receive HRA as a part of your salary and are also repaying a housing loan You can use your Home Loan for a tax exemption of Rs 50 000 under Section 80EE if your loan amount is under Rs 35 lakh and the property value is under Rs 50 lakh

How To Use Home Loan Interest Tax Exemption

How To Use Home Loan Interest Tax Exemption

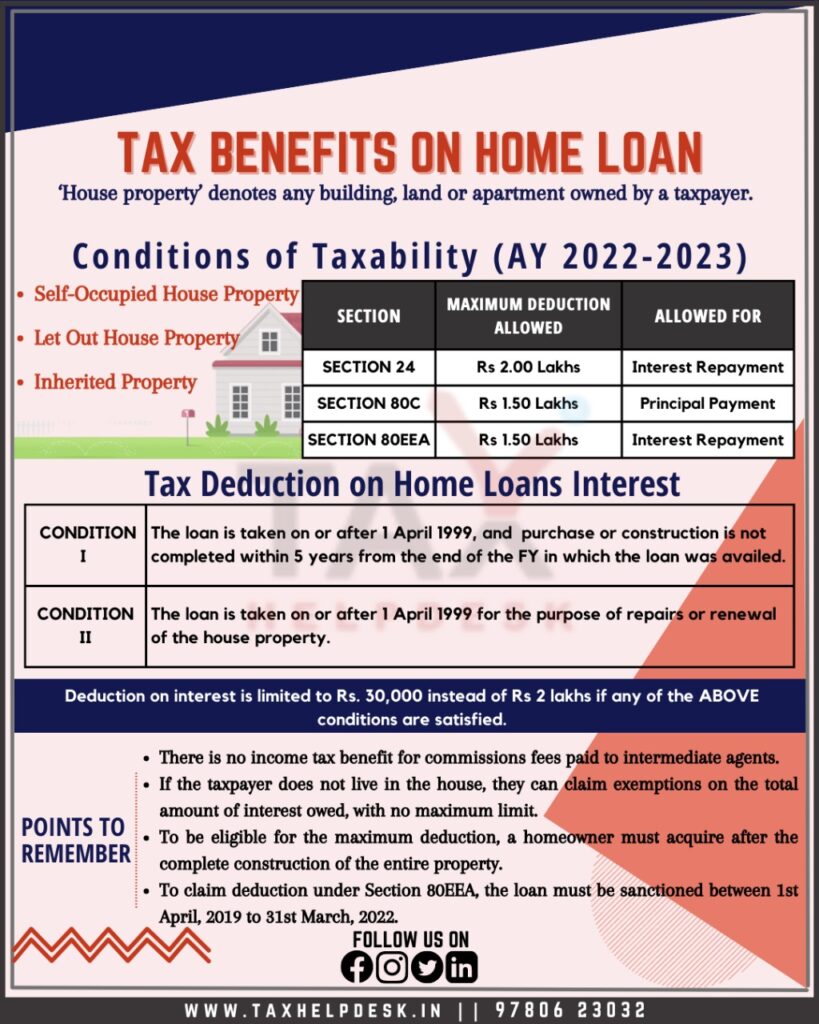

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Understanding The Mortgage Interest Deduction With TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All home loan borrowers should be informed of all income tax A step by step guide on how to claim interest on home loan deduction Check out the documents needed calculation of income and claiming u s 80C

Know how to claim income tax benefits on your home loan for FY 2024 25 Check tax benefits under different sections and the claiming process Check out the Home Loan tax benefits under Sections 24 b 80EE and 80C to save tax on your Home Loan Learn how much tax exemption you can claim on a housing loan

Download How To Use Home Loan Interest Tax Exemption

More picture related to How To Use Home Loan Interest Tax Exemption

Tax Benefits How To Use Home Loan Interest To Benefit Of Tax

https://blog.regrob.com/wp-content/uploads/2016/10/tax-benefit-on-home-loan-interest.png

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

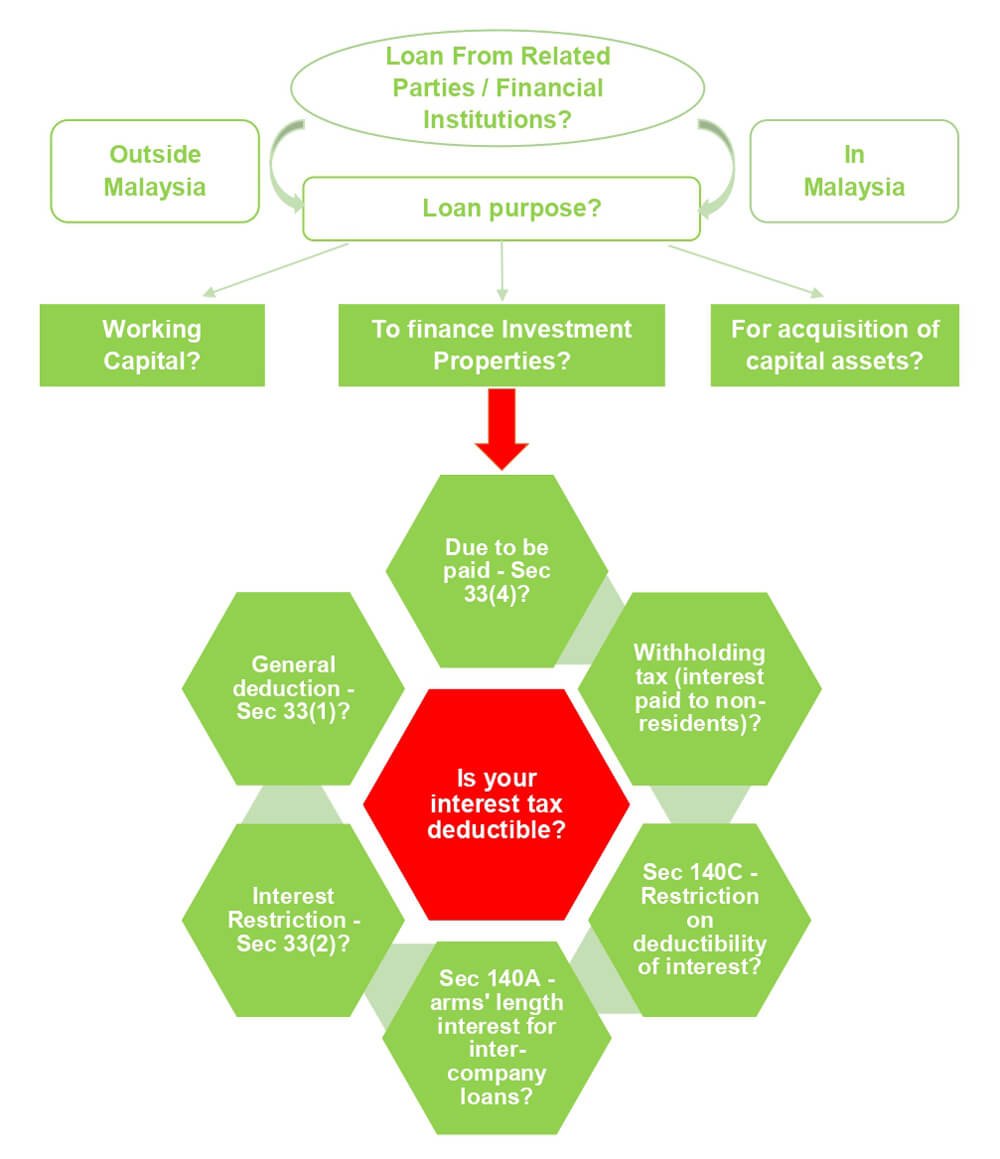

Is Your Interest Tax Deductible ShineWing TY TEOH

https://shinewingtyteoh.com/wp-content/uploads/2021/11/Interest-Tax-Graph.jpg

This post discusses home loan tax benefits under various sections of the Income Tax Act how to claim tax benefits tax benefits on a second home and property under construction and eligibility criteria Learn how much home loan interest is exempt from tax and discover strategies to reduce your taxable income while financing your dream home

Section 24 b of the Income Tax Act allows you to deduct the interest paid on your house loan A maximum tax deduction of Rs 2 lakh can be claimed from your gross income yearly for a self Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

https://www.ujjivansfb.in › ... › home-loan-tax-benefits

You can claim tax deductions on both the principal and interest paid towards your home loan in a financial year For the unversed home loan tax deductions are offered under

https://fi.money › guides › personal-loans › how-to...

House Rent Allowance HRA and home loan repayments both offer tax benefits to taxpayers If you receive HRA as a part of your salary and are also repaying a housing loan

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

How To Claim Tax Exemption On Home Loan Without Paying Interest In

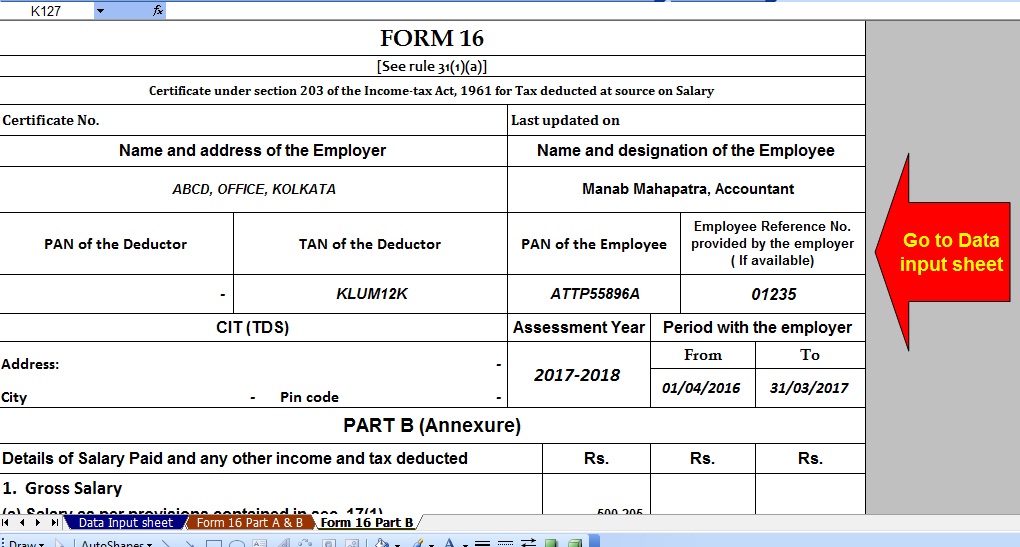

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

Home Loan Tax Benefits You Must Be Aware Today Financing Ease

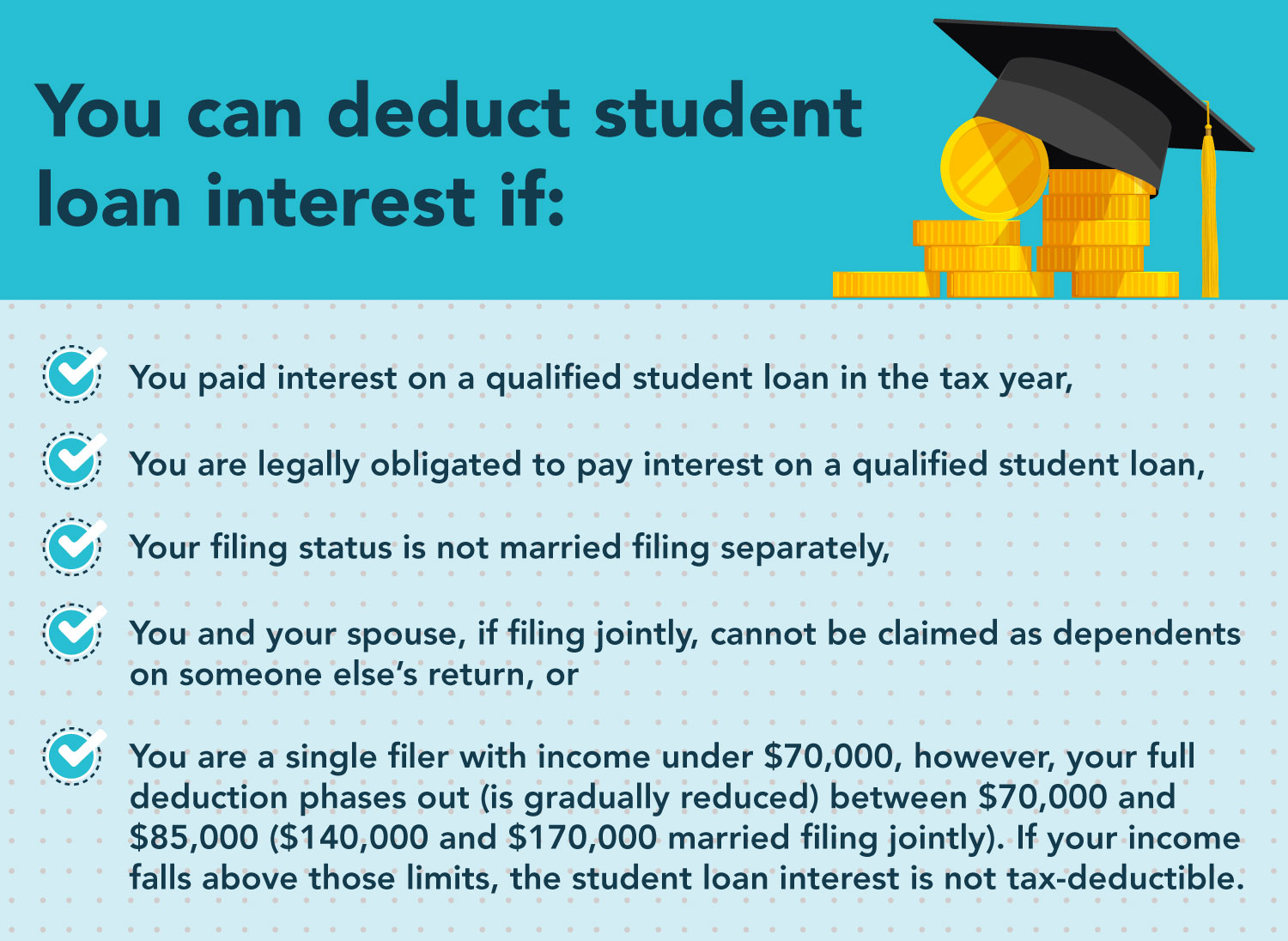

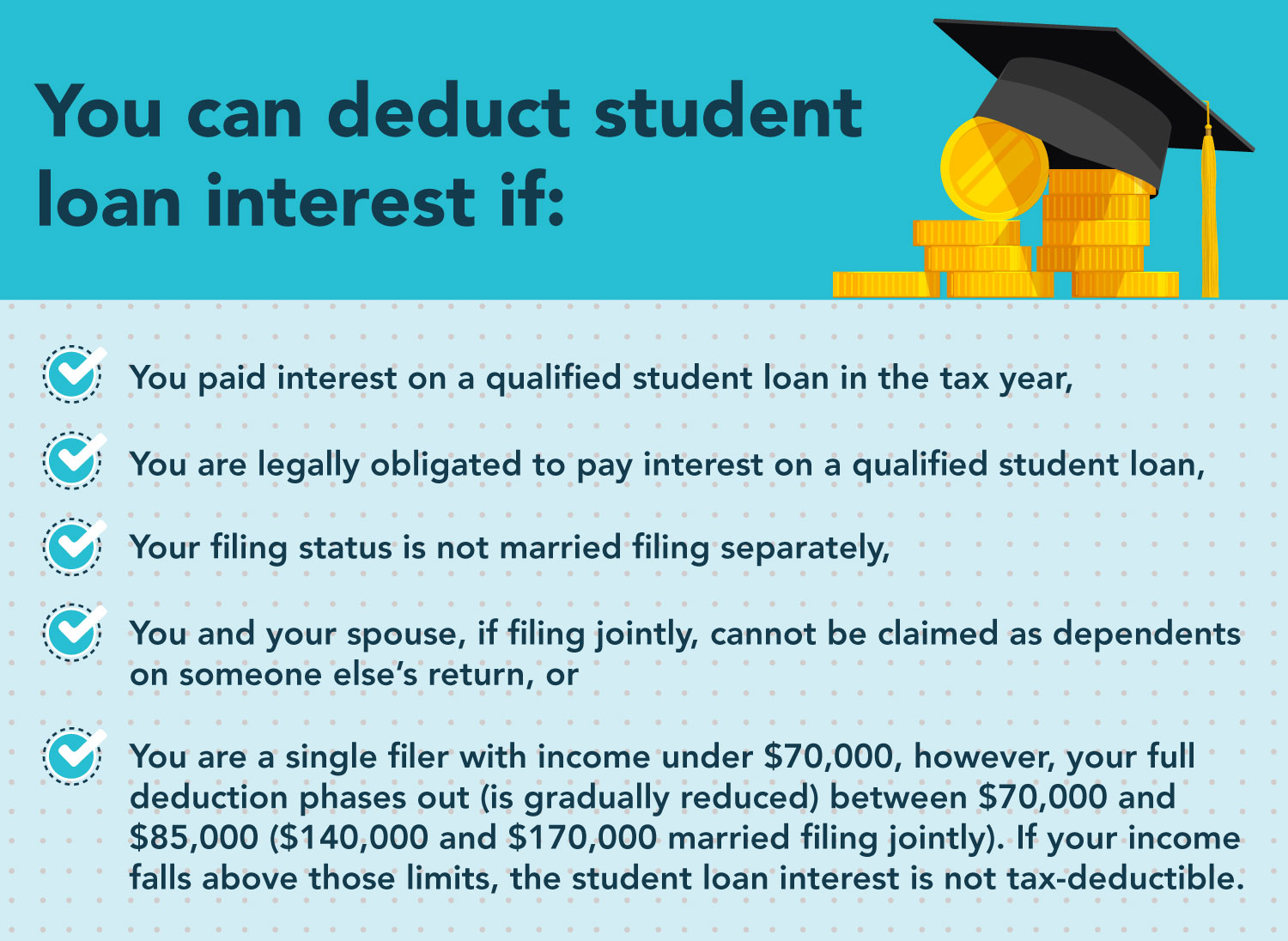

How Can You Find Out If You Paid Taxes On Student Loans

How Can You Find Out If You Paid Taxes On Student Loans

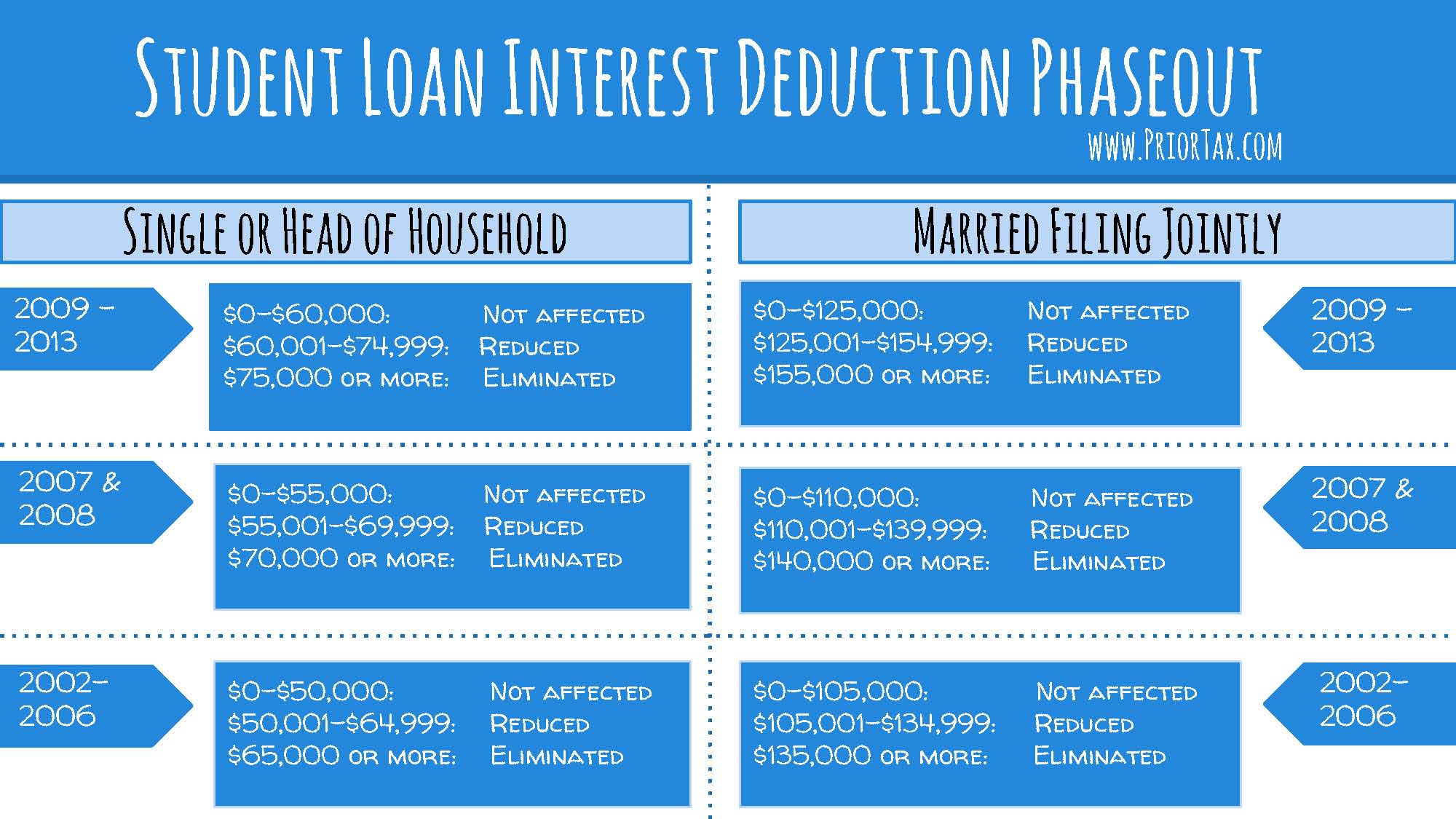

Pin On Infographics

Student Loan Interest Deduction 2013 PriorTax Blog

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

How To Use Home Loan Interest Tax Exemption - The mortgage interest deduction allows you to deduct the interest you paid on the first 750 000 of your mortgage debt during the tax year